Three such firms—Monster Beverage, Mondelez Worldwide, and Bristol-Myers Squibb—stand out as stable funding selections throughout the ongoing market correction.

Every of those companies boasts a various portfolio of well-known manufacturers and merchandise, positioning them as sensible buys.

Searching for actionable commerce concepts to navigate the present market volatility? Subscribe right here to unlock entry to InvestingPro’s AI-selected inventory winners.

President Donald Trump’s aggressive tariff insurance policies are reshaping international commerce, with current tariffs on Mexico, Canada, the European Union, and China already triggering retaliatory measures. As markets digest these developments, traders want methods to navigate the uncertainty.

Listed here are three shares positioned to climate—and doubtlessly thrive—throughout escalating commerce tensions.

1. Monster Beverage

12 months-To-Date Efficiency: +3.4%

Market Cap: $52.8 Billion

Monster Beverage (NASDAQ:) dominates the vitality drink market with its flagship Monster Vitality model, amongst others. The corporate additionally produces non-carbonated ready-to-drink drinks together with teas, juices, and low drinks.Supply: Investing.com

MNST inventory has proven resilience with a 9.7% acquire over the past month regardless of broader market volatility.

With a loyal client base and progressive advertising methods, Monster is well-positioned to proceed its development trajectory, making it a horny funding choice. Deutsche Financial institution not too long ago raised their value goal to $61.00 whereas sustaining a ’purchase’ score.  Supply: InvestingPro

Supply: InvestingPro

Because the main marketer and distributor of vitality drinks in the USA and a sturdy presence globally, Monster stands out for its capability to develop regardless of exterior challenges.

The corporate’s tariff publicity is taken into account manageable, with aluminum representing solely one-third of can prices.

2. Mondelez Worldwide

12 months-To-Date Efficiency: +8.3%

Market Cap: $83.7 Billion

Mondelez (NASDAQ:) Worldwide is a worldwide snack powerhouse, with a portfolio that features a few of the world’s most beloved and iconic manufacturers akin to Oreo, Cadbury, Milka, and Ritz. The corporate operates in roughly 160 international locations, giving it super geographic diversification.

MDLZ inventory has proven robust relative power amid the continued market correction, notching a acquire of about 6% throughout the previous month.

Mondelez’s power lies in its localized manufacturing mannequin. The corporate manufactures most merchandise throughout the areas the place they’re bought, considerably decreasing cross-border transport and tariff publicity. Moreover, the constant demand for snack merchandise, no matter financial circumstances, underscores Mondelez’s defensive qualities.

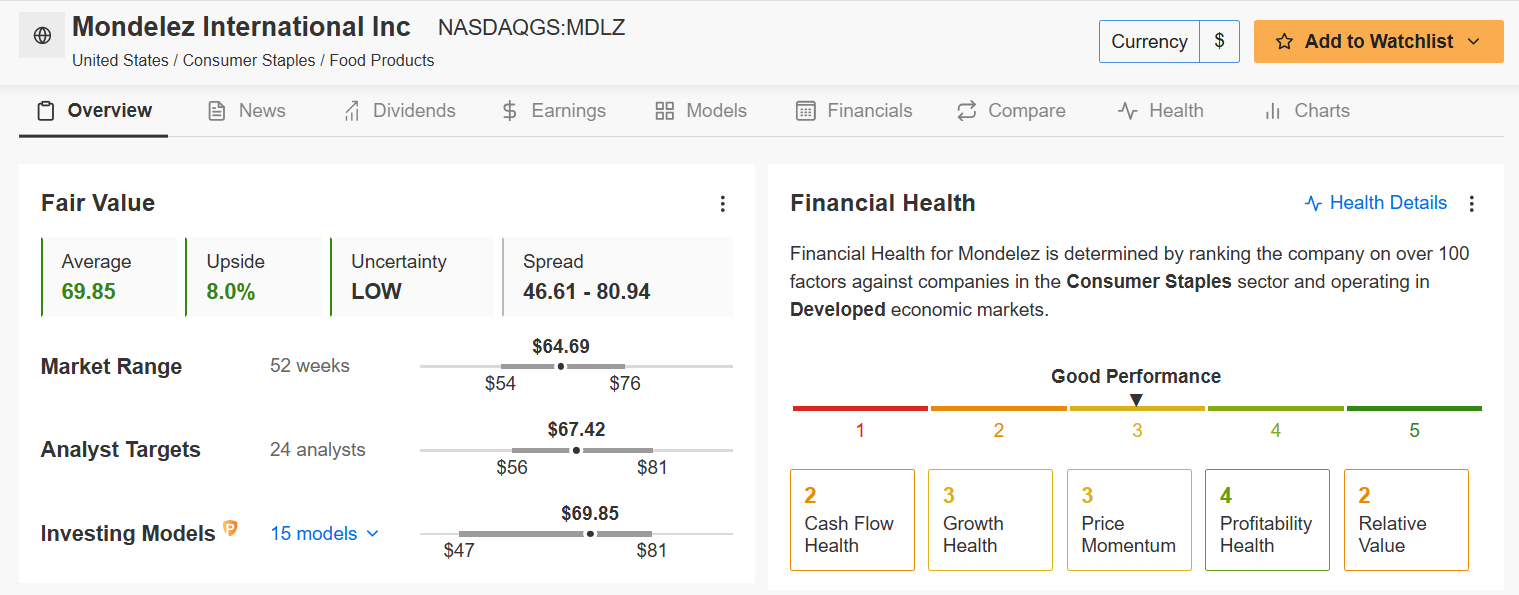

With a various product line that caters to international tastes and preferences, Mondelez is well-equipped to deal with the challenges of a commerce struggle. Truthful Worth estimates level to a possible upside of 8% from present ranges, whereas analysts keep a “Sturdy Purchase” consensus.  Supply: InvestingPro

Supply: InvestingPro

Moreover, the corporate gives a 3% dividend yield with an affordable payout ratio of fifty.9%, making it a stable alternative for traders searching for stability.

3. Bristol-Myers Squibb

12 months-To-Date Efficiency: +6.6%

Market Cap: $121.8 Billion

Bristol-Myers Squibb (NYSE:), a worldwide biopharmaceutical firm, rounds out the trio with its array of prescription prescription drugs and client merchandise. With a deal with therapeutic areas akin to oncology, cardiovascular, and immunology, Bristol-Myers has a sturdy pipeline of medicines addressing important well being wants.

BMY shares are displaying robust constructive momentum with a 7.7% inventory return over the previous month.

Pharmaceutical firms provide distinctive insulation from commerce tensions for a number of causes. First, life-saving medicines face fewer retaliatory tariffs as a result of humanitarian considerations. Second, excessive margins permit absorption of tariff impacts with out vital earnings deterioration. Lastly, mental property safety creates pricing energy no matter commerce circumstances.

With a market cap of $121.8 billion, a 4.1% dividend yield, and a “GOOD” Monetary Well being rating, BMY gives a horny mixture of worth, revenue, and defensive traits.  Supply: InvestingPro

Supply: InvestingPro

The corporate’s robust money stream helps each its dividend and continued analysis funding, making a virtuous cycle for long-term traders.

Conclusion

In conclusion, Monster Beverage, Mondelez Worldwide, and Bristol-Myers Squibb every exhibit traits that make them engaging funding choices throughout a worldwide commerce struggle.

Their robust model portfolios, defensive enterprise fashions, and strategic approaches to navigating financial challenges place them properly to ship secure returns in unsure occasions introduced on by tariffs.

Remember to try InvestingPro to remain in sync with the market development and what it means on your buying and selling. Whether or not you’re a novice investor or a seasoned dealer, leveraging InvestingPro can unlock a world of funding alternatives whereas minimizing dangers amid the difficult market backdrop.

Subscribe now and immediately unlock entry to a number of market-beating options, together with:

ProPicks AI: AI-selected inventory winners with confirmed monitor report.

InvestingPro Truthful Worth: Immediately discover out if a inventory is underpriced or overvalued.

Superior Inventory Screener: Seek for the very best shares primarily based on a whole bunch of chosen filters, and standards.

Prime Concepts: See what shares billionaire traders akin to Warren Buffett, Michael Burry, and George Soros are shopping for.

Disclosure: On the time of writing, I’m quick on the S&P 500 and through the ProShares Quick S&P 500 ETF (SH) and ProShares Quick QQQ ETF (PSQ).

I commonly rebalance my portfolio of particular person shares and ETFs primarily based on ongoing danger evaluation of each the macroeconomic setting and firms’ financials.

The views mentioned on this article are solely the opinion of the writer and shouldn’t be taken as funding recommendation.

Comply with Jesse Cohen on X/Twitter @JesseCohenInv for extra inventory market evaluation and perception.