The food and drinks business faces extra ingredient vulnerability than ever, with gadgets that had been as soon as thought of pantry staples changing into much less dependable as a consequence of local weather change, illness, and provide chain disruptions. This yr alone, the USA Division of Agriculture’s (USDA) Meals Value Outlook predicts a staggering 20.3% rise in egg costs.

Early outbreaks of the Avian Influenza H5N1 pressure precipitated important egg shortages in 2023. The state of affairs in 2025 is much more strained, with the nationwide flock remaining smaller than it was through the earlier outbreak, additional tightening provide.

The egg class isn’t the one one to expertise volatility as a consequence of uncontrollable components lately. Over the past 20 years, orange yields have declined by 75% or extra in key citrus areas, reminiscent of Florida and Brazil. That is primarily as a result of extreme impression of citrus greening illness, however excessive climate, reminiscent of droughts, floods, and hurricanes, has additionally impacted the juice business.

Equally, the cocoa business faces unprecedented challenges. West Africa is the place 80% of the world’s cocoa is grown, with 55% alone produced in Ghana and the Ivory Coast. In 2024, World cocoa manufacturing was down 11% as a consequence of more and more unfavorable climate situations, which proceed to spur crop illness. The outlook is worrisome as local weather change is predicted to accentuate the area’s El Niño local weather sample results.

Objects like eggs, cocoa, and oranges have lengthy been prized for his or her affordability, versatility, and dietary worth. Regardless of provide chain disruptions, shopper loyalty stays robust amongst these merchandise. As of February 2024, simply 4% of US egg customers anticipated decreasing their egg consumption, highlighting the inelastic nature of this market. Moreover, 87% of non-vegan US customers reported consuming eggs inside the six months main as much as February 2024. Briefly, eggs are an integral staple within the American food regimen.

Beneath are three key methods food and drinks manufacturers ought to think about as they proceed to navigate ingredient shortages in 2025 and past.

Key Methods to Enhance Ingredient Diversification

Show worth to win customers’s loyalty

Over half of US customers affiliate eggs with being straightforward to organize and wholesome. Options to interchange eggs must show their worth by matching these attributes: well being, comfort, and – particularly now – affordability.

Traditionally, plant-based egg substitutes have been costlier than conventional eggs. Nevertheless, a tipping level might quickly be reached the place these options obtain value parity. The continued Extremely Pathogenic Avian Influenza (HPAI) outbreak has made it harder to search out eggs on cabinets, probably pushing customers towards premium-priced, plant-based choices. This can be a crucial time for egg options to show their worth and ship on style and performance to retain customers as soon as the egg scarcity is resolved.

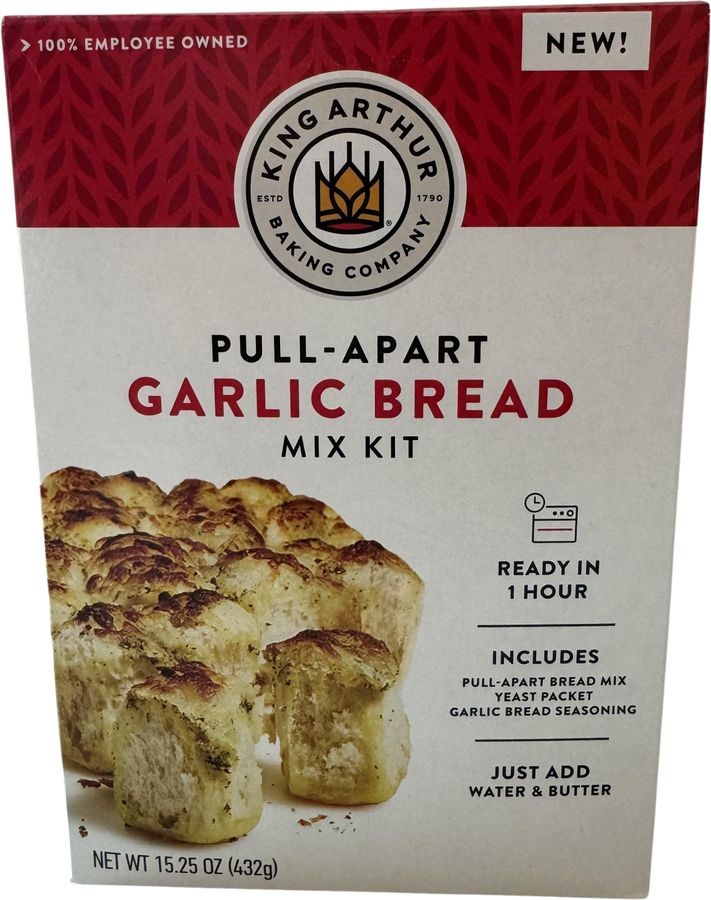

Along with being an inexpensive and easy-to-prepare protein, eggs have many technical advantages and are used continuously in baking, desserts and different classes. For instance, baking mixes usually require the buyer so as to add eggs to organize. Agile baking manufacturers can pivot to offer full baking mixes that don’t require extra eggs. These options may very well be both egg-free or made with dried egg substances however would supply customers the comfort of an all-in-one answer that may proceed to drive worth even after egg costs stabilize.

The lesson: Keep centered on delivering worth by way of style and performance to extend shopper loyalty.

Innovation remains to be paramount

Some forward-thinking manufacturers are serving to customers adapt and undertake ingredient diversification. For instance, King Arthur Baking, in a February 2025 Instagram submit, provided suggestions for baking with out eggs. Their options included aquafaba (water from beans), puréed tofu, mashed banana, pumpkin purée, applesauce, and flax or chia seeds.

Supply: Mintel Buy Intelligence

King Arthur Baking proactively helps customers adapt to ingredient innovation as eggs turn out to be scarce by way of clear and genuine communication, successfully safeguarding its model and gross sales within the course of.

Different manufacturers have sought to duplicate eggs’ distinctive properties in plant-based options. As an illustration, tofu can change scrambled eggs, whereas black salt is usually used to imitate eggs’ sulfur-like aroma.

The lesson: Inventive options assist customers and companies to adapt and navigate crises, even when provides dwindle.

Take heed to the large image

Repercussions of main points affecting the food and drinks business are not often remoted occasions. The identical goes for the impression HPAI has past the egg market.

The virus is spreading quickly throughout species, affecting chickens, turkeys, geese, wild birds, dairy cattle, cats, and even people. H5N1 subtypes are additionally rising and pose potential public well being dangers, although their pandemic potential stays unclear. HPAI has been much less extreme in dairy herds, however can nonetheless impression the dairy market and manufacturing. Greater than 1 / 4 of California’s dairy farms have already been affected, prompting Governor Newsom to declare a state of emergency.

Pet meals manufacturers must also keep vigilant, as cats are significantly susceptible to the virus. Pet house owners will seemingly search assurances concerning the security of their pets’ meals, inserting extra stress on the business.The lesson: Manufacturers should acknowledge the interconnected dangers posed by crises like HPAI and prioritize adaptable methods to take care of shopper belief.

Form the Way forward for Ingredient Diversification with Mintel

As sudden occasions proceed to disrupt provide chains, manufacturers and customers alike should adapt. Whether or not by way of modern options, artistic options, or heightened security measures, navigating the way forward for substances would require resilience and resourcefulness.

By taking these steps, meals manufacturers can proactively and authentically handle ingredient vulnerabilities and construct stronger relationships with their clients.

Wish to know extra about how altering shopper preferences are driving a profound transformation in ingredient innovation within the food and drinks business? Learn our Unveiling the Tendencies Driving Ingredient Innovation within the Meals Business perception on Highlight as we speak!

For extra substances market analysis, Mintel Purchasers can contact their Account Supervisor or entry the complete Ingredient Watch Perception right here (Consumer entry solely). When you aren’t a consumer, please contact us as we speak, and a member of our group will get in contact.