Printed on September twenty ninth, 2025 by Bob Ciura

Earnings traders usually look to actual property funding trusts, or REITs, as these shares normally have very excessive yields.

Actual property funding trusts – or REITs, for brief – will be unbelievable securities for producing significant portfolio earnings. REITs extensively supply larger dividend yields than the typical inventory.

Whereas the S&P 500 Index on common yields lower than 2% proper now, it’s comparatively straightforward to search out REITs with dividend yields of 5% or larger.

With this in thoughts, we created a listing of over 200 REITs.

You possibly can obtain your free 200+ REIT record (together with essential monetary metrics like dividend yields and payout ratios) by clicking on the hyperlink under:

Wanting extra particularly at a sure a part of the REIT business, we really feel that the healthcare REIT business could be very engaging for earnings traders.

These REITs personal quite a lot of healthcare properties, together with life science buildings, senior housing, expert nursing services, and extra.

Healthcare REITs have a good long-term progress trajectory as a result of the inhabitants continues to grow old within the U.S., with these over 80 anticipated to make up greater than half of the nation’s inhabitants by 2030.

Lots of these folks would require housing and medical therapy as they age. Mix this reality with a scarcity of healthcare properties, and the financial outlook for the foremost healthcare REITs could be very promising.

Along with the downloadable Excel sheet of all REITs, this text ranks the 8 highest-yielding healthcare REITs within the Certain Evaluation Analysis Database.

Desk Of Contents

Along with the total downloadable Excel spreadsheet, this text covers our prime 8 heatlhcare REITs right this moment, as ranked by their present dividend yield.

The desk of contents under permits for simple navigation.

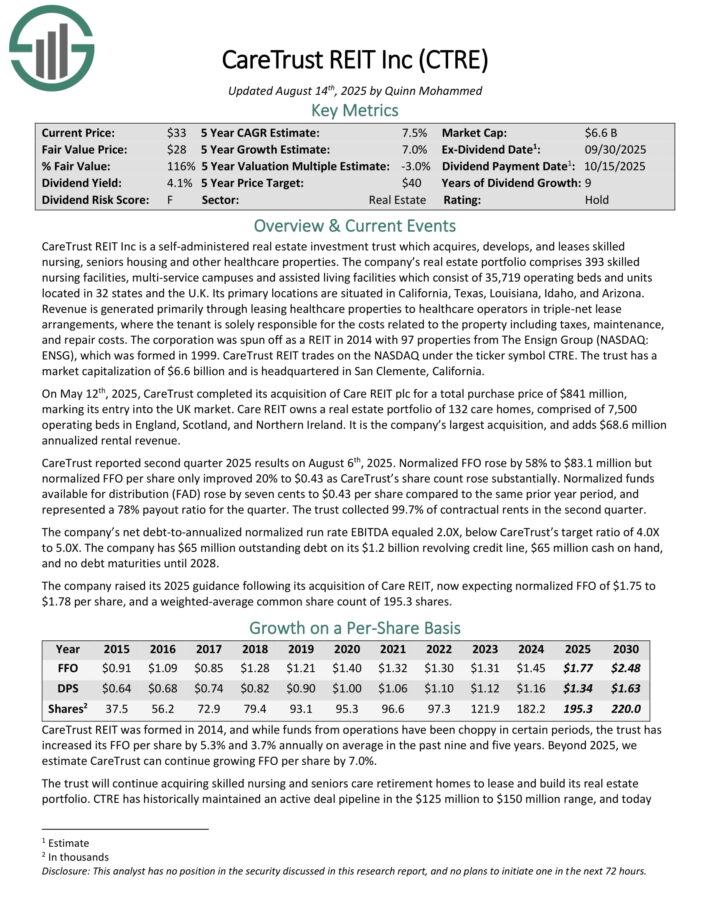

Healthcare REIT #8: CareTrust REIT (CTRE)

CareTrust REIT Inc is a self-administered actual property funding belief which acquires, develops, and leases expert nursing, seniors housing and different healthcare properties.

The corporate’s actual property portfolio contains 393 expert nursing services, multi-service campuses and assisted residing services which encompass 35,719 working beds and models positioned in 32 states and the U.Okay. Its major places are located in California, Texas, Louisiana, Idaho, and Arizona.

Income is generated primarily by means of leasing healthcare properties to healthcare operators in triple-net lease preparations.

On Could twelfth, 2025, CareTrust accomplished its acquisition of Care REIT plc for a complete buy value of $841 million, marking its entry into the UK market.

Care REIT owns an actual property portfolio of 132 care properties, comprised of seven,500 working beds in England, Scotland, and Northern Eire. It’s the firm’s largest acquisition, and provides $68.6 million annualized rental income.

CareTrust reported second quarter 2025 outcomes on August sixth, 2025. Normalized FFO rose by 58% to $83.1 million however normalized FFO per share solely improved 20% to $0.43 as CareTrust’s share rely rose considerably.

Normalized funds accessible for distribution rose by seven cents to $0.43 per share in comparison with the identical prior yr interval, and represented a 78% payout ratio for the quarter. The belief collected 99.7% of contractual rents within the second quarter.

The corporate’s web debt-to-annualized normalized run charge EBITDA equaled 2.0X, under CareTrust’s goal ratio of 4.0X to five.0X.

The corporate has $65 million excellent debt on its $1.2 billion revolving credit score line, $65 million money readily available, and no debt maturities till 2028.

Click on right here to obtain our most up-to-date Certain Evaluation report on CTRE (preview of web page 1 of three proven under):

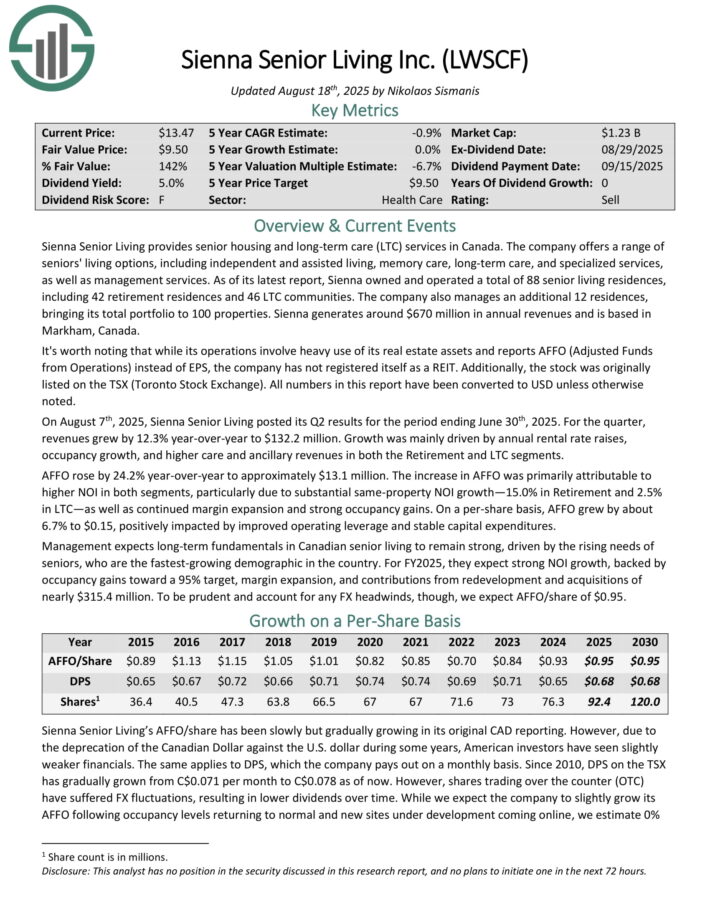

Prime REIT #7: Sienna Senior Residing (LWSCF)

Sienna Senior Residing gives senior housing and long-term care (LTC) companies in Canada. The corporate gives a spread of seniors’ residing choices, together with unbiased and assisted residing, reminiscence care, long-term care, and specialised companies, in addition to administration companies.

As of its newest report, Sienna owned and operated a complete of 88 senior residing residences, together with 42 retirement residences and 46 LTC communities.

The corporate additionally manages a further 12 residences, bringing its whole portfolio to 100 properties. Sienna generates round $670 million in annual revenues and relies in Markham, Canada.

On August seventh, 2025, Sienna Senior Residing posted its Q2 outcomes for the interval ending June thirtieth, 2025. For the quarter, revenues grew by 12.3% year-over-year to $132.2 million.

Progress was primarily pushed by annual rental charge raises, occupancy progress, and better care and ancillary revenues in each the Retirement and LTC segments.

AFFO rose by 24.2% year-over-year to roughly $13.1 million. The rise in AFFO was primarily attributable to larger NOI in each segments, notably on account of substantial same-property NOI progress—15.0% in Retirement and a couple of.5% in LTC—in addition to continued margin enlargement and powerful occupancy positive factors.

On a per-share foundation, AFFO grew by about 6.7% to $0.15, positively impacted by improved working leverage and steady capital expenditures.

Administration expects long-term fundamentals in Canadian senior residing to stay sturdy, pushed by the rising wants of seniors, who’re the fastest-growing demographic within the nation.

For FY2025, they anticipate sturdy NOI progress, backed by occupancy positive factors towards a 95% goal, margin enlargement, and contributions from redevelopment and acquisitions of almost $315.4 million.

Click on right here to obtain our most up-to-date Certain Evaluation report on LWSCF (preview of web page 1 of three proven under):

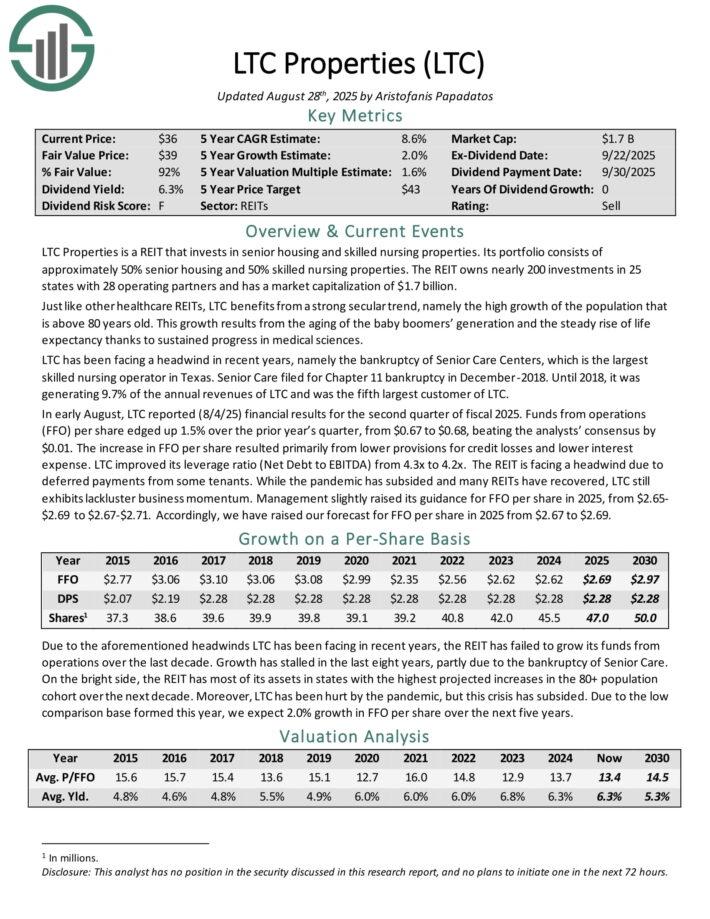

Prime REIT #6: LTC Properties (LTC)

LTC Properties is a REIT that invests in senior housing and expert nursing properties. Its portfolio consists of roughly 50% senior housing and 50% expert nursing properties.

The REIT owns almost 200 investments in 25 states with 28 working companions.

In early August, LTC reported (8/4/25) monetary outcomes for the second quarter of fiscal 2025. Funds from operations (FFO) per share edged up 1.5% over the prior yr’s quarter, from $0.67 to $0.68, beating the analysts’ consensus by $0.01.

The rise in FFO per share resulted primarily from decrease provisions for credit score losses and decrease curiosity expense. LTC improved its leverage ratio (Internet Debt to EBITDA) from 4.3x to 4.2x.

The REIT is going through a headwind on account of deferred funds from some tenants. Whereas the pandemic has subsided and lots of REITs have recovered, LTC nonetheless displays lackluster enterprise momentum.

Administration barely raised its steerage for FFO per share in 2025, from $2.65-$2.69 to $2.67-$2.71.

Click on right here to obtain our most up-to-date Certain Evaluation report on LTC (preview of web page 1 of three proven under):

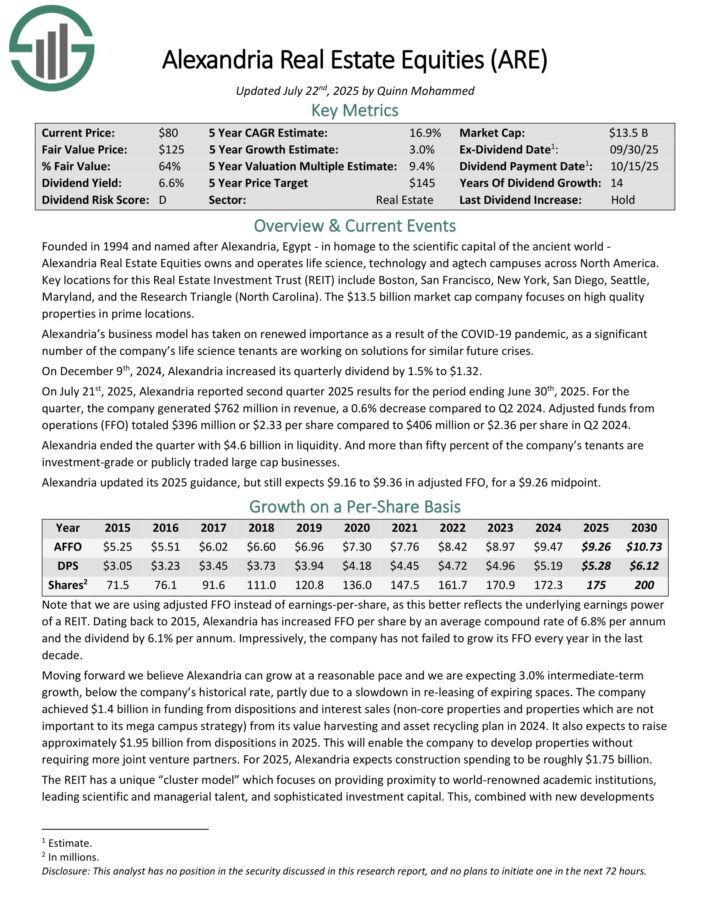

Prime REIT #5: Alexandria Actual Property Equities (ARE)

Alexandria Actual Property Equities owns and operates life science, know-how and agtech campuses throughout North America. Key places for this Actual Property Funding Belief (REIT) embrace Boston, San Francisco, New York, San Diego, Seattle, Maryland, and the Analysis Triangle (North Carolina).

The corporate focuses on top quality properties in prime places. Alexandria’s enterprise mannequin has taken on renewed significance because of the COVID-19 pandemic, as a big variety of the corporate’s life science tenants are engaged on options for related future crises.

On December ninth, 2024, Alexandria elevated its quarterly dividend by 1.5% to $1.32. On July twenty first, 2025, Alexandria reported second quarter 2025 outcomes for the interval ending June thirtieth, 2025.

For the quarter, the corporate generated $762 million in income, a 0.6% lower in comparison with Q2 2024.

Adjusted funds from operations (FFO) totaled $396 million or $2.33 per share in comparison with $406 million or $2.36 per share in Q2 2024.

Alexandria ended the quarter with $4.6 billion in liquidity. And greater than fifty % of the corporate’s tenants are investment-grade or publicly traded giant cap companies.

Click on right here to obtain our most up-to-date Certain Evaluation report on ARE (preview of web page 1 of three proven under):

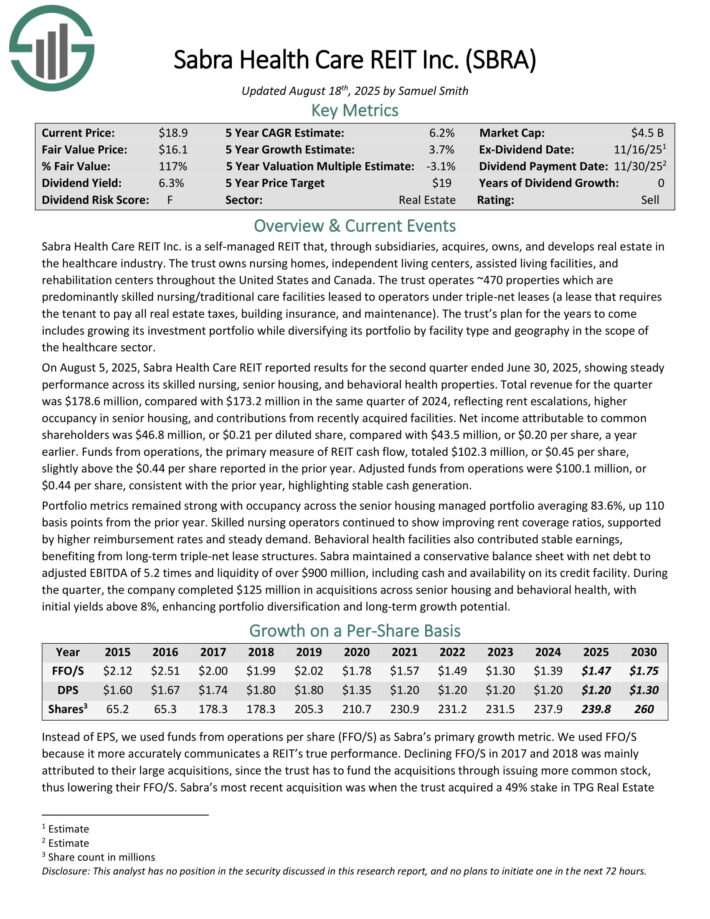

Prime REIT #4: Sabra Well being Care REIT (SBRA)

Sabra Well being Care REIT Inc. is a self-managed REIT that, by means of subsidiaries, acquires, owns, and develops actual property within the healthcare business. The belief owns nursing properties, unbiased residing facilities, assisted residing services, and rehabilitation facilities all through the USA and Canada.

The belief operates ~470 properties that are predominantly expert nursing/conventional care services leased to operators underneath triple-net leases (a lease that requires the tenant to pay all actual property taxes, constructing insurance coverage, and upkeep).

The belief’s plan for the years to come back contains rising its funding portfolio whereas diversifying its portfolio by facility kind and geography within the scope of the healthcare sector.

On August 5, 2025, Sabra Well being Care REIT reported outcomes for the second quarter ended June 30, 2025, exhibiting regular efficiency throughout its expert nursing, senior housing, and behavioral well being properties.

Whole income for the quarter was $178.6 million, in contrast with $173.2 million in the identical quarter of 2024, reflecting hire escalations, larger occupancy in senior housing, and contributions from lately acquired services.

Internet earnings attributable to frequent shareholders was $46.8 million, or $0.21 per diluted share, in contrast with $43.5 million, or $0.20 per share, a yr earlier.

Funds from operations totaled $102.3 million, or $0.45 per share, barely above the $0.44 per share reported within the prior yr.

Adjusted funds from operations had been $100.1 million, or $0.44 per share, according to the prior yr, highlighting steady money technology.

Portfolio metrics remained sturdy with occupancy throughout the senior housing managed portfolio averaging 83.6%, up 110 foundation factors from the prior yr.

Expert nursing operators continued to indicate bettering hire protection ratios, supported by larger reimbursement charges and regular demand.

Click on right here to obtain our most up-to-date Certain Evaluation report on SBRA (preview of web page 1 of three proven under):

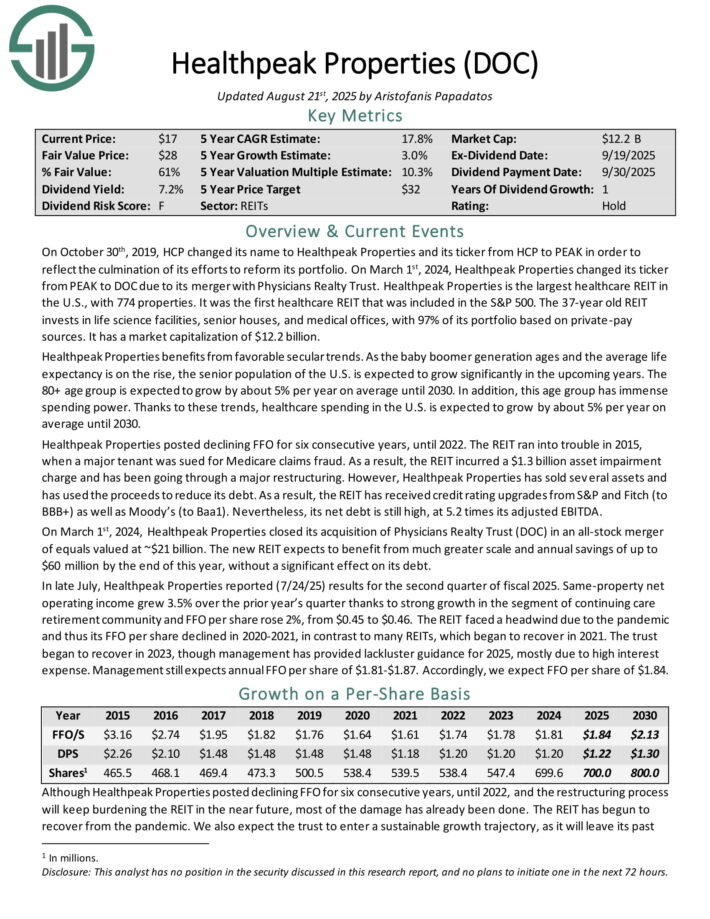

Prime REIT #3: Healthpeak Properties (DOC)

Healthpeak Properties is the biggest healthcare REIT within the U.S., with 774 properties. It was the primary healthcare REIT that was included within the S&P 500. The 37-year outdated REIT invests in life science services, senior homes, and medical places of work, with 97% of its portfolio primarily based on private-pay sources.

On July twenty fourth 2025, the REIT reported second-quarter monetary outcomes. Quarterly income of $694.35 million was in-line with analyst estimates, and represented a year-over-year decline of 0.2%.

Adjusted funds-from-operation (FFO) was $0.46 per share, up 2.2% from the identical quarter final yr. Adjusted FFO-per-share was additionally in-line with estimates. Similar-store money web working earnings progress was 3.5% for the second quarter.

Funding exercise for the quarter included two new growth agreements with a mixed projected value of $148 million to help Northside Hospital’s continued outpatient enlargement within the Atlanta market.

Healthpeak Properties additionally offered one outpatient medical land parcel in June 2025 and two outpatient medical buildings in July 2025 for mixed proceeds of roughly $35 million.

For 2025, Healthpeak Properties confirmed its forecast for adjusted diluted FFO-per-share to be in a spread of $1.81 to $1.87. As well as, same-store money (Adjusted) NOI progress is predicted to be 3.0% to 4.0% for the total yr.

Click on right here to obtain our most up-to-date Certain Evaluation report on DOC (preview of web page 1 of three proven under):

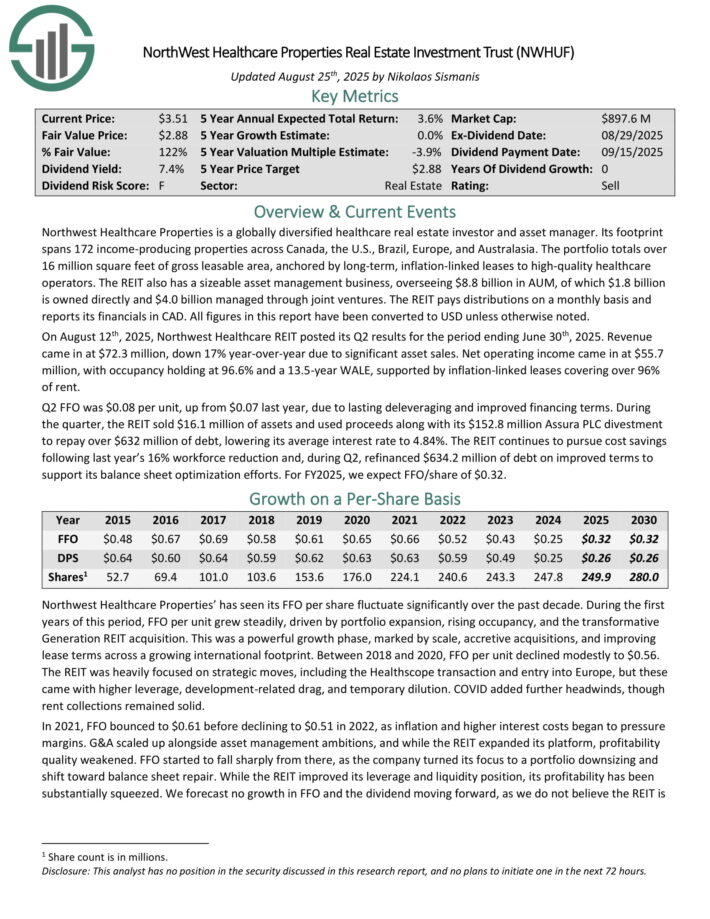

Prime REIT #2: NorthWest Healthcare Properties (NWHUF)

Northwest Healthcare Properties is a globally diversified healthcare actual property investor and asset supervisor. Its footprint spans 172 income-producing properties throughout Canada, the U.S., Brazil, Europe, and Australasia.

The portfolio totals over 16 million sq. ft of gross leasable space, anchored by long-term, inflation-linked leases to high-quality healthcare operators.

The REIT additionally has a sizeable asset administration enterprise, overseeing $8.8 billion in AUM, of which $1.8 billion is owned instantly and $4.0 billion managed by means of joint ventures.

On August twelfth, 2025, Northwest Healthcare REIT posted its Q2 outcomes for the interval ending June thirtieth, 2025. Income got here in at $72.3 million, down 17% year-over-year on account of important asset gross sales.

Internet working earnings got here in at $55.7 million, with occupancy holding at 96.6% and a 13.5-year WALE, supported by inflation-linked leases overlaying over 96% of hire.

Q2 FFO was $0.08 per unit, up from $0.07 final yr, on account of lasting deleveraging and improved financing phrases. Through the quarter, the REIT offered $16.1 million of belongings and used proceeds together with its $152.8 million Assura PLC divestment to repay over $632 million of debt, decreasing its common rate of interest to 4.84%.

The REIT continues to pursue value financial savings following final yr’s 16% workforce discount and, throughout Q2, refinanced $634.2 million of debt on improved phrases to help its steadiness sheet optimization efforts.

Click on right here to obtain our most up-to-date Certain Evaluation report on NWHUF (preview of web page 1 of three proven under):

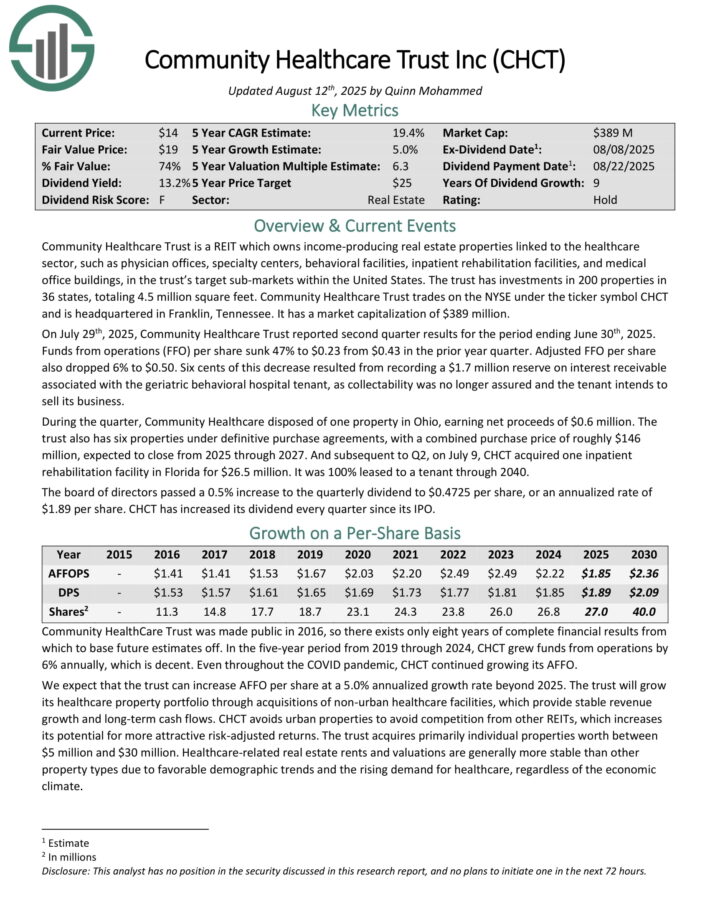

Prime REIT #1: Group Healthcare Belief (CHCT)

Group Healthcare Belief owns income-producing actual property properties linked to the healthcare sector, akin to doctor places of work, specialty facilities, behavioral services, inpatient rehabilitation services, and medical workplace buildings, within the belief’s goal sub-markets inside the USA.

The belief has investments in 200 properties in 36 states, totaling 4.5 million sq. ft.

On July twenty ninth, 2025, Group Healthcare Belief reported second quarter outcomes for the interval ending June thirtieth, 2025.

Funds from operations per share sank 47% to $0.23 from $0.43 within the prior yr quarter. Adjusted FFO per share additionally dropped 6% to $0.50.

Six cents of this lower resulted from recording a $1.7 million reserve on curiosity receivable related to the geriatric behavioral hospital tenant, as collectability was not assured and the tenant intends to promote its enterprise.

Through the quarter, Group Healthcare disposed of 1 property in Ohio, incomes web proceeds of $0.6 million. The belief additionally has six properties underneath definitive buy agreements, with a mixed buy value of roughly $146 million, anticipated to shut from 2025 by means of 2027.

And subsequent to Q2, on July 9, CHCT acquired one inpatient rehabilitation facility in Florida for $26.5 million. It was 100% leased to a tenant by means of 2040.

Click on right here to obtain our most up-to-date Certain Evaluation report on CHCT (preview of web page 1 of three proven under):

Further Studying

You possibly can see extra high-quality dividend shares within the following Certain Dividend databases, every primarily based on lengthy streaks of steadily rising dividend funds:

You may additionally be seeking to create a extremely personalized dividend earnings stream to pay for all times’s bills.

The next lists present helpful data on excessive dividend shares and shares that pay month-to-month dividends:

Thanks for studying this text. Please ship any suggestions, corrections, or inquiries to help@suredividend.com.