Revealed on March twenty seventh, 2025 by Bob Ciura

The S&P 500 Index is off to a challenged begin to the yr. Thus far in 2025, the S&P 500 Index has declined 3%.

Many dividend shares are off to a lot worse begins year-to-date, which might current worth and earnings buyers with some compelling shopping for alternatives.

To start the seek for high quality dividend development shares, we advocate the Dividend Champions, a bunch of shares which have elevated their dividends for at the least 25 consecutive years.

You’ll be able to obtain your free copy of the Dividend Champions record, together with related monetary metrics like price-to-earnings ratios, dividend yields, and payout ratios, by clicking on the hyperlink under:

Traders are possible accustomed to the Dividend Aristocrats, a bunch of 69 shares within the S&P 500 Index with 25+ consecutive years of dividend will increase.

In the meantime, buyers also needs to familiarize themselves with the Dividend Champions, which have additionally raised their dividends for at the least 25 years in a row.

This text will focus on the three worst-performing Dividend Champions thus far in 2025, together with their anticipated returns over the subsequent 5 years.

Desk of Contents

You’ll be able to immediately leap to any particular part of the article by clicking on the hyperlinks under:

The three Dividend Champions have been ranked by anticipated complete annual return over the subsequent 5 years, from lowest to highest.

Overwhelmed Down Dividend Champion #3: Matthews Worldwide Corp. (MATW)

Yr-to-Date Efficiency: -15.6%

5-year anticipated returns: 12.2%

Matthews Worldwide Company gives model options, memorialization merchandise and industrial applied sciences on a worldwide scale. The corporate’s three enterprise segments are diversified.

The SGK Model Options gives model improvement companies, printing gear, artistic design companies, and embossing instruments to the consumer-packaged items and packaging industries.

The Memorialization section sells memorialization merchandise, caskets, and cremation gear to funeral house industries.

The Industrial applied sciences section is smaller than the opposite two companies and designs, manufactures and distributes marking, coding and industrial automation applied sciences and options.

Matthews Worldwide reported first quarter FY 2025 outcomes on February sixth, 2025. The corporate reported gross sales of $402 million, an 11% decline in comparison with the identical prior yr interval. The lower was the results of a 28% gross sales decline in its Industrial Applied sciences section.

Adjusted earnings had been $0.14 per share, a 62% lower from $0.37 a yr in the past. The corporate’s internet debt leverage ratio rose from 3.6 one yr in the past to three.9.

Matthews continues to count on $205 million to $215 million of adjusted EBITDA for fiscal 2025.

The dividend payout ratio for Matthews Worldwide has been very conservative and solely just lately eclipsed one third of earnings. This conservative payout ratio permits Matthews to proceed elevating the dividend because it has for the final 31 years.

The corporate has a small aggressive benefit in that it’s uniquely diversified throughout its companies, which permits it to climate totally different storms on a consolidated foundation.

Click on right here to obtain our most up-to-date Positive Evaluation report on MATW (preview of web page 1 of three proven under):

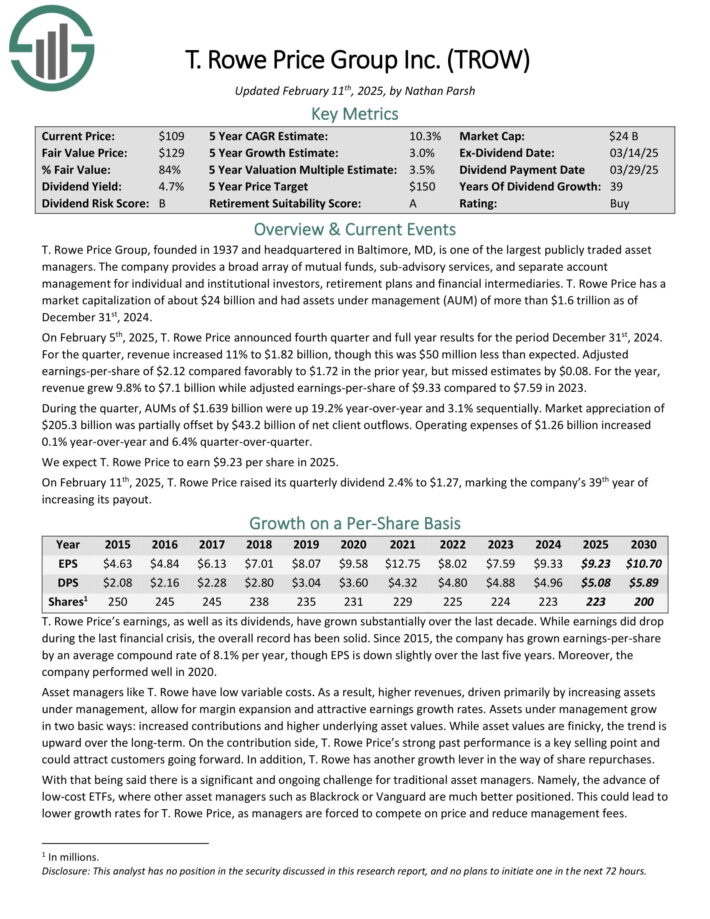

Overwhelmed Down Dividend Champion #2: T. Rowe Worth Group (TROW)

Yr-to-Date Efficiency: -16.0%

5-year anticipated returns: 13.6%

T. Rowe Worth Group, based in 1937 and headquartered in Baltimore, MD, is without doubt one of the largest publicly traded asset managers.

The corporate gives a broad array of mutual funds, sub-advisory companies, and separate account administration for particular person and institutional buyers, retirement plans and monetary intermediaries.

Supply: Investor Presentation

Property beneath administration develop in two primary methods: elevated contributions and better underlying asset values. Whereas asset values are finicky, the development is upward over the long run.

As well as, T. Rowe has one other development lever within the type of share repurchases. The corporate has shrunk its share rely by an annual charge of 1.3% during the last decade.

On February fifth, 2025, T. Rowe Worth introduced fourth quarter and full yr outcomes for the interval December thirty first, 2024.

For the quarter, income elevated 11% to $1.82 billion, although this was $50 million lower than anticipated. Adjusted earnings-per-share of $2.12 in contrast favorably to $1.72 within the prior yr, however missed estimates by $0.08.

For the yr, income grew 9.8% to $7.1 billion whereas adjusted earnings-per-share of $9.33 in comparison with $7.59 in 2023.

Through the quarter, AUMs of $1.639 billion had been up 19.2% year-over-year and three.1% sequentially. Market appreciation of $205.3 billion was partially offset by $43.2 billion of internet consumer outflows.

Working bills of $1.26 billion elevated 0.1% year-over-year and 6.4% quarter-over-quarter.

Click on right here to obtain our most up-to-date Positive Evaluation report on TROW (preview of web page 1 of three proven under):

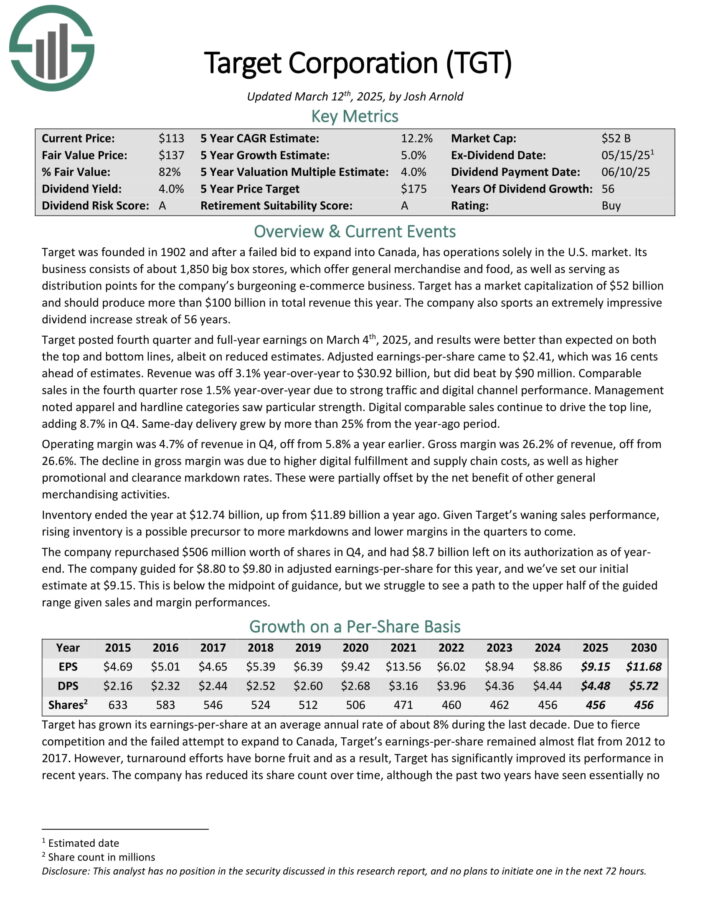

Overwhelmed Down Dividend Champion #1: Goal Company (TGT)

Yr-to-Date Efficiency: -20.9%

5-year anticipated returns: 13.6%

Goal was based in 1902 and now operates about 1,850 massive field shops, which supply common merchandise and meals, in addition to serving as distribution factors for the corporate’s e-commerce enterprise.

Goal posted fourth quarter and full-year earnings on March 4th, 2025, and outcomes had been higher than anticipated on each the highest and backside strains, albeit on decreased estimates. Adjusted earnings-per-share got here to $2.41, which was 16 cents forward of estimates.

Income was off 3.1% year-over-year to $30.92 billion, however did beat estimates by $90 million. Comparable gross sales within the fourth quarter rose 1.5% year-over-year resulting from robust site visitors and digital channel efficiency.

Administration famous attire and hardline classes noticed specific energy.

Supply: Investor Presentation

For 2025, Goal expects round 1% gross sales development and a modest improve in working margins. Nevertheless, elements like tariff uncertainties and shifting client confidence could stress short-term income.

The corporate stays centered on digital growth, provide chain enhancements, and shareholder returns, together with dividend will increase and inventory buybacks, with $8.7 billion nonetheless accessible beneath its repurchase program.

Digital comparable gross sales proceed to drive the highest line, including 8.7% in This fall. Similar-day supply grew by greater than 25% from the year-ago interval.

The corporate repurchased $506 million value of shares in This fall, and had $8.7 billion left on its authorization as of yr finish. The corporate guided for $8.80 to $9.80 in adjusted earnings-per-share for this yr.

Click on right here to obtain our most up-to-date Positive Evaluation report on TGT (preview of web page 1 of three proven under):

Desk of Contents

The Dividend Champions record shouldn’t be the one option to shortly display for shares that frequently pay rising dividends.

Thanks for studying this text. Please ship any suggestions, corrections, or inquiries to assist@suredividend.com.