Markets confronted challenges final week, with the US and a few European indices slipping, whereas China, Germany, France, and held agency.

Regardless of the uncertainty, buyers are discovering sturdy alternatives in six key areas.

1. Gold as a Protected-Haven Asset

US shares have surged to an all-time excessive following Trump’s tariff coverage. Inventories on the New York Comex change reached 39.7 million ounces on Wednesday—the best stage since 1992—valued at roughly $115 billion.

Premiums between New York futures and the London spot market are sometimes modest, reflecting transportation and storage prices. Nonetheless, this dynamic modified considerably late final 12 months.

In the meantime, South Korea’s Mint is going through a bullion scarcity resulting from hovering demand. Gold merchandising machines within the capital have been emptied as customers rush to purchase the final word safe-haven asset. This demand surge has led South Korean banks to quickly droop bullion gross sales, as provide can not meet native demand.

Retail buyers are driving this development, utilizing as a hedge towards home political instability and broader financial and geopolitical uncertainties stemming from Trump’s tariffs.

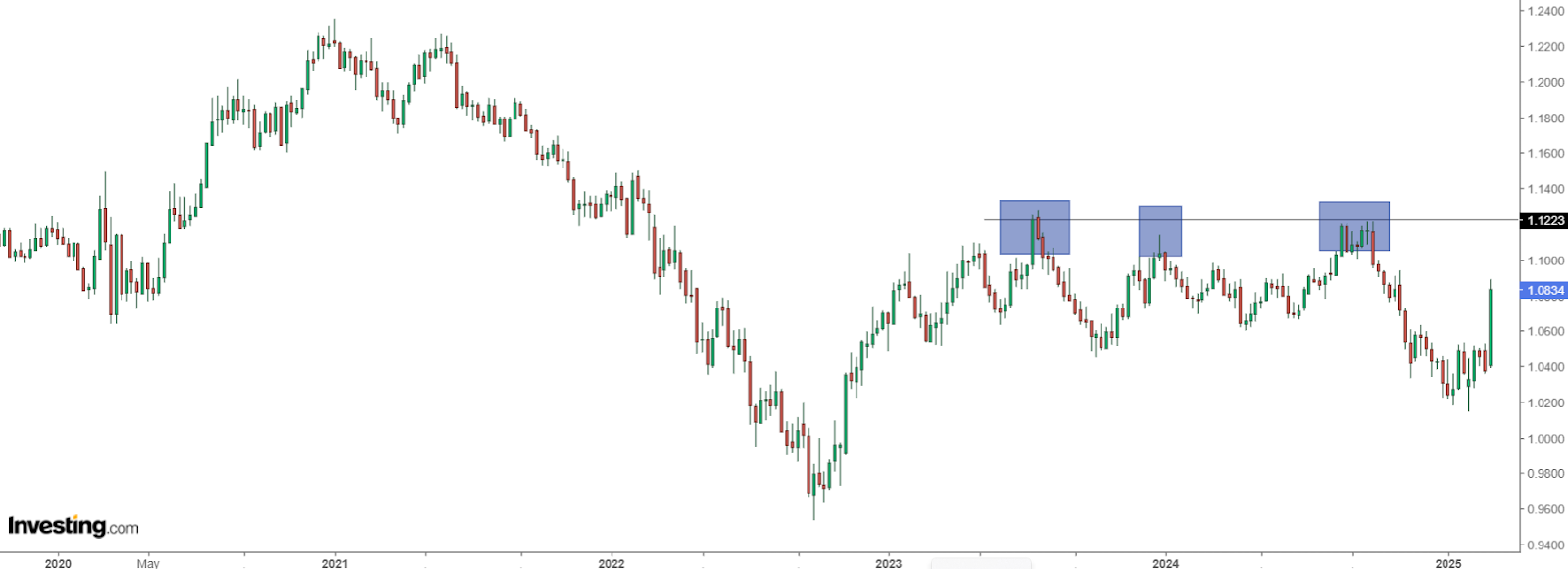

2. Hedge Funds Betting on a Stronger EUR/USD

Hedge funds are aggressively buying choices that guess on appreciating 6-8% earlier than the tip of the 12 months. Probably the most optimistic projections counsel it may even attain the 1.20 stage, final seen in 2021.

Hedge funds are aggressively buying choices that guess on appreciating 6-8% earlier than the tip of the 12 months. Probably the most optimistic projections counsel it may even attain the 1.20 stage, final seen in 2021.

The foreign money pair closed the week up practically +5%, marking its greatest efficiency since March 2009, fueled by:

Germany’s determination to launch a whole bunch of billions of euros for protection and infrastructure spending, resulting in historic borrowing will increase.

The European Central Financial institution is taking a extra cautious stance on cuts, with merchants now pricing in a single or two further 25-basis-point cuts for the 12 months.

Europe is ramping up protection spending, lowering reliance on the U.S. and strengthening its personal navy capabilities.

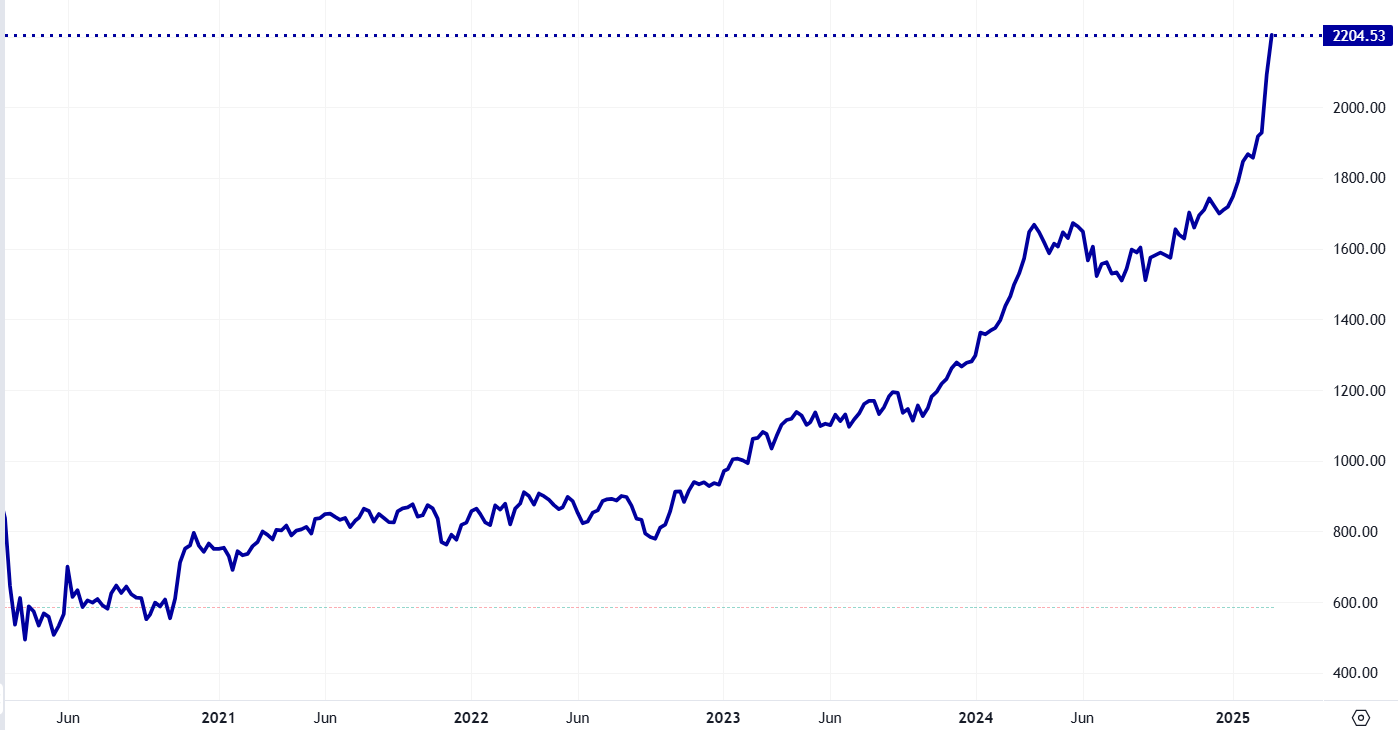

3. European Protection Shares at Report Ranges

The Choose STOXX Europe Aerospace & Protection ETF (NYSE:) has surged to all-time highs, gaining 18.71% over the previous 4 weeks and accumulating a 29.31% enhance year-to-date.

A complete of 10 shares have risen by over 50%, whereas 13 shares are setting new data.

This development is pushed by greater European protection budgets and the potential deployment of European forces close to the Ukraine-Russia border.

Though valuations are excessive, earnings per share (EPS) development forecasts counsel they continue to be cheap.

Key Shares to Watch:

Rheinmetall AG (ETR:)

Indra A (BME:)

Thales (EPA: EPA:)

Leonardo SpA (BIT:)

SAAB AB ser. B (BS:)

Dassault Aviation SA (EPA:) (EPA: AM)

BAE Methods (LON: LON:)

4. European Shares Benefiting from ECB Price Cuts

The European Central Financial institution (ECB) has lowered rates of interest to 2.50%, marking the bottom stage since February 2023. A number of industries are benefiting from this transfer:

Actual property

SOCIMIs (Spanish REITs)

Overleveraged corporations

Utilities

Telecommunications

Excessive-dividend shares

Notable Shares in Spain:

Merlin Group SA (WA:)(BME: MRL)

Inmobiliaria Colonial SA (BME:)(BME: COL)

Endesa (BME: BME:)

Enagás

Inditex (BME: BME:)

Cellnex Telecom SA (BME:)(BME: CLNX)

Iberdrola (OTC:) (BME: IBE)

Naturgy Vitality Group SA (BME:)(BME: NTGY)

Redeia

Notable Shares within the Remainder of Europe:

Vinci (EPA: EPA:)

Deutsche Telekom (OTC:) (ETR: DTEGn)

Compagnie de Saint Gobain SA (EPA:) (EPA: SGOB)

Enel (BIT: BIT:)

5. Low-Volatility US Shares Outperform

The has declined 5% from its February all-time excessive, wiping out practically $3 billion in post-election beneficial properties.

The has declined 5% from its February all-time excessive, wiping out practically $3 billion in post-election beneficial properties.

In the meantime, two of the biggest low-volatility ETFs are delivering their greatest performances in years:

Invesco S&P 500® Low Volatility ETF (NYSE:) (SPLV): Tracks the 100 least risky shares within the S&P 500, together with Coca-Cola (NYSE: NYSE:) and Berkshire Hathaway (NYSE: NYSE:). It outperformed the S&P 500 by 5.9 proportion factors in February, the strongest displaying since April 2022.

MSCI USA Min-Vol Issue ETF (USMV): Outperformed the S&P 500 by essentially the most since 2019.

6. Robust Inflows into US Bond ETFs

Traders are pouring into ultra-short bond and gold ETFs as market uncertainty looms.

Safer mutual funds noticed inflows in February, whereas riskier choices, equivalent to ETFs, confronted redemptions.

Final month delivered the strongest returns for U.S. bonds since July 2024. The Vanguard Whole Inventory Market Index Fund ETF Shares (NYSE:) closed greater in 10 of the final 12 buying and selling classes. Longer-term bond ETFs carried out even higher, with the iShares 20+ 12 months Treasury Bond (NASDAQ:) ETF surging 5.7%—its greatest month since December 2023. Extremely-short bond funds attracted $14 billion, the best month-to-month influx since October 2023. The JPMorgan Extremely-Quick Earnings ETF (NYSE:), the third-largest within the class, introduced in $1.9 billion.

****Disclaimer: This text is written for informational functions solely. It isn’t supposed to encourage the acquisition of property in any manner, nor does it represent a solicitation, supply, suggestion or suggestion to speculate. I want to remind you that every one property are evaluated from a number of views and are extremely dangerous, so any funding determination and the related threat belongs to the investor. We additionally don’t present any funding advisory companies.