Printed on November 14th, 2025 by Bob Ciura

Dividend development is a robust sign of an organization’s monetary well being, administration’s confidence, and dedication to long-term worth creation.

Dividend development shares have traditionally generated superior returns with much less volatility relative to shares with flat dividends, shares that scale back their dividend, and shares that don’t pay dividends

It’s particularly uncommon to search out an investing issue that has traditionally supplied – and I imagine is more likely to proceed providing – each superior returns and decrease volatility.

And it stands to motive that dividend development shares would offer each stronger returns and decrease volatility versus non-dividend development shares.

Rising dividends are a optimistic sign of underlying enterprise development on a per share foundation and constant money stream technology capacity.

Dividend development is measured in years of consecutive will increase, and proportion or compound improve over a lot of years.

All different issues being equal, longer streaks and higher proportion will increase are most well-liked.

Longer streaks are most well-liked as a result of they present an organization can improve dividends over a variety of financial and aggressive environments. They present proof of a sturdy aggressive benefit.

It’s no small feat to spice up a dividend year-after-year for many years at a time, via recessions, wars, and epidemics.

And since dividends are paid with precise money, they’ll’t be faked. An organization can not pay dividends for any significant size of time with out producing money flows to help the dividend.

After all, not all dividend development shares make equally good investments…

Because of this we suggest shares with at the least 10+ consecutive years of dividend will increase, which we name ‘blue chip’ shares.

You possibly can obtain our free blue chip shares checklist with necessary monetary metrics, resembling dividend yields and price-to-earnings ratios, by clicking on the hyperlink beneath:

Blue-chip shares are established, financially robust, and constantly worthwhile publicly traded corporations.

By investing in blue-chip shares with lengthy histories of accelerating dividends every year, whatever the state of the worldwide economic system, buyers can unleash the ability of dividend development.

This text will talk about 10 blue-chip shares with the best anticipated future dividend development within the Positive Evaluation Analysis Database.

The ten blue chip shares beneath are sorted by estimated dividend development fee, from lowest to highest.

Desk of Contents

The desk of contents beneath permits for simple navigation.

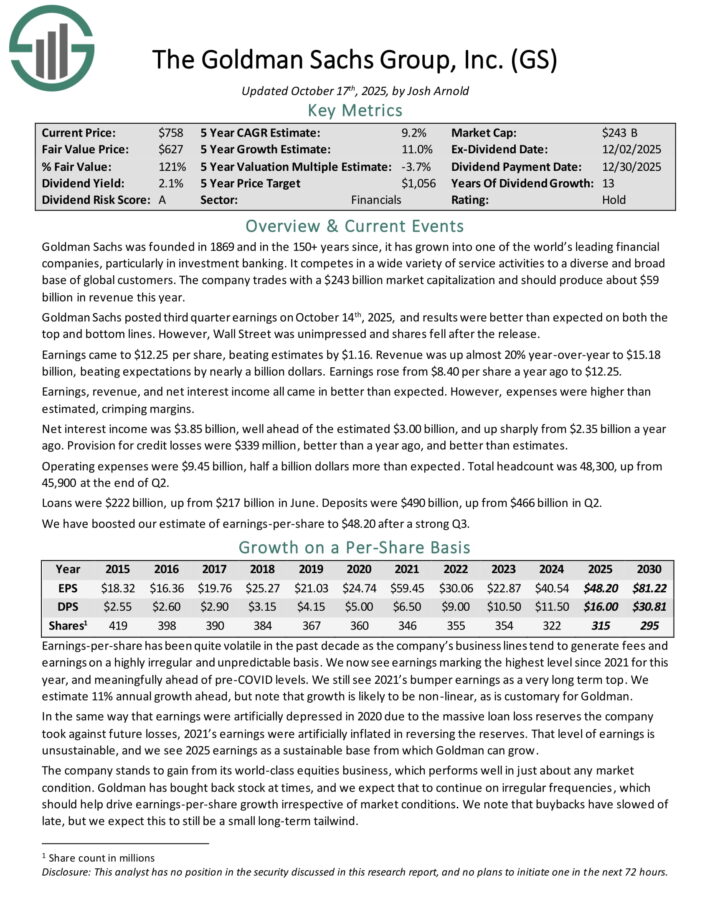

Dividend Progress Inventory: Goldman Sachs Group (GS)

Goldman Sachs was based in 1869 and within the 150+ years since, it has grown into one of many world’s main monetary corporations, significantly in funding banking.

It competes in all kinds of service actions to a various and broad base of worldwide prospects. The corporate ought to produce about $55 billion in income this 12 months.

Goldman Sachs posted third quarter earnings on October 14th, 2025, and outcomes have been higher than anticipated on each the highest and backside strains. Earnings got here to $12.25 per share, beating estimates by $1.16.

Income was up nearly 20% year-over-year to $15.18 billion, beating expectations by almost a billion {dollars}. Earnings rose from $8.40 per share a 12 months in the past to $12.25.

Internet curiosity earnings was $3.85 billion, nicely forward of the estimated $3.00 billion, and up sharply from $2.35 billion a 12 months in the past. Provision for credit score losses have been $339 million, higher than a 12 months in the past, and higher than estimates.

Working bills have been $9.45 billion, half a billion {dollars} greater than anticipated. Whole headcount was 48,300, up from 45,900 on the finish of Q2. Loans have been $222 billion, up from $217 billion in June. Deposits have been $490 billion, up from $466 billion in Q2.

Click on right here to obtain our most up-to-date Positive Evaluation report on GS (preview of web page 1 of three proven beneath):

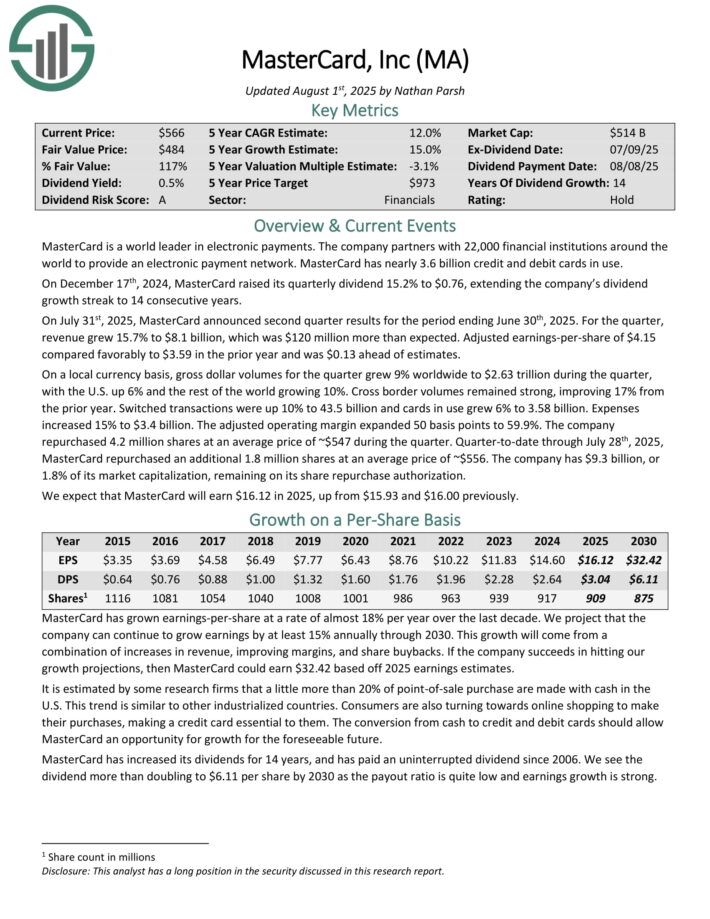

Dividend Progress Inventory: Mastercard Inc. (MA)

MasterCard is a world chief in digital funds. The corporate companions with 25,000 monetary establishments all over the world to supply an digital fee community. MasterCard has greater than 3.1 billion credit score and debit playing cards in use.

On July thirty first, 2025, MasterCard introduced second quarter outcomes for the interval ending June thirtieth, 2025. For the quarter, income grew 15.7% to $8.1 billion, which was $120 million greater than anticipated. Adjusted earnings-per-share of $4.15 in contrast favorably to $3.59 within the prior 12 months and was $0.13 forward of estimates.

On a neighborhood foreign money foundation, gross greenback volumes for the quarter grew 9% worldwide to $2.63 trillion in the course of the quarter, with the U.S. up 6% and the remainder of the world rising 10%. Cross border volumes remained robust, bettering 17% from the prior 12 months.

Switched transactions have been up 10% to 43.5 billion and playing cards in use grew 6% to three.58 billion. Bills elevated 15% to $3.4 billion. The adjusted working margin expanded 50 foundation factors to 59.9%.

The corporate repurchased 4.2 million shares at a mean value of ~$547 in the course of the quarter. Quarter-to-date via July twenty eighth, 2025, MasterCard repurchased a further 1.8 million shares at a mean value of ~$556.

Click on right here to obtain our most up-to-date Positive Evaluation report on Mastercard (preview of web page 1 of three proven beneath):

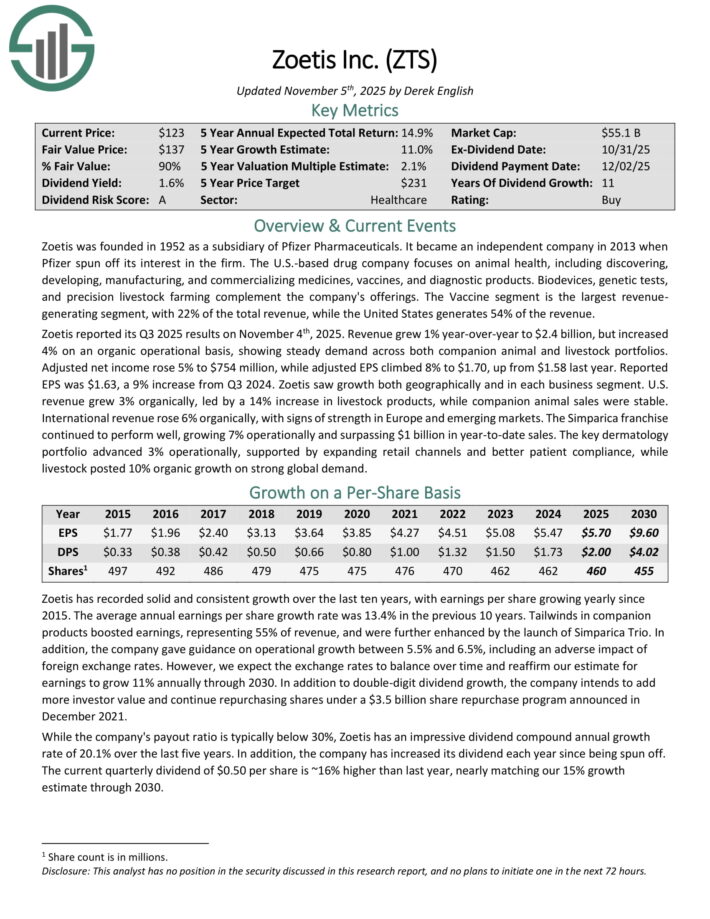

Dividend Progress Inventory: Zoetis Inc. (ZTS)

Zoetis was based in 1952 as a subsidiary of Pfizer Prescription drugs. It grew to become an unbiased firm in 2013 when Pfizer spun off its curiosity within the agency.

The U.S.-based drug firm focuses on animal well being, together with discovering, growing, manufacturing, and commercializing medicines, vaccines, and diagnostic merchandise.

Biodevices, genetic checks, and precision livestock farming complement the corporate’s choices. The Vaccine section is the most important income producing section, with 22% of the full income, whereas the USA generates 54% of the income.

Zoetis reported its Q3 2025 outcomes on November 4th, 2025. Income grew 1% year-over-year to $2.4 billion, however elevated 4% on an natural operational foundation, exhibiting regular demand throughout each companion animal and livestock portfolios.

Adjusted web earnings rose 5% to $754 million, whereas adjusted EPS climbed 8% to $1.70, up from $1.58 final 12 months. Reported EPS was $1.63, a 9% improve from Q3 2024. Zoetis noticed development each geographically and in every enterprise section.

U.S. income grew 3% organically, led by a 14% improve in livestock merchandise, whereas companion animal gross sales have been steady.

Worldwide income rose 6% organically, with indicators of power in Europe and rising markets. The Simparica franchise continued to carry out nicely, rising 7% operationally and surpassing $1 billion in year-to-date gross sales.

Click on right here to obtain our most up-to-date Positive Evaluation report on ZTS (preview of web page 1 of three proven beneath):

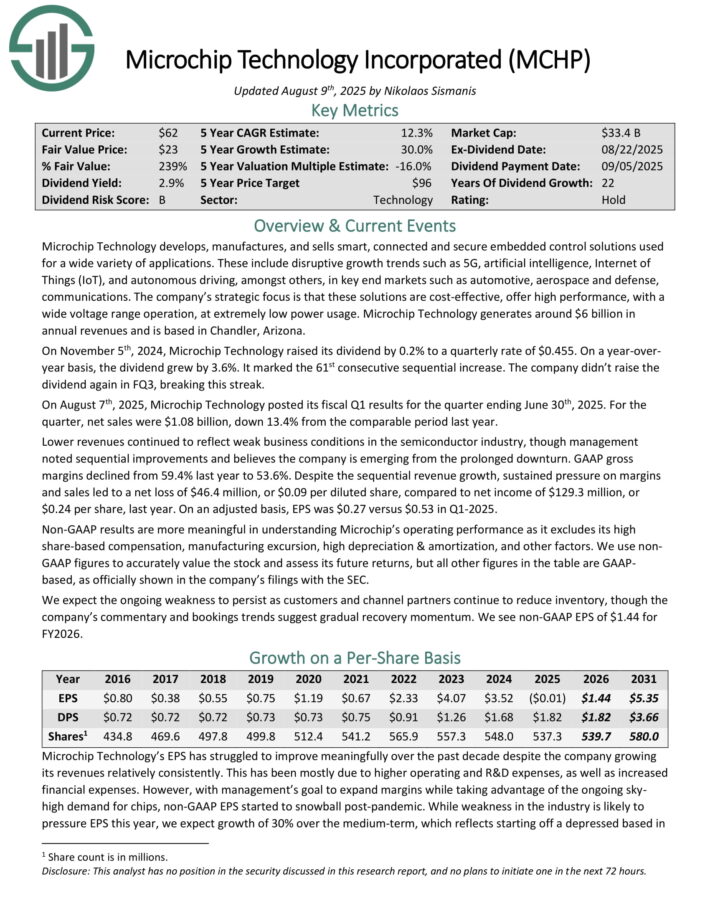

Dividend Progress Inventory: Microchip Know-how (MCHP)

Microchip Know-how develops, manufactures, and sells good, related and safe embedded management options used for all kinds of functions.

These embody disruptive development tendencies resembling 5G, synthetic intelligence, Web of Issues (IoT), and autonomous driving, amongst others, in key finish markets resembling automotive, aerospace and protection, communications.

Microchip Know-how generates round $6 billion in annual revenues and relies in Chandler, Arizona.

On August seventh, 2025, Microchip Know-how posted its fiscal Q1 outcomes for the quarter ending June thirtieth, 2025. For the quarter, web gross sales have been $1.08 billion, down 13.4% from the comparable interval final 12 months.

Decrease revenues continued to replicate weak enterprise situations within the semiconductor trade, although administration famous sequential enhancements and believes the corporate is rising from the extended downturn.

GAAP gross margins declined from 59.4% final 12 months to 53.6%. Regardless of the sequential income development, sustained strain on margins and gross sales led to a web lack of $46.4 million, or $0.09 per diluted share, in comparison with web earnings of $129.3 million, or $0.24 per share, final 12 months.

On an adjusted foundation, EPS was $0.27 versus $0.53 in Q1-2025.

Click on right here to obtain our most up-to-date Positive Evaluation report on MCHP (preview of web page 1 of three proven beneath):

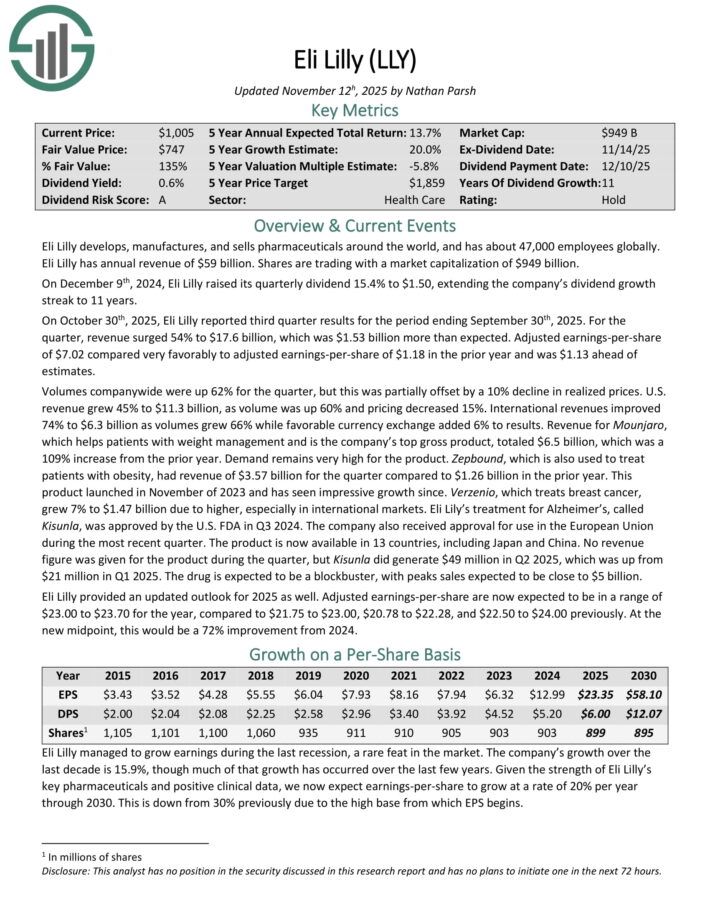

Dividend Progress Inventory: Eli Lilly (LLY)

Eli Lilly develops, manufactures, and sells prescribed drugs all over the world, and has about 47,000 staff globally. Eli Lilly has annual income of $59 billion.

On October thirtieth, 2025, Eli Lilly reported third quarter outcomes for the interval ending September thirtieth, 2025. For the quarter, income surged 54% to $17.6 billion, which was $1.53 billion greater than anticipated.

Adjusted earnings-per-share of $7.02 in contrast very favorably to adjusted earnings-per-share of $1.18 within the prior 12 months and was $1.13 forward of estimates.

Volumes companywide have been up 62% for the quarter, however this was partially offset by a ten% decline in realized costs. U.S. income grew 45% to $11.3 billion, as quantity was up 60% and pricing decreased 15%.

Worldwide revenues improved 74% to $6.3 billion as volumes grew 66% whereas favorable foreign money alternate added 6% to outcomes. Income for Mounjaro, which helps sufferers with weight administration and is the corporate’s prime gross product, totaled $6.5 billion, which was a 109% improve from the prior 12 months.

Zepbound, which can also be used to deal with sufferers with weight problems, had income of $3.57 billion for the quarter in comparison with $1.26 billion within the prior 12 months. This product launched in November of 2023 and has seen spectacular development since.

Verzenio, which treats breast most cancers, grew 7% to $1.47 billion as a consequence of larger, particularly in worldwide markets.

Eli Lilly offered an up to date outlook for 2025 as nicely. Adjusted earnings-per-share are actually anticipated to be in a variety of $23.00 to $23.70 for the 12 months.

Click on right here to obtain our most up-to-date Positive Evaluation report on LLY (preview of web page 1 of three proven beneath):

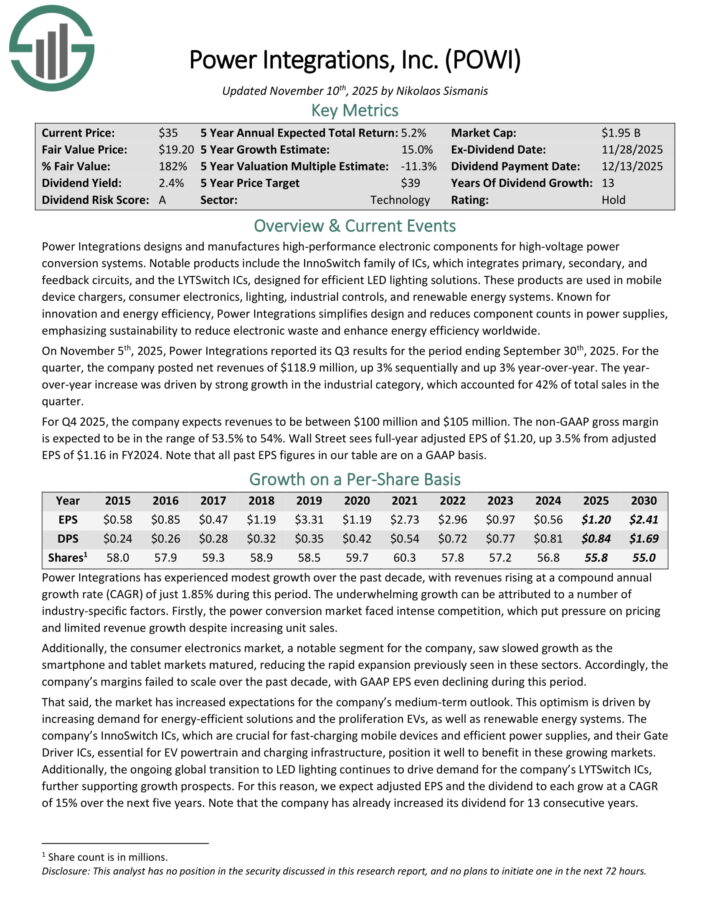

Dividend Progress Inventory: Energy Integrations Inc. (POWI)

Energy Integrations designs and manufactures high-performance digital elements for high-voltage energy conversion methods.

Notable merchandise embody the InnoSwitch household of ICs, which integrates major, secondary, and suggestions circuits, and the LYTSwitch ICs, designed for environment friendly LED lighting options. These merchandise are utilized in cellular machine chargers, shopper electronics, lighting, industrial controls, and renewable power methods.

Recognized for innovation and power effectivity, Energy Integrations simplifies design and reduces element counts in energy provides, emphasizing sustainability to scale back digital waste and improve power effectivity worldwide.

On November fifth, 2025, Energy Integrations reported its Q3 outcomes. For the quarter, the corporate posted web revenues of $118.9 million, up 3% sequentially and up 3% year-over-year. The year-over-year improve was pushed by robust development within the industrial class, which accounted for 42% of complete gross sales within the quarter.

For This autumn 2025, the corporate expects revenues to be between $100 million and $105 million. The non-GAAP gross margin is predicted to be within the vary of 53.5% to 54%.

Wall Road sees full-year adjusted EPS of $1.20, up 3.5% from adjusted EPS of $1.16 in FY2024. Word that each one previous EPS figures in our desk are on a GAAP foundation.

Click on right here to obtain our most up-to-date Positive Evaluation report on POWI (preview of web page 1 of three proven beneath):

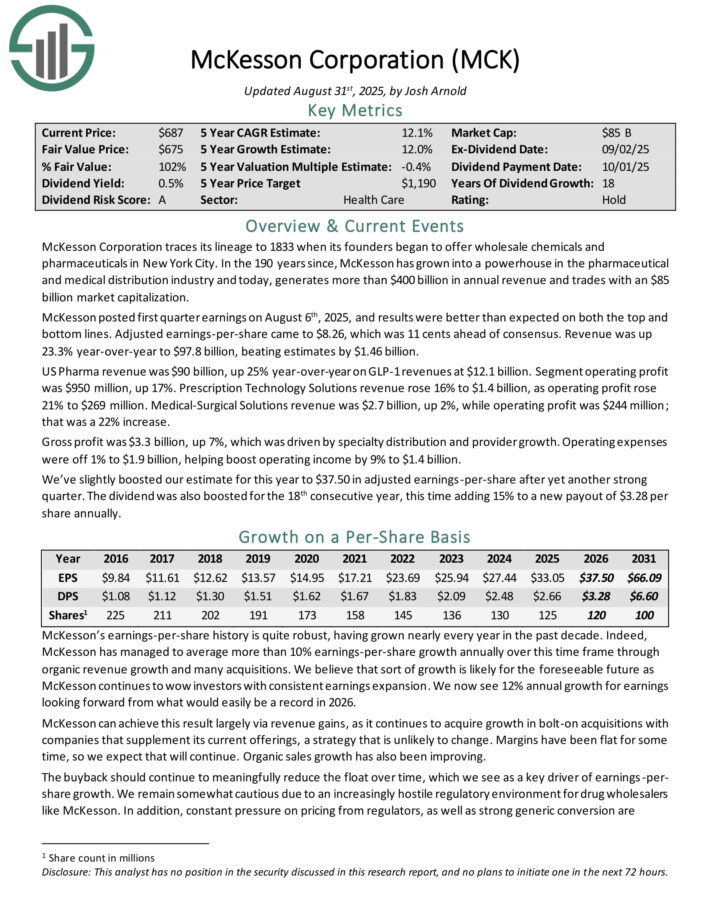

Dividend Progress Inventory: McKesson Company (MCK)

McKesson Company traces its lineage to 1833 when its founders started to supply wholesale chemical substances and prescribed drugs in New York Metropolis.

Within the 190 years since, McKesson has grown right into a powerhouse within the pharmaceutical and medical distribution trade and right now, generates greater than $300 billion in annual income.

McKesson posted first quarter earnings on August sixth, 2025, and outcomes have been higher than anticipated on each the highest and backside strains.

Adjusted earnings-per-share got here to $8.26, which was 11 cents forward of consensus. Income was up 23.3% year-over-year to $97.8 billion, beating estimates by $1.46 billion.

US Pharma income was $90 billion, up 25% year-over-year on GLP-1 revenues at $12.1 billion. Section working revenue was $950 million, up 17%.

Prescription Know-how Options income rose 16% to $1.4 billion, as working revenue rose 21% to $269 million. Medical-Surgical Options income was $2.7 billion, up 2%, whereas working revenue was $244 million; that was a 22% improve.

Gross revenue was $3.3 billion, up 7%, which was pushed by specialty distribution and supplier development. Working bills have been off 1% to $1.9 billion, serving to increase working earnings by 9% to $1.4 billion.

Click on right here to obtain our most up-to-date Positive Evaluation report on MCK (preview of web page 1 of three proven beneath):

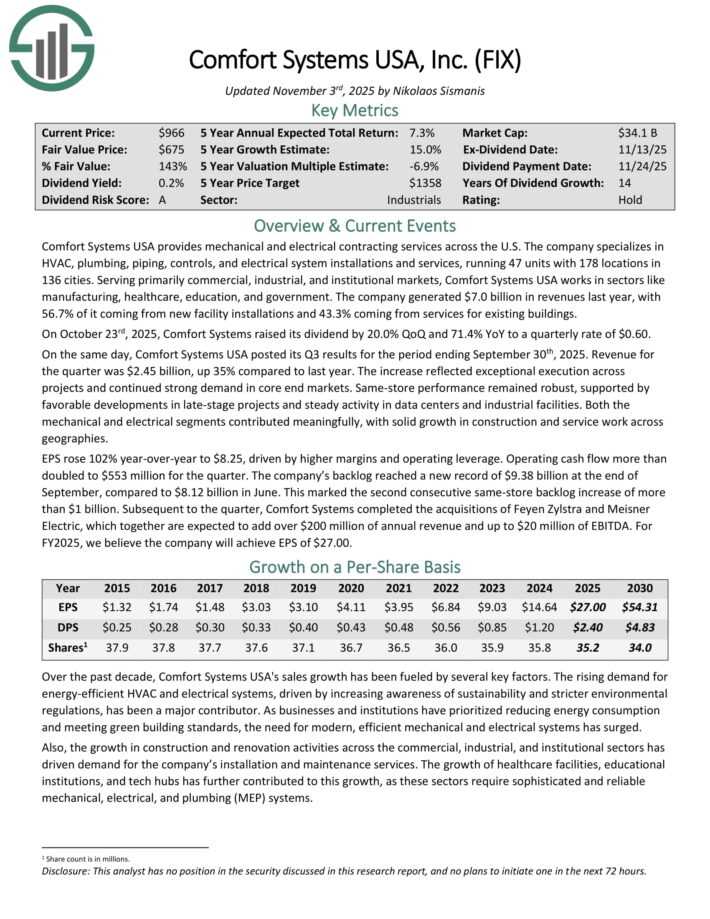

Dividend Progress Inventory: Consolation Programs USA (FIX)

Consolation Programs USA supplies mechanical and electrical contracting providers throughout the U.S. The corporate makes a speciality of HVAC, plumbing, piping, controls, and electrical system installations and providers, working 47 items with 178 areas in 136 cities.

Serving primarily business, industrial, and institutional markets, Consolation Programs USA works in sectors like manufacturing, healthcare, training, and authorities. The corporate generated $7.0 billion in revenues final 12 months, with 56.7% of it coming from new facility installations and 43.3% coming from providers for current buildings.

On October twenty third, 2025, Consolation Programs raised its dividend by 20.0% QoQ and 71.4% YoY to a quarterly fee of $0.60. On the identical day, Consolation Programs USA posted its Q3 outcomes for the interval ending September thirtieth, 2025. Income for the quarter was $2.45 billion, up 35% in comparison with final 12 months.

The rise mirrored distinctive execution throughout initiatives and continued robust demand in core finish markets. Identical-store efficiency remained strong, supported by favorable developments in late-stage initiatives and regular exercise in knowledge facilities and industrial services.

Each the mechanical and electrical segments contributed meaningfully, with strong development in building and repair work throughout geographies.

EPS rose 102% year-over-year to $8.25, pushed by larger margins and working leverage. Working money stream greater than doubled to $553 million for the quarter. The corporate’s backlog reached a brand new report of $9.38 billion on the finish of September, in comparison with $8.12 billion in June.

This marked the second consecutive same-store backlog improve of greater than $1 billion. Subsequent to the quarter, Consolation Programs accomplished the acquisitions of Feyen Zylstra and Meisner Electrical, which collectively are anticipated so as to add over $200 million of annual income and as much as $20 million of EBITDA.

Click on right here to obtain our most up-to-date Positive Evaluation report on FIX (preview of web page 1 of three proven beneath):

Dividend Progress Inventory: Lemaitre Vascular (LMAT)

LeMaitre Vascular develops, markets, providers, and backs medical units and implants to deal with peripheral vascular illness.

Their choices embody restore stream allografts, angioscopes, embolectomy and thrombectomy catheters, occlusion and perfusion catheters, artery graft biologic grafts, carotid shunts, radiopaque tape, valvulotomes, vascular grafts, cardiac patches, and closure methods.

On August fifth, 2025, LeMaitre introduced outcomes for the second quarter of 2025, reporting Q2 non-GAAP EPS of $0.60 that beat analysts’ estimates by $0.03.

LeMaitre Vascular delivered robust Q2 2025 outcomes, with gross sales climbing 15% year-over-year to $64.2 million, solely pushed by natural development.

Beneficial properties have been led by catheters, which have been up 27%, and grafts, which have been larger by 19%, with value will increase contributing 8% and unit volumes including 7% to development. Regional efficiency was broad-based, with EMEA gross sales up 23%, Americas up 12%, and APAC up 12%.

Gross margin expanded 110 foundation factors to 70.0% on improved pricing and manufacturing efficiencies, whereas working earnings rose 12% to $16.1 million, representing a 25% margin. Money elevated by $16.9 million sequentially to $319.5 million.

The corporate raised full-year steerage to $251 million in gross sales (+14%) and $2.30 EPS (+19%) on the midpoint.

Click on right here to obtain our most up-to-date Positive Evaluation report on LMAT (preview of web page 1 of three proven beneath):

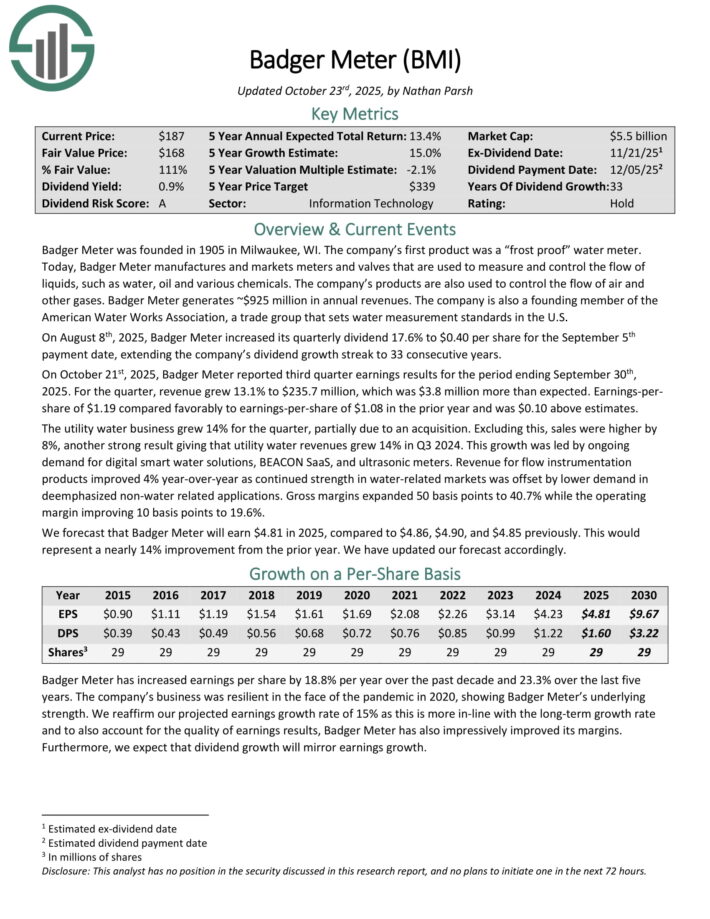

Dividend Progress Inventory: Badger Meter (BMI)

Badger Meter manufactures and markets meters and valves which are used to measure and management the stream of liquids, resembling water, oil and varied chemical substances.

The corporate’s merchandise are additionally used to regulate the stream of air and different gases. Badger Meter generates ~$925 million in annual revenues.

On August eighth, 2025, Badger Meter elevated its quarterly dividend 17.6% to $0.40 per share for the September fifth fee date, extending the corporate’s dividend development streak to 33 consecutive years.

On October twenty first, 2025, Badger Meter reported third quarter earnings outcomes. For the quarter, income grew 13.1% to $235.7 million, which was $3.8 million greater than anticipated.

Earnings-per-share of $1.19 in contrast favorably to earnings-per-share of $1.08 within the prior 12 months and was $0.10 above estimates.

The utility water enterprise grew 14% for the quarter, partially as a consequence of an acquisition. Excluding this, gross sales have been larger by 8%, one other robust consequence giving that utility water revenues grew 14% in Q3 2024. This development was led by ongoing demand for digital good water options, BEACON SaaS, and ultrasonic meters.

Income for stream instrumentation merchandise improved 4% year-over-year as continued power in water-related markets was offset by decrease demand in de-emphasized non-water associated functions.

Click on right here to obtain our most up-to-date Positive Evaluation report on BMI (preview of web page 1 of three proven beneath):

Extra Studying

In case you are curious about discovering different high quality dividend development shares, the next Positive Dividend assets could also be helpful:

Different Positive Dividend Sources

Thanks for studying this text. Please ship any suggestions, corrections, or inquiries to help@suredividend.com.