Transient Reminder

In 2018, US President Donald Trump initiated a commerce battle replace with sanctions in opposition to China. Financial disagreement between the US and China started in 2018 when United States President Donald Trump imposed tariffs and different commerce restrictions on China in an try and drive modifications to what he referred to as the US’ “unfair commerce practices.” These practices embrace a rising commerce deficit, theft of mental property, and the pressured switch of American expertise to China.

With Trump assuming the presidency once more in 2025, the second season of commerce wars has formally begun. US President Donald Trump declared ‘tax’ the ‘most stunning phrase’ within the dictionary earlier than the elections held final yr. Trump added a brand new message to his first time period, opposing ‘international’ affect within the US and defending the ‘America First’ strategy. The cornerstone of his commerce coverage is supporting US firms to develop the financial system and improve employment. Whereas consultants warn that this may increasingly not work in apply, Trump has now taken a sequence of steps to scale back imports.

US President Donald Trump has introduced that the primary international locations he’ll impose 25% tariffs on are Canada and Mexico. Additionally, a brand new 10 p.c customs responsibility on items from China will come into impact. US President Donald Trump introduced that taxes may even be imposed on items equipped from the European Union. He mentioned,

“They do not purchase our vehicles, they do not purchase our agricultural merchandise, they nearly do not buy something, however we purchase all the pieces from them,” Trump cited these components as the rationale for these taxes.

It was additionally emphasised that Trump selected this methodology to help the labor market in America and to take care of the unemployment downside. As is thought, Trump criticized the Biden administration’s selections throughout his election marketing campaign. He additionally pointed to the Biden administration as the rationale for the continuing Russia-Ukraine disaster and mentioned,

“In line with my plan, American employees will now not lose their jobs to foreigners, and foreigners might be afraid to lose their jobs to US employees.”

Overseas Commerce Companions

Mexico was the primary buying and selling companion of the US with a quantity of $839.9 billion the earlier yr, in response to United States Census Bureau knowledge.

Additionally, Canada’s commerce quantity was introduced as $762.1 billion in second place, China’s commerce quantity was introduced as $582.5 billion in third place, and Germany’s commerce quantity was introduced as $236.0 billion in fourth place.

Then again, the united stateshas commerce deficits with many international locations. Meaning, they purchase greater than the product produced. After we have a look at the highest 15 international locations, solely the USA is on the plus aspect in commerce relations with the Netherlands.

America has rapidly begun taking steps to restart commerce wars. So is the American financial system macroeconomically prepared for these commerce wars?

USA Gross Home Product, Final 8 years

In 2017 and 2018, the U.S. financial system skilled regular progress, with rising by 2.5% and three.0%, respectively.The yr 2019 continued this pattern with a 2.6% progress fee. Nevertheless, 2020 noticed a slight contraction of 0.9%, primarily as a result of financial influence of the COVID-19 pandemic. The financial system rebounded strongly in 2021 with a ten.9% improve, adopted by continued progress in 2022 at 9.8%. The expansion charges moderated in 2023 and 2024, with will increase of 6.6% and 5.2%, respectively.

These figures spotlight the resilience of the U.S. financial system within the face of challenges, in addition to its capability for restoration and sustained progress.

The continuation of the primary commerce battle was supported between 2021 and 2025, whereas Biden was president. Throughout this era, the COVID disaster and the Russian-Ukrainian battle within the world market affected the markets greater than the commerce wars.

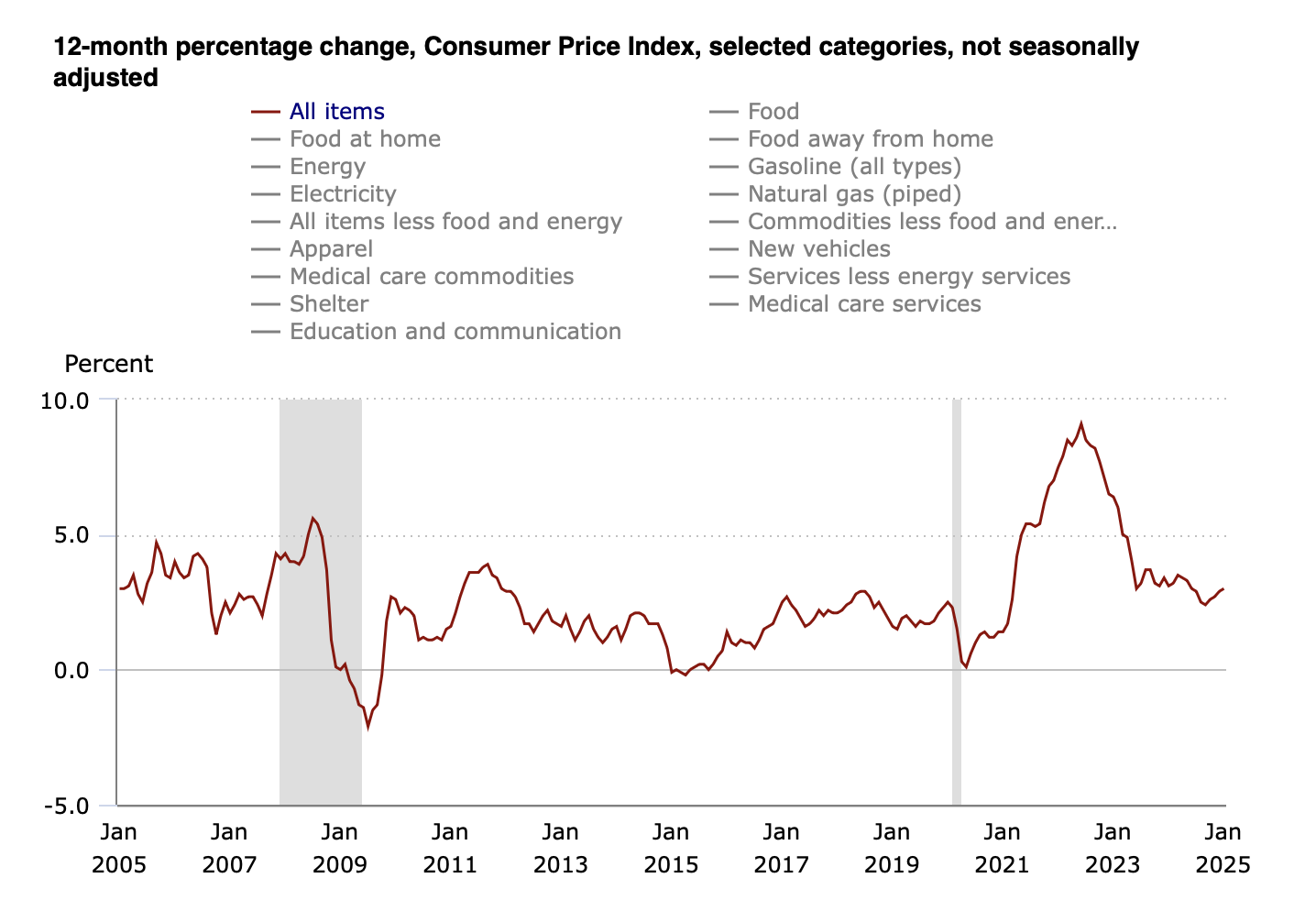

USA Shopper Worth Index, Final 8 Years

In 2017 and 2018, remained comparatively steady, aligning intently with the Federal Reserve’s goal of two%. Nevertheless, in 2019 and 2020, the speed declined to 1.8% and 1.2% respectively, partly as a result of subdued financial exercise and the onset of the COVID-19 pandemic. The pandemic led to decreased shopper spending and disruptions in provide chains, contributing to cheaper price pressures.

The yr 2021 marked a big shift, with inflation rising to 4.7%. This surge was pushed by components similar to provide chain bottlenecks, elevated shopper demand because the financial system reopened, and financial stimulus measures. The upward pattern continued into 2022, with inflation peaking at 8.0%, the best degree in 4 many years. Contributing components included persistent provide chain points, labor shortages, and geopolitical tensions affecting power costs.

In response to rising inflation, the carried out financial tightening measures, together with elevating rates of interest. These actions, together with easing provide chain constraints, led to a moderation in inflation charges to 4.1% in 2023 and additional all the way down to 2.9% in 2024, nearing the Federal Reserve’s goal as soon as once more.

It is essential to notice that these figures are primarily based on historic knowledge as much as 2024, and precise inflation charges could be influenced by a large number of things, together with financial insurance policies, world occasions, and market dynamics.

How Modified Is US Greenback Index (DXY)

Over the previous eight years, the (DXY) has skilled notable fluctuations, reflecting varied financial and geopolitical occasions. Here is a abstract of its annual efficiency:

In 2022, the DXY reached a peak of 110.05, influenced by Federal Reserve fee hikes and geopolitical tensions, notably the Russian invasion of Ukraine. The next yr, 2023, noticed a slight decline to 101.33 as inflation stabilized and unemployment remained low. These actions underscore the DXY’s sensitivity to world occasions, financial insurance policies, and market sentiment.

Technical Evaluation

The Greenback Index, Every day

The robust worth of the in direction of the tip of final yr within the every day time sequence could be attributed to international coverage and the guarantees of the brand new President. Failure to completely meet traders’ expectations led to worth losses. The pinnacle and shoulders sample seen on the chart has reached its downward targets. Relying on China’s response to the brand new tariffs, the decline might proceed.

Weekly

Within the weekly time sequence, the bull market continues to dominate. Nevertheless, the potential for new tariffs coming into drive is rising stress. Within the Greenback Index, the place graphical evaluation is dominant, declines might attain the extent of 100.450 if there are robust responses to the sanctions imposed by President Trump.

EUR/USD, Weekly

weekly chart displays a consolidation part with key resistance at 1.0850 and help at 1.0700. Merchants ought to monitor these ranges intently, as a breakout in both path might set the tone for the pair’s subsequent vital transfer.

Technical evaluation signifies that the pair is in a consolidation part, with robust resistance anticipated across the 1.12570 degree, similar to the 50% Fibonacci retracement. Conversely, a decline beneath the 1.0700 help might resume the downward pattern in direction of the 1.023/0.958 help zone than the minimums.

US100, Weekly

The US100 index, also referred to as the (NDX), is a inventory market index that features 100 of the most important non-financial and technology-focused firms listed on the NASDAQ Inventory Alternate. The index is closely weighted in direction of tech giants like Apple (NASDAQ:), Microsoft (NASDAQ:), Amazon (NASDAQ:), Google (Alphabet (NASDAQ:)), and Tesla (NASDAQ:), making it extremely delicate to developments within the tech business.

If China responds to US sanctions, the may very well be probably the most affected by the commerce battle. After the value reaches most ranges, rebounds are seen. When the value is rising and the RSI oscillator is falling, disagreements come up.

If the pattern line is damaged and the value continues to fall, the goal is seen as 18450.

Ongoing Crises

The issues awaiting answer embrace the Russia-Ukraine disaster. To finish this disaster, US and Russian officers held talks in Saudi Arabia. If the embargoes on Russia are lifted when the disaster ends, it’ll enable Russia to regain world markets. Russia has a big share of world commerce with its underground sources, fuel, and commerce quantity. Russia’s re-emergence in world markets will immediately have an effect on commodities particularly. The strengthening of huge firms similar to Gazprom and Lukoil may even be inevitable.

Conclusion

The US financial system continues to develop stably and stay loyal to the decided inflation and rates of interest. New tariffs imposed on buying and selling companions will drive giant firms to spend money on the US, which can stimulate the US labor market and make the financial system extra energetic. Nevertheless, new tariffs won’t go unanswered. Nations with giant economies like China can present that this battle will not be one-sided. The US’s want to show as soon as once more that it’s the speaker and decision-maker amongst international locations goes by the tariffs. Then again, it’s now not proper to speak a few single massive financial system idea. Many international locations on this planet have declared their financial and all-around freedom.