Up to date on March seventh, 2025 by Bob Ciura

Oil and fuel royalty trusts are actually providing exceptionally excessive distributions to their traders, leading to a lot greater yields than the ~1.3% common dividend yield of the S&P 500.

We now have created a spreadsheet of excessive dividend shares with dividend yields of 5% or extra…

You’ll be able to obtain your free full record of all securities with 5%+ yields (together with essential monetary metrics resembling dividend yield and payout ratio) by clicking on the hyperlink beneath:

On this article, we’ll focus on the prospects of the 5 highest-yielding royalty trusts.

Desk of Contents

You’ll be able to immediately leap to any particular part of the article through the use of the hyperlinks beneath:

Excessive-Yield Royalty Belief No. 4: Permian Basin Royalty Belief (PBT)

Permian Basin Royalty Belief is an oil and fuel belief, which was based in 1980. In 2023, about 55% of output was oil and 45% was fuel, however 85% of revenues got here from oil.

PBT is a mixture belief: unit holders have a 75% internet overriding royalty curiosity in Waddell Ranch Properties in Texas, which incorporates a number of oil and fuel wells; and a 95% internet overriding royalty curiosity within the Texas Royalty Properties, which incorporates varied oil wells.

The belief’s property are static in that no additional properties could be added. The belief has no operations however is merely a cross via automobile for the royalties. PBT had royalty revenue of $54.4 million in 2022 and $29.0 million in 2023.

In mid-November, PBT reported (11/12/24) monetary outcomes for the third quarter of fiscal 2024. The typical realized worth of oil considerably improved over the prior 12 months’s interval. Given additionally excessive working prices at Waddell Ranch properties in final 12 months’s quarter, distributable revenue per unit greater than doubled, from $0.07 to $0.17.

Click on right here to obtain our most up-to-date Certain Evaluation report on Permian Basin Royalty Belief (PBT) (preview of web page 1 of three proven beneath):

Excessive-Yield Royalty Belief No. 3: Permianville Royalty Belief (PVL)

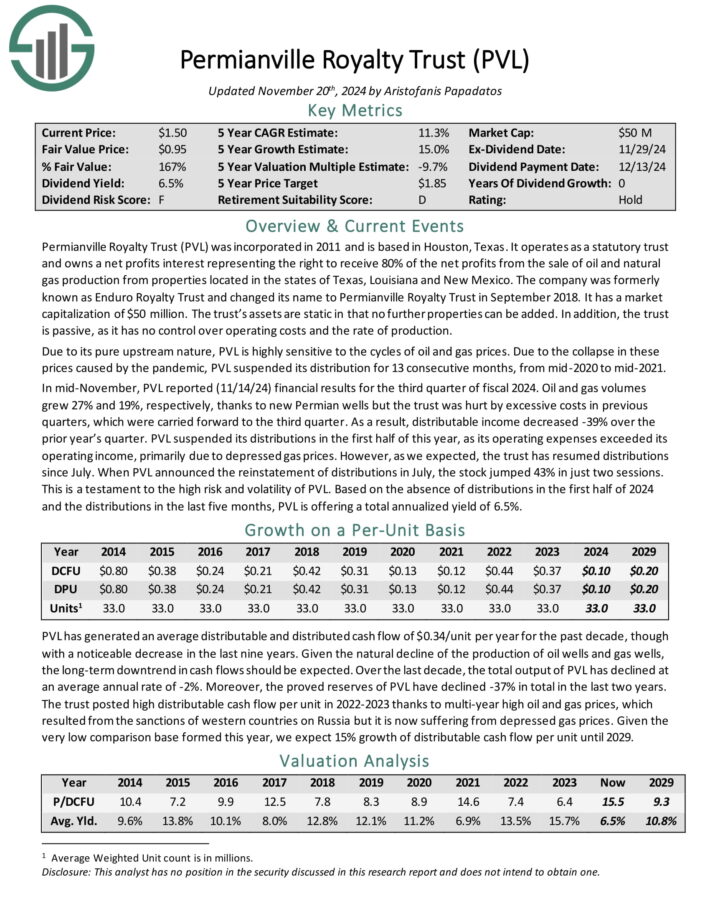

Permianville Royalty Belief (PVL) was integrated in 2011 and is predicated in Houston, Texas. It operates as a statutory belief and owns a internet income curiosity representing the fitting to obtain 80% of the online income from the sale of oil and pure fuel manufacturing from properties situated within the states of Texas, Louisiana and New Mexico.

It has a market capitalization of $63 million. The belief’s property are static in that no additional properties could be added. As well as, the belief is passive, because it has no management over working prices and the speed of manufacturing.

In mid-November, PVL reported (11/14/24) monetary outcomes for the third quarter of fiscal 2024. Oil and fuel volumes grew 27% and 19%, respectively, because of new Permian wells however the belief was damage by extreme prices in earlier quarters, which had been carried ahead to the third quarter.

In consequence, distributable revenue decreased -39% over the prior 12 months’s quarter.

Click on right here to obtain our most up-to-date Certain Evaluation report on PVL (preview of web page 1 of three proven beneath):

Excessive-Yield Royalty Belief No. 2: Cross Timbers Royalty Belief (CRT)

Cross Timbers Royalty Belief is an oil and fuel belief (about 50/50), arrange in 1991 by XTO Power. Its unitholders have a 90% internet revenue curiosity in producing properties in Texas, Oklahoma, and New Mexico; and a 75% internet revenue curiosity in working curiosity properties in Texas and Oklahoma.

In mid-November, CRT reported (11/13/24) outcomes for the third quarter of fiscal 2024. Fuel volumes elevated 17% over the prior 12 months’s quarter because of timing of receipts of Oklahoma internet revenue pursuits however oil volumes declined -23%.

As well as, the common realized worth of fuel dipped -14%. In consequence, distributable money movement (DCF) per unit decreased 37%.

Click on right here to obtain our most up-to-date Certain Evaluation report on Cross Timbers Royalty Belief (CRT) (preview of web page 1 of three proven beneath):

Excessive-Yield Royalty Belief No. 1: PermRock Royalty Belief (PRT)

PermRock Royalty Belief is a belief fashioned in late 2017 by Boaz Power, an organization that’s centered on the acquisition, improvement and operation of oil and pure fuel properties within the Permian Basin. The Belief advantages from the distinctive traits of the Permian Basin, which is essentially the most prolific oil-producing space within the U.S.

On November thirteenth, 2024, PermRock Royalty reported third quarter 2024 outcomes for the interval ending September thirtieth, 2024. Internet income revenue acquired by the belief was $1.55 million, in comparison with $1.69 million in Q3 2023. The typical realized sale worth of oil improved 11% year-over-year, whereas pure fuel plummeted by 23%.

Distributable revenue for the belief got here to $1.34 million, down 9% from $1.47 million within the prior 12 months interval and distributable revenue per unit of $0.11 was decrease by a penny from $0.12 within the prior 12 months.

Click on right here to obtain our most up-to-date Certain Evaluation report on PermRock Royalty Belief (PRT) (preview of web page 1 of three proven beneath):

Ultimate Ideas

On the floor, oil and fuel royalty trusts are enticing as they broadly provide greater yields than the S&P 500 common.

Nonetheless, oil and fuel costs are notorious for his or her dramatic swings. Oil costs have been on a downtrend for the previous a number of months.

Subsequently, traders needs to be ready for a lot decrease distributions from royalty trusts going ahead. They need to additionally pay attention to the extreme danger of all these trusts close to the height of their cycle.

The perfect time to purchase these trusts is throughout a extreme downturn of the power sector, when these shares plunge and thus turn into deeply undervalued from a long-term perspective.

As talked about above, all of the oil and fuel trusts are extremely dangerous because of the pure decline of their manufacturing and their sensitivity to the costs of oil and fuel.

If you’re eager about discovering high-quality dividend development shares and/or different high-yield securities and revenue securities, the next Certain Dividend sources might be helpful:

Excessive-Yield Particular person Safety Analysis

Different Certain Dividend Assets

Thanks for studying this text. Please ship any suggestions, corrections, or inquiries to help@suredividend.com.