Motive to belief

Strict editorial coverage that focuses on accuracy, relevance, and impartiality

Created by business consultants and meticulously reviewed

The very best requirements in reporting and publishing

Strict editorial coverage that focuses on accuracy, relevance, and impartiality

Morbi pretium leo et nisl aliquam mollis. Quisque arcu lorem, ultricies quis pellentesque nec, ullamcorper eu odio.

Este artículo también está disponible en español.

Avalanche (AVAX) has been one of many standout performers in current weeks, surging greater than 53% since March 11 as bulls try and kickstart a broader restoration rally. The sturdy rebound follows a brutal correction during which AVAX misplaced over 72% of its worth since mid-December 2024, triggering widespread capitulation and worry throughout the market. Now, with value motion displaying indicators of energy, traders are cautiously optimistic — however uncertainty stays.

Associated Studying

Whereas the current rally has introduced some reduction, many analysts consider the market could also be coming into a consolidation section. AVAX is presently struggling to carry above the $22 mark, a key resistance degree that might decide whether or not the uptrend continues or stalls. A number of technical alerts are flashing warning as momentum begins to gradual.

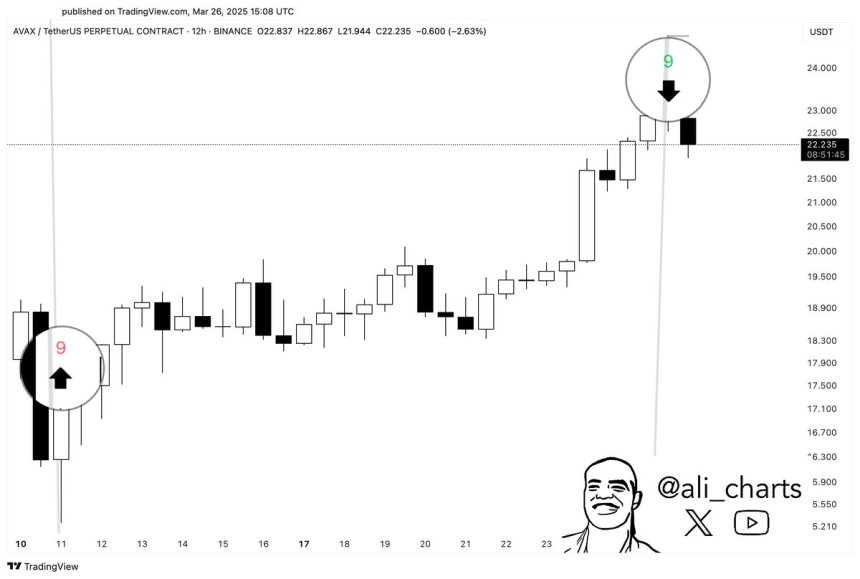

High analyst Ali Martinez shared insights on X, mentioning that the TD Sequential indicator is now presenting a contemporary promote sign. This means that AVAX could also be due for a short-term pullback or a interval of sideways motion. With the broader market nonetheless below strain, merchants are watching carefully to see whether or not Avalanche can preserve its good points or lose momentum.

Avalanche Wakes Up However Faces Critical Dangers

Avalanche is displaying indicators of life after enduring months of intense promoting strain. Like many altcoins, AVAX has been closely impacted by macroeconomic volatility, dropping over 70% of its worth since mid-December 2024. Now, as bullish momentum begins to return throughout choose altcoins, Avalanche is making an attempt to stage a restoration rally. The current 53% surge since March 11 has revived hopes that AVAX could possibly be prepared to interrupt out — however headwinds nonetheless stay.

The broader market surroundings continues to be formed by uncertainty. Commerce battle fears and unstable macroeconomic alerts have stored strain on threat belongings, together with cryptocurrencies. Many traders stay cautious and are nonetheless offloading positions close to present ranges, involved in regards to the long-term route of the market. Whereas momentum is returning to some sectors, the trail for Avalanche is way from clear.

High analyst Ali Martinez not too long ago highlighted a technical improvement utilizing the TD Sequential indicator. After precisely calling the current backside and a 50% rally in AVAX, the indicator is now flashing a promote sign. This means that Avalanche could possibly be due for a short-term retrace or interval of consolidation earlier than any additional transfer increased.

The $22 degree stays a vital resistance zone for AVAX. A brief cooldown right here could also be wholesome — giving bulls time to regroup earlier than making an attempt a breakout. If AVAX can maintain key help and reset after the present rally, it may construct a stronger basis for a decisive push above $22 within the weeks forward. For now, all eyes are on value motion as Avalanche balances between correction and continuation in a market nonetheless clouded by uncertainty.

Associated Studying

AVAX Struggles Beneath $22 As Bulls Intention For $30 Breakout

Avalanche (AVAX) is presently buying and selling at $21.80 after briefly reaching $23.40 simply two days in the past. The current pullback displays cooling momentum as bulls wrestle to take care of strain close to short-term resistance. Nonetheless, the development stays intact — for now. To maintain the restoration rally, bulls should defend present ranges and push towards reclaiming the $30 mark, which aligns with the 200-day shifting common (MA) and 200-day exponential shifting common (EMA). A profitable breakout above this zone can be a powerful bullish sign and will mark the start of a bigger uptrend.

Nonetheless, failure to carry above $20 within the coming days can be a warning signal. A breakdown beneath this degree may set off elevated promoting strain and ship AVAX again towards the $17 zone — a key help space from earlier consolidations. As Avalanche continues to commerce inside a risky vary, the following few periods might be essential in figuring out short-term route.

Associated Studying

With the market nonetheless below macroeconomic strain, bulls should act shortly to take care of momentum. A decisive transfer above $30 stays the goal, however holding the $20 degree is simply as essential to keep away from a deeper retrace and renewed bearish sentiment.

Featured picture from Dall-E, chart from TradingView