However equities can’t maintain positive aspects as Canada and the EU slap counter-tariffs on the US.

The US authorities shutdown menace additionally weighs on markets.

US Inflation Slows Extra Than Anticipated

There was some reduction for markets on Wednesday after US moderated greater than anticipated in February, reinforcing bets that the Fed will resume its rate-cutting cycle later within the yr. The fell from 3.0% to 2.8% y/y, under the forecast of two.9%, whereas eased from 3.3% to three.1% y/y. On a month-on-month foundation, the patron worth index rose on the slowest tempo since October.

The information is sweet information for the Fed because it gears up for the March 18-19 coverage assembly. While the Fed is nearly sure to maintain unchanged subsequent week, FOMC members usually tend to pencil in further price cuts for 2025 of their dot plot now that the inflation image is lastly turning extra favorable, significantly as providers CPI can also be coming down.

Counter-Tariffs Dent Sentiment

Wall Avenue cheered the delicate CPI report, albeit in a subdued vogue. The ended the session 0.5% larger, whereas the was up 1.1%. However futures have turned damaging at present, with shares in Europe additionally within the purple.

It proved tough for buyers to take care of the CPI-led optimism for lengthy because the commerce warfare took one other flip for the more serious. Each Canada and the European Union introduced retaliatory tariffs in opposition to america because the 25% levies on all and imports introduced by President Trump in February went into impact yesterday.

Canada stated it can impose tariffs of about $20 billion on US items, whereas the EU introduced $28 billion value of duties. Trump has promised a response, elevating the danger of an extra escalation between the key buying and selling companions.

Fed Price Reduce Bets Little Modified

Any enhance to Fed price minimize expectations from the CPI knowledge has been offset by the worsening commerce outlook, with buyers now pricing in slightly below three 25-bps-rate cuts for the yr amid worries concerning the inflationary impression of tariffs.

The Trump administration might have blinked just a few occasions within the commerce negotiations, but it surely’s but to collapse to Wall Avenue merchants. Even with the S&P 500 being on the verge of getting into correction territory, Trump is refusing to ease up on his commerce rhetoric. That is making buyers nervous as they proceed to worry about what impression the elevated protectionism could have on the US and world financial system, with the danger of a recession remaining elevated.

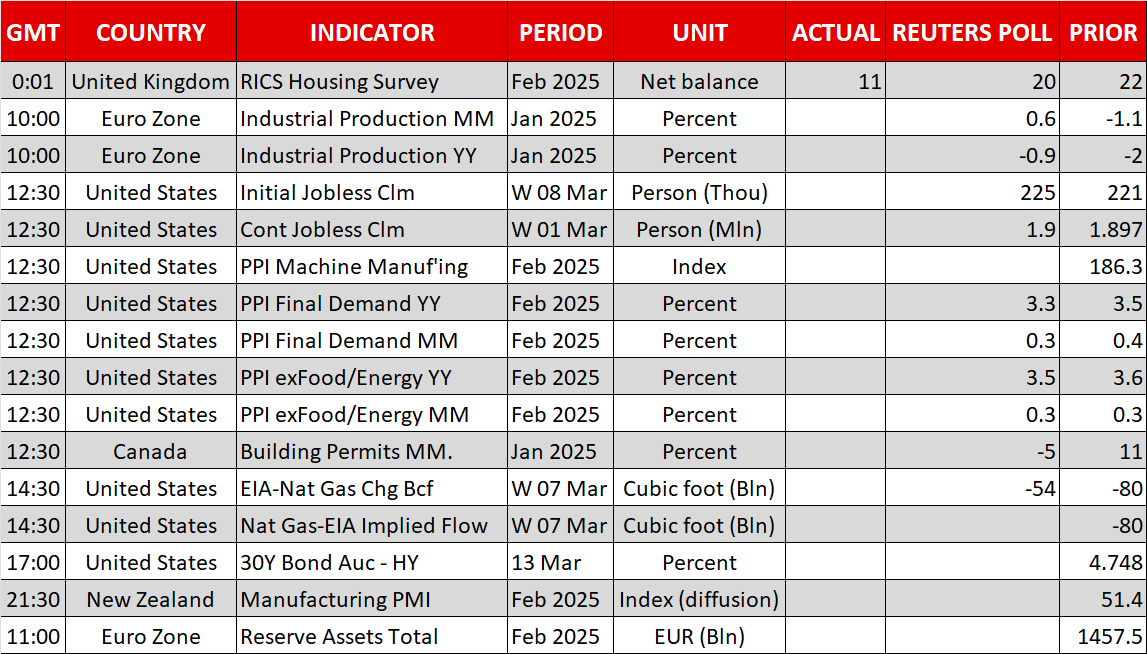

Buying and selling circumstances are more likely to stay uneven at present because the and the newest are due at 12:30 GMT.

Markets can even be waiting for any updates from Congress a few doable deal on a stopgap funding invoice. The Home handed its spending invoice on Tuesday, however Senate Democrats have rejected the measures. Republicans will want the help of not less than eight Democrats for the laws to go the Senate, in any other case, the federal government might shut down on Saturday.

Greenback Off Lows, Yen Will get a Carry

The made a modest restoration on Wednesday however is blended at present. The ’s rally has misplaced some momentum following the commerce flare-up between Washington and Brussels. The top of Germany’s central financial institution, Joachim Nagel, has warned the financial system might tip again into recession if extra tariffs are introduced.

The was considerably firmer, although, on Thursday, after Financial institution of Japan Governor Kazuo Ueda sounded upbeat about wage progress and consumption, suggesting that additional price hikes are seemingly over the course of the yr.

The remained supported regardless of the Financial institution of Canada’s price minimize yesterday and warning of “a brand new disaster” from Trump’s commerce warfare.

Gold Eyes New Report

costs edged up for a 3rd day, approaching the $2,950 space the place it set a document excessive on February 24. The rising uncertainty from Trump’s insurance policies is driving buyers again to the favored protected haven at the same time as US Treasury yields stage a good restoration.

There are additionally doubts as as to whether Russia will signal as much as the US ceasefire deal that Ukraine has already agreed to. US officers are touring to Moscow at present for talks on a doable deal.