Be part of Our Telegram channel to remain updated on breaking information protection

The Bitcoin value has dropped a fraction of a % within the final 24 hours to commerce at $121,310 as of three.45 a.m. EST.

This comes as Twitter co-founder Jack Dorsey’s Sq. introduced the launch of a Bitcoin pockets for retailers in a transfer designed to take Bitcoin funds mainstream and problem bank cards.

JUST IN: Jack Dorsey’s Sq. launched a #Bitcoin pockets answer to allow native companies to simply accept BTC funds with zero charges.

Bullish 🚀 pic.twitter.com/giHUcQTLLr

— Bitcoin Journal (@BitcoinMagazine) October 8, 2025

The pockets, a part of Dorsey’s greater imaginative and prescient for Bitcoin, permits retailers to mechanically convert as much as 50% of their each day gross sales into Bitcoin, beginning November 10. For the primary time, small companies can settle for Bitcoin funds and keep away from conventional card community charges, with zero transaction costs till 2027.

Connecting the ecosystem with @Sq. has been the dream since we launched bitcoin in @CashApp in 2018

Beginning immediately, all retailers can now seamlessly stack bitcoin behind the scenes from their each day gross sales

Bitcoin Funds Acceptance will likely be dwell for everybody on November 10 pic.twitter.com/mTqbu8wfGG

— Miles 🌞 (@milessuter) October 8, 2025

After that, a 1% payment will apply, which continues to be a lot decrease than typical card charges. Dorsey believes the service will assist retailers hedge towards inflation and financial uncertainty, saying, “It would possible improve in worth. It’s actually a hedge towards the whole lot that we’re seeing within the financial system.”

On the identical time, Dorsey is campaigning for US lawmakers to exempt small Bitcoin funds from taxes, a transfer that would increase on a regular basis crypto adoption and add momentum to Bitcoin’s use as cash.

JUST IN: 🇺🇸 Senator Cynthia Lummis tells Jack Dorsey we’ve got a invoice prepared for de minimis tax exemptions on Bitcoin

Tax-free Bitcoin funds quickly 😎 pic.twitter.com/VSvULFqAEe

— Bitcoin Archive (@BTC_Archive) October 9, 2025

Bitcoin Worth Outlook: On-Chain Tendencies and Tax

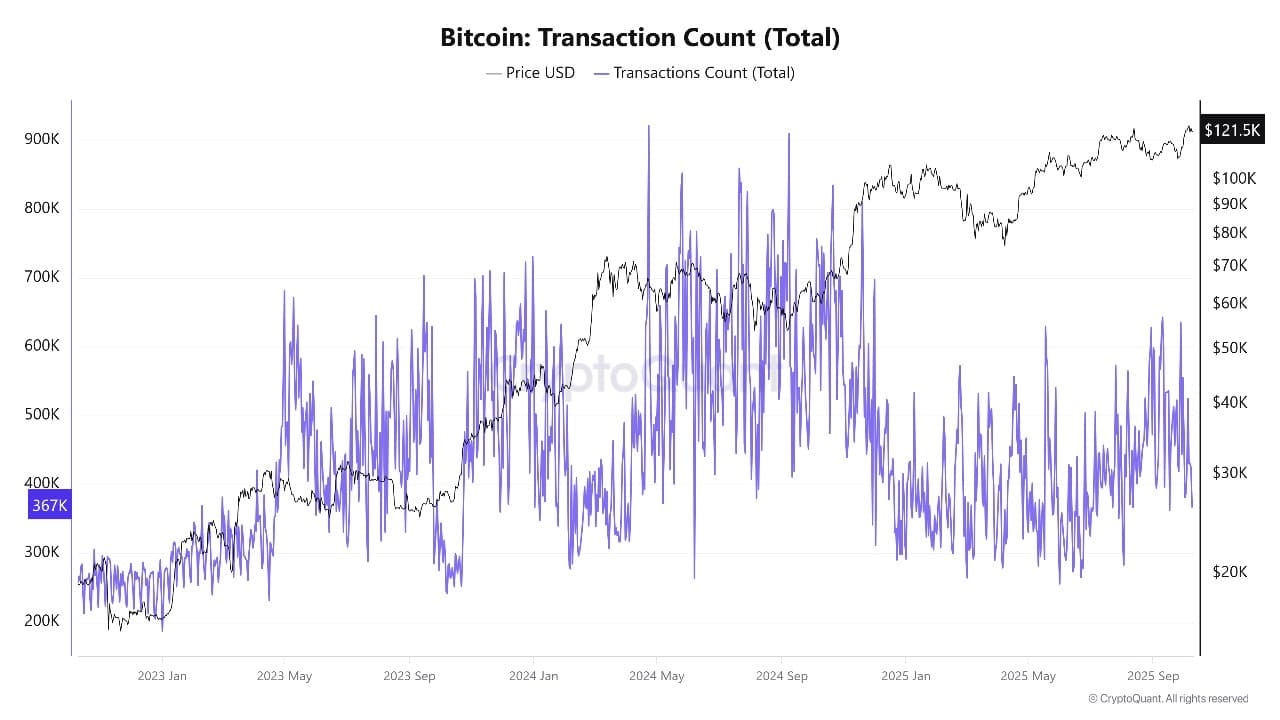

Dorsey’s Bitcoin pockets service might improve demand amongst retailers, as extra companies begin changing each day earnings into Bitcoin. This development is already being watched carefully on the blockchain. Analysts say the variety of Bitcoin addresses and transaction counts reveals extra actual exercise, with long-term holders growing their positions.

Bitcoin Transaction Rely Supply: CryptoQuant

However there’s one other issue at play: tax guidelines. The U. Treasury not too long ago introduced new interim steerage that will exempt some paper earnings on digital belongings from the 15% company minimal tax.

That is excellent news for firms holding massive quantities of Bitcoin, however for peculiar customers, the principle problem is avoiding tax points from small, on a regular basis crypto purchases.

Dorsey’s push for a de minimis exemption has gained help from politicians and the crypto neighborhood. If handed, this might take away a giant hurdle for spending Bitcoin at shops and should draw much more customers into utilizing crypto for funds.

Elevated retail and on-chain exercise usually alerts wholesome demand, however profit-taking might sluggish momentum within the quick run.

Bitcoin Worth Evaluation: Key Assist and Resistance Ranges

Trying on the BTCUSD 4-hour value chart, Bitcoin is holding above the important thing help at $119,320, just under the present value of $121,273. This help zone sits close to current lows and is watched carefully by merchants.

BTCUSD Evaluation Supply: Tradingview

If Bitcoin falls under this space, the following main helps are at $117,040 and $115,251, as proven by Fibonacci retracement ranges and prior consolidation on the chart.

The 50-period Easy Transferring Common (SMA) is at $122,298, whereas the 200-period SMA is at $115,936. Bitcoin is buying and selling near its short-term shifting common, suggesting indecision. The 200-period SMA, situated effectively under the value, acts as a longer-term cushion towards additional declines.

On the upside, preliminary resistance is seen at $125,903, with a serious excessive at $126,272.

Technical indicators present Bitcoin is cooling off after its current surge. The Relative Power Index (RSI) is at 45.49, which means the coin is neither overbought nor oversold, which might sign room for extra consolidation earlier than the following massive transfer.

The MACD indicator is barely adverse, indicating slowing momentum and a attainable danger of additional short-term dips.

Bitcoin Worth Holds Above 119k Assist

If Bitcoin stays above the $119,320 help and consumers step in after current information, the value might rebound towards $122,220 and better resistance close to $126,000 within the subsequent few weeks. Nonetheless, if sellers push under $119,000, Bitcoin might retest deeper helps round $117,000 and $115,000 earlier than bulls return.

If Block’s new pockets positive aspects traction with retailers and lawmakers help simpler tax guidelines for crypto, the coin value might stabilise and get better quickly.

Merchants will likely be watching key value ranges, the tempo of service provider adoption, and new alerts from Washington. All might affect whether or not the following transfer is up or down for Bitcoin in October.

Associated Articles:

Finest Pockets – Diversify Your Crypto Portfolio

Straightforward to Use, Characteristic-Pushed Crypto Pockets

Get Early Entry to Upcoming Token ICOs

Multi-Chain, Multi-Pockets, Non-Custodial

Now On App Retailer, Google Play

Stake To Earn Native Token $BEST

250,000+ Month-to-month Energetic Customers

Be part of Our Telegram channel to remain updated on breaking information protection