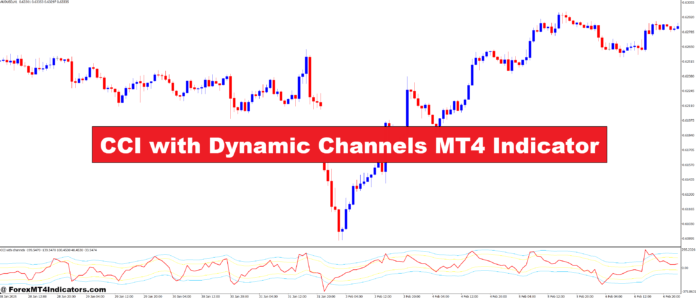

The CCI with Dynamic Channels MT4 Indicator presents a robust answer by combining the flexibility of the Commodity Channel Index (CCI) with dynamic channels for higher market evaluation. It helps merchants spot developments and reversals extra successfully, giving them a transparent edge of their buying and selling methods. Let’s dive deeper into how this indicator works and the way it can enhance your buying and selling selections.

What’s the CCI with Dynamic Channels MT4 Indicator?

The CCI with Dynamic Channels MT4 Indicator is a classy instrument designed to reinforce the effectiveness of the Commodity Channel Index (CCI) on the MetaTrader 4 platform. By including dynamic channels across the CCI, it helps merchants visualize overbought or oversold situations extra clearly. In contrast to customary CCI indicators, this model mechanically adjusts the channel ranges to market volatility, making it simpler for merchants to determine entry and exit factors. The dynamic channels adapt in real-time, guaranteeing the dealer has up-to-date data on market situations with out guide changes.

How It Helps Merchants Make Higher Selections

Utilizing the CCI with Dynamic Channels MT4 Indicator can considerably cut back the guesswork in buying and selling. It guides merchants in making well-timed selections by offering visible cues of market energy and potential reversals. For instance, when the worth breaks via a dynamic channel, it alerts a possible market shift. This will immediate merchants to enter a commerce when situations are favorable, relatively than counting on intuition or obscure indicators. Because the channels regulate to volatility, merchants can depend on extra correct knowledge, growing their probabilities of success in risky markets.

Key Advantages of the Indicator

One of many main advantages of the CCI with Dynamic Channels MT4 Indicator is its capacity to adapt to numerous market situations. Whereas conventional CCI indicators use mounted ranges, this instrument presents extra flexibility. Its dynamic nature means it adjusts based on the energy of market developments. Merchants can customise the indicator to suit their methods, offering a personalised buying and selling expertise. Moreover, the real-time updates assist merchants keep forward of the curve, guaranteeing they by no means miss essential adjustments available in the market. Whether or not you’re a newbie or an skilled dealer, this instrument gives a dependable and user-friendly answer for extra knowledgeable buying and selling.

Easy methods to Commerce with CCI with Dynamic Channels MT4 Indicator

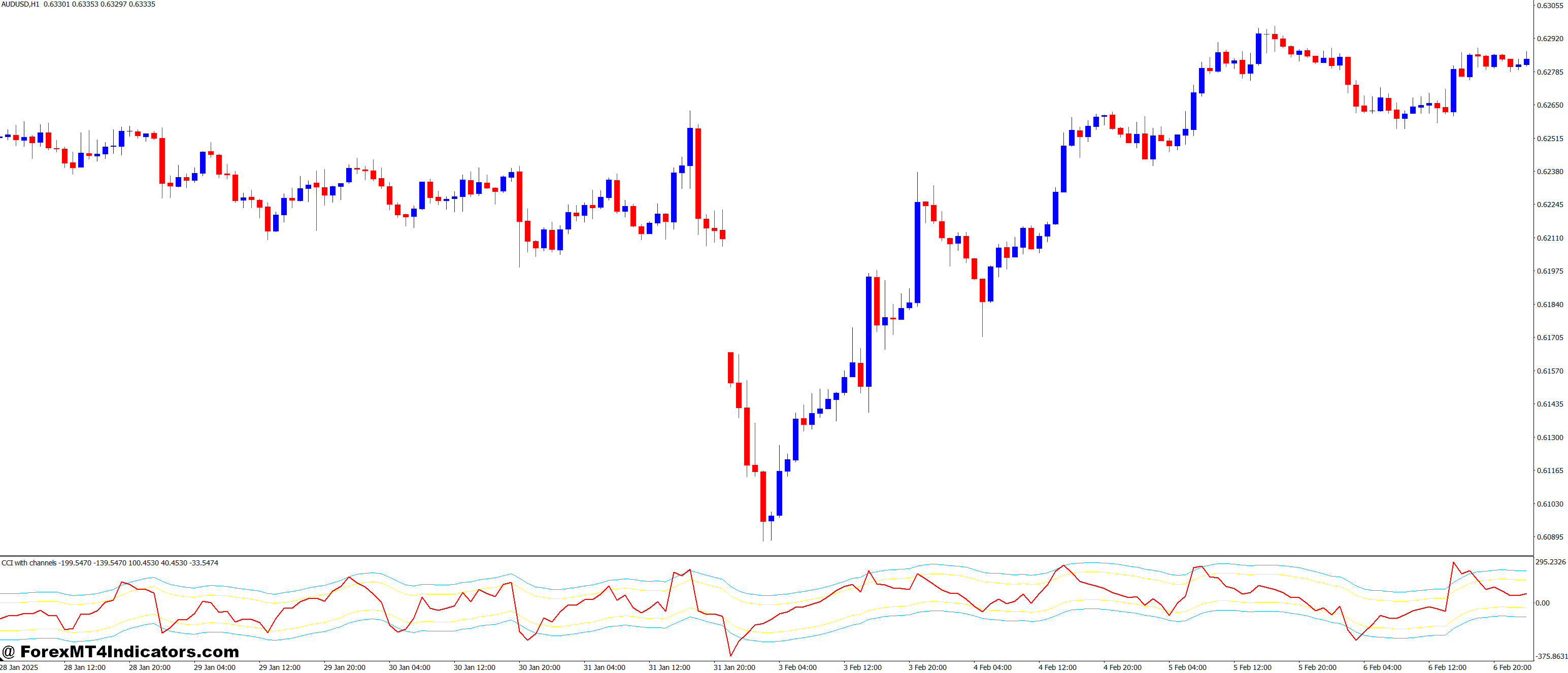

Purchase Entry

Situation 1: CCI crosses beneath the decrease dynamic channel, indicating an oversold market situation.

Situation 2: After crossing beneath, the CCI line begins to maneuver upward, signaling a possible reversal.

Situation 3: Affirm the general development is bullish (e.g., worth is above the shifting common or uptrend).

Entry: Place a purchase order when the CCI line begins shifting upwards after hitting the decrease dynamic channel.

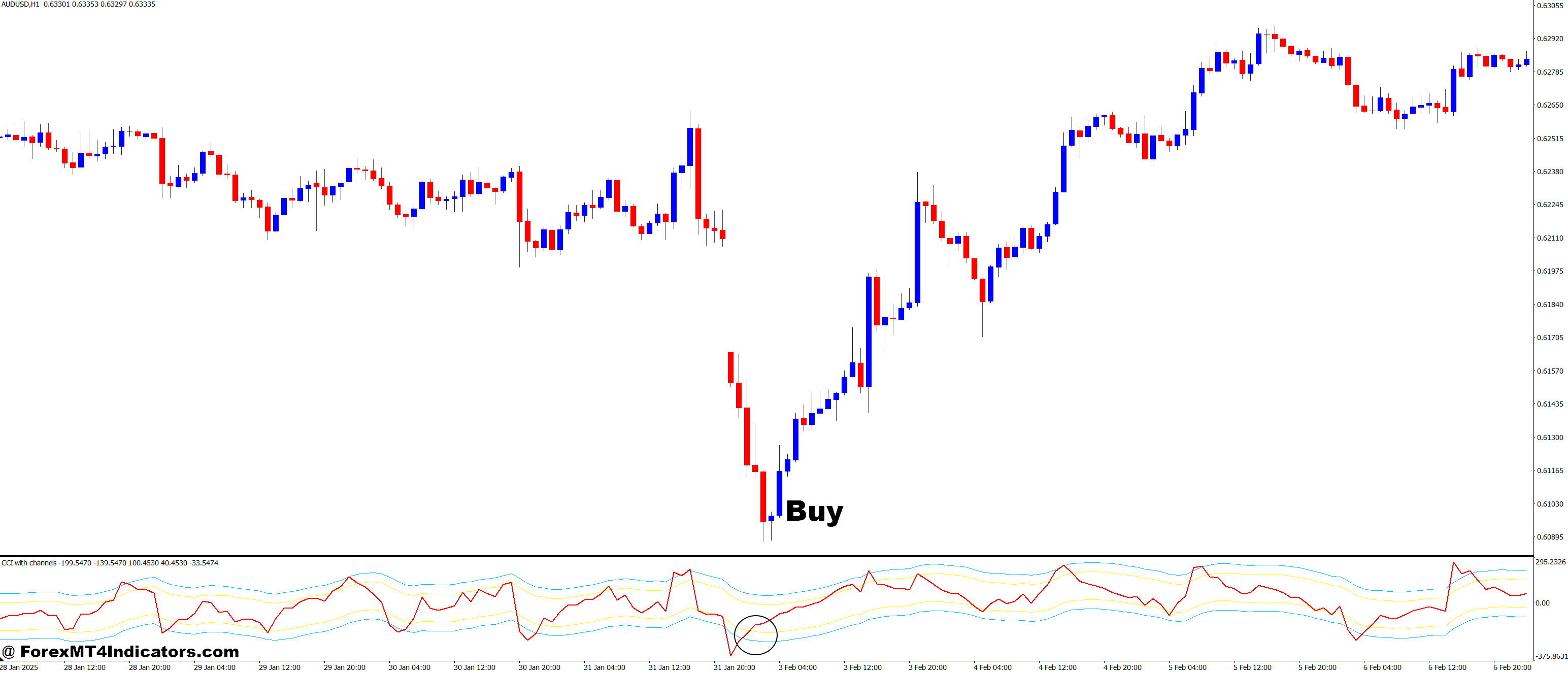

Promote Entry

Situation 1: CCI crosses above the higher dynamic channel, indicating an overbought market situation.

Situation 2: After crossing above, the CCI line begins to maneuver downward, signaling a possible reversal.

Situation 3: Affirm the general development is bearish (e.g., worth is beneath the shifting common or downtrend).

Entry: Place a promote order when the CCI line begins shifting downwards after hitting the higher dynamic channel.

Conclusion

The CCI with Dynamic Channels MT4 Indicator is effective for merchants trying to improve their technical evaluation and enhance their decision-making course of. Its capacity to regulate to market situations and supply clear visible alerts makes it an important instrument for these searching for to navigate the complexities of the market. By using this indicator, merchants could make extra assured, well timed, and knowledgeable selections, giving them an edge of their buying and selling journey. Whether or not you’re new to buying and selling or a seasoned professional, this indicator is a must have on your toolbox.

Advisable MT4/MT5 Dealer

XM Dealer

Free $50 To Begin Buying and selling Immediately! (Withdraw-able Revenue)

Deposit Bonus as much as $5,000

Limitless Loyalty Program

Award Successful Foreign exchange Dealer

Extra Unique Bonuses All through The Yr

Unique 50% Money Rebates for all Trades!

>> Signal Up for XM Dealer Account right here with Unique 50% Money Rebates For All Future Trades [Use This Special Invitation Link] <<

Already an XM consumer however lacking out on cashback? Open New Actual Account and Enter this Associate Code: 𝟕𝐖𝟑𝐉𝐐