Motive to belief

Strict editorial coverage that focuses on accuracy, relevance, and impartiality

Created by business specialists and meticulously reviewed

The very best requirements in reporting and publishing

Strict editorial coverage that focuses on accuracy, relevance, and impartiality

Morbi pretium leo et nisl aliquam mollis. Quisque arcu lorem, ultricies quis pellentesque nec, ullamcorper eu odio.

Este artículo también está disponible en español.

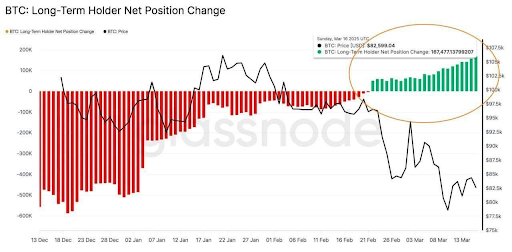

Bitcoin’s long-term holders have resumed accumulation in what’s a notable shift in investor sentiment regardless of the turbulence that has gripped the market in latest weeks. Significantly, information from on-chain analytics platform Glassnode exhibits that the “BTC: Lengthy-term holder internet place change” metric has flipped optimistic for the primary time this yr. This means that long-term Bitcoin buyers are capitalizing on market situations so as to add important quantities of BTC to their holdings.

Lengthy-Time period Holders Add 167,000 BTC Amid March Crash

Earlier this month, Bitcoin’s worth plunged from above $90,000 to round $80,000 throughout a speedy sell-off. This worth surprised many merchants and triggered a steady wave of liquidations amongst short-term buyers. But regardless of this steep correction, long-term holders handled the sub-$90,000 ranges as a shopping for alternative relatively than a cause to capitulate.

Associated Studying

In different phrases, cash are shifting into wallets that haven’t spent their BTC in a very long time, which is a notable reversal after beginning 2025 with a unfavorable internet place change. This marks the primary internet accumulation by these “HODLers” in 2025. Glassnode’s Lengthy-Time period Holder Internet Place Change metric, which had been within the pink, flipped “inexperienced” as long-term buyers aggressively collected by the downturn.

On-chain information exhibits that this flip to inexperienced has seen long-term holders enhance their internet Bitcoin holdings by greater than 167,000 BTC up to now month. This notable inflow is valued at practically $14 billion. In brief, the cohort of seasoned holders started scooping up low-cost BTC whereas short-term sentiment was at its bleakest.

Is A Bitcoin Worth Restoration Brewing?

The timing of this flip from pink selloff to inexperienced accumulation amongst long-term holders is hanging, contemplating what the Bitcoin worth went by up to now two weeks. This information means that a big a part of the Bitcoin crash was brought on by panic-selling amongst short-term holders. This conduct aligns with previous market cycles between August and September 2024, the place long-term holders collected aggressively throughout a worth dip.

Associated Studying

Curiously, Glassnode’s long-term holder metric isn’t the one one pointing to optimistic Bitcoin sentiment amongst massive holders. After weeks of uncertainty, Bitcoin exchange-traded funds (ETFs) have began seeing internet inflows once more. On March 17, spot Bitcoin ETFs collectively drew in about $274.6 million, the most important single-day influx in 28 days and a transparent sign of renewed investor curiosity.

The very subsequent day introduced one other wave of recent capital, with roughly $209 million pouring into Bitcoin funds on March 18. In reality, this three-day streak represents the primary sustained run of optimistic inflows since February 18, a interval throughout which Bitcoin funds have skilled consecutive days of outflows.

On the time of writing, Bitcoin is buying and selling at $83,500.

Featured picture from Unsplash, chart from Tradingview.com