Every firm operates inside sectors which might be comparatively resilient to financial fluctuations.

Contemplate these shares for his or her defensive qualities and long-term development potential.

Searching for actionable commerce concepts to navigate the present market volatility? Subscribe right here to unlock entry to InvestingPro’s AI-selected inventory winners.

As the worldwide economic system braces for the repercussions of a possible commerce conflict, buyers are understandably anxious about market volatility and the affect on their portfolios. In instances of heightened world uncertainty and escalating commerce tensions, it is prudent to hunt out safe-haven shares that provide stability and development prospects, whatever the prevailing market circumstances.

Three such corporations, Merck (NSE:), NextEra Power (NYSE:), and Tyson Meals (NYSE:) stand out for his or her robust fundamentals and resilient enterprise fashions. These corporations share essential traits that make them enticing throughout commerce wars: important services or products, robust home market positions, and comparatively low publicity to worldwide commerce disruptions.

Their mixture of defensive traits, strong financials, and affordable valuations makes them compelling investments in periods of elevated world commerce tensions.

1. Merck

12 months-To-Date Efficiency: -6.9%

Market Cap: $233.8 Billion

Merck, one of many world’s main pharmaceutical corporations, is famend for its revolutionary healthcare options, together with cutting-edge oncology remedies and a broad portfolio of vaccines and pharmaceuticals.

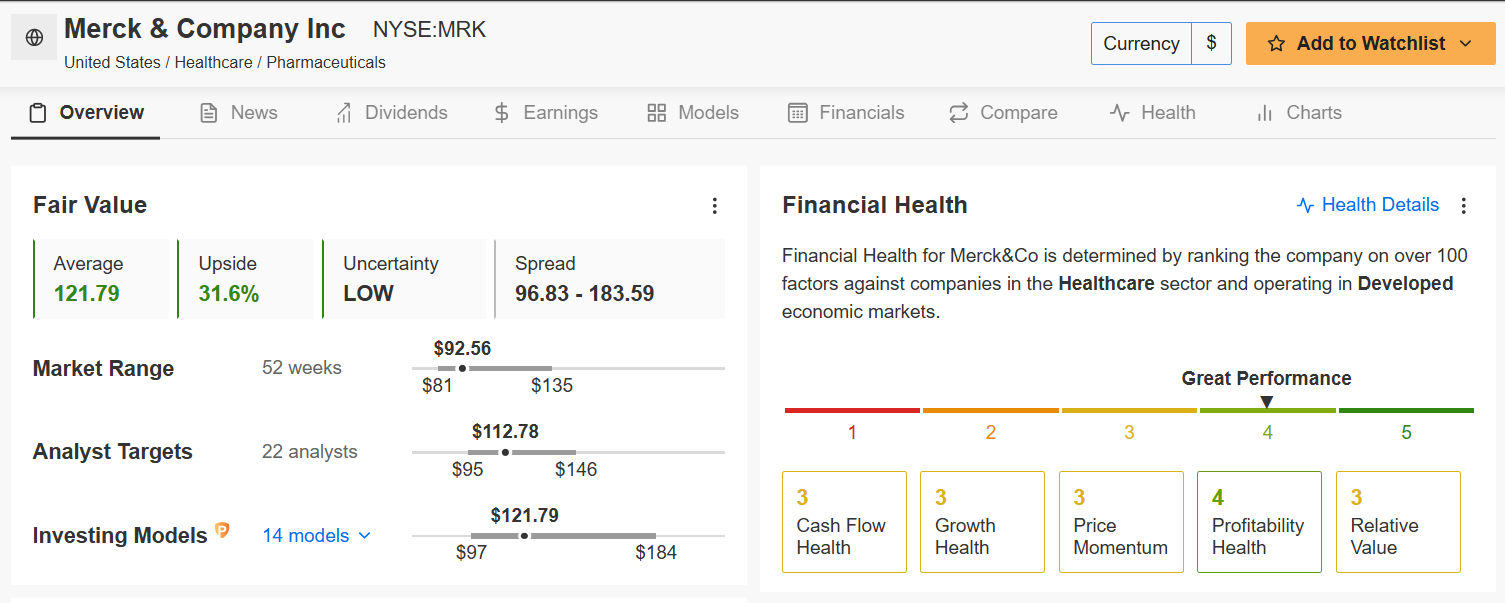

Supply: Investing.com

What makes Merck significantly enticing throughout commerce tensions is its defensive nature (beta of 0.36), robust dividend yield (3.48%), and spectacular return on fairness (40.8%). The corporate’s important healthcare merchandise have a tendency to take care of demand no matter financial circumstances, offering a pure hedge in opposition to market volatility.

Buying and selling at $92.56, MRK inventory seems considerably undervalued in comparison with its Truthful Worth of $121.79 (+31.6% upside potential). Analysts keep a ‘Sturdy Purchase’ consensus with a imply value goal of $112.78, starting from $95.00 to $146.00.

Supply: InvestingPro

Merck’s numerous portfolio of merchandise and its dedication to innovation via substantial R&D investments place it nicely for development, even amidst a commerce conflict. The corporate’s key manufacturers, corresponding to Januvia for diabetes and Keytruda for most cancers therapy, proceed to drive gross sales and display the corporate’s resilience, as evident by its ‘GREAT’ Monetary Well being rating.

2. NextEra Power

12 months-To-Date Efficiency: -1.1%

Market Cap: $145.7 Billion

NextEra Power, a frontrunner in renewable power and one of many largest utility corporations in america, supplies important energy via each conventional and clear power sources.

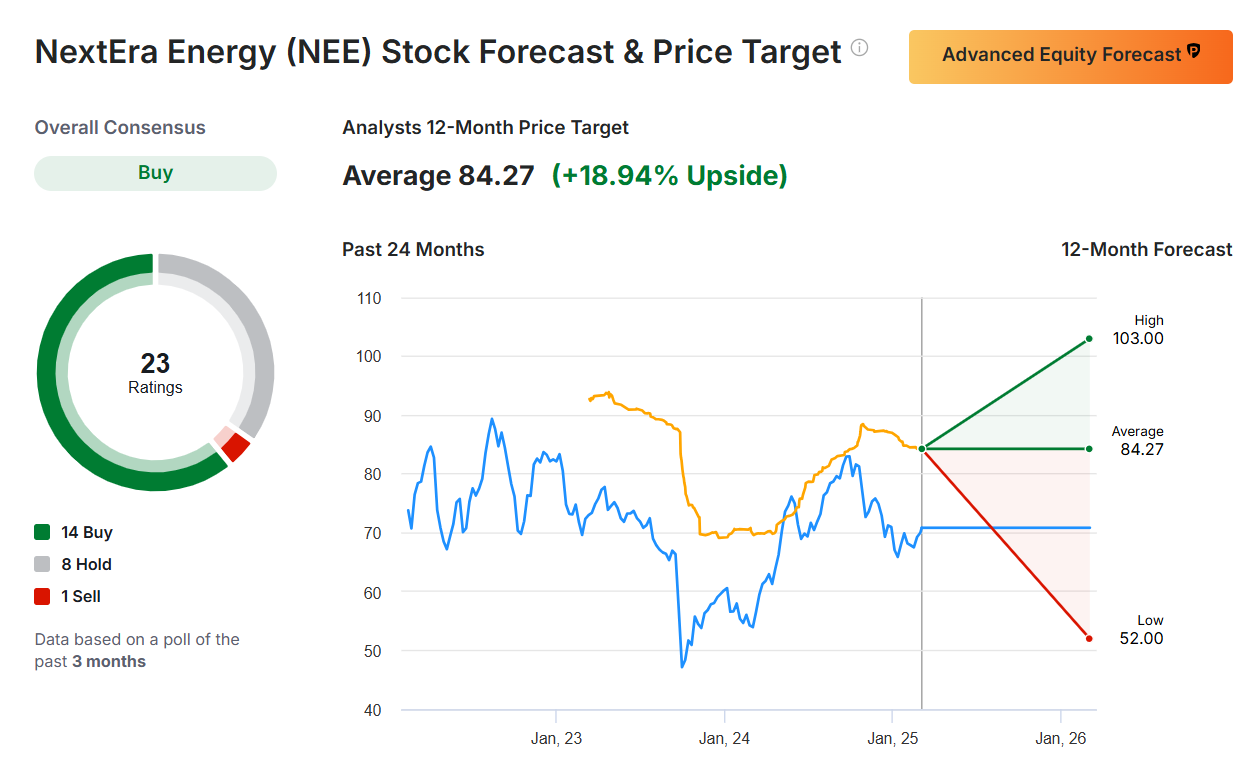

Supply: Investing.com

NextEra’s defensive enchantment stems from its low beta of 0.57, enticing 3.2% dividend yield, and controlled enterprise mannequin. The corporate’s concentrate on home renewable power infrastructure makes it comparatively insulated from world commerce disputes, whereas its important service nature supplies constant demand via financial cycles.

Buying and selling at $70.85, analysts see a big upside with value targets starting from $52.00 to $103.00, with a imply goal of $84.27 (+19% upside).

Supply: Investing.com

With a protracted historical past of secure money flows and a dedication to sustainable development, NextEra is uniquely positioned to learn from each the power transition and the inherent stability of the utility sector. As commerce tensions heighten and volatility will increase, NextEra’s dependable dividend yield and constant efficiency supply buyers a safe foothold, whereas its aggressive investments in renewable power guarantee long-term development prospects.

3. Tyson Meals

12 months-To-Date Efficiency: +5.3%

Market Cap: $21.5 Billion

Tyson Meals, a serious participant within the meals processing business, produces a various vary of protein merchandise, together with beef, pork, and hen, together with packaged ready meals.

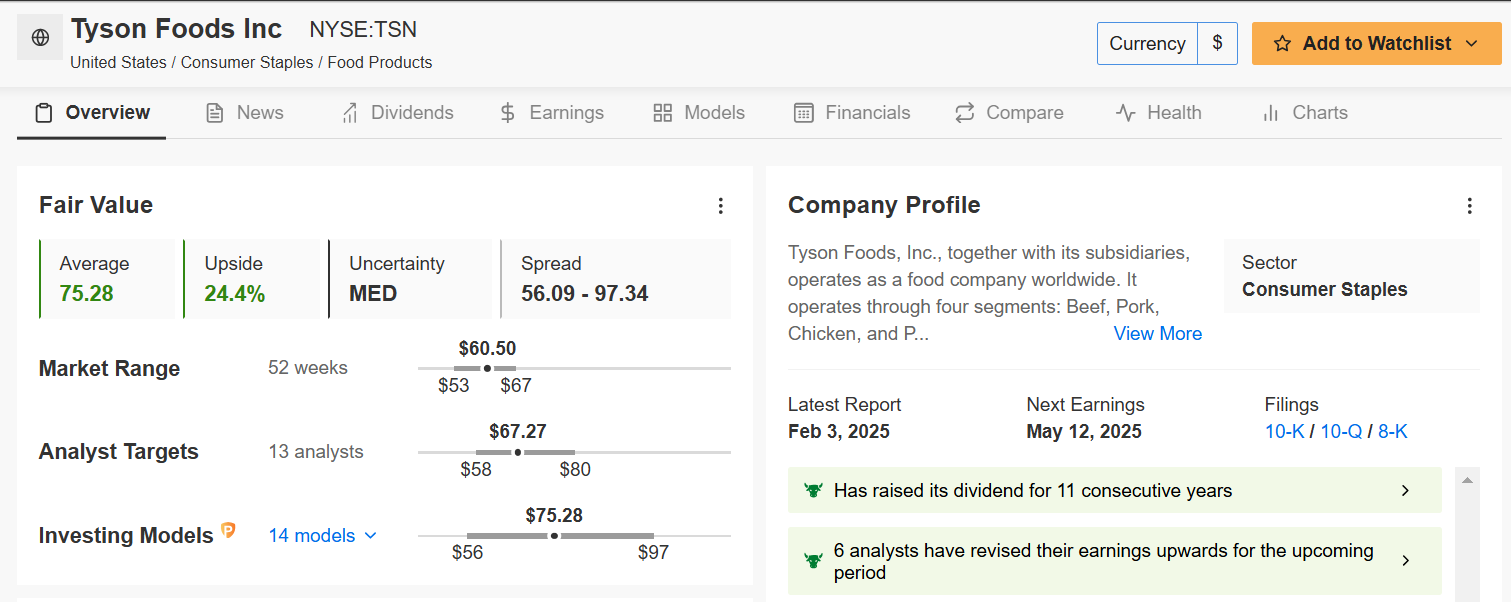

Supply: Investing.com

Tyson’s defensive traits embrace a average beta of 0.71, a strong 3.3% dividend yield, and robust market place throughout protein classes. The corporate’s home focus and important client staples nature present stability throughout worldwide commerce disruptions.

At present buying and selling at $60.50, TSN shares present promising upside potential with a Truthful Worth estimate of $75.28 (+24.4% upside). Analysts keep a ‘Purchase’ score with value targets starting from $58.00 to $80.00.

Supply: InvestingPro

As considered one of America’s largest meals producers, Tyson Meals important position within the meals provide chain makes it comparatively resistant to commerce conflict impacts. The corporate’s built-in operations, mixed with robust market share within the U.S., supply a stage of stability that’s significantly interesting in periods of financial turbulence.

Conclusion

Within the face of a looming commerce conflict and the next market volatility, buyers would do nicely to think about safe-haven shares that provide stability and development potential.

Merck, with its important healthcare merchandise, NextEra Power, with its management in renewable power, and Tyson Meals, with its important meals choices, signify strong selections for buyers trying to climate the financial storm.

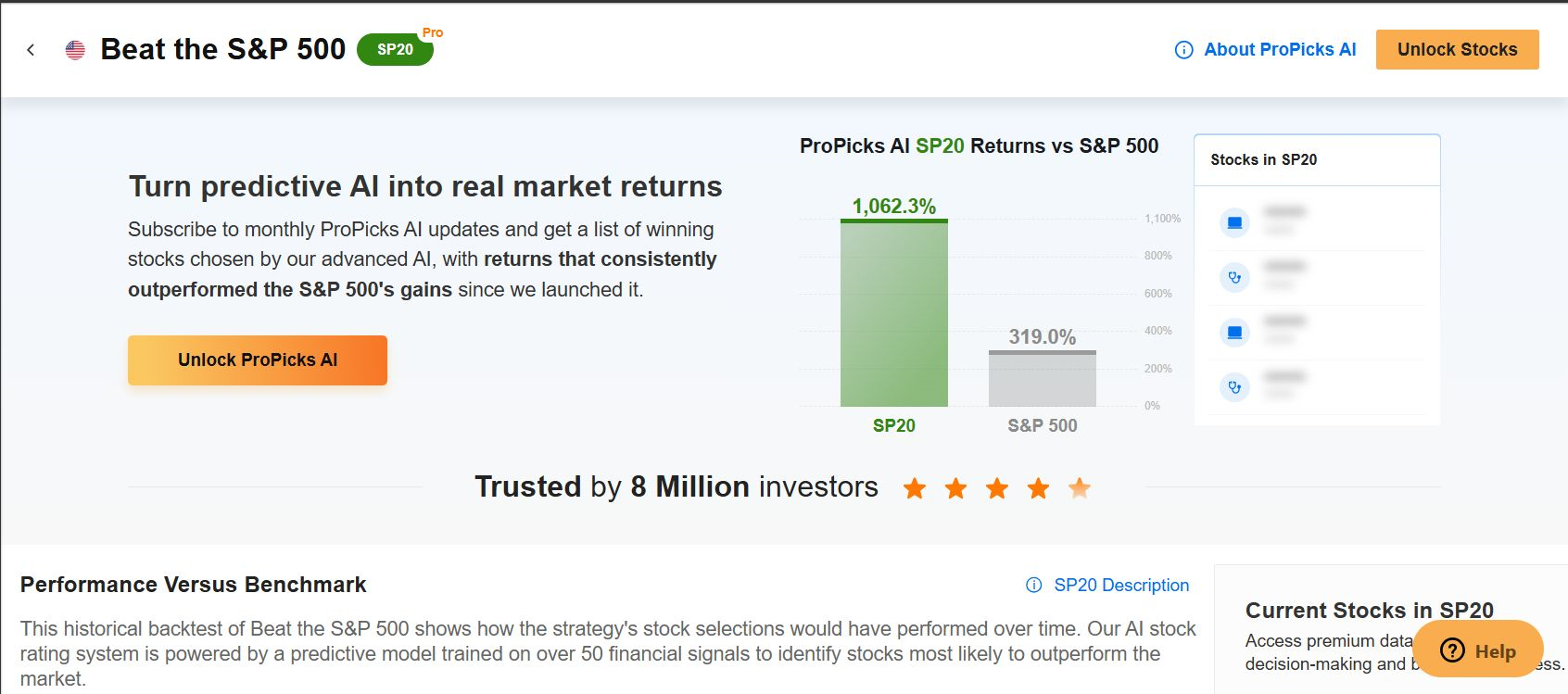

You should definitely try InvestingPro to remain in sync with the market development and what it means on your buying and selling. Whether or not you are a novice investor or a seasoned dealer, leveraging InvestingPro can unlock a world of funding alternatives whereas minimizing dangers amid the difficult market backdrop.

Subscribe now and immediately unlock entry to a number of market-beating options, together with:

ProPicks AI: AI-selected inventory winners with confirmed monitor file.

InvestingPro Truthful Worth: Immediately discover out if a inventory is underpriced or overvalued.

Superior Inventory Screener: Seek for the perfect shares based mostly on a whole bunch of chosen filters, and standards.

High Concepts: See what shares billionaire buyers corresponding to Warren Buffett, Michael Burry, and George Soros are shopping for.

Disclosure: On the time of writing, I’m lengthy on the S&P 500, and the Nasdaq 100 by way of the SPDR® S&P 500 ETF (SPY), and the Invesco QQQ Belief ETF (QQQ). I’m additionally lengthy on the Invesco High QQQ ETF (QBIG), Invesco S&P 500 Equal Weight ETF (RSP), and VanEck Vectors Semiconductor ETF (SMH).

I repeatedly rebalance my portfolio of particular person shares and ETFs based mostly on ongoing danger evaluation of each the macroeconomic surroundings and corporations’ financials.

The views mentioned on this article are solely the opinion of the writer and shouldn’t be taken as funding recommendation.

Comply with Jesse Cohen on X/Twitter @JesseCohenInv for extra inventory market evaluation and perception.