Revealed on March twenty fourth, 2025 by Bob CiuraSpreadsheet knowledge up to date day by day

Micro-cap shares are publicly-traded firms with market capitalizations between $50 million and $300 million. These signify the smallest firms within the inventory market.

The whole variety of micro-cap shares varies relying upon market situations. Proper now there are tons of of micro-cap shares, so there are lots for buyers to select from.

Because the smallest shares, micro-caps might have stronger development potential over the long term than large-cap shares or mega-cap shares.

On the identical time, micro-cap shares carry numerous distinctive danger elements to think about.

You’ll be able to obtain a free spreadsheet of all 1400+ micro cap shares proper now (together with essential monetary metrics equivalent to price-to-earnings ratios and dividend yields) by clicking on the hyperlink beneath:

The downloadable micro-cap shares record above was curated from two main micro-cap inventory ETFs:

iShares Micro-Cap ETF (IWC)

First Belief Dow Jones Choose Micro-Cap Index Fund (FDM)

This text features a spreadsheet and desk of all of our micro-cap shares, in addition to detailed evaluation on our Prime 10 micro-cap shares in the present day.

Maintain studying to see the ten greatest micro-cap shares analyzed intimately.

The ten Finest Micro Cap Shares In the present day

Now that we’ve outlined what a micro-cap inventory is, let’s check out the ten greatest micro-cap shares, as outlined by our Positive Evaluation Analysis Database.

The database ranks complete anticipated annual returns, combining present yield, forecast earnings development and any change in value from the valuation.

Notice: The Positive Evaluation Analysis Database is targeted on revenue producing securities. Consequently, we don’t observe or rank securities that don’t pay dividends. Micro-cap shares that don’t pay dividends have been excluded from the Prime 10 rankings beneath.

We’ve screened the micro-cap shares with the best 5-year anticipated returns and have offered them beneath, ranked from lowest to highest.

You’ll be able to immediately soar to any particular person inventory evaluation by utilizing the hyperlinks beneath:

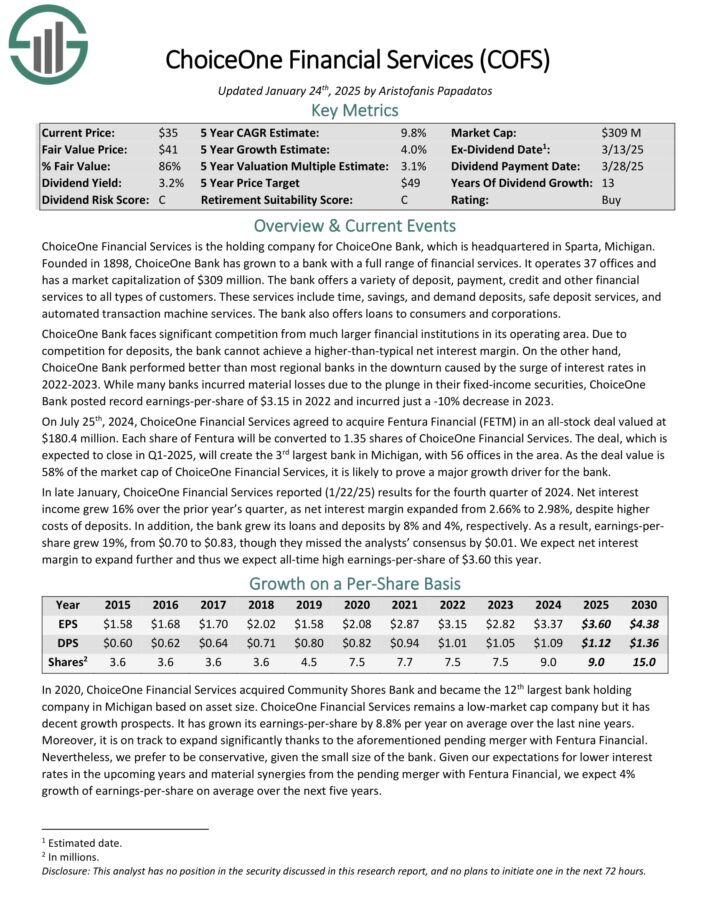

Micro Cap Inventory #10: ChoiceOne Monetary Companies (COFS)

5-year anticipated annual returns: 14.5%

ChoiceOne Monetary Companies is the holding firm for ChoiceOne Financial institution, which is headquartered in Sparta, Michigan.

Based in 1898, ChoiceOne Financial institution has grown to a financial institution with a full vary of monetary companies. It operates 37 workplaces and gives quite a lot of deposit, fee, credit score and different monetary companies to all kinds of clients.

These companies embody time, financial savings, and demand deposits, secure deposit companies, and automatic transaction machine companies. The financial institution additionally gives loans to shoppers and companies.

In late January, ChoiceOne Monetary Companies reported (1/22/25) outcomes for the fourth quarter of 2024. Internet curiosity revenue grew 16% over the prior yr’s quarter, as internet curiosity margin expanded from 2.66% to 2.98%, regardless of increased prices of deposits. As well as, the financial institution grew its loans and deposits by 8% and 4%, respectively.

Consequently, earnings-per-share grew 19%, from $0.70 to $0.83, although they missed the analysts’ consensus by $0.01. We anticipate internet curiosity margin to increase additional and thus we anticipate all-time excessive earnings-per-share of $3.60 this yr.

Click on right here to obtain our most up-to-date Positive Evaluation report on COFS (preview of web page 1 of three proven beneath):

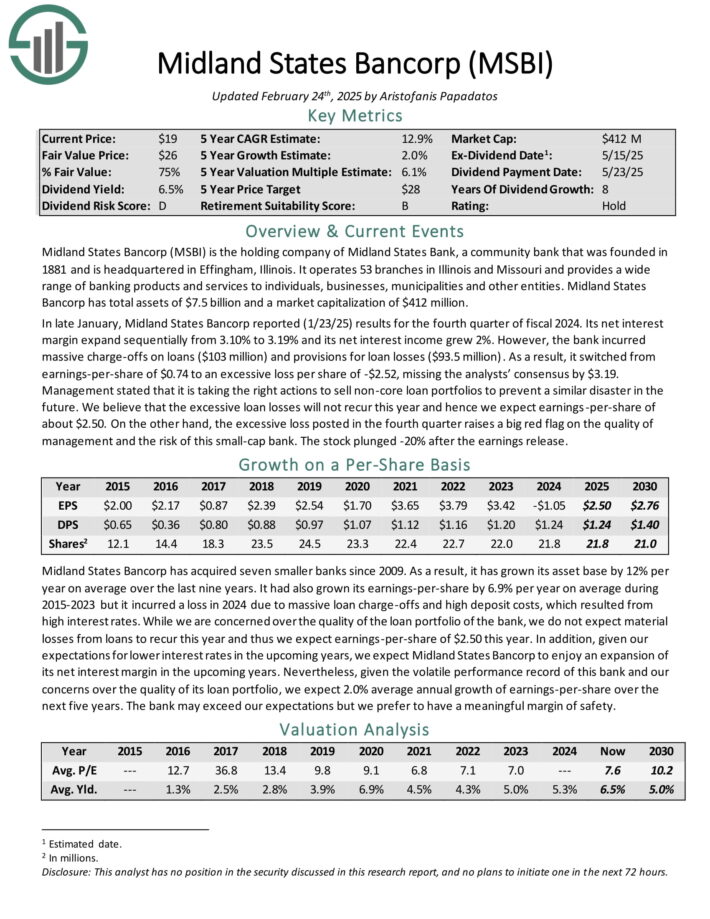

Micro Cap Inventory #9: Midland States Bancorp (MSBI)

5-year anticipated annual returns: 14.7%

Midland States Bancorp (MSBI) is the holding firm of Midland States Financial institution, a neighborhood financial institution that was based in 1881 and is headquartered in Effingham, Illinois.

It operates 53 branches in Illinois and Missouri and gives a variety of banking services to people, companies, municipalities and different entities. Midland States Bancorp has complete belongings of $7.5 billion.

In late January, Midland States Bancorp reported (1/23/25) outcomes for the fourth quarter of fiscal 2024. Its internet curiosity margin increase sequentially from 3.10% to three.19% and its internet curiosity revenue grew 2%.

Nevertheless, the financial institution incurred large charge-offs on loans ($103 million) and provisions for mortgage losses ($93.5 million).

Consequently, it switched from earnings-per-share of $0.74 to an extreme loss per share of -$2.52, lacking the analysts’ consensus by $3.19.

Midland States Bancorp has acquired seven smaller banks since 2009. Consequently, it grew its asset base by 12% per yr on common over the past 9 years.

It had additionally grown its earnings-per-share by 6.9% per yr on common throughout 2015-2023 however it incurred a loss in 2024 resulting from large mortgage charge-offs and excessive deposit prices, which resulted from excessive rates of interest.

Click on right here to obtain our most up-to-date Positive Evaluation report on MSBI (preview of web page 1 of three proven beneath):

Micro Cap Inventory #8: Oak Valley Bancorp (OVLY)

5-year anticipated annual returns: 15.9%

Oak Valley Bancorp is a regional banking holding firm primarily based in Oakdale, California, working by means of its subsidiary, Oak Valley Neighborhood Financial institution. It gives a variety of monetary companies together with business and shopper loans, deposit accounts, and funding companies.

On January twenty fourth, 2025, Oak Valley posted its This fall and full-year outcomes for the interval ending December thirty first, 2024. For the interval, internet curiosity revenue got here in at $17.8 million, in comparison with $17.7 million within the earlier quarter and $17.9 million final yr.

The decline over final yr was resulting from increased deposit curiosity expense, as the common price of funds rose to 0.78% in 2024 from 0.28% in 2023. This increased curiosity expense was partly offset by year-over-year mortgage development of $90.0 million (8.8%).

The web curiosity margin for the quarter was 4.00%, down from 4.07% in Q3-2024 and 4.15% in This fall-2023. Nonetheless, it stays fairly excessive.

For the quarter, earnings per share (EPS) got here in at $0.73, up one cent in comparison with final yr. For the yr, EPS was $3.04. For FY2025, we anticipate EPS of about $3.20.

Click on right here to obtain our most up-to-date Positive Evaluation report on OVLY (preview of web page 1 of three proven beneath):

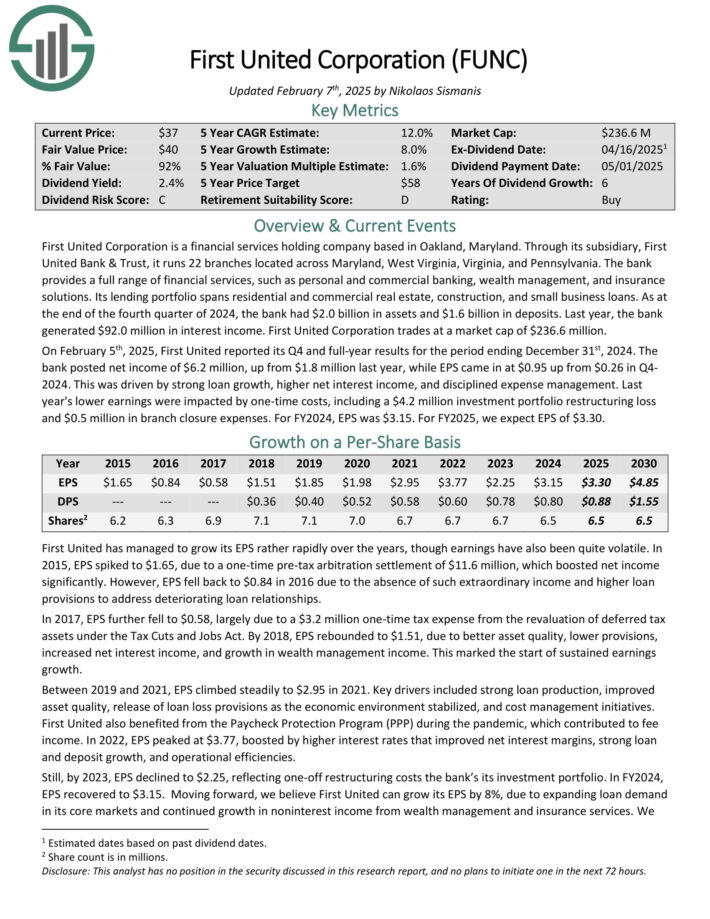

Micro Cap Inventory #7: First United Company (FUNC)

5-year anticipated annual returns: 15.9%

First United Company is a monetary companies holding firm primarily based in Oakland, Maryland. Via its subsidiary, First United Financial institution & Belief, it runs 22 branches situated throughout Maryland, West Virginia, Virginia, and Pennsylvania.

The financial institution gives a full vary of monetary companies, equivalent to private and business banking, wealth administration, and insurance coverage options.

Its lending portfolio spans residential and business actual property, building, and small enterprise loans. As on the finish of the fourth quarter of 2024, the financial institution had $2.0 billion in belongings and $1.6 billion in deposits. Final yr, the financial institution generated $92.0 million in curiosity revenue.

On February fifth, 2025, First United reported its This fall and full-year outcomes for the interval ending December thirty first, 2024. The financial institution posted internet revenue of $6.2 million, up from $1.8 million final yr, whereas EPS got here in at $0.95 up from $0.26 in This fall 2024. This was pushed by robust mortgage development, increased internet curiosity revenue, and disciplined expense administration.

Click on right here to obtain our most up-to-date Positive Evaluation report on FUNC (preview of web page 1 of three proven beneath):

Micro Cap Inventory #6: Peoples Monetary (PFIS)

5-year anticipated annual returns: 16.1%

Peoples Monetary Companies (PFIS) is the holding firm of Peoples Safety Financial institution and Belief Firm, a neighborhood financial institution that was based in 1905 and is headquartered in Scranton, Pennsylvania.

It operates 44 branches in Pennsylvania and gives varied banking services to shoppers, municipalities and companies.

On July 1st, 2024, Peoples Monetary Companies accomplished its acquisition of FNCB Bancorp in an all-stock deal. As per the phrases of the deal, the shareholders of FNCB now personal ~29% of the mixed entity.

Because of the merger, the financial institution grew its complete belongings from $3.7 billion to $5.5 billion and thus it turned the fifth largest neighborhood financial institution in Pennsylvania.

In early February, Peoples Monetary Companies reported (2/6/24) monetary outcomes for the fourth quarter of fiscal 2024. Loans and deposits grew 40% and 28%, respectively, over the prior yr’s quarter, due to the acquisition of FNCB Bancorp.

Internet curiosity margin expanded impressively, from 2.30% within the prior yr’s quarter to three.25% due to the a lot increased internet curiosity margin of the acquired financial institution.

Click on right here to obtain our most up-to-date Positive Evaluation report on PFIS (preview of web page 1 of three proven beneath):

Micro Cap Inventory #5: Orrstown Monetary Companies (ORRF)

5-year anticipated annual returns: 16.4%

Orrstown Monetary Companies, Inc. is a neighborhood financial institution. ORRF serves because the holding firm for its working financial institution subsidiary, Orrstown Financial institution.

The corporate gives banking and monetary advisory companies to clients situated within the south-central Pennsylvania counties of Berks, Cumberland, Dauphin, Franklin, Lancaster, Perry, and York. ORRF additionally serves clients in Anne Arundel, Baltimore, Howard, and Washington counties in Maryland.

Its financial savings merchandise embody cash market accounts, financial savings accounts, certificates of deposit, and checking accounts. Mortgage merchandise provided encompass residential mortgages, dwelling fairness strains of credit score, business mortgages, building loans, and business loans.

Monetary advisory companies offered embody fiduciary, funding advisory, and brokerage companies.

On January thirty first, ORRF launched its monetary outcomes for the fourth quarter ended December thirty first. The corporate’s internet curiosity revenue soared 94.4% over the year-ago interval to $50.6 million throughout the quarter, which was principally because of the acquisition of Codorus Valley Bancorp. The opposite tailwind for ORRF was a 34-basis level year-over-year enlargement within the internet curiosity margin to 4.05% within the quarter.

Because of the acquisition, the corporate’s noninterest revenue additionally surged 73.3% over the year-ago interval to $11.2 million for the quarter. ORRF’s adjusted diluted EPS edged 4.8% increased year-over-year to $0.87 throughout the quarter.

Click on right here to obtain our most up-to-date Positive Evaluation report on ORRF (preview of web page 1 of three proven beneath):

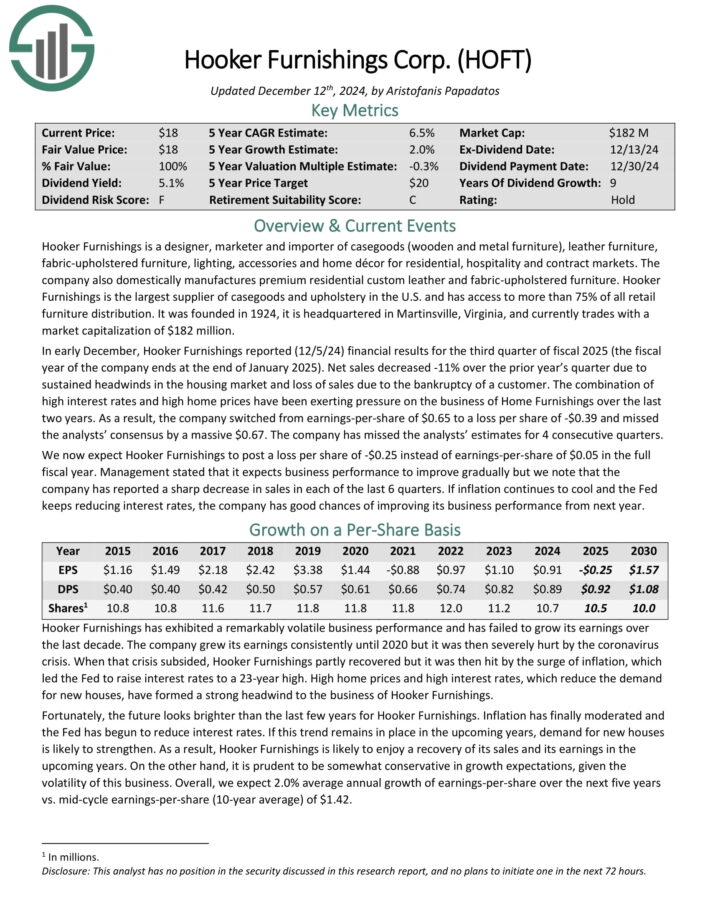

Micro Cap Inventory #4: Hooker Furnishings (HOFT)

5-year anticipated annual returns: 16.5%

Hooker Furnishings is a designer, marketer and importer of casegoods (wood and steel furnishings), leather-based furnishings, fabric-upholstered furnishings, lighting, equipment and residential décor for residential, hospitality and contract markets.

The corporate additionally domestically manufactures premium residential customized leather-based and fabric-upholstered furnishings.

Hooker Furnishings is the biggest provider of casegoods and fabric within the U.S. and has entry to greater than 75% of all retail furnishings distribution.

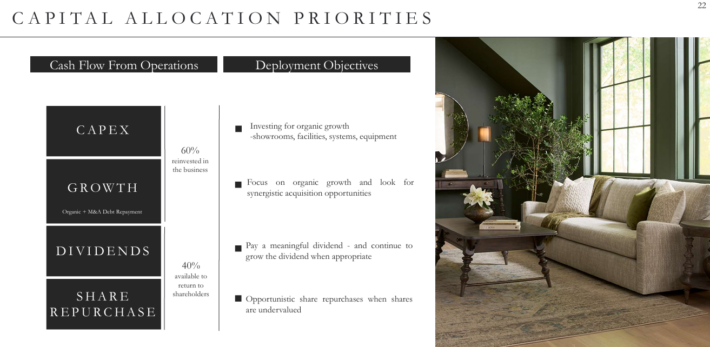

Supply: Investor Presentation

In early December, Hooker Furnishings reported (12/5/24) monetary outcomes for the third quarter of fiscal 2025. Internet gross sales decreased -11% over the prior yr’s quarter resulting from sustained headwinds within the housing market and lack of gross sales because of the chapter of a buyer.

The mixture of excessive rates of interest and excessive dwelling costs have been exerting strain on the enterprise of Residence Furnishings over the past two years.

Consequently, the corporate switched from earnings-per-share of $0.65 to a loss per share of -$0.39 and missed the analysts’ consensus by an enormous $0.67.

Click on right here to obtain our most up-to-date Positive Evaluation report on HOFT (preview of web page 1 of three proven beneath):

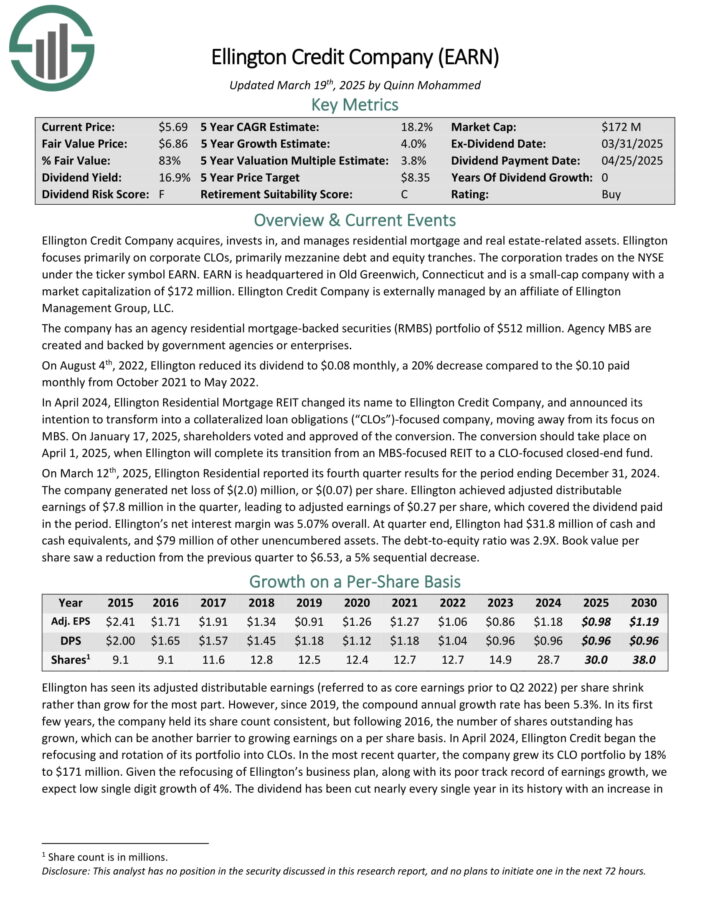

Micro Cap Inventory #3: Ellington Credit score Co. (EARN)

5-year anticipated annual returns: 18.2%

Ellington Credit score Co. acquires, invests in, and manages residential mortgage and actual property associated belongings. Ellington focuses totally on residential mortgage-backed securities, particularly these backed by a U.S. Authorities company or U.S. authorities–sponsored enterprise.

Company MBS are created and backed by authorities companies or enterprises, whereas non-agency MBS are not assured by the federal government.

On March twelfth, 2025, Ellington Residential reported its fourth quarter outcomes for the interval ending December 31, 2024. The corporate generated a internet lack of $(2.0) million, or $(0.07) per share.

Ellington achieved adjusted distributable earnings of $7.8 million within the quarter, resulting in adjusted earnings of $0.27 per share, which coated the dividend paid within the interval.

Ellington’s internet curiosity margin was 5.07% general. At quarter finish, Ellington had $31.8 million of money and money equivalents, and $79 million of different unencumbered belongings.

Click on right here to obtain our most up-to-date Positive Evaluation report on EARN (preview of web page 1 of three proven beneath):

Micro Cap Inventory #2: Clipper Realty (CLPR)

5-year anticipated annual returns: 19.5%

Clipper Realty is a Actual Property Funding Belief, or REIT, that was based by the merger of 4 pre-existing actual property firms. The founders retain about 2/3 of the possession and votes in the present day, as they’ve by no means bought a share.

Clipper owns business (primarily multifamily and workplace with a small sliver of retail) actual property throughout New York Metropolis.

On February 18, 2025, Clipper Realty Inc. reported its monetary outcomes for the fourth quarter of 2024. The corporate achieved report quarterly income of $38 million, marking a 9.1% enhance from the earlier yr.

Internet Working Earnings (NOI) rose to $22.5 million, reflecting a 12.5% development, whereas Adjusted Funds From Operations (AFFO) reached $8.1 million, up 29%.

This efficiency was primarily pushed by a $2.9 million enhance in residential income, attributed to robust leasing actions and operational efficiencies.

Click on right here to obtain our most up-to-date Positive Evaluation report on CLPR (preview of web page 1 of three proven beneath):

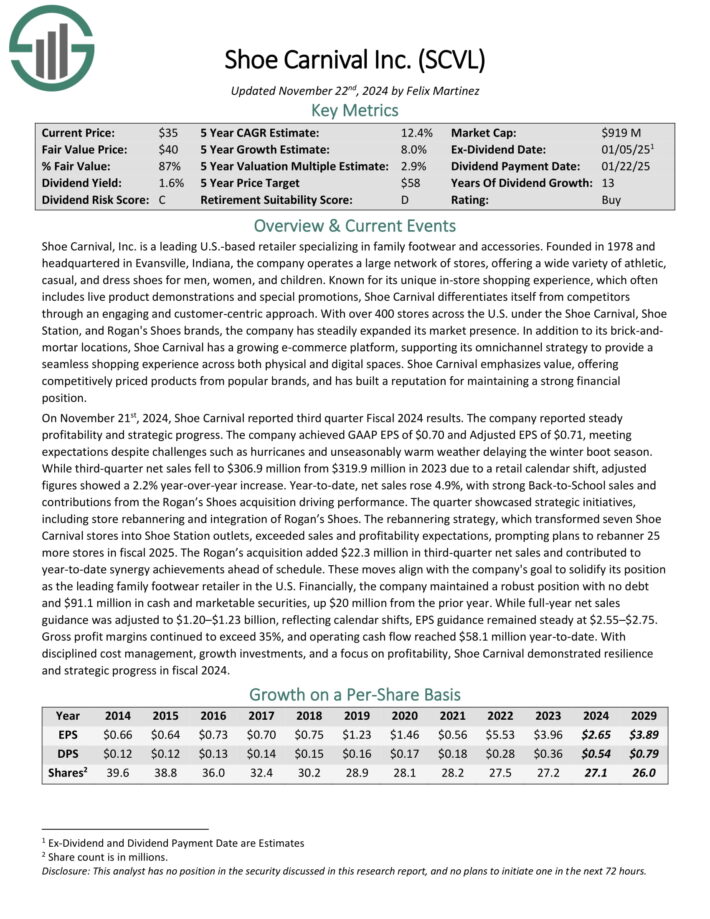

Micro Cap Inventory #1: Shoe Carnival, Inc. (SCVL)

5-year anticipated annual returns: 23.7%

Shoe Carnival, Inc. is a number one U.S.-based retailer specializing in household footwear and equipment. The corporate operates a big community of shops, providing all kinds of athletic, informal, and costume footwear for males, girls, and youngsters.

With over 400 shops throughout the U.S. underneath the Shoe Carnival, Shoe Station, and Rogan’s Sneakers manufacturers, the corporate has steadily expanded its market presence.

Along with its brick-and mortar places, Shoe Carnival has a rising e-commerce platform, supporting its omnichannel technique.

On November twenty first, 2024, Shoe Carnival reported third quarter Fiscal 2024 outcomes. The corporate reported GAAP EPS of $0.70 and Adjusted EPS of $0.71, assembly expectations.

Whereas third-quarter internet gross sales fell to $306.9 million from $319.9 million in 2023 resulting from a retail calendar shift, adjusted figures confirmed a 2.2% year-over-year enhance.

12 months-to-date, internet gross sales rose 4.9%, with robust Again-to-Faculty gross sales and contributions from the Rogan’s Sneakers acquisition driving efficiency.

Click on right here to obtain our most up-to-date Positive Evaluation report on SCVL (preview of web page 1 of three proven beneath):

Remaining Ideas

Micro-cap shares are the smallest firms at the moment buying and selling on the inventory market. The potential good thing about investing in micro-cap shares is the potential for increased development, and shareholder returns, over time.

In fact, buyers have to rigorously take into account the distinctive dangers related to investing in micro-cap shares. The ten micro-cap shares on this record all pay dividends to shareholders and have constructive anticipated returns.

Consequently, these 10 micro-cap shares may very well be enticing for dividend development buyers.

Different Dividend Lists

The next lists comprise many extra high-quality dividend shares:

The Dividend Aristocrats Listing is comprised of 69 shares within the S&P 500 Index with 25+ years of consecutive dividend will increase.

The Excessive Yield Dividend Aristocrats Listing is comprised of the 20 Dividend Aristocrats with the best present yields.

The Dividend Achievers Listing is comprised of ~400 NASDAQ shares with 10+ years of consecutive dividend will increase.

The Dividend Kings Listing is much more unique than the Dividend Aristocrats. It’s comprised of 55 shares with 50+ years of consecutive dividend will increase.

The Excessive Yield Dividend Kings Listing is comprised of the 20 Dividend Kings with the best present yields.

The Excessive Dividend Shares Listing: shares that attraction to buyers within the highest yields of 5% or extra.

The Month-to-month Dividend Shares Listing: shares that pay dividends each month, for 12 dividend funds per yr.

The Dividend Champions Listing: shares which have elevated their dividends for 25+ consecutive years.Notice: Not all Dividend Champions are Dividend Aristocrats as a result of Dividend Aristocrats have extra necessities like being in The S&P 500.

Thanks for studying this text. Please ship any suggestions, corrections, or inquiries to help@suredividend.com.