Up to date on March 14th, 2025 by Bob Ciura

The Dividend Kings are the best-of-the-best in dividend longevity.

What’s a Dividend King? A inventory with 50 or extra consecutive years of dividend will increase.

The downloadable Dividend Kings Spreadsheet Checklist beneath incorporates the next for every inventory within the index amongst different essential investing metrics:

Payout ratio

Dividend yield

Worth-to-earnings ratio

You possibly can see the complete downloadable spreadsheet of all 54 Dividend Kings (together with essential monetary metrics akin to dividend yields, payout ratios, and price-to-earnings ratios) by clicking on the hyperlink beneath:

We usually rank shares based mostly on their five-year anticipated annual returns, as acknowledged within the Certain Evaluation Analysis Database.

However for buyers primarily involved in revenue, additionally it is helpful to rank the Dividend Kings based on their dividend yields.

This text will rank the 20 highest-yielding Dividend Kings as we speak.

Desk of Contents

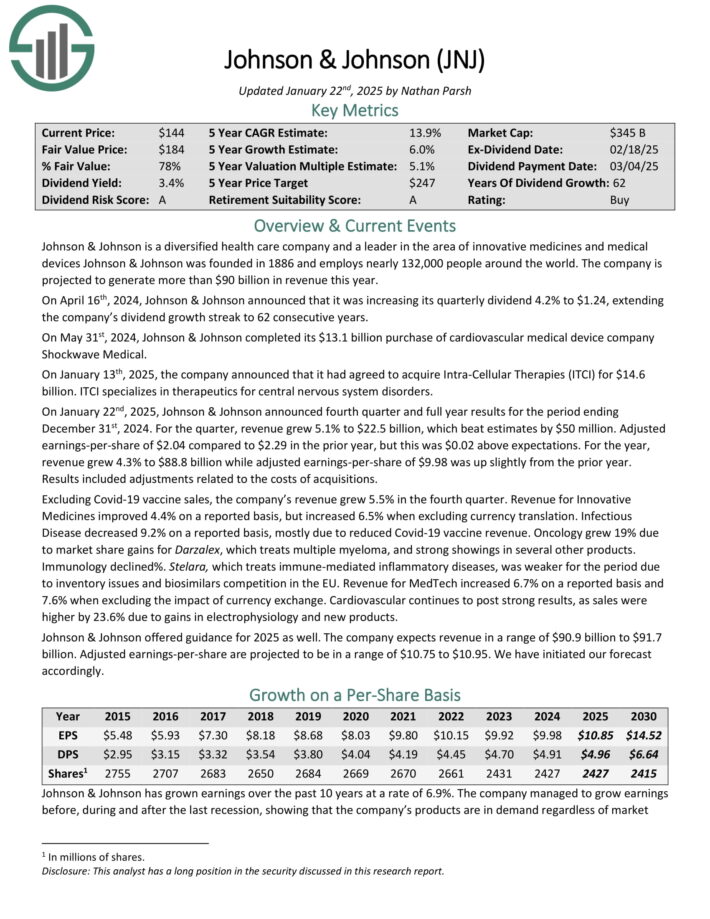

Excessive Yield Dividend King #20: Johnson & Johnson (JNJ)

Johnson & Johnson is a diversified well being care firm and a frontrunner within the space of progressive medicines and medical units Johnson & Johnson was based in 1886 and employs practically 132,000 folks all over the world.

On January twenty second, 2025, Johnson & Johnson introduced fourth quarter and full yr outcomes for the interval ending December thirty first, 2024.

Supply: Investor Presentation

For the quarter, income grew 5.1% to $22.5 billion, which beat estimates by $50 million. Adjusted earnings-per-share of $2.04 in comparison with $2.29 within the prior yr, however this was $0.02 above expectations.

For the yr, income grew 4.3% to $88.8 billion whereas adjusted earnings-per-share of $9.98 was up barely from the prior yr. Outcomes included changes associated to the prices of acquisitions.

Click on right here to obtain our most up-to-date Certain Evaluation report on JNJ (preview of web page 1 of three proven beneath):

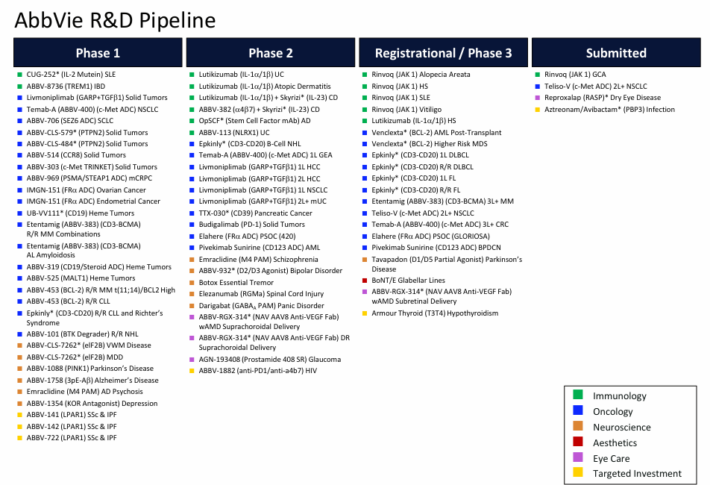

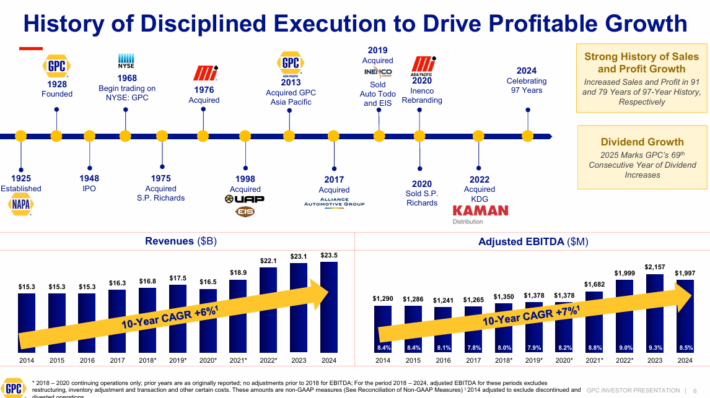

Excessive Yield Dividend King #19: AbbVie Inc. (ABBV)

AbbVie is a pharmaceutical firm spun off by Abbott Laboratories (ABT) in 2013. Its most essential product is Humira, now dealing with biosimilar competitors in Europe and the U.S., which has had a noticeable affect on the corporate.

Even so, AbbVie stays a large within the healthcare sector, with a big and diversified product portfolio.

Supply: Investor Presentation

AbbVie reported its fourth quarter earnings outcomes on January thirty first. Quarterly income of $15.1 billion rose 6% year-over-year.

Income was positively impacted by development from a few of its newer medicine, together with Skyrizi and Rinvoq, whereas Humira gross sales declined by 49% as a result of rising competitors from biosimilars and market share losses.

AbbVie earned $2.16 per share in the course of the fourth quarter, down 23% year-over-year. Earnings-per-share missed the consensus analyst estimate by $0.10. AbbVie expects to earn $12.12 – $12.32 on a per-share foundation this yr.

Click on right here to obtain our most up-to-date Certain Evaluation report on AbbVie (preview of web page 1 of three proven beneath):

Excessive Yield Dividend King #18: SJW Group (SJW)

SJW Group is a water utility firm that produces, purchases, shops, purifies and distributes water to customers and companies within the Silicon Valley space of California, the world north of San Antonio, Texas, Connecticut, and Maine.

SJW Group has a small actual property division that owns and develops properties for residential and warehouse clients in California and Tennessee. The corporate generates about $670 million in annual revenues.

On February twenty seventh, 2025, SJW Group introduced fourth quarter and full yr outcomes for the interval ending December thirty first, 2024. For the quarter, income improved 15.5% to $197.8 million, which topped expectations by $10.3 million.

Earnings-per-share of $0.74 in contrast favorably to earnings-per-share of $0.59 within the prior yr and was $0.19 forward of estimates. For the yr, income grew 12% to $748.4 million whereas earnings-per-share of $2.87 in comparison with $2.68 in2023.

For the quarter, greater water charges total added $22.8 million to outcomes and better buyer utilization added $9.9 million whereas regulatory mechanisms lowered income totals by $7.1 million. Working manufacturing bills totaled $154.2 million, which was a 14% enhance from the prior yr.

Click on right here to obtain our most up-to-date Certain Evaluation report on SJW (preview of web page 1 of three proven beneath):

Excessive Yield Dividend King #17: Consolidated Edison (ED)

Consolidated Edison is a large-cap utility inventory. The corporate generates practically $15 billion in annual income and has a market capitalization of roughly $36 billion.

The corporate serves 3.7 million electrical clients, and one other 1.1 million fuel clients, in New York.

Supply: Investor Presentation

It operates electrical, fuel, and steam transmission companies, with a steam system that’s the largest within the U.S.

On February twentieth, 2025, Consolidated Edison introduced fourth quarter and full yr outcomes for the interval ending December thirty first, 2024. For the quarter, income grew 6.5% to $3.7 billion, which beat estimates by $36 million.

Adjusted earnings of $340 million, or $0.98 per share, in comparison with adjusted earnings of $346 million, or $1.00 per share, within the earlier yr. Adjusted earnings-per-share have been $0.02 forward of expectations.

For the yr, income elevated 4.0% to $15.3 billion whereas adjusted earnings of $1.87 billion, or $5.40 per share, in comparison with adjusted earnings of $1.76 billion, or $5.07 per share, in 2023.

Common charge base balances are actually projected to develop by 8.2% yearly via 2029 based mostly off 2025 ranges. That is up from the corporate’s prior forecast of 6.4%.

Click on right here to obtain our most up-to-date Certain Evaluation report on Consolidated Edison (preview of web page 1 of three proven beneath):

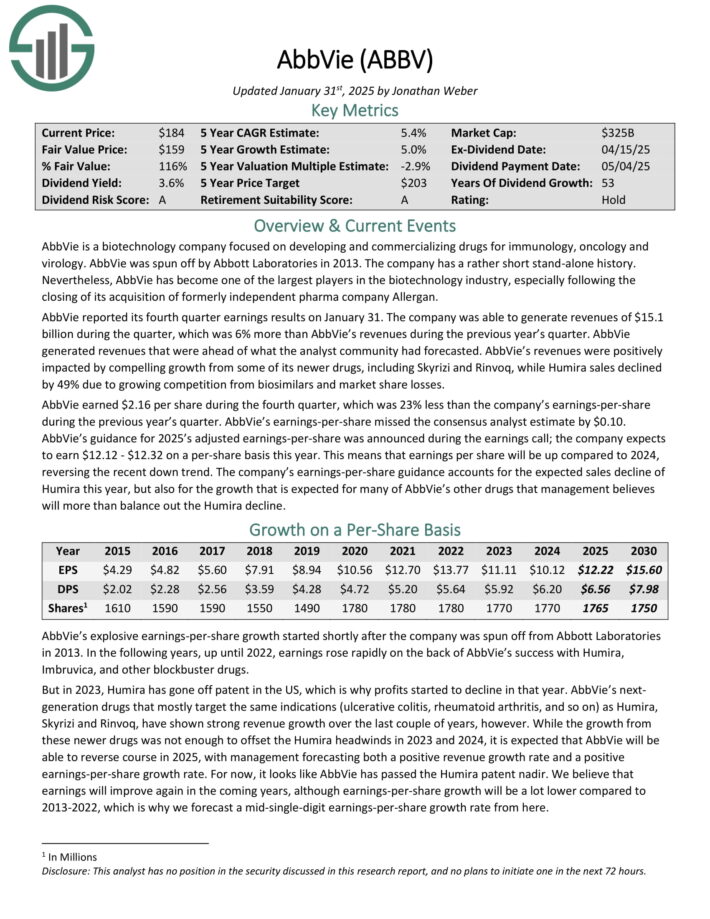

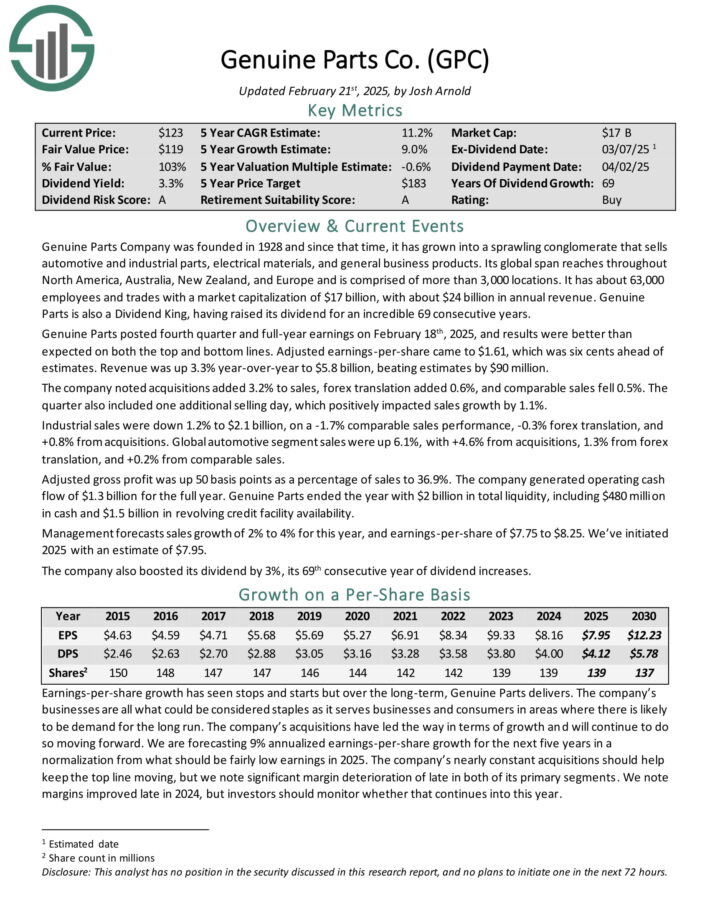

Excessive Yield Dividend King #16: Real Components Firm (GPC)

Real Components has the world’s largest international auto elements community, with greater than 10,800 places worldwide. As a serious distributor of automotive and industrial elements, Real Components generates annual income of practically $24 billion.

Supply: Investor Presentation

It operates two segments, that are automotive (contains the NAPA model) and the economic elements group which sells industrial substitute elements to MRO (upkeep, restore, and operations) and OEM (authentic tools producer) clients.

Prospects are derived from a variety of segments, together with meals and beverage, metals and mining, oil and fuel, and well being care.

Real Components posted fourth quarter and full-year earnings on February 18th, 2025, and outcomes have been higher than anticipated on each the highest and backside traces. Adjusted earnings-per-share got here to $1.61, which was six cents forward of estimates.

Income was up 3.3% year-over-year to $5.8 billion, beating estimates by $90 million. The corporate famous acquisitions added 3.2% to gross sales, foreign exchange translation added 0.6%, and comparable gross sales fell 0.5%.

Click on right here to obtain our most up-to-date Certain Evaluation report on GPC (preview of web page 1 of three proven beneath):

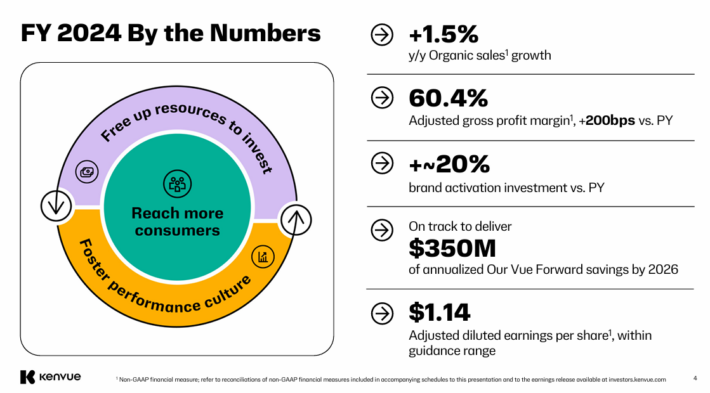

Excessive Yield Dividend King #15: Kenvue Inc. (KVUE)

Kenvue has three segments, together with Self Care, Pores and skin Well being and Magnificence, and Important Well being. Self Care’s product portfolio contains cough, chilly, allergy, smoking cessation, and ache care merchandise amongst others.

Pores and skin Well being and Magnificence holds merchandise akin to face, physique, hair, and solar care. Important Well being incorporates merchandise for ladies’s well being, wound care, oral care, and child care.

Effectively-known manufacturers in Kenvue’s product line up embody Tylenol, Listerine, Band-Support, Neutrogena, Nicorette, and Zyrtec.

On February sixth, 2025, Kenvue introduced fourth quarter and full-year earnings outcomes For the quarter, income declined 0.1% to $3.66 billion, which was $109 million lower than anticipated.

Supply: Investor Presentation

Adjusted earnings-per-share of $0.26 in contrast unfavorably to $0.31 final yr and was in-line with estimates.

For the yr, income improved 0.1% to $15.5 billion whereas adjusted earnings-per-share of $1.14 in comparison with $1.29 in 2023.

Natural gross sales improved 1.7% for the quarter and 1.5% for the yr. For the quarter, pricing and blend added 1% whereas quantity grew 0.7%.

Pores and skin Well being and Magnificence and Self Care have been constructive for the interval, however have been offset by weaker outcomes for Important Well being. Gross revenue margin expanded 80 foundation factors to 56.5%.

Click on right here to obtain our most up-to-date Certain Evaluation report on KVUE (preview of web page 1 of three proven beneath):

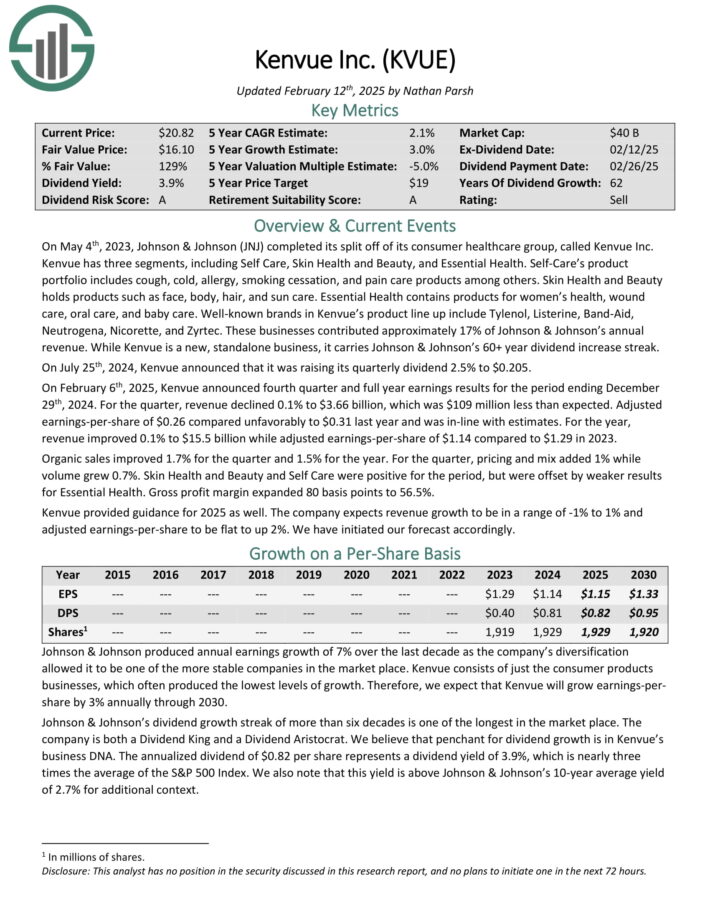

Excessive Yield Dividend King #14: Kimberly-Clark (KMB)

Kimberly-Clark is a worldwide shopper merchandise firm that operates in 175 international locations and sells disposable shopper items, together with paper towels, diapers, and tissues.

It operates segments that every home many standard manufacturers: the Private Care Section (Huggies, Pull-Ups, Kotex, Rely, Poise), the Shopper Tissue phase (Kleenex, Scott, Cottonelle, and Viva), and knowledgeable phase.

Kimberly-Clark posted fourth quarter and full-year earnings on January twenty eighth, 2025. Adjusted earnings-per-share got here to $1.50, lacking estimates by a penny.

Income was off 0.8% year-on-year to $4.93 billion, however nonetheless beat estimates by $70 million.

Natural gross sales development was 2.3% for the quarter with the steadiness of the transfer in income from foreign exchange translation and divestitures. Natural gross sales have been pushed by quantity development of 1.5%, which was one of the best efficiency of the yr.

Supply: Investor Presentation

Pricing elevated 0.6%, and product combine added 0.1%. The corporate famous all segments grew quantity in the course of the quarter.

Adjusted gross margin was up 50 foundation level year-on-year to 35.4% of gross sales, as productiveness good points have been partially offset by investments and manufacturing price headwinds. Full-year money from operations was $3.2 billion, down from $3.5 billion in 2023.

Click on right here to obtain our most up-to-date Certain Evaluation report on Kimberly-Clark (preview of web page 1 of three proven beneath):

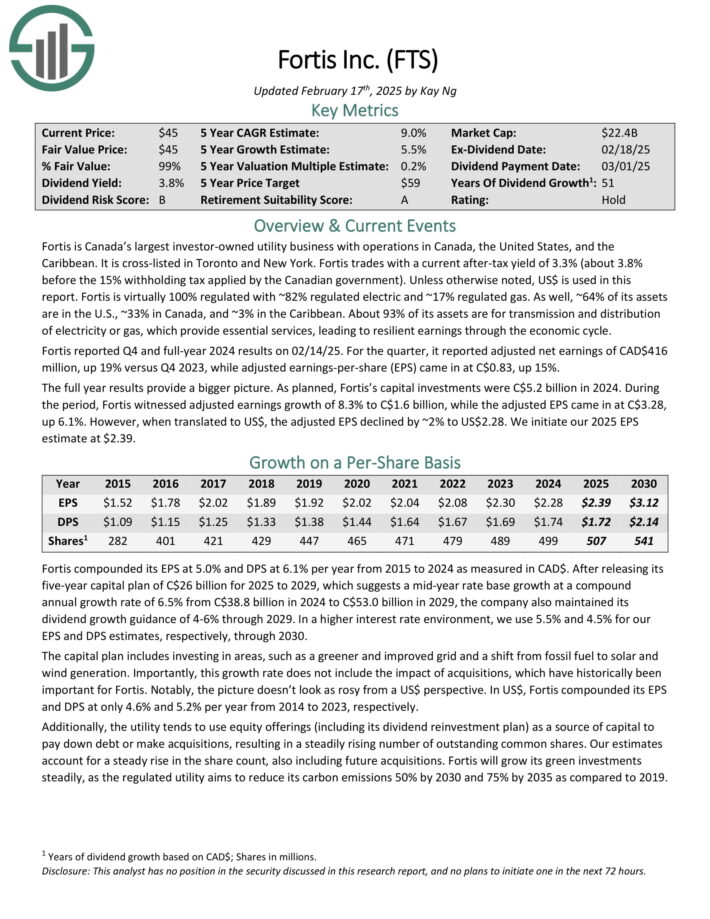

Excessive Yield Dividend King #13: Fortis (FTS)

Fortis is Canada’s largest investor-owned utility enterprise with operations in Canada, the US, and the Caribbean.

Fortis presently has 99% regulated belongings: 82% regulated electrical and 17% regulated fuel. Roughly 64% are within the U.S., 33% in Canada, and three% within the Caribbean.

Supply: Investor Presentation

Fortis reported This autumn and full-year 2024 outcomes on 02/14/25. For the quarter, it reported adjusted internet earnings of CAD$416 million, up 19% versus This autumn 2023, whereas adjusted earnings-per-share (EPS) got here in at C$0.83, up 15%.

As deliberate, Fortis’s capital investments have been C$5.2 billion in 2024.

In the course of the interval, Fortis witnessed adjusted earnings development of 8.3% to C$1.6 billion, whereas the adjusted EPS got here in at C$3.28, up 6.1%. Nevertheless, when translated to US$, the adjusted EPS declined by ~2% to US$2.28.

After releasing its five-year capital plan of C$26 billion for 2025 to 2029, which suggests a mid-year charge base development at a compound annual development charge of 6.5% from C$38.8 billion in 2024 to C$53.0 billion in 2029, the corporate additionally maintained its dividend development steering of 4-6% via 2029.

Click on right here to obtain our most up-to-date Certain Evaluation report on FTS (preview of web page 1 of three proven beneath):

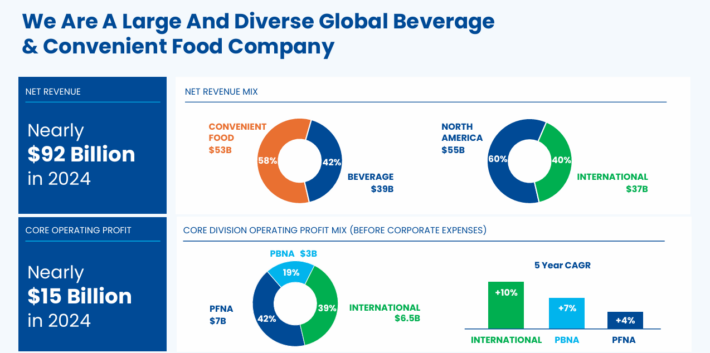

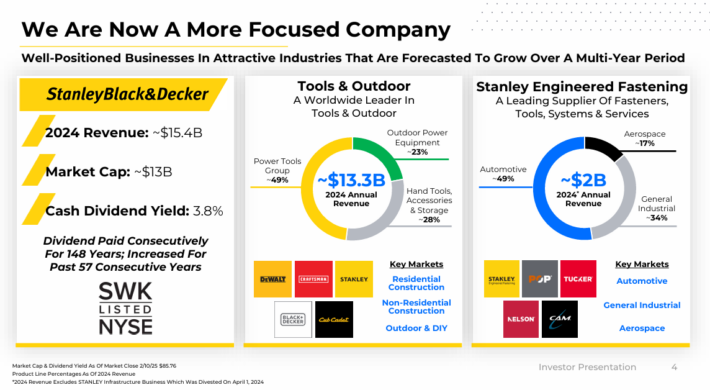

Excessive Yield Dividend King #12: PepsiCo Inc. (PEP)

PepsiCo is a worldwide meals and beverage firm. Its merchandise embody Pepsi, Mountain Dew, Frito-Lay chips, Gatorade, Tropicana orange juice and Quaker meals.

Its enterprise is cut up roughly 60-40 when it comes to meals and beverage income. It is usually balanced geographically between the U.S. and the remainder of the world.

Supply: Investor Presentation

On February 4th, 2025, PepsiCo introduced that it might enhance its annualized dividend by 5.0% to $5.69 beginning with the cost that was made in June 2025, extending the corporate’s dividend development streak to 53 consecutive years.

That very same day, PepsiCo introduced fourth quarter and full yr outcomes for the interval ending December thirty first, 2025. For the quarter, income decreased 0.3% to $27.8 billion, which was $110 million beneath estimates.

Adjusted earnings-per-share of $1.96 in contrast favorably to $1.78 the prior yr and was $0.02 higher than excepted.

For the yr, income grew 0.4% to $91.9 billion whereas adjusted earnings-per-share of $8.16 in comparison with $7.62 in 2023. Foreign money alternate lowered income by 2% and earnings-per-share by 4%.

Click on right here to obtain our most up-to-date Certain Evaluation report on PEP (preview of web page 1 of three proven beneath):

Excessive Yield Dividend King #11: Hormel Meals (HRL)

Hormel Meals was based again in 1891 in Minnesota. Since that point, the corporate has grown right into a juggernaut within the meals merchandise trade with practically $10 billion in annual income.

Hormel has stored with its core competency as a processor of meat merchandise for properly over 100 years, however has additionally grown into different enterprise traces via acquisitions.

Hormel has a big portfolio of category-leading manufacturers. Just some of its prime manufacturers embody embody Skippy, SPAM, Applegate, Justin’s, and greater than 30 others.

It has additionally pursued acquisitions to drive development. For instance, in 2021, Hormel acquired the Planters snack nuts enterprise from Kraft-Heinz (KHC) for $3.35 billion, which has boosted Hormel’s development.

Supply: Investor Presentation

Hormel posted fourth quarter and full-year earnings on December 4th, 2024, and outcomes have been consistent with expectations. The corporate posted adjusted earnings-per-share of 42 cents, which met estimates. Income was off 2% year-on-year to $3.14 billion, additionally hitting estimates.

Working revenue was $308 million for the quarter on an adjusted foundation, or 9.8% of income. Working money move was $409 million for This autumn.

For the yr, gross sales have been $11.9 billion, and adjusted working revenue was $1.1 billion, or 9.6% of income. Adjusted earnings-per-share was $1.58. Working money move hit a report of $1.3 billion.

Steering for 2025 was initiated at $11.9 billion to $12.2 billion in gross sales, with natural internet gross sales development of 1% to three%.

Click on right here to obtain our most up-to-date Certain Evaluation report on HRL (preview of web page 1 of three proven beneath):

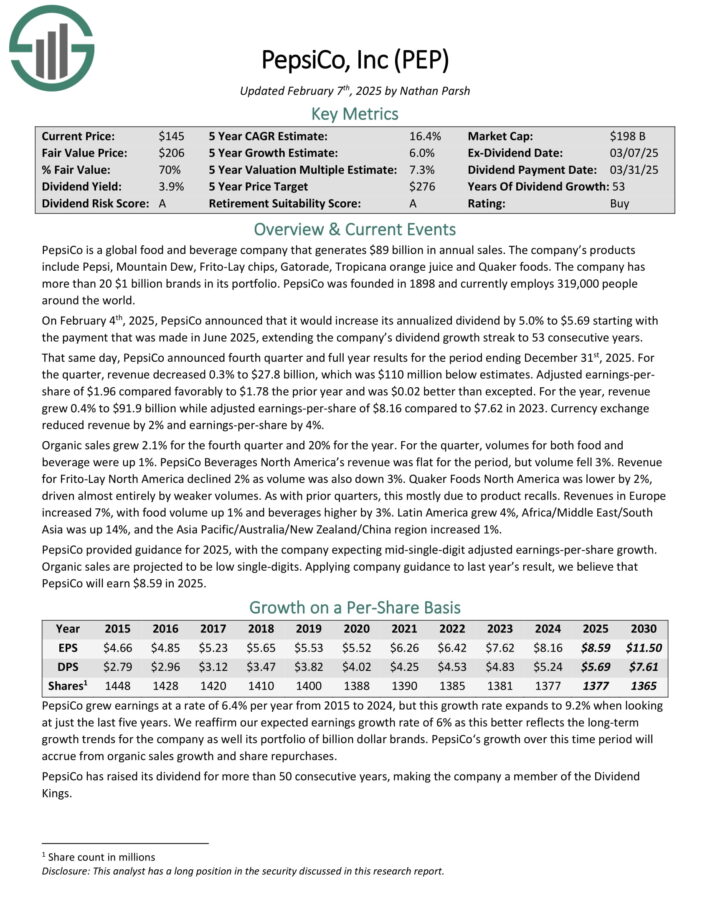

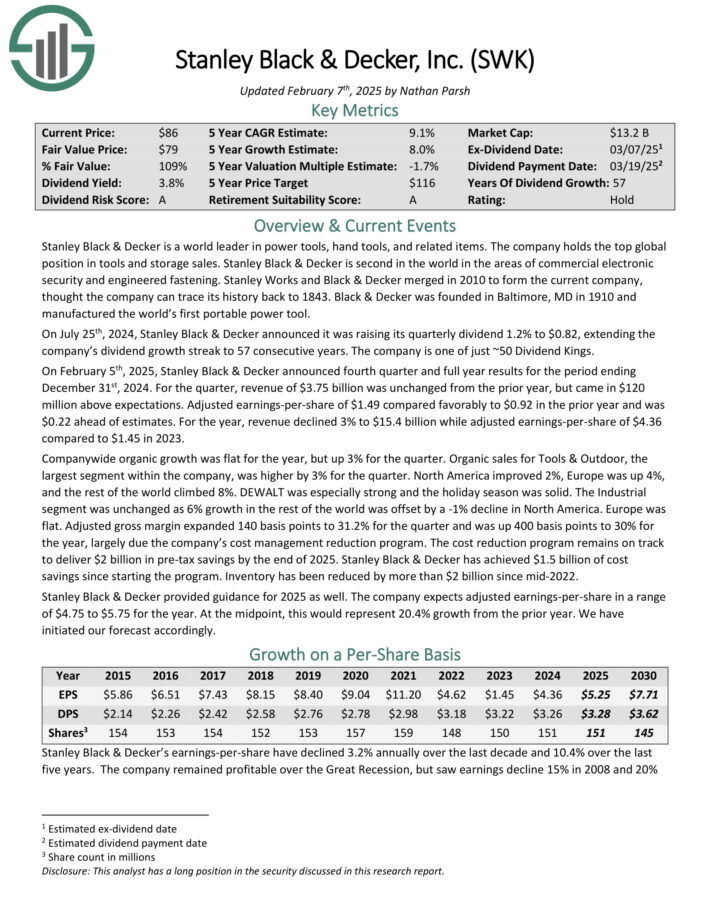

Excessive Yield Dividend King #10: Stanley Black & Decker (SWK)

Stanley Black & Decker is a world chief in energy instruments, hand instruments, and associated gadgets. The corporate holds the highest international place in instruments and storage gross sales.

Stanley Black & Decker is second on this planet within the areas of economic digital safety and engineered fastening. The corporate consists of three segments: instruments & out of doors, and industrial.

Supply: Investor Presentation

On February fifth, 2025, Stanley Black & Decker introduced fourth quarter and full-year outcomes. For the quarter, income of $3.75 billion was unchanged from the prior yr, however got here in $120 million above expectations.

Adjusted earnings-per-share of $1.49 in contrast favorably to $0.92 within the prior yr and was $0.22 forward of estimates. For the yr, income declined 3% to $15.4 billion whereas adjusted earnings-per-share of $4.36 in comparison with $1.45 in 2023.

Natural development was flat for the yr, however up 3% for the quarter. Natural gross sales for Instruments & Out of doors, the biggest phase inside the firm, was greater by 3% for the quarter.

Click on right here to obtain our most up-to-date Certain Evaluation report on SWK (preview of web page 1 of three proven beneath):

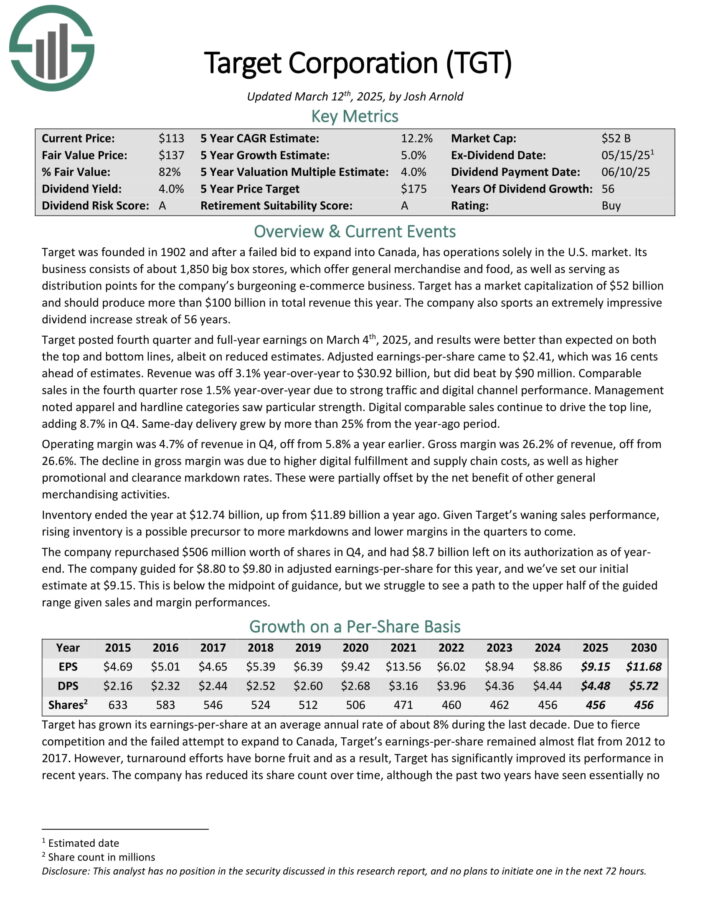

Excessive Yield Dividend King #9: Goal Company (TGT)

Goal was based in 1902 and now operates about 1,850 large field shops, which supply basic merchandise and meals, in addition to serving as distribution factors for the corporate’s e-commerce enterprise.

Goal posted fourth quarter and full-year earnings on March 4th, 2025, and outcomes have been higher than anticipated on each the highest and backside traces, albeit on lowered estimates. Adjusted earnings-per-share got here to $2.41, which was 16 cents forward of estimates.

Income was off 3.1% year-over-year to $30.92 billion, however did beat estimates by $90 million. Comparable gross sales within the fourth quarter rose 1.5% year-over-year as a result of robust site visitors and digital channel efficiency. Administration famous attire and hardline classes noticed explicit power.

Digital comparable gross sales proceed to drive the highest line, including 8.7% in This autumn. Similar-day supply grew by greater than 25% from the year-ago interval.

The corporate repurchased $506 million price of shares in This autumn, and had $8.7 billion left on its authorization as of yr finish. The corporate guided for $8.80 to $9.80 in adjusted earnings-per-share for this yr.

Click on right here to obtain our most up-to-date Certain Evaluation report on TGT (preview of web page 1 of three proven beneath):

Excessive Yield Dividend King #8: Archer Daniels Midland (ADM)

Archer-Daniels-Midland is the biggest publicly traded farmland product firm in the US. Its companies embody processing cereal grains, oilseeds, and agricultural storage and transportation.

Archer-Daniels-Midland reported its third-quarter outcomes for Fiscal 12 months (FY) 2024 on November 18th, 2024.

The corporate reported adjusted internet earnings of $530 million and adjusted EPS of $1.09, each down from the prior yr as a result of a $461 million non-cash cost associated to its Wilmar fairness funding.

Consolidated money flows year-to-date reached $2.34 billion, reflecting robust operations regardless of market challenges.

Click on right here to obtain our most up-to-date Certain Evaluation report on ADM (preview of web page 1 of three proven beneath):

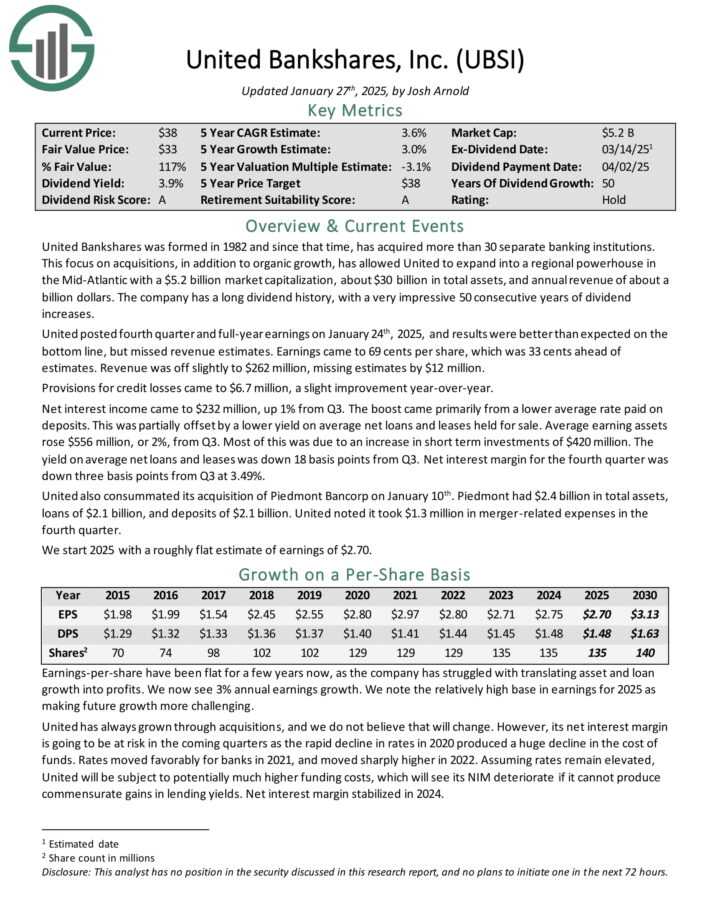

Excessive Yield Dividend King #7: United Bankshares (UBSI)

United Bankshares was fashioned in 1982 and since that point, has acquired greater than 30 separate banking establishments.

This give attention to acquisitions, along with natural development, has allowed United to broaden within the Mid-Atlantic with about $30 billion in whole belongings, and annual income of about $1 billion.

United posted fourth quarter and full-year earnings on January twenty fourth, 2025, and outcomes have been higher than anticipated on the underside line, however missed income estimates.

Earnings got here to 69 cents per share, which was 33 cents forward of estimates. Income was off barely to $262 million, lacking estimates by $12 million.

Provisions for credit score losses got here to $6.7 million, a slight enchancment year-over-year. Web curiosity revenue got here to $232 million, up 1% from Q3. The increase got here primarily from a decrease common charge paid on deposits.

This was partially offset by a decrease yield on common internet loans and leases held on the market. Common incomes belongings rose $556 million, or 2%, from Q3. Most of this was as a result of a rise in brief time period investments of $420 million.

The yield on common internet loans and leases was down 18 foundation factors from Q3. Web curiosity margin for the fourth quarter was down three foundation factors from Q3 at 3.49%.

Click on right here to obtain our most up-to-date Certain Evaluation report on UBSI (preview of web page 1 of three proven beneath):

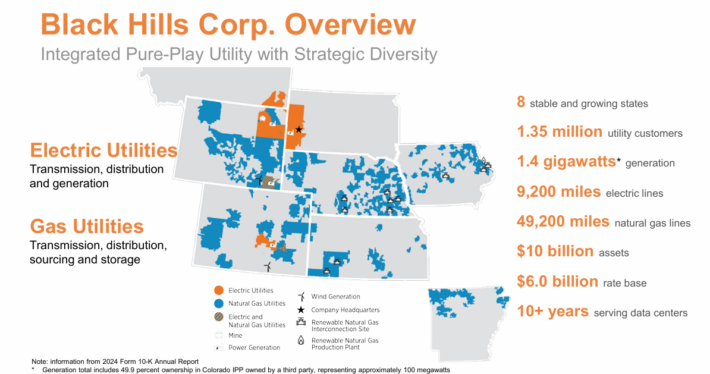

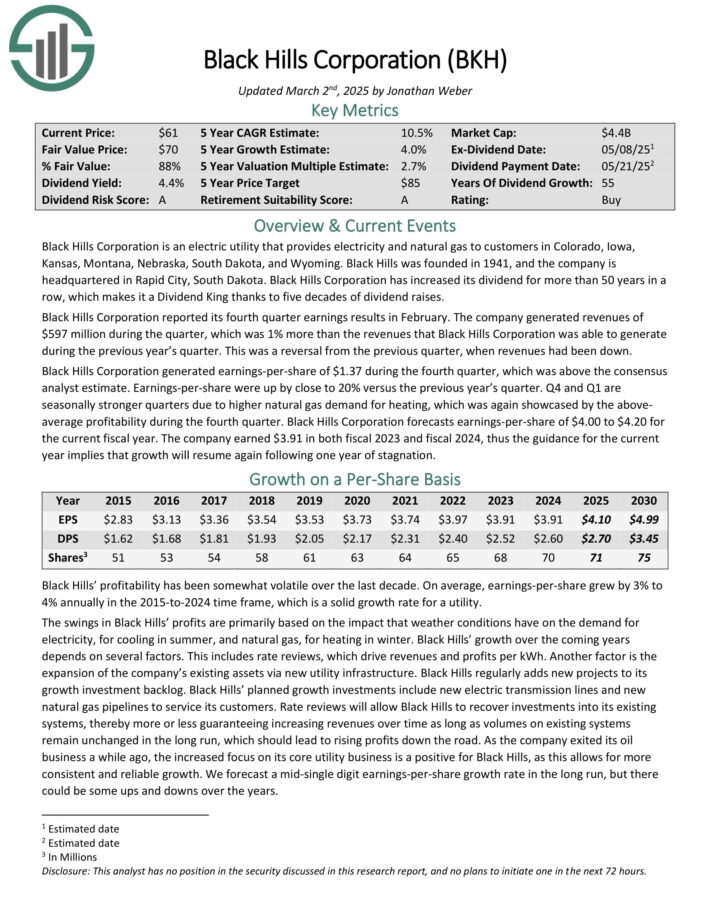

Excessive Yield Dividend King #6: Black Hills Company (BKH)

Black Hills Company is an electrical utility that gives electrical energy and pure fuel to clients in Colorado, Iowa, Kansas, Montana, Nebraska, South Dakota, and Wyoming.

The corporate has 1.35 million utility clients in eight states. Its pure fuel belongings embody 49,200 miles of pure fuel traces. Individually, it has ~9,200 miles of electrical traces and 1.4 gigawatts of electrical technology capability.

Supply: Investor Presentation

Black Hills Company reported its fourth quarter earnings ends in February. The corporate generated revenues of $597 million in the course of the quarter, which was up 1% year-over-year.

Earnings-per-share of $1.37 in the course of the fourth quarter was above the consensus analyst estimate. Earnings-per-share have been up by shut to twenty% versus the earlier yr’s quarter. This autumn and Q1 are seasonally stronger quarters as a result of greater pure fuel demand for heating, which was once more showcased by the above-average profitability in the course of the fourth quarter.

Black Hills Company forecasts earnings-per-share of $4.00 to $4.20 for the present fiscal yr.

Click on right here to obtain our most up-to-date Certain Evaluation report on BKH (preview of web page 1 of three proven beneath):

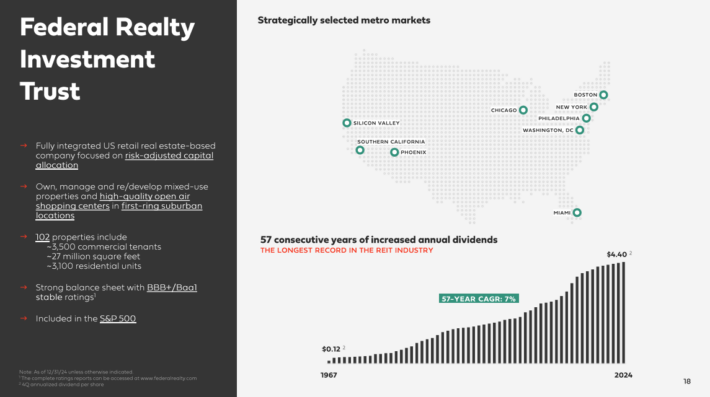

Excessive Yield Dividend King #5: Federal Realty Funding Belief (FRT)

Federal Realty was based in 1962. As a Actual Property Funding Belief, Federal Realty’s enterprise mannequin is to personal and lease out actual property properties.

It makes use of a good portion of its rental revenue, in addition to exterior financing, to accumulate new properties.

Supply: Investor Presentation

On February 13, 2025, Federal Realty Funding Belief reported its monetary outcomes for the fourth quarter of 2024. The corporate achieved funds from operations (FFO) per share of $1.73 for the quarter and $6.77 for the complete yr, setting all-time information even after accounting for a one-time $0.04 cost associated to an government departure.

Whole income surpassed $300 million for the quarter and $1.2 billion for the yr, reflecting development charges of seven% and 6% over their respective prior durations. Leased occupancy reached 96.2%, and occupied occupancy was 94.1% at year-end, the best ranges in practically a decade.

These outcomes have been pushed by robust tenant demand, with each leased and occupied metrics growing by 200 and 190 foundation factors, respectively, over year-end 2023 ranges.

The corporate additionally reported strong lease rollover of 11% on a money foundation and sector-leading contractual lease will increase of roughly 2.5% for each anchor and small store tenants.

Click on right here to obtain our most up-to-date Certain Evaluation report on Federal Realty (preview of web page 1 of three proven beneath):

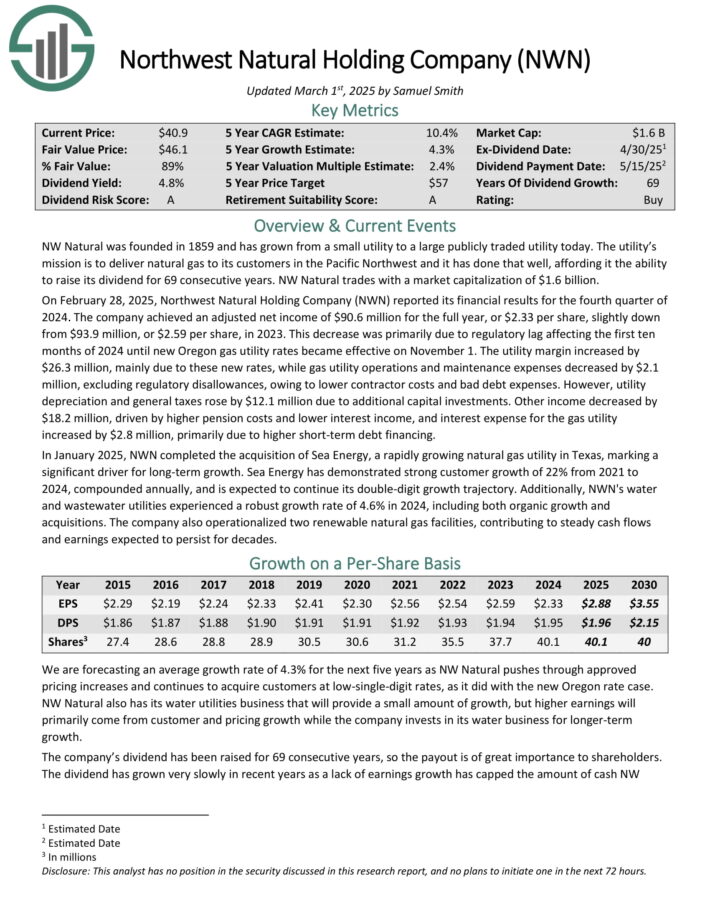

Excessive Yield Dividend King #4: Northwest Pure Holding Co. (NWN)

Northwest was based over 160 years in the past as a pure fuel utility in Portland, Oregon.

It has grown from a really small, native utility that offered fuel service to a handful of consumers to a really profitable regional utility with pursuits that now embody water and wastewater, which have been bought in latest acquisitions.

The corporate’s places served are proven within the picture beneath.

Supply: Investor Presentation

Northwest gives fuel service to 2.5 million clients in ~140 communities in Oregon and Washington, serving greater than 795,000 connections. It additionally owns and operates ~35 billion cubic ft of underground fuel storage capability.

On February 28, 2025, Northwest Pure Holding Firm (NWN) reported its monetary outcomes for the fourth quarter of 2024. The corporate achieved an adjusted internet revenue of $90.6 million for the complete yr, or $2.33 per share, barely down from $93.9 million, or $2.59 per share, in 2023.

This lower was primarily as a result of regulatory lag affecting the primary ten months of 2024 till new Oregon fuel utility charges grew to become efficient on November 1. The utility margin elevated by $26.3 million, primarily as a result of these new charges.

Click on right here to obtain our most up-to-date Certain Evaluation report on NWN (preview of web page 1 of three proven beneath):

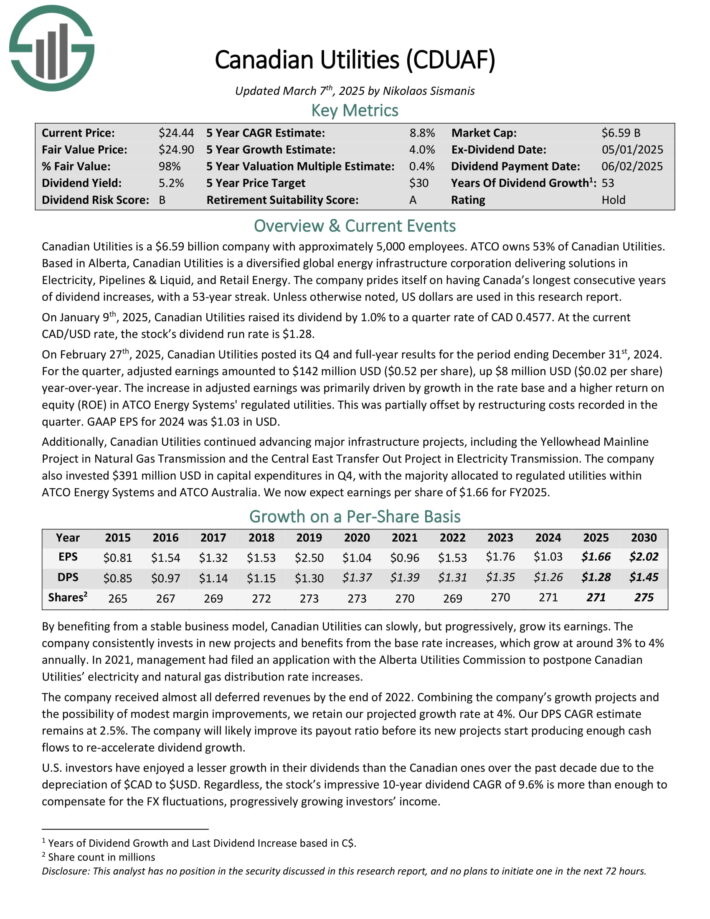

Excessive Yield Dividend King #3: Canadian Utilities (CDUAF)

Canadian Utilities is a utility firm with roughly 5,000 staff. ATCO owns 53% of Canadian Utilities. Primarily based in Alberta, Canadian Utilities is a diversified international power infrastructure company delivering options in Electrical energy, Pipelines & Liquid, and Retail Vitality.

The corporate has an extended historical past of producing regular development and constant earnings via the financial cycle.

Supply: Investor Presentation

On February twenty seventh, 2025, Canadian Utilities posted its This autumn and full-year outcomes for the interval ending December thirty first, 2024.

For the quarter, adjusted earnings amounted to $142 million USD ($0.52 per share), up $8 million USD ($0.02 per-share) year-over-year.

The rise in adjusted earnings was primarily pushed by development within the charge base and the next return on fairness (ROE) in ATCO Vitality Techniques’ regulated utilities.

This was partially offset by restructuring prices recorded within the quarter. GAAP EPS for 2024 was $1.03 in USD.

Click on right here to obtain our most up-to-date Certain Evaluation report on CDUAF (preview of web page 1 of three proven beneath):

Excessive Yield Dividend King #2: Common Company (UVV)

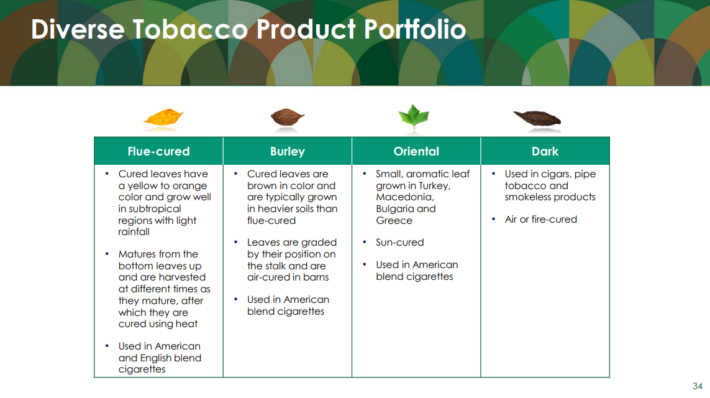

Common Company is a market chief in supplying leaf tobacco and different plant-based inputs to shopper product producers.

The Tobacco Operations phase buys and sells tobacco used to make cigarettes, cigars, pipe tobacco, and smokeless merchandise.

Common buys tobacco from its suppliers, processes it, and sells it to giant tobacco firms within the US and internationally.

Supply: Investor Presentation

The Ingredient Operations deal primarily with greens and fruits however is considerably smaller than the tobacco operations.

Common Company reported its third quarter earnings ends in February. The corporate generated revenues of $937 million in the course of the quarter, which was greater than the revenues that Common Company generated in the course of the earlier interval.

Revenues have been positively impacted by product combine modifications, whereas bigger and better-yielding crops additionally had a constructive affect on the corporate’s top-line. Common Company’s revenues additionally rose on a year-over-year foundation, displaying a 14% enhance.

Click on right here to obtain our most up-to-date Certain Evaluation report on Common (preview of web page 1 of three proven beneath):

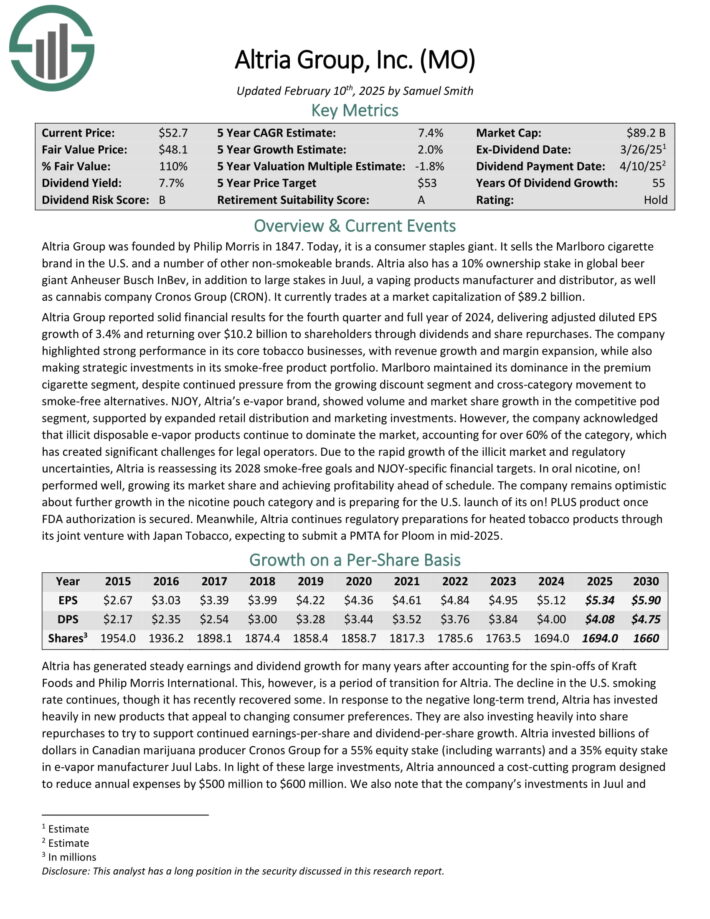

Excessive Yield Dividend King #1: Altria Group (MO)

Altria is a tobacco inventory that sells cigarettes, chewing tobacco, cigars, e-cigarettes, and extra beneath a wide range of manufacturers, together with Marlboro, Skoal, and Copenhagen, amongst others.

With a present dividend yield of practically 8%, Altria is a perfect retirement funding inventory.

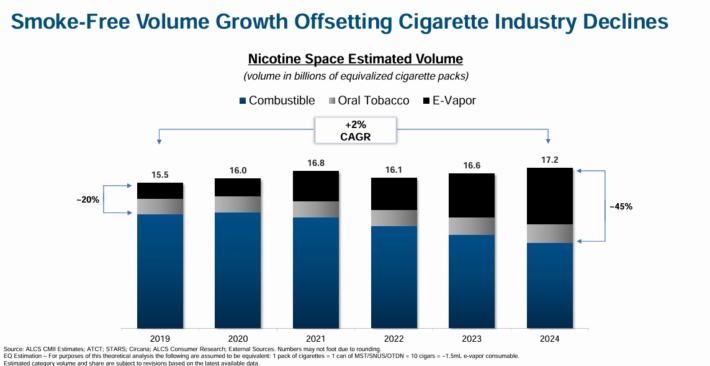

It is a interval of transition for Altria. The decline within the U.S. smoking charge continues. In response, Altria has invested closely in new merchandise that enchantment to altering shopper preferences, because the smoke-free class continues to develop.

Supply: Investor Presentation

The corporate additionally has a 35% funding stake in e-cigarette maker JUUL, and a forty five% stake within the Canadian hashish producer Cronos Group (CRON).

Altria Group reported strong monetary outcomes for the fourth quarter and full yr of 2024. For the fourth quarter, income of $5.1 billion beat analyst estimates by $50 million, and elevated 1.6% year-over-year. Adjusted EPS of $1.29 beat by a penny.

For the complete yr, Altria generated adjusted diluted EPS development of three.4% and returned over $10.2 billion to shareholders via dividends and share repurchases.

For 2025, Altria expects adjusted diluted EPS in a variety of $5.22 to $5.37. This represents an adjusted diluted EPS development charge of two% to five% for 2025.

Click on right here to obtain our most up-to-date Certain Evaluation report on Altria (preview of web page 1 of three proven beneath):

Last Ideas

Excessive yield dividend shares have apparent enchantment to revenue buyers. The S&P 500 Index yields simply ~1.2% proper now on common, making excessive yield shares much more enticing by comparability.

After all, buyers ought to at all times do their analysis earlier than shopping for particular person shares.

That mentioned, the 20 shares on this record have yields no less than double the S&P 500 Index common. And, every of those shares has elevated their dividends for 50 consecutive years.

They’re all a part of the unique Dividend Kings record. In consequence, revenue buyers might discover these 20 dividend shares enticing.

Additional Studying

In case you are involved in discovering high-quality dividend development shares and/or different high-yield securities and revenue securities, the next Certain Dividend sources will probably be helpful:

Excessive-Yield Particular person Safety Analysis

Different Certain Dividend Sources

Thanks for studying this text. Please ship any suggestions, corrections, or inquiries to assist@suredividend.com.