Armed with knowledge from our mates at CrunchBase, I’ve analyzed the most important international startup funding rounds for February 2025. This month’s rankings reveal a number of notable tendencies, significantly the sturdy resurgence of US-based startups dominating the highest positions—a shift from current months the place we’ve seen extra geographic variety.

What’s significantly hanging is that 9 out of the highest 11 funded firms are headquartered in america. The AI sector continues its funding momentum, with six firms immediately concerned in synthetic intelligence applied sciences.

The manufacturing and safety sectors additionally made notable appearances, with substantial capital flowing to firms constructing bodily expertise options alongside software program improvements.

Under, I’ve included complete particulars for every firm: {industry} classifications, spherical varieties, firm descriptions, collaborating buyers, founding info, headquarters location, and whole fairness funding so far.

February’s funding panorama reveals a pronounced dominance of US-based startups, with 9 of the 11 largest rounds going to American firms. This represents a major shift from current months after we noticed larger worldwide variety in main funding occasions. Solely two non-US firms made the listing—StackAdapt from Toronto and Krutrim from Bangalore—highlighting the distinctive focus of capital within the American tech ecosystem this month.

Synthetic intelligence stays the dominant funding theme, with AI-focused startups representing over half the businesses on the listing and capturing roughly 60% of the entire funding. Corporations like Harvey, Collectively AI, and Abridge are leveraging generative AI throughout various purposes from authorized providers to healthcare, confirming that buyers proceed to guess closely on AI’s transformative potential.

Notably noteworthy is the resurgence of curiosity in {hardware} and bodily expertise options. Corporations like Lambda (AI infrastructure), Apptronik (robotics), and Saronic (unmanned floor automobiles) point out that buyers are trying past pure software program performs to firms constructing tangible merchandise that interface with the bodily world.

The fast trajectory of sure startups is outstanding, with firms like Saronic (based 2022) securing large funding rounds regardless of their relative youth. In simply three years, Saronic has raised a complete of $845M and reached Sequence C funding.

Lastly, the variety of industries represented—from authorized tech and healthcare to quantum computing and maritime safety—demonstrates how technological innovation continues to rework a number of sectors concurrently. This cross-industry affect suggests we’re witnessing not simply remoted breakthroughs however a broader technological transformation reshaping the worldwide economic system.

within the prime NYC Startup Fundings? – The Largest NYC Startup Funding Rounds of February 2025Interested within the prime LA Startup Fundings? – The Largest LA Startup Funding Rounds for February 2025Interested within the prime London Startup Funding? – The Largest London Startups Funding Rounds of February 2025Interested within the prime US Startup Funding? – The Largest US Startups Funding Rounds of February 2025

The TechWatch Media Group viewers is driving progress and innovation on a world scale. With its regional media properties (New York Tech, London Tech, LA Tech) TechWatch Media Group is the freeway for expertise and entrepreneurship. There are a variety of choices to succeed in this viewers of the world’s most modern organizations and startups at scale together with strategic model placement in a high-visibility piece like this, which will probably be learn by the overwhelming majority of key decision-makers within the international enterprise group and past. Study extra about how a digital marketing campaign will return your funding right here.

11. Verkada $200.0M

Spherical: Sequence EDescription: San Mateo-based Verkada is a cloud-based bodily safety platform that focuses on safety cameras and safety options for enterprises. Based by Benjamin Bercovitz, Filip Kaliszan, Hans Robertson, and James Ren in 2016, Verkada has now raised a complete of $643.9M in whole fairness funding and is backed by Basic Catalyst, Sequoia Capital, Lightspeed Enterprise Companions, Eclipse Ventures, and First Spherical Capital.Traders within the spherical: Eclipse Ventures, Basic CatalystIndustry: Enterprise Software program, Web of Issues, Bodily Safety, Good BuildingFounders: Benjamin Bercovitz, Filip Kaliszan, Hans Robertson, James RenFounding yr: 2016Location: San MateoTotal fairness funding raised: $643.9M

10. Krutrim $229.7M

Spherical: VentureDescription: Bangalore-based Krutrim is a expertise firm that gives an AI-based platform to develop and help the operations of the mobility {industry}. Based by Bhavish Aggarwal in 2023, Krutrim has now raised a complete of $279.7M in whole fairness funding and is backed by Z47 and Bhavish Aggarwal.Traders within the spherical: Bhavish AggarwalIndustry: Synthetic Intelligence (AI), Cloud Knowledge Providers, Cloud InfrastructureFounders: Bhavish AggarwalFounding yr: 2023Location: BangaloreTotal fairness funding raised: $279.7M

9. QuEra Computing $230.0M

Spherical: VentureDescription: Boston-based QuEra Computing is a neutral-atoms-based quantum computing startup, situated in Boston, close to Harvard College. Based by Dirk Englund, John Pena, Markus Greiner, Mikhail Lukin, Nathan Gemelke, and Vladan Vuletic in 2018, QuEra Computing has now raised a complete of $17.0M in whole fairness funding and is backed by Valor Fairness Companions, Google, SoftBank Imaginative and prescient Fund, Safar Companions, and Day One Ventures.Traders within the spherical: Alphabet, Google, QVT Monetary, Safar Companions, SoftBank Imaginative and prescient Fund, Valor Fairness PartnersIndustry: Pc, Client Analysis, Quantum ComputingFounders: Dirk Englund, John Pena, Markus Greiner, Mikhail Lukin, Nathan Gemelke, Vladan VuleticFounding yr: 2018Location: BostonTotal fairness funding raised: $17.0M

8. StackAdapt $235.0M

Spherical: VentureDescription: Toronto-based StackAdapt is a multi-channel programmatic promoting platform that helps maximize digital advertising efforts by way of data-driven options. Based by Ildar Shar, Vitaly Pecherskiy, and Yang Han in 2014, StackAdapt has now raised a complete of $536.6M in whole fairness funding and is backed by Summit Companions, Academics’ Enterprise Development, Plaza Ventures, MaRS Funding Accelerator Fund, and Intrepid Development Companions.Traders within the spherical: Intrepid Development Companions, Academics’ Enterprise GrowthIndustry: Advert Retargeting, Advert Concentrating on, Promoting, Promoting Platforms, Digital Advertising, Machine Studying, Advertising, Cell Promoting, Video AdvertisingFounders: Ildar Shar, Vitaly Pecherskiy, Yang HanFounding yr: 2014Location: TorontoTotal fairness funding raised: $536.6M

7. Abridge $250.0M

Spherical: Sequence DDescription: Pittsburgh-based Abridge is an AI-driven platform that transforms patient-clinician conversations into structured medical notes for healthcare industries. Based by Florian Metze, Sandeep Konam, and Shivdev Rao in 2018, Abridge has now raised a complete of $457.5M in whole fairness funding and is backed by Union Sq. Ventures, Lightspeed Enterprise Companions, Bessemer Enterprise Companions, IVP, and Pillar VC.Traders within the spherical: Bessemer Enterprise Companions, California HealthCare Basis, CapitalG, CVS Well being Ventures, Elad Gil, IVP, Ok. Ventures, Lightspeed Enterprise Companions, NVentures, Redpoint, Spark Capital, SV AngelIndustry: Synthetic Intelligence (AI), Digital Well being Document (EHR), Enterprise Software program, Generative AI, Well being Care, Clever Programs, Machine Studying, Medical, Pure Language Processing, SaaSFounders: Florian Metze, Sandeep Konam, Shivdev RaoFounding yr: 2018Location: PittsburghTotal fairness funding raised: $457.5M

The TechWatch Media Group viewers is driving progress and innovation on a world scale. With its regional media properties (New York Tech, London Tech, LA Tech) TechWatch Media Group is the freeway for expertise and entrepreneurship. There are a variety of choices to succeed in this viewers of the world’s most modern organizations and startups at scale together with strategic model placement in a high-visibility piece like this, which will probably be learn by the overwhelming majority of key decision-makers within the international enterprise group and past. Study extra about how a digital marketing campaign will return your funding right here.

6. Harvey $300.0M

Spherical: Sequence DDescription: San Francisco-based Harvey gives AI-driven instruments to help authorized professionals with analysis, doc evaluation, and contract evaluation. Based by Gabe Pereyra and Winston Weinberg in 2022, Harvey has now raised a complete of $506.0M in whole fairness funding and is backed by OpenAI, Sequoia Capital, Kleiner Perkins, Coatue, and Conviction Companions.Traders within the spherical: Coatue, Conviction Companions, Elad Gil, Google Ventures, Kleiner Perkins, OpenAI Startup Fund, REV, Sequoia CapitalIndustry: Synthetic Intelligence (AI), Data Know-how, Authorized, Authorized TechFounders: Gabe Pereyra, Winston WeinbergFounding yr: 2022Location: San FranciscoTotal fairness funding raised: $506.0M

5. Collectively AI $305.0M

Spherical: Sequence BDescription: San Francisco-based Collectively AI is a cloud-based platform designed for establishing open-source generative AI and infrastructure for growing AI fashions. Based by Ce Zhang, Chris Re, Percy Liang, and Vipul Ved Prakash in 2022, Collectively AI has now raised a complete of $533.5M in whole fairness funding and is backed by Basic Catalyst, NVIDIA, First Spherical Capital, Emergence Capital, and New Enterprise Associates.Traders within the spherical: Courageous Capital, Cadenza Ventures, Coatue, DAMAC Capital, Definition, Emergence Capital, Basic Catalyst, Greycroft, John J. Chambers, Kleiner Perkins, Lengthy Journey Ventures, Lux Capital, March Capital, NVIDIA, Prosperity7 Ventures, Salesforce Ventures, Scott Banister, SE VenturesIndustry: Synthetic Intelligence (AI), Generative AI, Web, IT Infrastructure, Open SourceFounders: Ce Zhang, Chris Re, Percy Liang, Vipul Ved PrakashFounding yr: 2022Location: San FranciscoTotal fairness funding raised: $533.5M

4. Apptronik $403.0M

Spherical: Sequence ADescription: Austin-based Apptronik designs and builds human-centered robotics methods. Based by Invoice Helmsing, Jeffrey Cardenas, and Nicholas Paine in 2016, Apptronik has now raised a complete of $431.5M in whole fairness funding and is backed by B Capital, Google, Scrum Ventures, Capital Manufacturing unit, and ARK Funding Administration.Traders within the spherical: ARK Funding Administration, B Capital, Capital Manufacturing unit, Ethos Household Workplace, Google, Japan Publish Capital, Mercedes-Benz Group AG, RyderVentures, Scrum Ventures, Trajectory VenturesIndustry: Synthetic Intelligence (AI), Industrial Automation, Equipment Manufacturing, RoboticsFounders: Invoice Helmsing, Jeffrey Cardenas, Nicholas PaineFounding yr: 2016Location: AustinTotal fairness funding raised: $431.5M

3. Lambda $480.0M

Spherical: Sequence DDescription: San Francisco-based Lambda gives infrastructure, cloud providers, and software program for the coaching and inferencing of AI fashions. Based by Michael Balaban and Stephen Balaban in 2012, Lambda has now raised a complete of $902.7M in whole fairness funding and is backed by B Capital, NVIDIA, Alumni Ventures, US Progressive Know-how Fund, and Bossa Make investments.Traders within the spherical: 1517 Fund, Andra Capital, Andrej Karpathy, ARK Funding Administration, Crescent Cove Advisors, Fincadia Advisors, G Squared, IQT, KHK & Companions, NVIDIA, Pegatron, SGW, Supermicro, US Progressive Know-how Fund, Wistron Company, WiwynnIndustry: Synthetic Intelligence (AI), Cloud Computing, GPU, Machine LearningFounders: Michael Balaban, Stephen BalabanFounding yr: 2012Location: San FranciscoTotal fairness funding raised: $902.7M

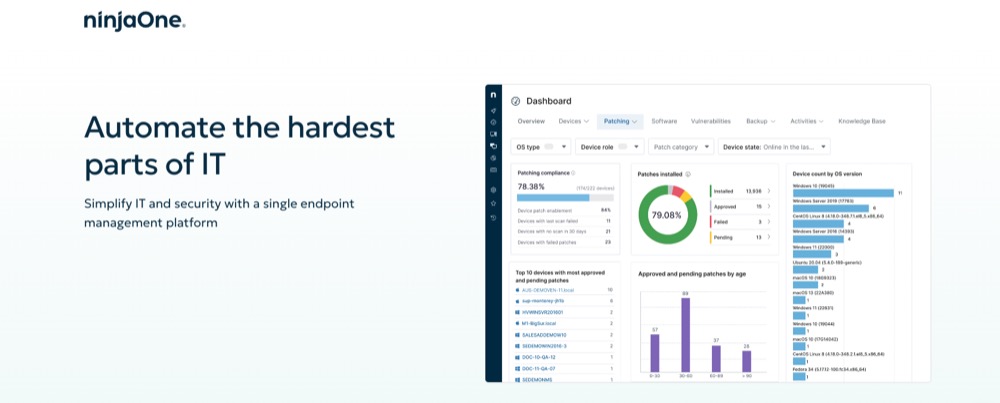

2. NinjaOne $500.0M

Spherical: Sequence CDescription: Austin-based NinjaOne serves as an IT platform for endpoint administration that enhances productiveness, minimizes dangers, and lowers total IT bills. Based by Christopher Matarese, Eric Herrera, and Sal Sferlazza in 2013, NinjaOne has now raised a complete of $761.5M in whole fairness funding and is backed by ICONIQ Development, Summit Companions, CapitalG, Amit Agarwal, and Frank Slootman.Traders within the spherical: CapitalG, ICONIQ GrowthIndustry: Cyber Safety, Doc Administration, Data Providers, Software program, Software program EngineeringFounders: Christopher Matarese, Eric Herrera, Sal SferlazzaFounding yr: 2013Location: AustinTotal fairness funding raised: $761.5M

1. Saronic $600.0M

Spherical: Sequence CDescription: Austin-based Saronic designs and manufactures unmanned floor automobiles for maritime safety and area consciousness. Based by Dino Mavrookas, Doug Lambert, Rob Lehman, and Vibhav Altekar in 2022, Saronic has now raised a complete of $845.0M in whole fairness funding and is backed by Basic Catalyst, Andreessen Horowitz, Lightspeed Enterprise Companions, 8VC, and US Progressive Know-how Fund.Traders within the spherical: 8VC, Andreessen Horowitz, Caffeinated Capital, Elad Gil, Basic Catalyst, Lightspeed Enterprise Companions, Silent VenturesIndustry: Synthetic Intelligence (AI), Manufacturing, Marine Know-how, Navy, SecurityFounders: Dino Mavrookas, Doug Lambert, Rob Lehman, Vibhav AltekarFounding yr: 2022Location: AustinTotal fairness funding raised: $845.0M

The TechWatch Media Group viewers is driving progress and innovation on a world scale. With its regional media properties (New York Tech, London Tech, LA Tech) TechWatch Media Group is the freeway for expertise and entrepreneurship. There are a variety of choices to succeed in this viewers of the world’s most modern organizations and startups at scale together with strategic model placement in a high-visibility piece like this, which will probably be learn by the overwhelming majority of key decision-makers within the international enterprise group and past. Study extra about how a digital marketing campaign will return your funding right here.