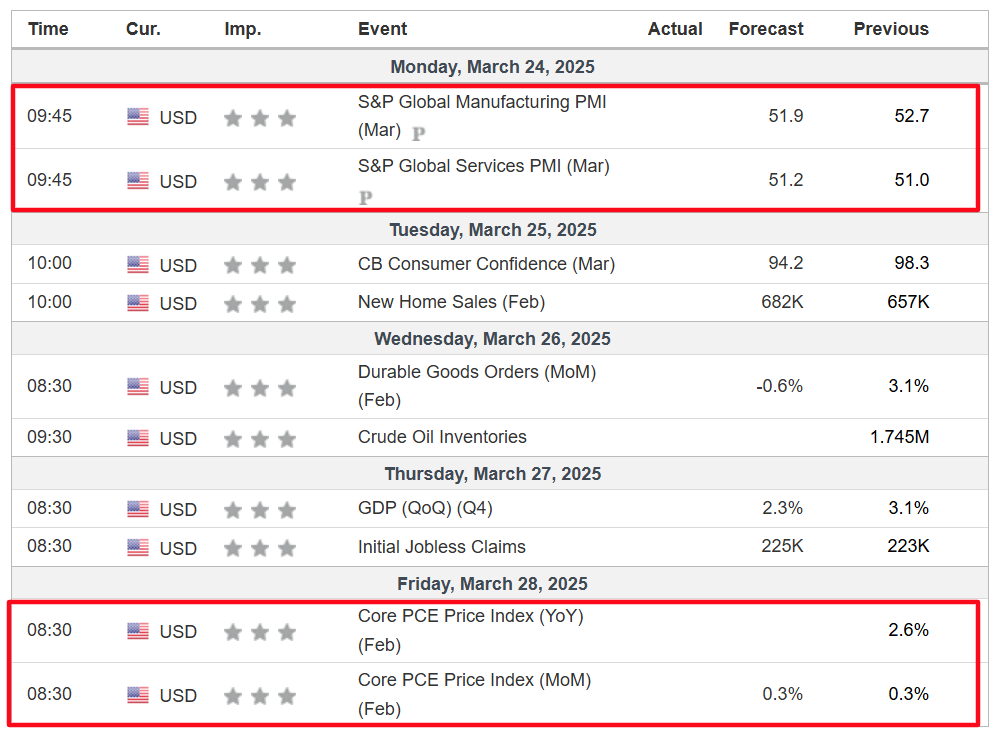

• PCE inflation knowledge, Fed audio system, Trump tariff information will probably be in focus this week.

• Lululemon’s sturdy model presence, modern product strains, and efficient advertising methods place it favorably for a strong earnings report.

• Greenback Tree’s downbeat revenue and gross sales progress prospects recommend a extra cautious strategy, probably making it a inventory to promote.

• On the lookout for actionable commerce concepts to navigate the present market volatility? Subscribe right here to unlock entry to InvestingPro’s AI-selected inventory winners.

U.S. shares ended barely increased on Friday, with the key indexes averting a fifth straight week of losses, after President Donald Trump signaled “flexibility” on upcoming reciprocal tariffs.

For the week, the jumped 1.2%, the gained 0.5%, whereas the tech-heavy rose 0.2%.

Supply: Investing.com

The week forward is anticipated to be one other busy one as buyers proceed to evaluate the outlook for the financial system, inflation, rates of interest and company earnings amid President Trump’s commerce warfare.

Most essential on the financial calendar will probably be Friday’s core PCE worth index, which is the Fed’s favourite inflation gauge. That will probably be accompanied by a heavy slate of Fed audio system, together with district governors Tom Barkin, Raphael Bostic, Neel Kashkari, and Alberto Musalem all set to make public appearances.

Supply: Investing.com

Elsewhere, on the earnings docket, there are only a handful of company outcomes due, together with Lululemon (NASDAQ:), GameStop (NYSE:), Chewy (NYSE:), McCormick (NYSE:), KB House (NYSE:), and Greenback Tree (NASDAQ:).

No matter which route the market goes, under I spotlight one inventory more likely to be in demand and one other which may see contemporary draw back. Bear in mind although, my timeframe is only for the week forward, Monday, March 24 – Friday, March 28.

Inventory To Purchase: Lululemon

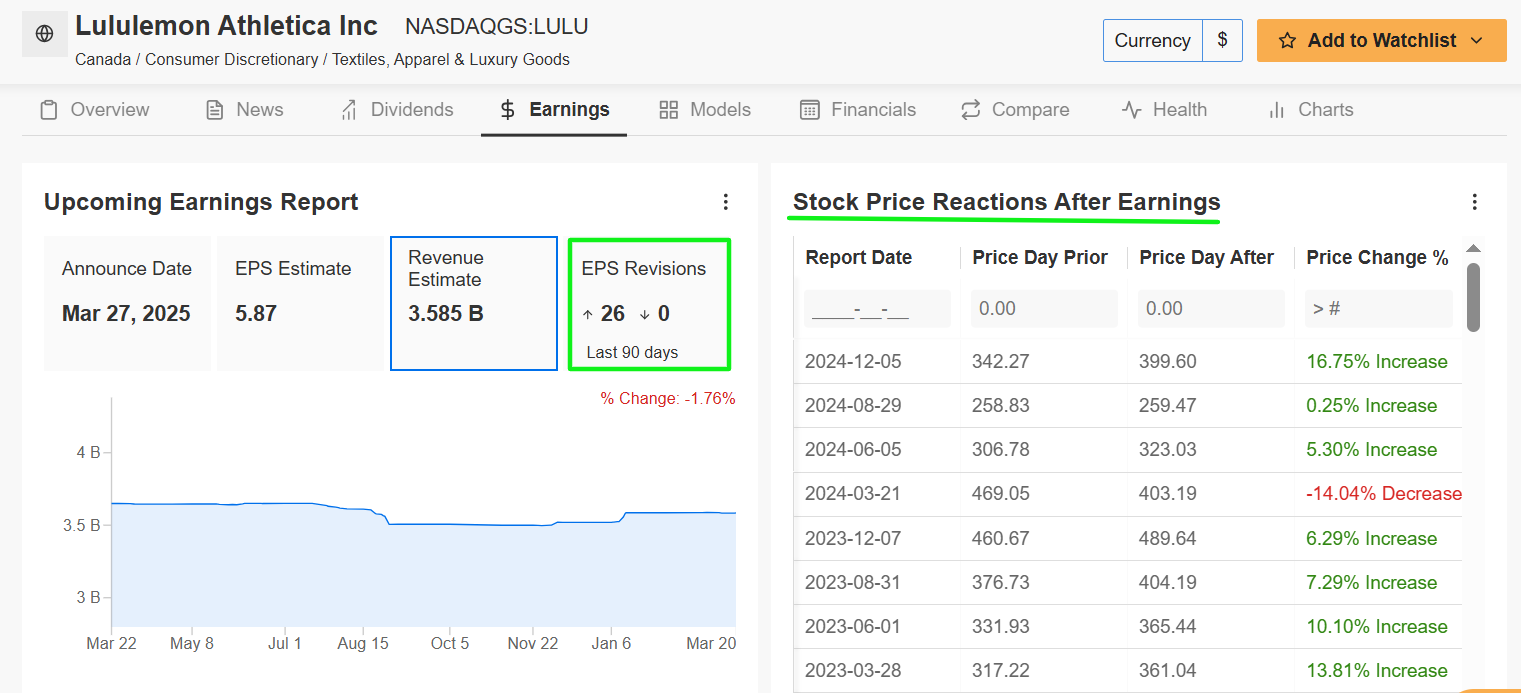

Lululemon, the Canadian athletic put on large, is getting ready to unveil its fourth-quarter earnings on Thursday at 4:05PM ET. Based on the choices market, merchants are pricing in a swing of about 10% in both route for LULU inventory following the print. Shares gapped up 16.7% after the final earnings report got here out in December.

Famend for its modern merchandise, sturdy model loyalty, and increasing market presence, Lululemon has lengthy been a favourite amongst each buyers and analysts. Latest optimism has been evident, with revenue estimates revised upward 26 occasions within the weeks main as much as the report—in comparison with zero downward revisions, in line with InvestingPro.

Supply: InvestingPro

The corporate is anticipated to report better-than-feared earnings and steering, pushed by a number of key components. Consensus estimates name for Lululemon to ship This fall earnings per share of $5.87, rising 11% from EPS of $5.29 within the year-ago interval.

In the meantime, gross sales for the interval are anticipated to extend 11.5% yearly to $3.58 billion because the athleisure maker loved a powerful vacation buying season amid sturdy shopper demand for its yoga gear and sportswear.

Whereas buyers are bracing for weaker steering, it’s my perception that Lululemon’s administration will present a better-than-feared outlook for the present fiscal yr because it advantages from an improved stock strategy and promising fundamentals. Moreover, the corporate’s enlargement into new markets, each domestically and internationally, and its steady innovation in product strains and materials have broadened its enchantment, leveraging the rising pattern of athleisure.

Supply: Investing.com

LULU inventory ended Friday’s session at $322.62. Yr-to-date, shares are down 15.6%, underperforming the broader market over the identical timeframe. Lululemon has a market cap of round $39 billion, making it probably the most worthwhile athletic attire firms on the planet.

It ought to be famous that Lululemon demonstrates distinctive monetary well being with an general rating of three.06, incomes a “GREAT” ranking in line with InvestingPro metrics. The corporate notably excels in profitability with a formidable 4.35 rating. LULU additionally performs strongly in money circulate technology (3.59) and progress metrics (3.47).

Make sure you take a look at InvestingPro to remain in sync with the market pattern and what it means in your buying and selling. Subscribe now and place your portfolio one step forward of everybody else!

Inventory to Promote: Greenback Tree

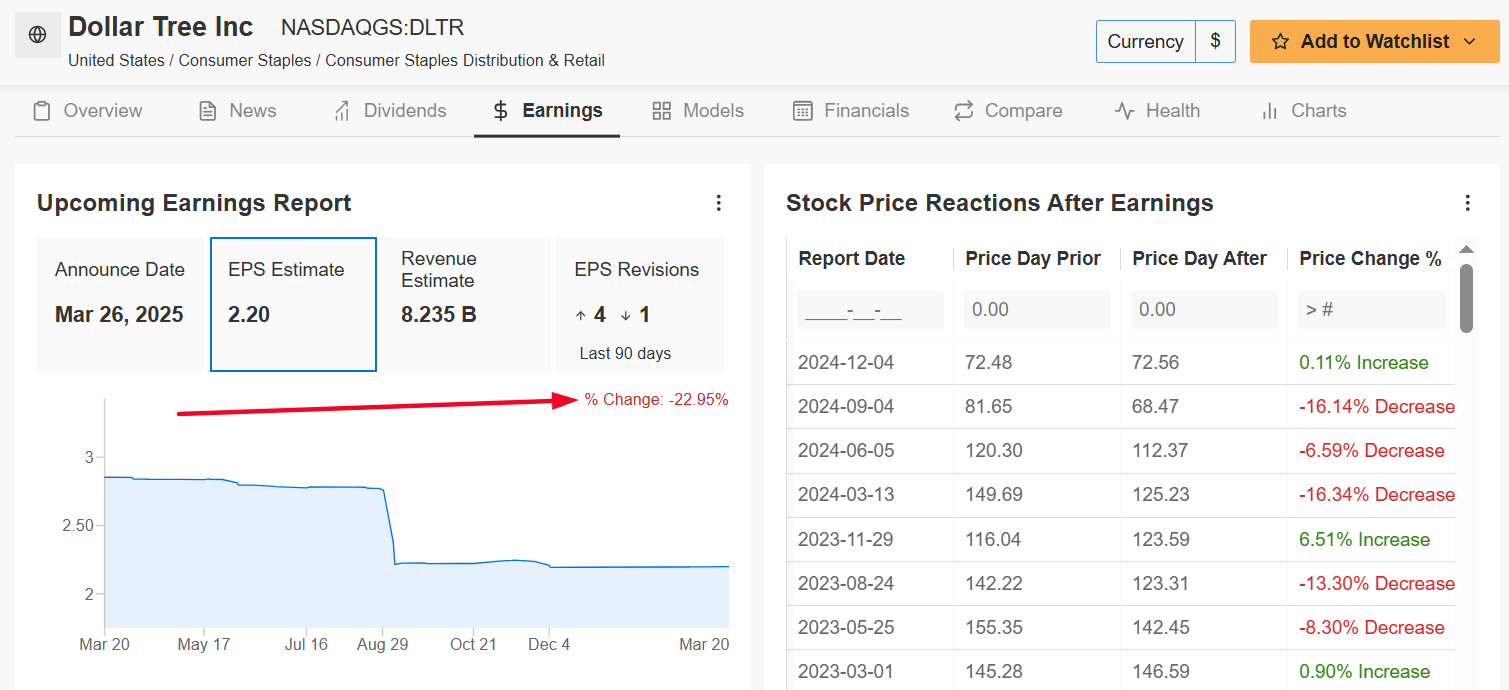

On the flip facet, Greenback Tree is bracing for a tricky week because it prepares to launch its fourth-quarter monetary outcomes on Wednesday at 6:30AM ET. The struggling low cost retailer has been navigating a bunch of unfavourable headwinds which have impacted its enterprise.

Market individuals count on a large swing in DLTR shares after the report drops, with a doable implied transfer of roughly 14% in both route as per the choices market. The Chesapeake, Virginia-based selection retailer operator’s margins are below stress, and an InvestingPro survey reveals that analysts have slashed their revenue estimates by over 20% up to now 90 days.

Supply: InvestingPro

This bearish sentiment displays considerations about Greenback Tree’s skill to navigate the more and more aggressive low cost retail sector, particularly as shopper spending shifts in direction of bigger, extra established gamers that supply higher offers and a broader product choice.

Greenback Tree is anticipated to put up a revenue of $2.20 for the fourth quarter, falling 13.7% from EPS of $2.55 within the year-ago interval. Income is seen inching down 4.7% year-over-year to $8.23 billion amid fierce competitors from retail giants like Walmart (NYSE:) and Amazon (NASDAQ:), in addition to Chinese language e-commerce platform Temu.

Trying forward, I count on that the retailer will present disappointing full-year gross sales and revenue steering as a result of robust macro local weather. Greenback Tree’s adherence to its $1 worth level, whereas iconic, has change into more and more unsustainable within the face of inflation, limiting its skill to move on prices to customers.

Supply: Investing.com

DLTR inventory closed at $66.75 on Friday. At present valuations, Greenback Tree has a market cap of $14.3 billion, making it the second largest U.S. greenback retailer within the nation after Greenback Normal (NYSE:). Shares, that are buying and selling under their key transferring averages, are down 11% in 2025.

Not surprisingly, InvestingPro’s AI-powered quantitative mannequin charges Greenback Tree with a ‘FAIR’ Monetary Well being Rating of two.08, citing considerations over weakening revenue margins, spotty gross sales progress, and declining free money circulate.

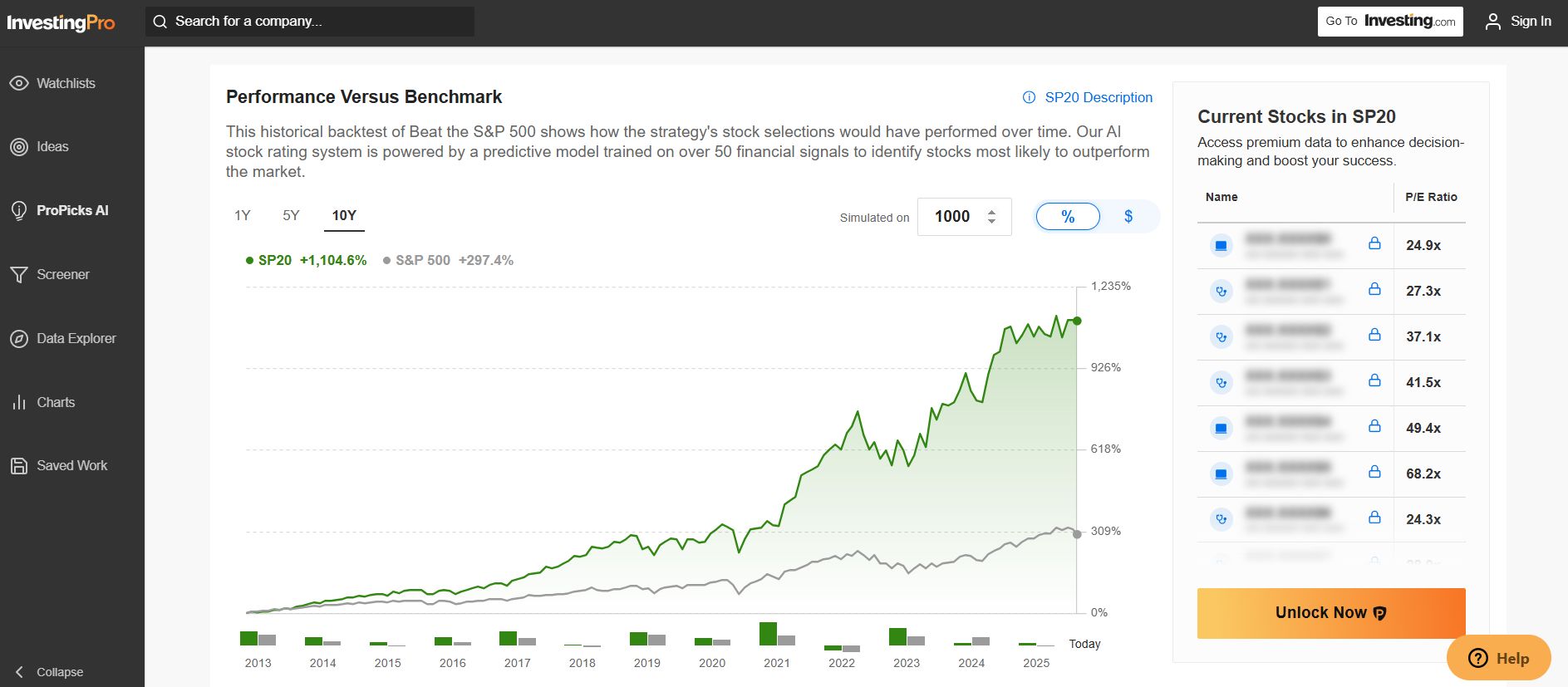

Whether or not you’re a novice investor or a seasoned dealer, leveraging InvestingPro can unlock a world of funding alternatives whereas minimizing dangers amid the difficult market backdrop.

Subscribe now and immediately unlock entry to a number of market-beating options, together with:

• ProPicks AI: AI-selected inventory winners with confirmed observe report.

• InvestingPro Honest Worth: Immediately discover out if a inventory is underpriced or overvalued.

• Superior Inventory Screener: Seek for the perfect shares primarily based on a whole lot of chosen filters, and standards.

• High Concepts: See what shares billionaire buyers resembling Warren Buffett, Michael Burry, and George Soros are shopping for.

Disclosure: On the time of writing, I’m lengthy on the S&P 500, and the through the SPDR® S&P 500 ETF (SPY), and the Invesco QQQ Belief ETF (QQQ). I’m additionally lengthy on the Invesco High QQQ ETF (QBIG), Invesco S&P 500 Equal Weight ETF (RSP), and VanEck Vectors Semiconductor ETF (SMH).

I usually rebalance my portfolio of particular person shares and ETFs primarily based on ongoing threat evaluation of each the macroeconomic setting and firms’ financials.

The views mentioned on this article are solely the opinion of the writer and shouldn’t be taken as funding recommendation.

Observe Jesse Cohen on X/Twitter @JesseCohenInv for extra inventory market evaluation and perception.