Commerce Assistant: multifunctional device for a handy buying and selling

The utility is split into 4 essential tabs:

[new] tab: New trades, Lot / Threat / Threat-Reward calculation. [manage] tab: Commerce administration, Breakeven, Trailing, Auto-Shut, Auto-Ranges. [info] tab: Commerce statistics, market evaluation. [tool] tab: Indicators and auxiliary utilities.

Clickable Hyperlinks:

[tool] tab: indicators and auxiliary instruments

This part incorporates further instruments that may be helpful for sure buying and selling actions,thereby simplifying and dashing up the buying and selling course of.

Every device might be turned on/off by clicking on the corresponding inexperienced button. [always on] possibility: if enabled – crucial instruments will stay energetic even when switching to the one other tab, or minimizing the principle panel. Click on [v] to decide on which instruments must be energetic when utilizing the “At all times on” possibility. To show off all of the instruments without delay, use the [X] button on the prime of the tab. The positions of the indicator’s panels might be saved to a preset, after which you possibly can rapidly choose a handy one: [L] (Location) button; There are lots of settings on this tab: it can save you the configurations to a preset, after which load one of many presets if crucial: [P] button. Click on [v] to open the settings of the corresponding device.

Disclaimer: not one of the indicators ought to be perceived as funding recommendation. They’re supplied ‘as is’, supplying you with a mathematical value evaluation. All buying and selling selections ought to be made by you, and you’re the just one accountable for your buying and selling outcomes.

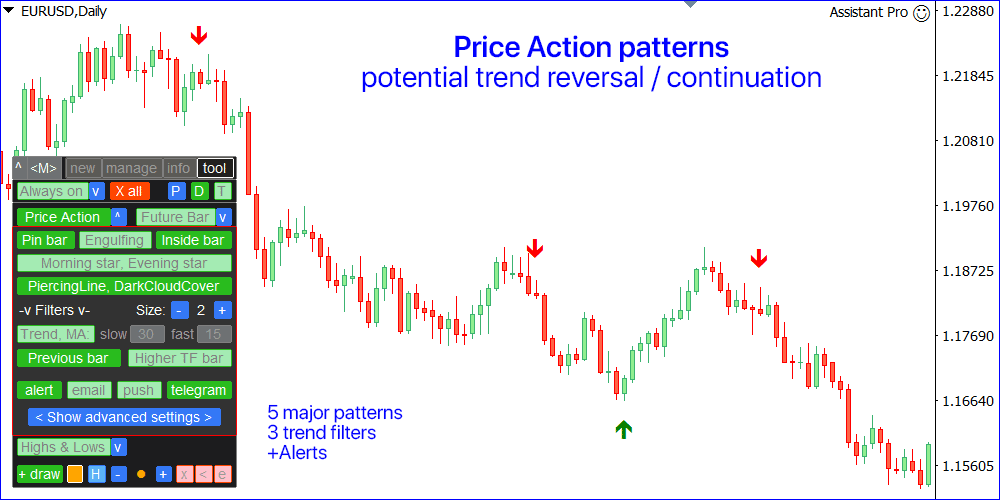

[Price Action] indicator

Value patterns indicating a possible reversal or continuation of the development.

Please word: the indicator just isn’t initially configured for every Image and supplied ‘as is’: for the very best outcomes, it is strongly recommended to configure the patterns for every Image.

Indicator settings [v]:

Allow / disable every of the patterns:a) Pin barb) Engulfing patternc) Inside bar (Harami)d) Morning/Night stare) Darkish cloud cowl / piercing line Alter the dimensions of the chart arrows. On / off the present development filter [Trend, MA] :If energetic, solely patterns within the route of the present commerce can be displayed.The development is set by Shifting Averages: their durations may also be adjusted:a) Sluggish MA above Quick MA: it means a downtrend;b) Sluggish MA under Quick MA: it means an uptrend; [Previous bar] filter: patterns solely in the identical route because the earlier bar on present TF. [Higher TF] filter: patterns solely in the identical route because the final closed bar on a better TF.Larger timeframe means: M15 when utilizing M5, H4 when utilizing H1, and so forth. Notifications on a brand new value motion sign: terminal [alerts] / [email] / [push] / [telegram] [< Show advanced settings >] : click on to configure the patterns. Click on on the colour pattern to alter it: individually for Purchase and Promote arrows.

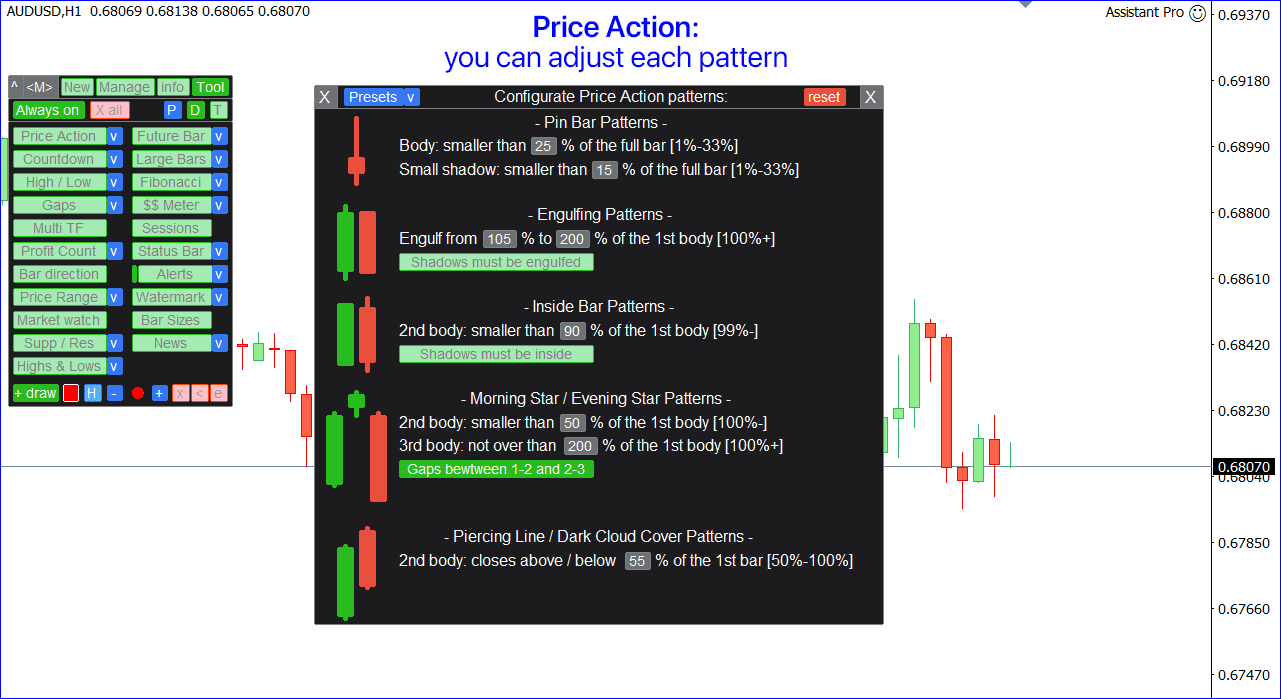

Superior settings of the Value Motion patterns

You may alter every sample for the very best buying and selling outcomes.

A tough visualization of what the sample will appear to be is displayed on the left. You may [reset] the settings to the default settings. There are lots of settings, however it can save you the configurations to a [Presets v], after which load one of many preset if crucial.

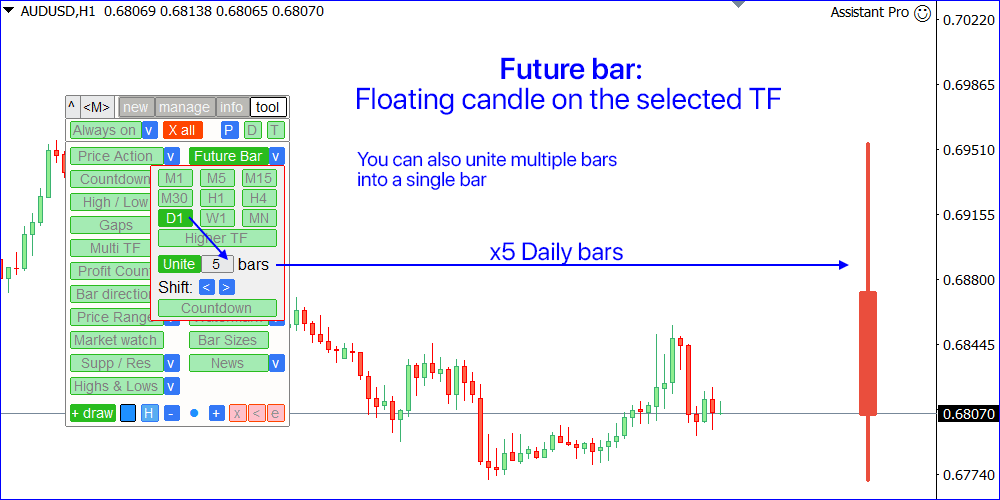

[Future Bar] device

Visualizes the present (floating) bar on the chosen timeframe, or a number of bars united to the only bar.

Indicator settings [v]:

Choose the timeframe of the long run bar. [Unite] possibility: you mix the desired variety of final bars right into a single bar. [<] / [>] buttons: transfer the long run bar to the left / proper relative to the present chart bar; [Countdown] to the closing time of the long run bar: displayed on the backside of the chart. Colours: could also be decided [automatically] (similar as chart’s candles), or you possibly can set it [manually]: for Up and Down bars individually.

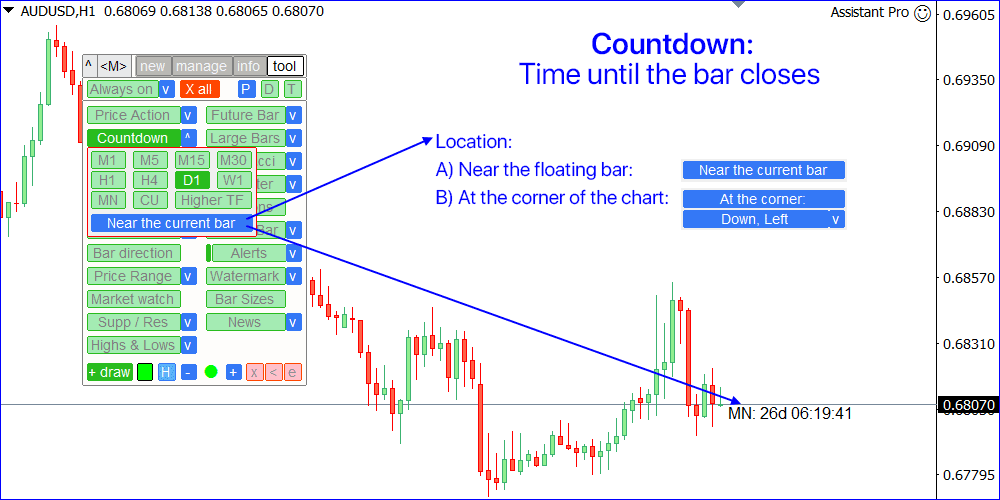

[Countdown] utility

Time till the bar closes on the chosen TF.

Settings [v]:

Choose the timer location: both close to the floating chart bar, or on the backside of the chart; Timeframe for the countdown;

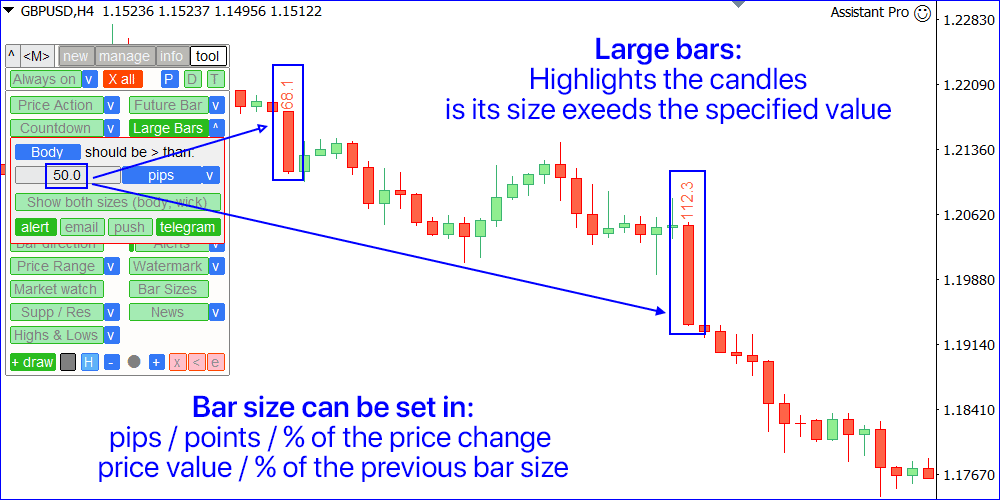

[Large Bars] indicator

Highlights the massive bars on the chart.

Indicator settings [v] :

Set the minimal bar dimension: all bars whose dimension is the same as or exceeds the desired worth – can be marked on the chart, indicating its dimension; The dimensions might be calculated both by the [body] (open-close) or by [shadow] (high-low). [Show both sizes] possibility: each physique and shadow sizes can be proven on the chart. On/off the alert on a brand new giant bar: terminal [alert] / [email] / [push] / [telegram]; Colours: individually for Up and Down bars;

Bar dimension might be set by way of:pips / factors / % value change / value worth / % of the earlier bar dimension / % of the ATR worth

This indicator:

Handy to filter the patterns in a interval of low volatility; Signifies the potential starting of a brand new development; Helps to see essentially the most important bars; Can be utilized when buying and selling binary choices;

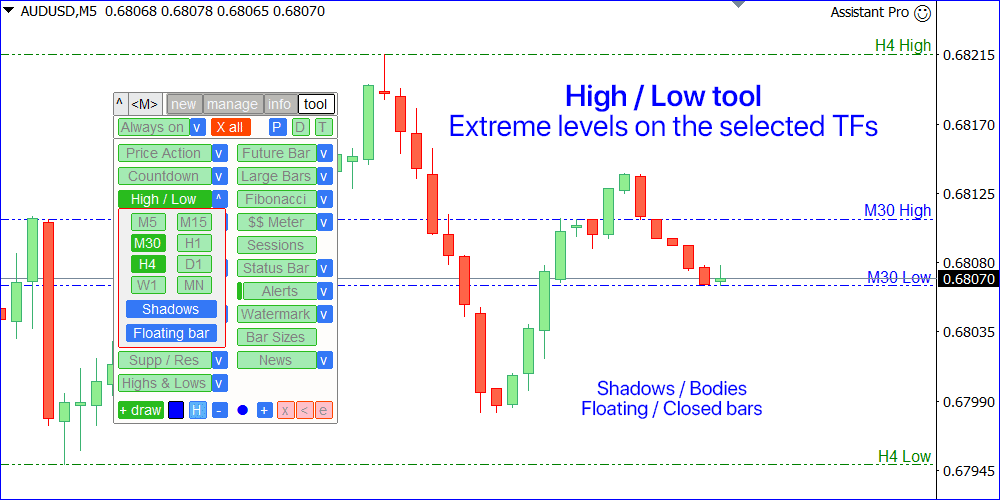

[High / Low] indicator

Reveals the intense ranges of the chosen timeframes: highest and lowest costs.

Indicator settings [v]:

Choose the TimeFrames, the degrees of which can be displayed on the chart. Calculation mode: [Real bodies] (Open/Shut costs), or [Shadows] (Excessive/Low costs). Calculation base: [Closed bar] (final closed), or [Floating bar] (presently open). The road type / colours might be adjusted: click on on the colour pattern.

This indicator:

Might assist you to to see potential reversal ranges; Patterns fashioned close to the degrees might have extra significance; When buying and selling on a decrease timeframes, it would allow you to see the larger image;

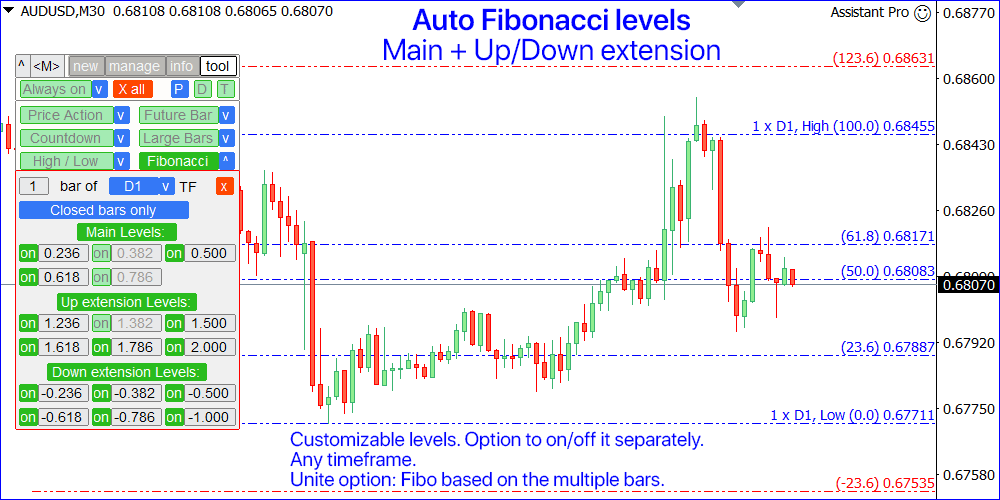

[Fibonacci] indicator

Routinely plots the Fibo ranges based mostly on the final shut bar(s) of the chosen timeframe.

Indicator settings [v]:

Set the variety of bars based mostly on which the degrees can be calculated. For instance:1 Bar: the degrees can be constructed based mostly on the Excessive/Low values of the final closed bar;2 Bars: the degrees can be constructed based mostly on the values of the final 2 closed bars; Set the TimeFrame that can be used for the calculation. [Close bar only]: calculation solely based mostly on already closed bars; [Include a floating bar]: present (floating) bar can be included within the calculation Customise the Fibonacci ranges. You may also every of them, or the whole group:5 essential ranges, 6 up extension ranges, 6 down extension ranges. You may reset [x] the degrees to the default settings (traditional Fibonacci ranges). To set the strains coloration: click on on the colour pattern (individually for 3 teams). Types would be the frequent.

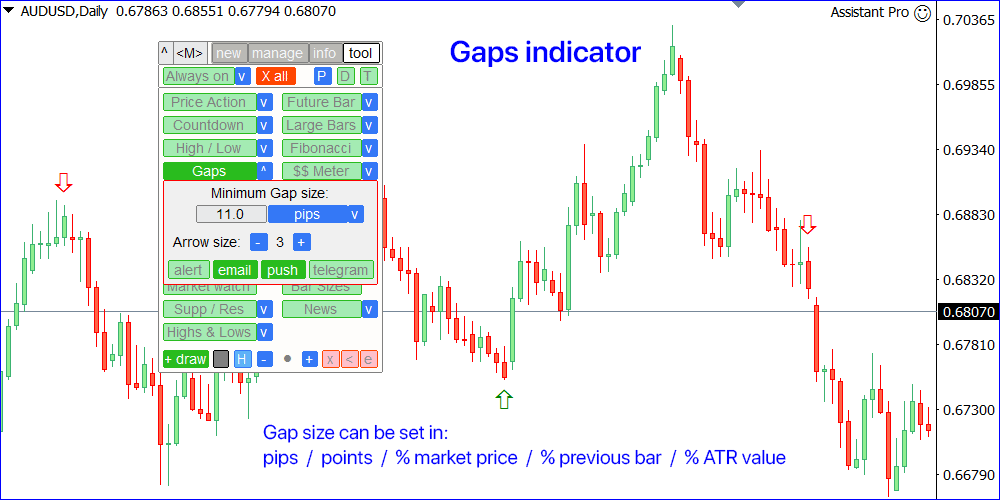

[Gaps] indicator

Reveals the Hole look on the chart: when the opening value of a brand new bar differs from the closing value of the earlier bar.

Indicator settings [v]:

Set the minimal Hole dimension to be displayed:in Pips / Factors / % of value change / % of the earlier bar dimension / % of the ATR worth; Set the dimensions of the arrows on the chart; On/off the notification when a brand new hole happens: [alert] / [email] / [push] / [telegram] You may alter the arrow colours: individually for Up and Down gaps.

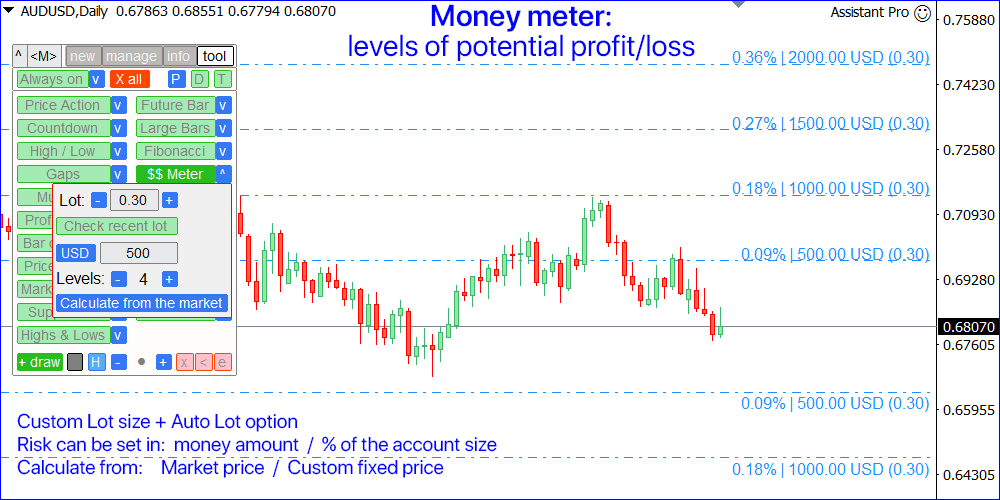

[$$ Meter]: Cash meter device

Reveals the degrees of potential Revenue / Loss, when buying and selling utilizing a given lot dimension.

Indicator settings [v]:

Lot dimension for calculation (there’s additionally an choice to auto-set the final used lot) Grid step: [%] of the account dimension / quantity of [Money] The quantity of ranges displayed for every route The extent from which the degrees ought to be calculated:a) the present market value [Calculate from the market],b) or a hard and fast value stage [Calculate from the price:] The road coloration and elegance

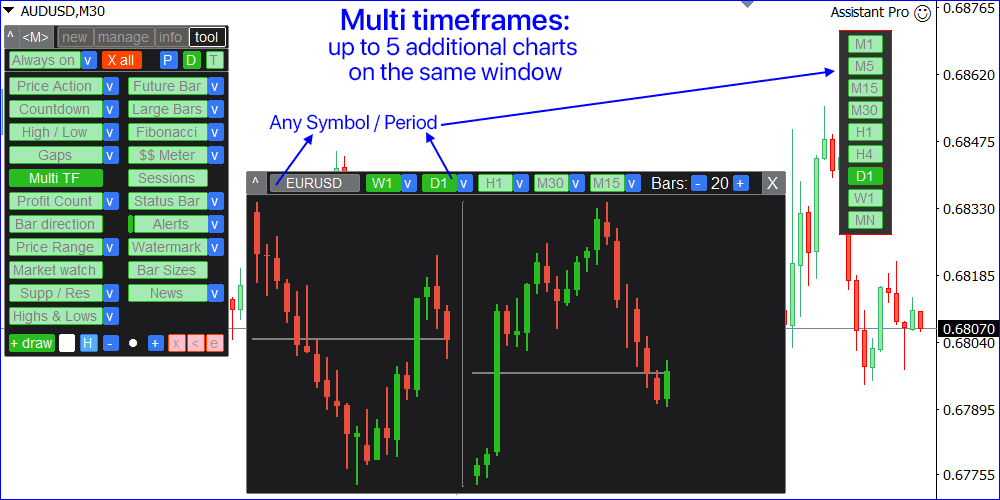

[Multi TF]: multi timeframe device

Reveals as much as 5 further timeframes on the identical chart.

It opens in a separate window: it may be moved (drag anyplace), and minimized [v].

You may alter:

The chart Durations. Every of the TF might be disabled. The quantity of the bars displayed for every TF:a) 5 energetic charts: max = 25 barsb) 4 energetic charts: max = 30 barsc) 3 energetic charts: max = 45 barsd) 2 energetic charts: max = 45 barse) 1 energetic chart: max = 90 bars Image for calculation.

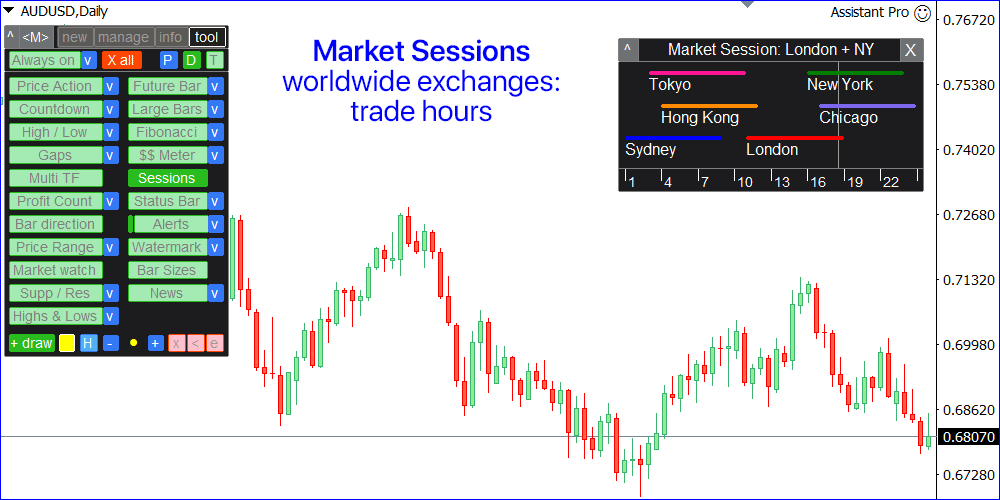

[Sessions] device

Reveals the working hours of the world’s exchanges.

The vertical line strikes because the day progresses and exhibits the present time. You may see which markets are presently essentially the most energetic, so you possibly can choose essentially the most unstable devices. Particularly helpful for the intra-day merchants. This device opens in a separate window : it may be moved (drag anyplace), and minimized [^]. Within the settings [v] you possibly can alter which era can be displayed on the decrease timeline:[GMT] / [Local time] in your laptop / [Broker’s time] on the Market watch

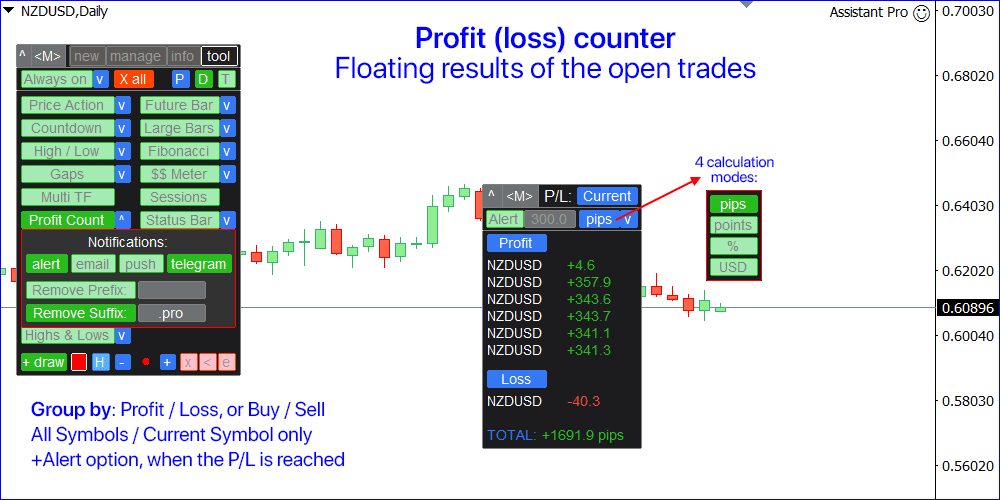

[Profit Count] device

Calculates the floating revenue / lack of the open trades, grouped into 2 classes.

Utilizing the blue switches you possibly can change the tactic of grouping the trades: [Buys] / [Sells] [Profit] / [Loss] The Image and the floating P/L are displayed for every commerce. The entire outcome for all trades is proven under. This device opens in a separate window : it may be moved [< >] and minimized [v] . Tip: Click on on the Image or monetary outcome to begin managing the commerce.

Settings on the separate panel:

Image for counting: [Current] / [For All]; [Alert] : if enabled – there can be a notification when the floating P/L exceeds the worth you set within the subsequent enter subject. The kind of P/L calculation: [pips] / [points] / [%] / [currency].

Settings on the principle panel [v] :

You may select the place the P/L achievement notifications can be despatched: [alert] / [email] / [push] / [telegram]. Choices for auto eradicating the [Prefix] / [Suffix]. It will make the Image names compact: helpful if there are additional characters, similar to “EURUSD.professional”.

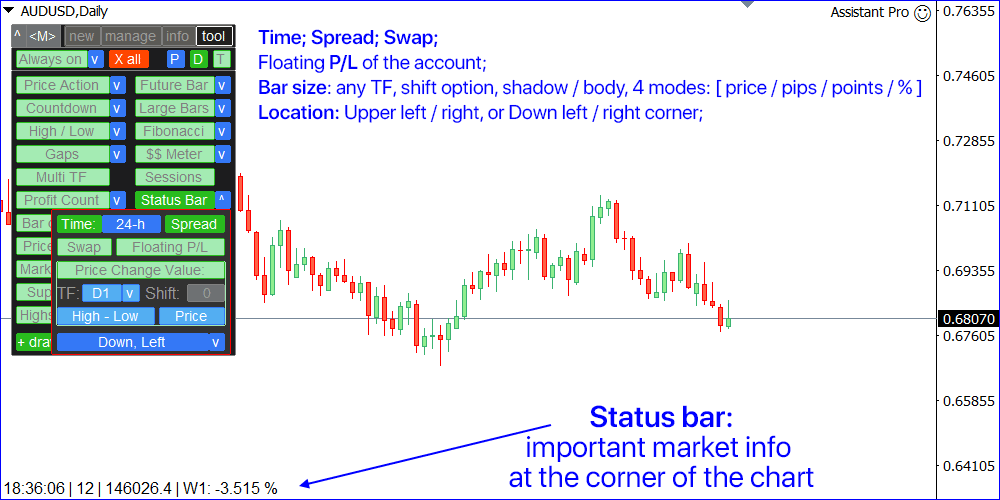

[Status bar] device

Reveals vital market info on the backside of the chart.

Within the settings [v] you possibly can optionally on/off every of the information:

Native [Time] (in your laptop): it could be set within the [am/pm] or [24-h] format. Present [Spread] for the Image. Present [Swap]: for Lengthy and Brief positions. [Floating P/L] of the whole account:account foreign money / % of the account dimension: relying on the chosen sort on the [new] tab. [Price Change Value]: the bar dimension on the chosen TF.a. Set the shift relative to the present bar: 0 = the worth of the presently open (floating) bar; 1 = earlier closed bar, and so forth..b) Calculation strategies: [Open-Close] dimension (physique), or [High-Low] dimension (shadow).c) The dimensions might be calculated in [Price] / [Pips] / [Points] / [%] change. Place on the chart: higher left/proper, or down left/proper nook

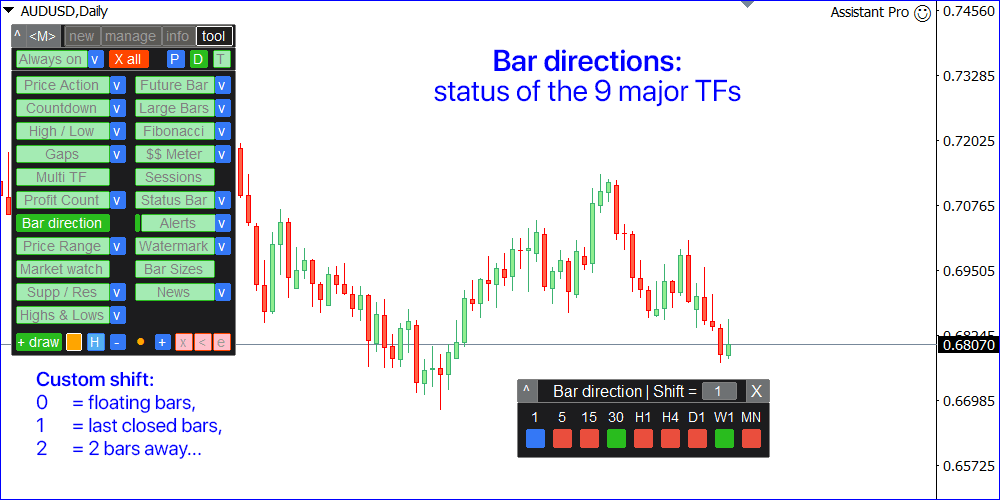

[Bar direction] indicator

Reveals the route of the bars on all main timeframes.

Purple: shut < open: shut value is decrease than open value Inexperienced: shut > open: shut value is increased than open value Blue: shut = open: shut value is the same as the open value

Within the window you can even set the Shift of the calculated bar, relative to the present bar:

Shift = 0: the route of the present (open) bars, Shift = 1: the route of the final closed bars, and so forth…

This indicator:

Lets you see the general development route; Could also be helpful when buying and selling binary choices; Helps to search out the corrective and development actions;

This device opens in a separate window: it may be moved (drag anyplace), and minimized [v].

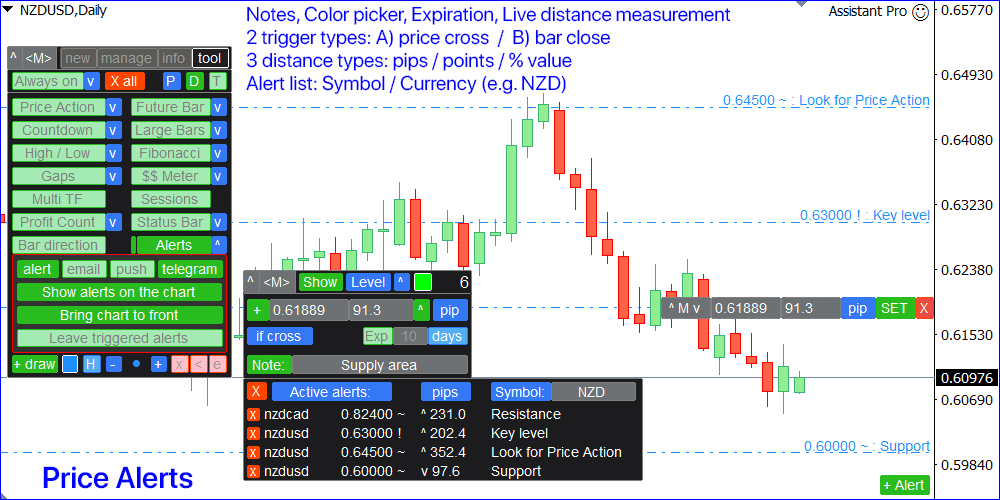

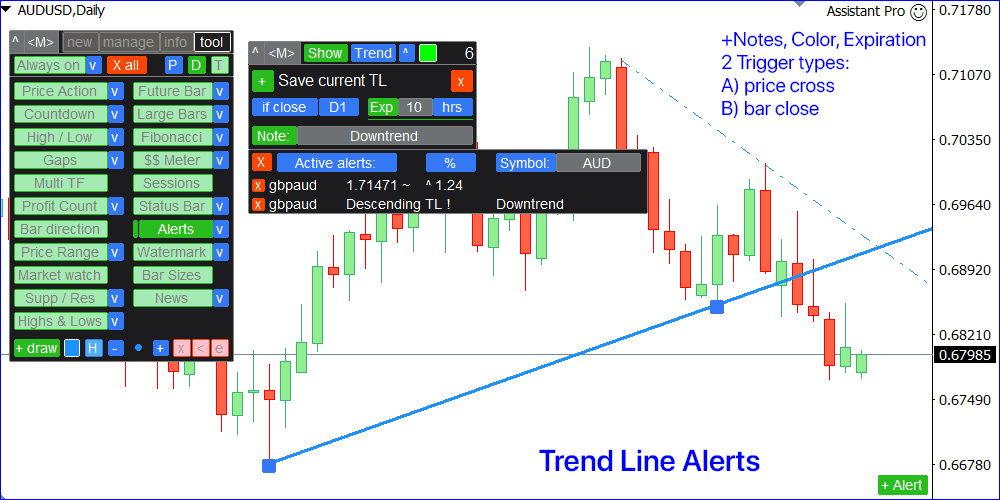

[Alerts]: notification when a value stage / development line is reached

This device opens in a separate window: it may be moved [< >] and minimized [v].

There are 2 alert sorts, you possibly can choose it utilizing the blue change on the prime of the panel:

[Level]: alert on the value stage; [Trend]: alert on the development line;

There are 2 sorts of triggers: so you possibly can choose when the alert ought to be despatched:

[if cross]: when the worth crosses the extent / development line; [if close]: when the bar closes past the extent / development line;

So as to add a brand new value alert:

Kind the extent value, or set the worth change worth (relative to the present value). Click on [+] to avoid wasting the alert.

When utilizing the worth change worth:

Use the blue change to set the calculation technique: % of change / pips / factors. Use [^] / [v] change to invert the extent in the wrong way from the present value: e.g. if it was [+10] pips (above), you possibly can invert it to [-10] pips (under). If alert stage is throughout the seen chart space: a separate interface for a fast alert setting can be displayed: Drag [^ M v] to regulate the extent with the mouse. Maintain whereas shifting to make use of a magnet . You may also sort the worth / change values within the enter fields. Click on [SET] so as to add the alert, or [X] to cancel and conceal the row.

So as to add a brand new development line alert:

Click on [+] to begin drawing a development line. Use the ■ DOTS on the chart to regulate the TL. Click on [+] to avoid wasting the development line, or [x] to cease drawing.

Choices:

You may set the expiration: if [Exp] is energetic, alert can be cancelled after the desired time. [Note]: add a reminder of what must be performed when the alert is triggered.

On the prime of the panel:

[Show]: if energetic, the alert strains can be visualized on the chart. When the energetic Alert ranges are displayed on the chart, you possibly can click on on the extent description to begin the modification. The entire quantity of the energetic alerts on all Symbols is displayed on the prime proper nook. [v]: click on to point out the record of the alerts [color]: click on to set a coloration to visualise alert on the chart. It should be chosen earlier than the alert is saved.

Working with the record of the alerts:

Use the blue change to change between the [Active alerts] and [Triggered alerts]; You may view the alerts on [Current] Image, for the desired [Symbol:] , or [ALL] alerts;When utilizing [Symbol:] technique, you can even test the alerts for the group of Symbols: e.g. sort ‘EUR’ to test alerts on all foreign money pairs with EUR. Click on [x] to delete alerts: individually, or ALL from the record (for those who click on [x] on the first row); When checking the [Active alerts] record: Click on on the Image to use it to the present chart; Click on on the Value to change the alert: parameters might be adjusted above, and the alert might be dragged on the chart (if seen); The present distance from the market value to the alert stage is calculated: you possibly can set the calculation technique utilizing the blue change: pips / factors / %. Click on on the space worth to make use of the alert value because the entry stage for a brand new commerce; Click on on the Be aware to edit or add it; When viewing [Triggered alerts] : click on on the extent to make use of it because the entry value for a brand new commerce

Settings on the principle utility panel [v] :

You may on/off every sort of the notification: [alert] / [email] / [push] / [telegram] [Show alerts on the chart]: if energetic, the alerts can be visualized on the chart. [Bring chart to front]: if energetic, the chart of the triggered alert can be moved ahead. [Leave triggered alerts]: if energetic, triggered alerts can be moved to a separate record, and can be visualized on the chart. So it is possible for you to to research the reached ranges.Then you possibly can delete triggered ranges manually in 2 methods: From the triggered record of alerts on the alert panel: [x] button; Or from the chart: by clicking on the road or description Click on [EN] on the chart to make use of the triggered stage because the entry value for a brand new commerce. [Quick <+Alert> button]: if energetic – an extra button on the backside of the chart can be displayed for a fast alert setting.

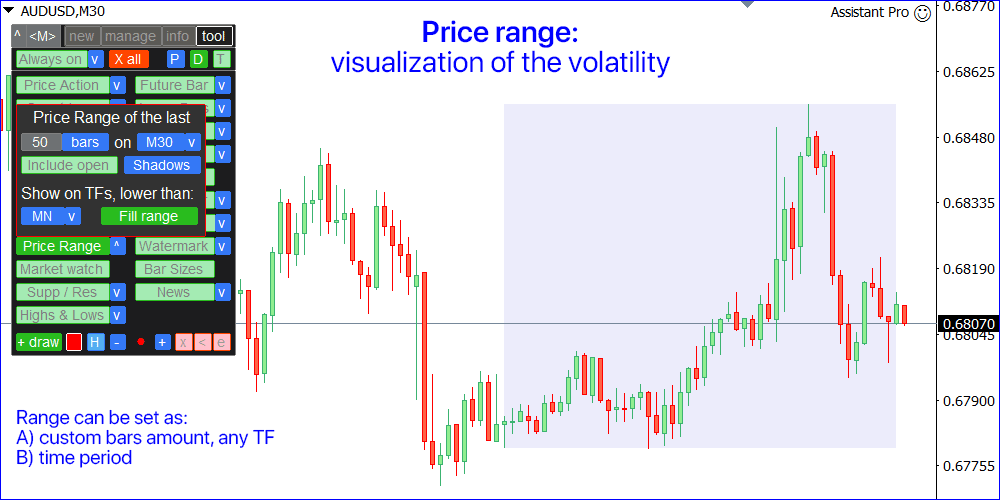

[Price Range] indicator

Visualization of the buying and selling vary.

Indicator settings [v]:

Vary interval: quantity of [minutes] / [hours] / [days] / [bars]. Calculation technique: [Shadows] (high-low costs), or [Bodies] (open-close costs). Choose the timeframe, the place the vary ought to be displayed: e.g. if you choose each day [D1] TF, the vary won’t be seen on the weekly timeframe, however can be seen on all timeframes decrease than D1 (4H, 1H, M30…). If utilizing [bars] sort (pt.1), you additionally must set:a. TimeFrame for calculation.b. [Include open] possibility: if energetic, the present (floating) bar can even be included to the vary. Coloration: click on on the pattern to alter it.

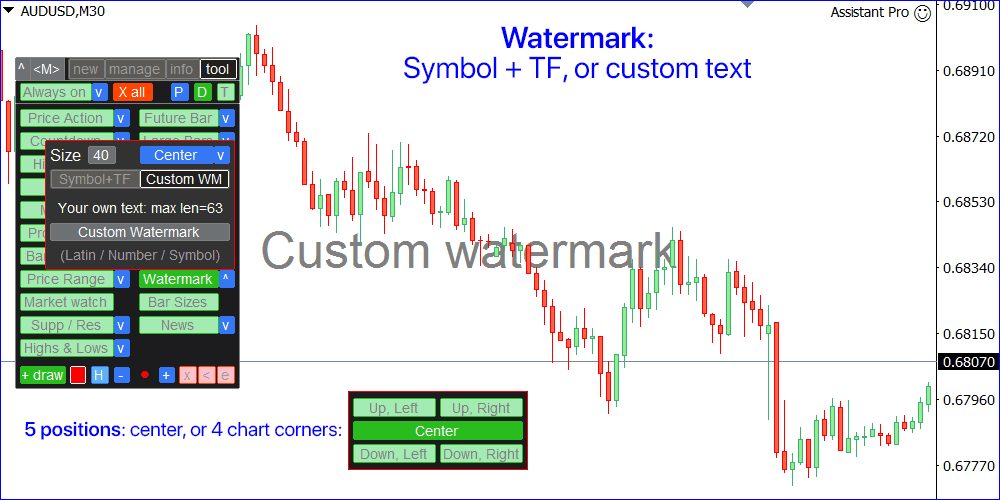

[Watermark] device

Extra textual content on the background of the chart.

Indicator settings [v]:

The textual content dimension and coloration; Place, nook: Prime left / Prime proper / Heart / Backside left / Backside proper. Select what can be displayed: both the present [Symbol + TF] , or your [Custom] textual content.a. When utilizing the [Symbol+TF] possibility, you can even configure:i. You may individually embody the [Symbol] and [Period] to the Watermark textual content.ii. [Remove Prefix] and [Remove Suffix] from the Image: It is handy if the Image identify has an extra indicators, similar to “EURUSD.professional”.

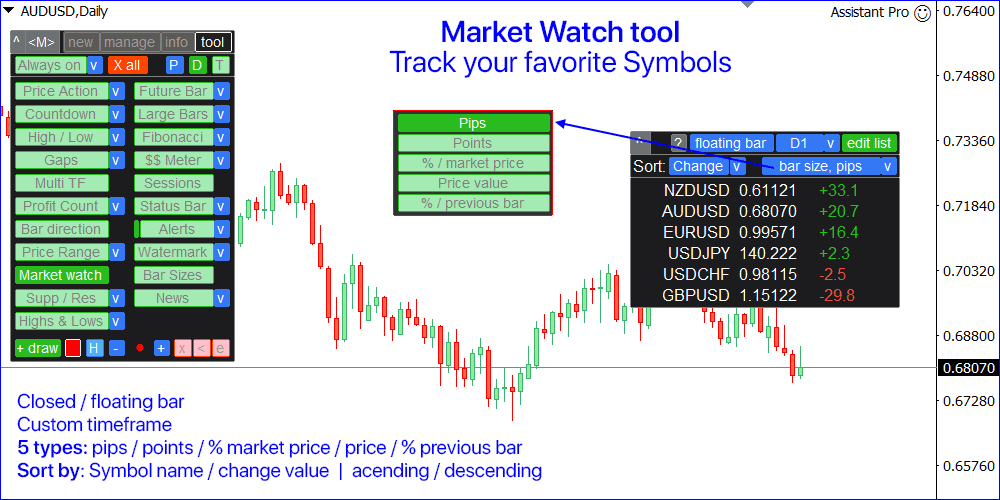

[Market watch] device

Monitor your favourite Symbols.

This device opens in a separate window: it may be moved (drag anyplace), and minimized [v].

You may alter the Watchlist on the panel:

Click on [edit list] so as to add / take away the Symbols from the Watchlist. Calculated worth: it could both be the final [closed bar] , or the present [floating bar]. Choose the [timeframe] for calculation. There are 2 sorts of the worth sorting : by the [Symbol] identify, or by the worth [change]. The values might be sorted in ascending [^] or descending [v] order. There are 4 calculation strategies, click on [v] to alter it:a) [bar size, pips]: bar dimension, in pips;b) [bar size, points]: bar dimension, in market factors ;c) [bar size, % price]: bar dimension, as a share of the worth change;d) [bar, price value]: value distinction between the utmost / minimal bar costs;e) [% / prev bar size]: the dimensions of the calculated bar, in comparison with the earlier bar dimension;

Ideas: when the ‘Market Watch’ utility is energetic:

Use the left / proper keyboard buttons to change by way of the record of the Symbols. You may also click on on the Image identify to open its chart.

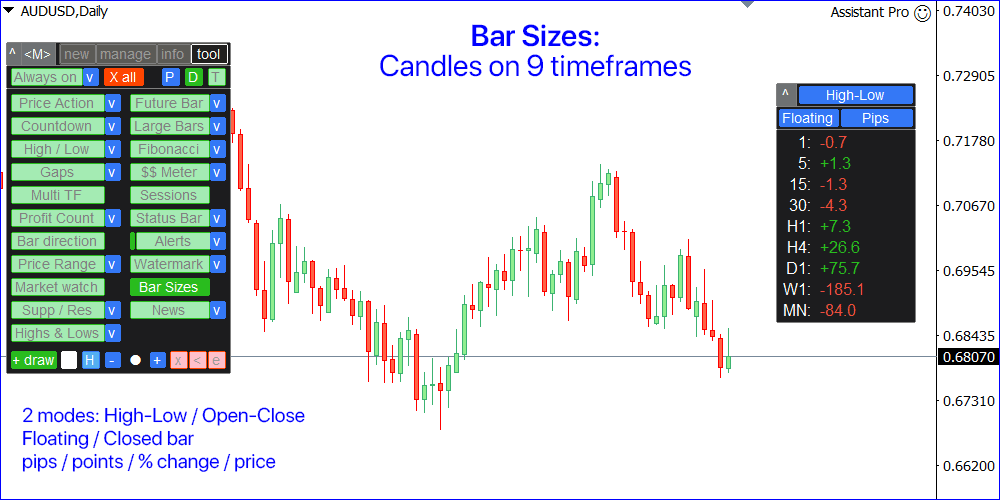

[Bar Sizes] device

Calculates the bar sizes of 9 essential timeframes.

This device opens in a separate window: it may be moved (drag anyplace), and minimized [v].

On the panel, you possibly can alter the calculation:

Costs used for calculation: [Bodies] (open-close dimension), or [Shadows] (high-low dimension). Choose the used bar: [Floating] (presently open), or the final [Closed] bar. Calculation technique: [Pips] / [Points] / [% change] / [Price].

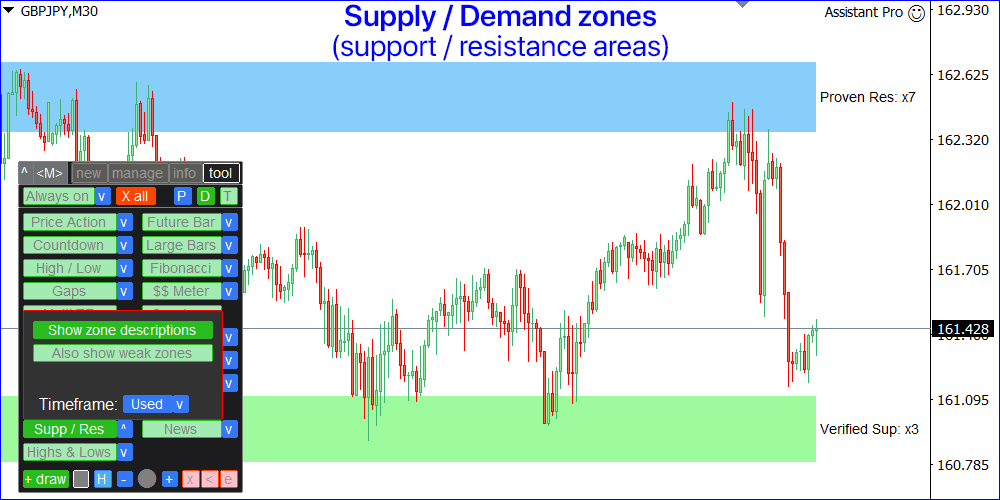

[Supp / Res]: help / resistance zones

Provide / demand zones: observable areas the place value has approached many occasions previously.

The indicator exhibits the place the worth might doubtlessly be reversed once more.

Normally, the extra occasions the worth has been rejected from the extent, the extra important it’s.

Indicator settings [v]:

[Show zone descriptions]: if energetic – there can be a short data for every chart space. [Also show weak zones]: if energetic – unconfirmed zones can even be seen. [Always show indicator]: if energetic – chart zones will stay on the chart even when switching to the opposite tab, of minimizing the principle panel. [Timeframe]: select the timeframe that can be used when calculating the zones. You may set the essential colours : individually for the help and resistance: chosen coloration can be much less intense for a weak zones, so it would visually assist you to analyze the chart.

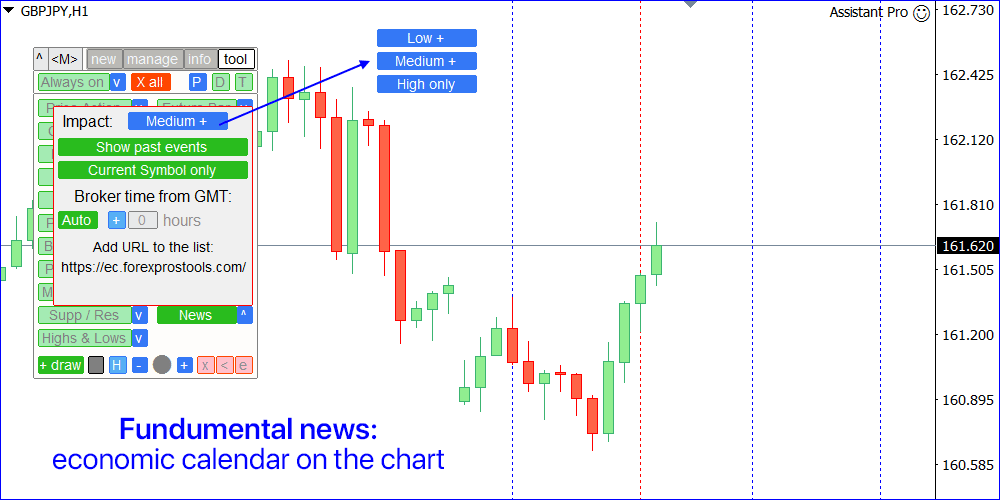

[News] device

Visualization of the financial occasions on the chart.

The indicator attracts vertical strains, displaying you when financial information are coming.

Throughout the main information, there could also be an elevated value volatility.

Indicator settings [v]:

Influence: select the information of what significance you wish to see: Low+ / Medium+ / Excessive solely. [Show past events]: if enabled, the previous occasions can even be seen. [Current Symbol only]: if energetic, solely occasions associated to the chart Image can be proven. Dealer time from GMT: set the time distinction of your dealer, in comparison with the Greenwich Imply Time. You utilize [Auto] possibility as a substitute: time can be synchronized if the market is open.When setting the time distinction manually: Dealer’s time might be checked on the ‘Market watch’ (View -> Market Watch);If GMT = 17:30, and the dealer’s time = 19:30: worth ought to be +2 (hours);If GMT = 17:30, and the dealer’s time = 16:30: worth ought to be -1 (hour); The indicator wants your permission to entry an exterior information web site:a) Within the terminal, go to the Instruments -> Choices (Ctrl+O) -> Professional Advisors:b) Activate ‘Enable WebRequest for listed UR L’ possibility;c) Add URL “https://ec.forexprostools.com/” to the record; To set the strains coloration : click on on the colour pattern (individually for every affect).

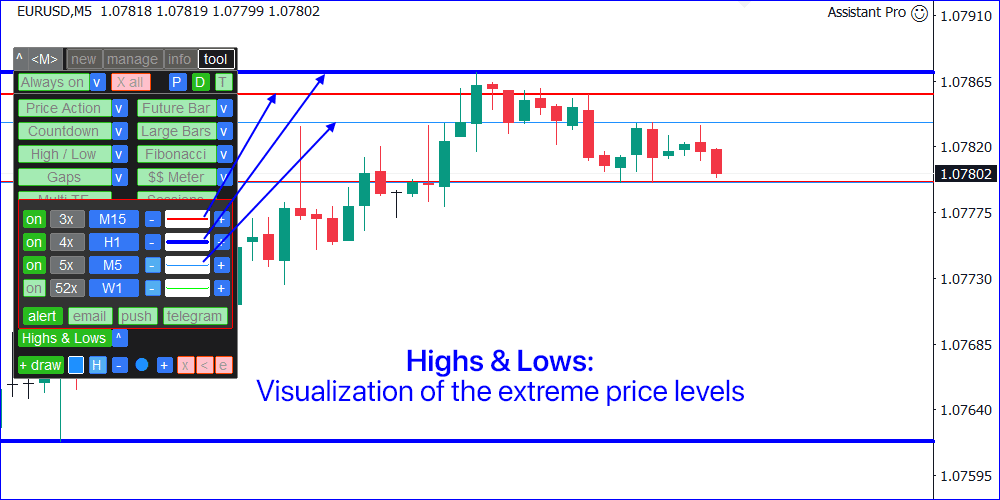

[Highs & Lows] device

Visualization of the Excessive and Low value ranges for the chosen time interval.

As much as 4 totally different timeframes and durations can be utilized.

Indicator settings [v]:

Every stage might be enabled / disabled: [on] button; Subsequent, you possibly can set the variety of durations to calculate:for instance, [x2] will imply the final 2 bars of the chosen timeframe. Utilizing the [blue button] you possibly can set the timeframe: will probably be used to calculate the degrees. [-] and [+] buttons can be utilized to regulate the width of the chart strains. Click on on the road preview to regulate its coloration.

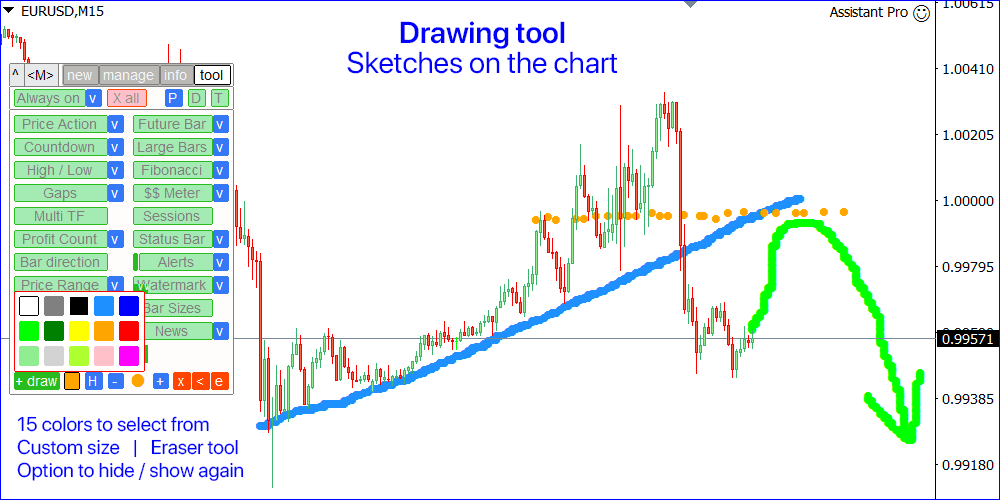

Drawing device

On the backside of the [tool] tab there are controls for customized drawings on the chart.

Click on [+ draw] to begin drawing: maintain down the left mouse button and draw on the chart. Click on [stop X] to cease drawing. You may choose the comb coloration : click on on the colour icon. Click on [-] and [+] to alter the comb dimension. Click on [x] to take away all of your drawings, or [<] to cancel the latest drawing motion. Click on [e] to activate the Eraser: its dimension might be adjusted with the [-] / [+] buttons. You may briefly Conceal all drawings from the chart: [H] button.Nevertheless, they won’t be deleted, and it is possible for you to to Present them once more Central (further) coloration might be personalized within the settings [s] on the [new] tab.

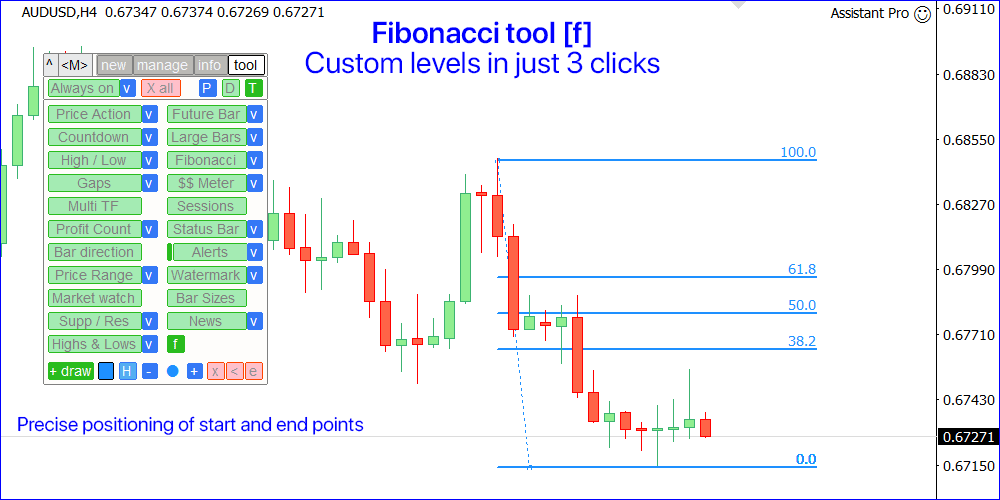

Fibonacci device [f]

You may draw customized Fibonacci ranges with exact positioning of begin and finish factors.

When utilizing the [f] device – the colour and width of the degrees will rely on the settings you chose for the ‘draw’ device.

The values of the degrees are synchronized along with your settings for the automated [Fibonacci] device.

For exact positioning, the magnet is enabled by default, however you possibly can pause its motion by holding the key.

Ranges are created in 3 clicks: the preliminary value, the ultimate value, and the width of the created ranges.At every stage you will notice tooltips on the prime of the chart.

Hyperlinks to the descriptions of the different tabs:

[new] tab: New trades, Lot / Threat / Threat-Reward calculation. [manage] tab: Commerce administration, Breakeven, Trailing, Auto-Shut, Auto-Ranges. [info] tab: Commerce statistics, market evaluation.