Within the dynamic world of investing, discovering undervalued gems can result in vital positive factors.

Right here, we spotlight 5 shares, all buying and selling underneath $10, that not solely provide worth but in addition have the potential for double-digit truthful worth upside.

In response to the AI-powered InvestingPro Honest Worth Mannequin, these corporations are considerably undervalued, making them compelling buys.

On the lookout for actionable commerce concepts to navigate the present market volatility? Subscribe right here to unlock entry to InvestingPro’s AI-selected inventory winners.

In at the moment’s dynamic market, undervalued shares buying and selling underneath $10 can provide traders super upside when paired with stable fundamentals and clear development catalysts.

Leveraging InvestingPro’s AI-powered Honest Worth fashions, we’ve recognized 5 corporations that stand out: IHS Holding (NYSE:), Melco Resorts & Leisure (NASDAQ:), Inter and Co Class A (NASDAQ:), Janus Worldwide Group (NYSE:), and Agilon Well being (NYSE:).

Every of those shares is buying and selling at discount ranges and presents vital double-digit upside potential as they capitalize on favorable trade tailwinds.

1. IHS Holding

Present Value: $3.50

Honest Worth Estimate: $4.64 (+32.6% Upside)

Market Cap: $1.2 Billion

IHS Holding, usually referred to in its operational capability as IHS Towers, is a worldwide big within the shared communications infrastructure sector. With operations throughout Africa, Latin America, and the Center East, IHS makes a speciality of constructing, working, and growing very important communication infrastructure in rising markets.

Supply: InvestingPro

The InvestingPro Honest Worth mannequin means that IHS shares are considerably undervalued, making them a gorgeous purchase at present ranges. Buying and selling at $3.50, InvestingPro estimates its truthful worth at $4.64, indicating a possible upside of +32.6%.

Regardless of difficult market circumstances, IHS sports activities a ‘FAIR’ Monetary Well being Rating of two.18. The corporate’s EBITDA of $966.47M and powerful return on invested capital (ROIC) of 10.9% demonstrates operational effectivity.

IHS at present owns and manages a powerful portfolio of over 40,000 towers throughout 10 international locations spanning three continents. This fast development trajectory positioned IHS as one of many world’s fastest-growing tower operators.

Supply: Investing.com

Shares have been on a tear because the begin of 2025, rising by about 20% year-to-date.

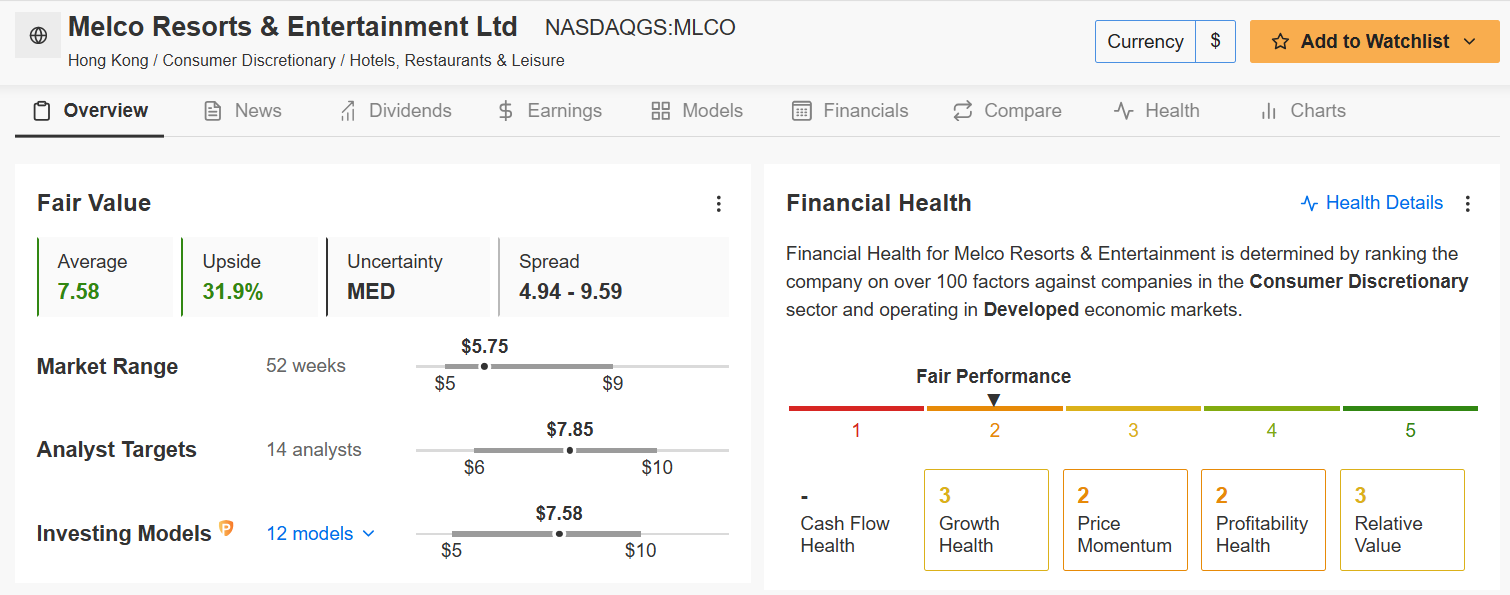

2. Melco Resorts & Leisure

Present Value: $5.75

Honest Worth Estimate: $7.58 (+31.9% Upside)

Market Cap: $2.5 Billion

Melco Resorts & Leisure is a premier developer, proprietor, and operator of gaming and leisure resorts, primarily in Asia. Recognized for its luxurious properties and built-in leisure experiences, Melco advantages from sturdy tourism traits and rising client spending in key markets.

Supply: InvestingPro

Shares of the Macau on line casino operator at present commerce at $5.75 with a ‘FAIR’ Monetary Well being Rating of two.29. Melco’s return to profitability with constructive earnings per share of $0.11 and projected development in FY2025 alerts a robust restoration.

With an InvestingPro Honest Worth estimate of $7.58 (+31.9% upside) and analyst targets as much as $10.00, Melco’s positioning within the Asian gaming market gives substantial upside potential.

The journey and leisure firm’s sturdy model, strategic growth initiatives, and diversified income streams make it a resilient performer.

Supply: Investing.com

The shares are nearly flat up to now in 2025 after a 34% decline in 2024.

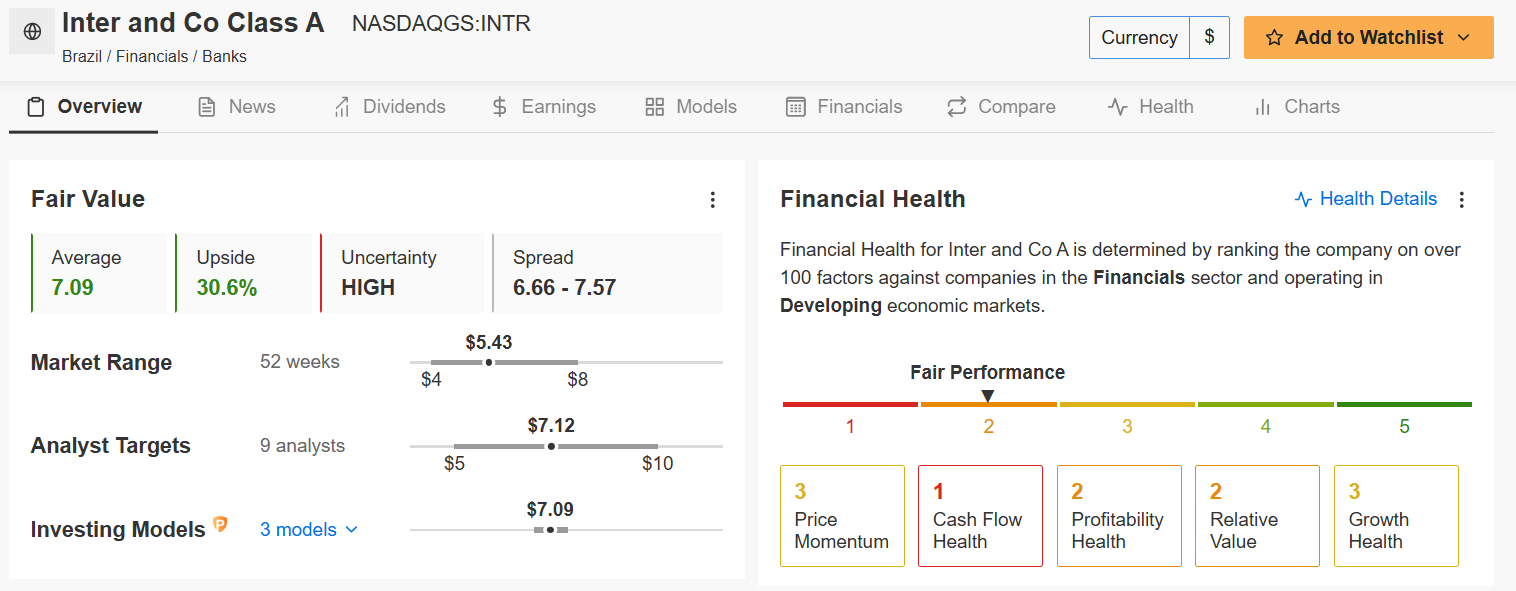

3. Inter & Firm

Present Value: $5.43

Honest Worth Estimate: $7.09 (+30.6% Upside)

Market Cap: $2.4 Billion

Inter & Co stands out as a pioneering pressure within the fintech sector, significantly in Brazil and the US. Based in 1994, the corporate developed from a standard financial institution to a number one digital banking platform by 2015. Its revolutionary tremendous app gives customers a complete suite of monetary companies, together with cash transfers, invoice funds, financial savings choices, investments, and buying rewards.

Supply: InvestingPro

Presently buying and selling at $5.43, INTR demonstrates sturdy fundamentals with a ‘FAIR’ Monetary Well being Rating of two.40. The Brazilian monetary expertise firm exhibits spectacular income development of 43.3% in FY2024, with projected development of 77% for FY2025.

With an InvestingPro Honest Worth estimate of $7.09 (+30.6% upside) and analyst targets reaching $10.00, Inter’s sturdy return on fairness (ROE) of 11.1% and average price-to-earnings ratio of 14.8x recommend vital development potential.

The corporate’s dividend yield of 1.5% provides a gorgeous earnings element.

Supply: Investing.com

Shares are up by roughly 29% up to now in 2025.

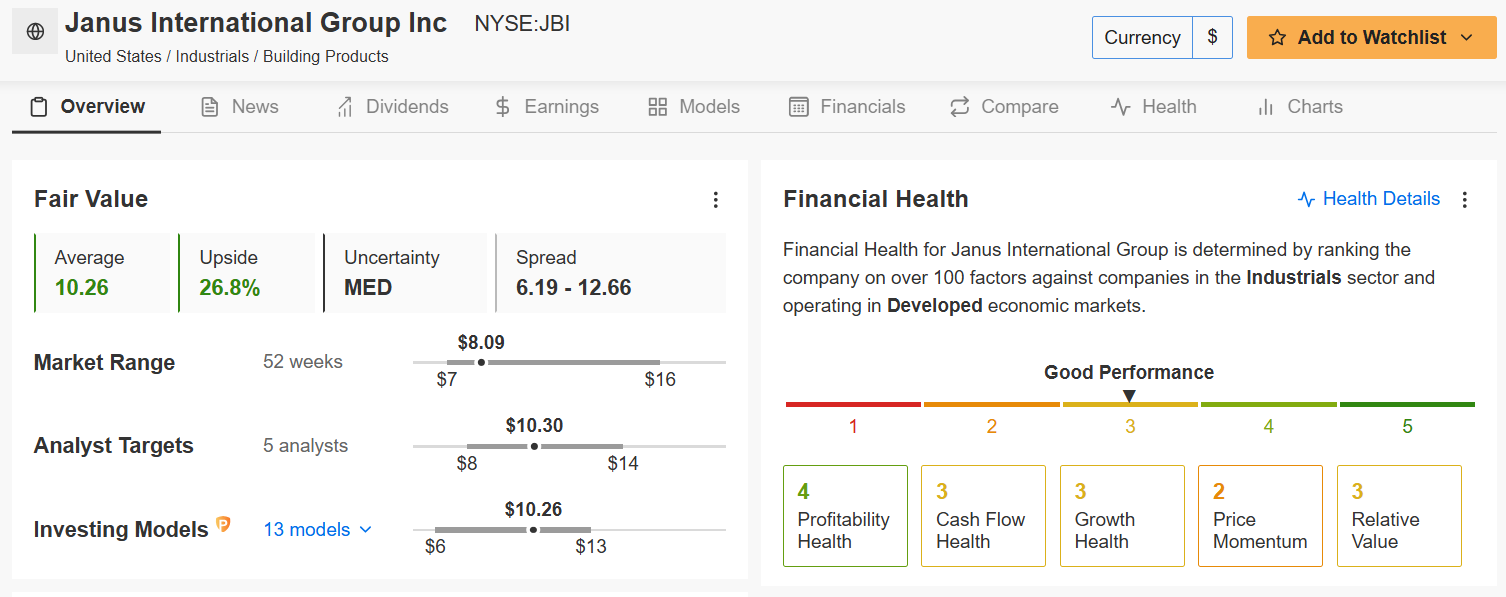

4. Janus Worldwide Group

Present Value: $8.09

Honest Worth Estimate: $10.26 (+26.8% Upside)

Market Cap: $1.1 Billion

Janus Worldwide Group is a worldwide producer and distributor of commercial merchandise serving a big selection of finish markets, together with automotive, agriculture, and development. The corporate’s intensive product portfolio and powerful distribution community have helped it obtain constant income development through the years.

Supply: InvestingPro

Presently buying and selling at $8.09, JBI stands out with a ‘GOOD’ Monetary Well being Rating of two.72. The self-storage options supplier maintains stable profitability with a powerful 13.6% ROE and 10.6% ROIC.

With a Honest Worth estimate of $10.26 (+26.8% upside) and analyst targets reaching $14.00, Janus’s sturdy market place and operational effectivity make it a gorgeous worth play.

As demand for industrial merchandise continues to rise amid elevated infrastructure spending, Janus Worldwide Group is well-positioned to thrive on this pattern. Its sturdy fundamentals and diversified publicity to rising finish markets make it an interesting decide for traders looking for industrial development at a discount value.

Supply: Investing.com

Shares are up round 10% because the begin of 2025.

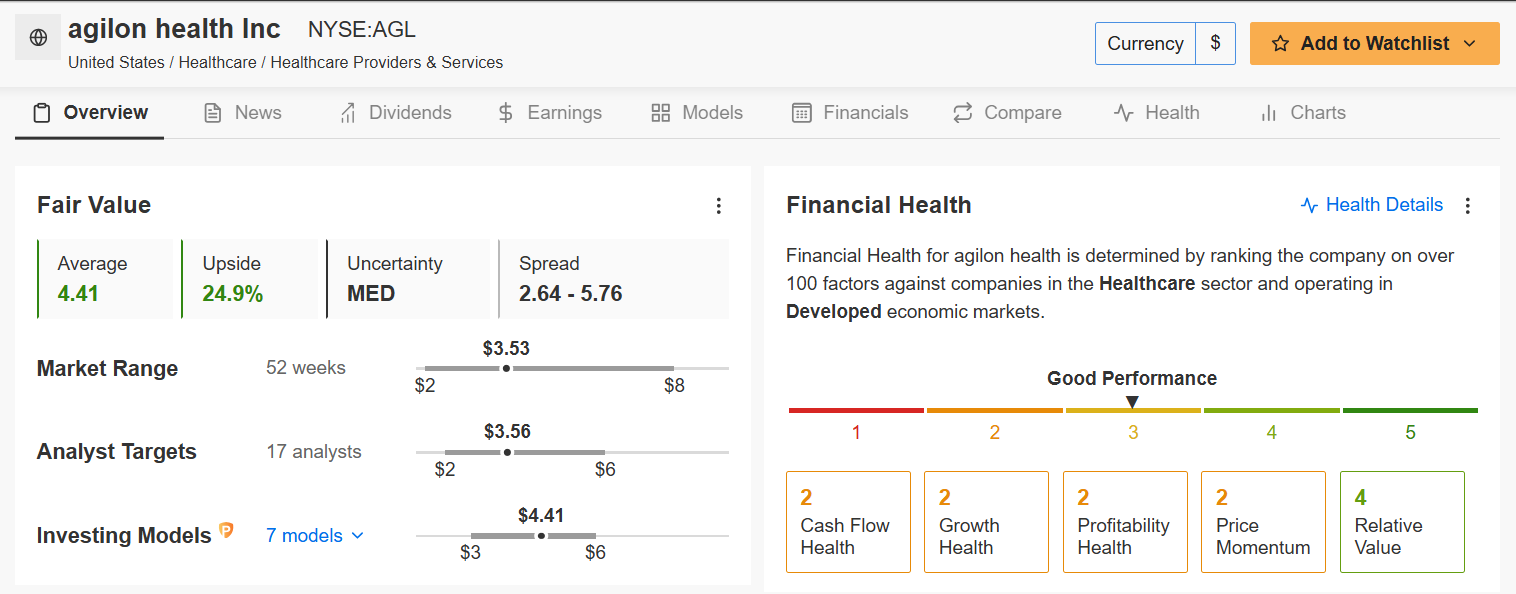

5. Agilon Well being

Present Value: $3.53

Honest Worth Estimate: $4.41 (+24.9% Upside)

Market Cap: $1.5 Billion

Agilon Well being is remodeling the supply of healthcare by partnering with physicians and payers to enhance outcomes for Medicare Benefit populations. Amid an growing older U.S. inhabitants and rising healthcare spending, the corporate leverages superior expertise and revolutionary care administration practices to drive value effectivity and enhanced affected person care.

Supply: InvestingPro

Agilon, buying and selling at $3.53, maintains a ‘FAIR’ Monetary Well being Rating of two.41. The healthcare firm’s spectacular income development of 40.4% in FY2024 showcases its increasing market presence.

With a Honest Worth estimate of $4.41 (+24.9% upside) and analyst targets reaching $6.00, Agilon’s transformation of major care supply presents vital development alternatives regardless of present operational losses.

Its sturdy development prospects and recurring income from long-term healthcare contracts make it a standout defensive play within the healthcare sector.

Supply: Investing.com

AGL inventory is up a whopping 85.6% via the primary three months of 2025.

Conclusion

These 5 shares— IHS Holding, Melco Resorts & Leisure, Inter & Co, Janus Worldwide Group, and Agilon Well being—provide compelling alternatives for traders keen to look past the headlines.

Buying and selling underneath $10 and supported by InvestingPro’s AI-powered Honest Worth fashions, every of those corporations is poised to ship double-digit upside as they capitalize on sturdy trade tailwinds.

For these looking for development at a discount value in at the moment’s unstable market, these undervalued performs present each stability and the potential for vital long-term returns.

Remember to try InvestingPro to remain in sync with the market pattern and what it means in your buying and selling. Whether or not you are a novice investor or a seasoned dealer, leveraging InvestingPro can unlock a world of funding alternatives whereas minimizing dangers amid the difficult market backdrop.

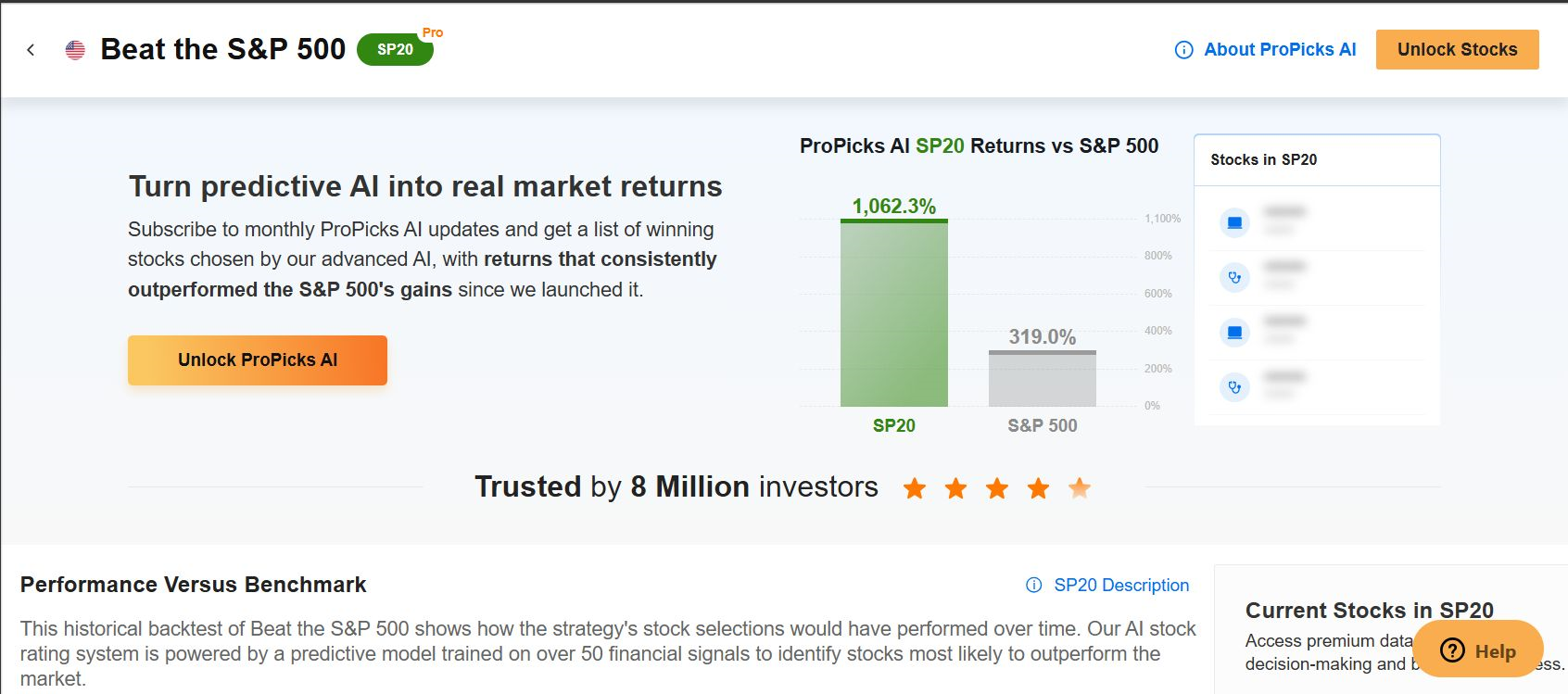

Subscribe now and immediately unlock entry to a number of market-beating options, together with:

ProPicks AI: AI-selected inventory winners with confirmed monitor report.

InvestingPro Honest Worth: Immediately discover out if a inventory is underpriced or overvalued.

Superior Inventory Screener: Seek for the perfect shares primarily based on a whole lot of chosen filters, and standards.

Prime Concepts: See what shares billionaire traders similar to Warren Buffett, Michael Burry, and George Soros are shopping for.

Disclosure: On the time of writing, I’m lengthy on the S&P 500, and the Nasdaq 100 by way of the SPDR® S&P 500 ETF (SPY), and the Invesco QQQ Belief ETF (QQQ). I’m additionally lengthy on the Invesco Prime QQQ ETF (QBIG), Invesco S&P 500 Equal Weight ETF (RSP), and VanEck Vectors Semiconductor ETF (SMH).

I recurrently rebalance my portfolio of particular person shares and ETFs primarily based on ongoing danger evaluation of each the macroeconomic setting and corporations’ financials.

The views mentioned on this article are solely the opinion of the creator and shouldn’t be taken as funding recommendation.

Observe Jesse Cohen on X/Twitter @JesseCohenInv for extra inventory market evaluation and perception.