Motive to belief

Strict editorial coverage that focuses on accuracy, relevance, and impartiality

Created by trade specialists and meticulously reviewed

The very best requirements in reporting and publishing

Strict editorial coverage that focuses on accuracy, relevance, and impartiality

Morbi pretium leo et nisl aliquam mollis. Quisque arcu lorem, ultricies quis pellentesque nec, ullamcorper eu odio.

Este artículo también está disponible en español.

Cardano is at present buying and selling round a key day by day demand zone, with bulls trying to step in and stabilize value motion after weeks of decline. The broader crypto market stays beneath strain, pushed by persistent macroeconomic instability and heightened international uncertainty. As monetary markets proceed to react to inflation fears, commerce tensions, and erratic coverage strikes, altcoins like ADA have been hit particularly onerous.

Associated Studying

Analysts are warning that the downtrend might proceed, with little indication of a shift in sentiment within the close to time period. Many imagine Cardano might observe the broader altcoin market, which has seen deep corrections throughout the board.

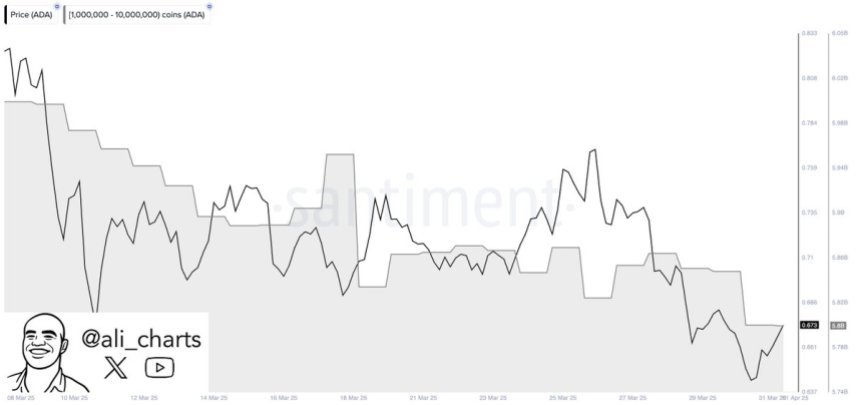

Including to the bearish outlook, on-chain knowledge from Santiment reveals that whales offloaded practically 200 million ADA all through March. This important sell-off by giant holders has solely added to the downward strain, fueling issues that extra draw back could also be forward if bulls fail to reclaim key ranges.

As Cardano trades close to assist, the subsequent few classes will probably be essential. Whether or not bulls can defend this zone and push ADA greater — or if continued whale promoting results in additional losses — stays to be seen in a market that’s displaying few indicators of stability.

Cardano Struggles As Whale Promoting Intensifies

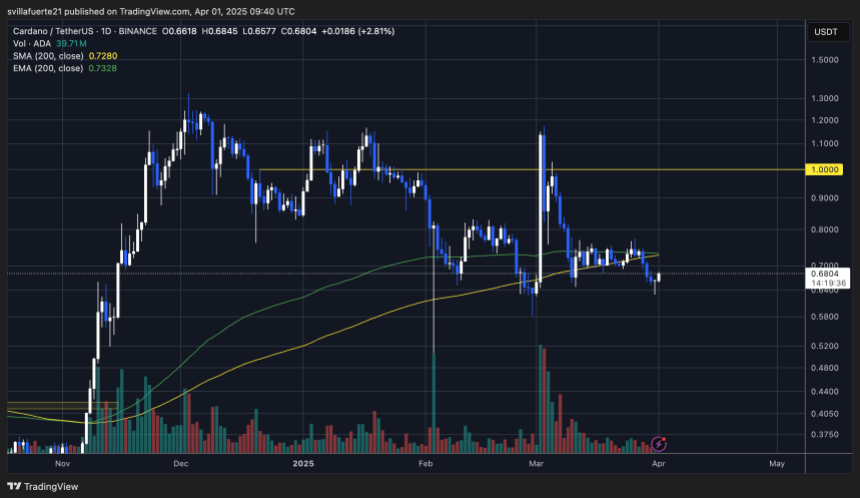

Cardano has seen a pointy decline, dropping greater than 45% of its worth since March 3 amid a wave of promoting strain that has rocked the broader crypto market. As macroeconomic instability continues to drive uncertainty throughout monetary markets, altcoins like ADA have taken the brunt of the injury. Now buying and selling close to a vital assist zone, Cardano faces rising strain from each retail sentiment and large-scale holders exiting their positions.

Bulls are in a tough place, needing to step in and defend present ranges to keep away from a steeper correction. If ADA fails to carry assist, analysts warn {that a} drop towards the $0.50 mark is probably going — a stage not seen in months and one that would affirm a shift right into a deeper bearish part.

Including to the bearish outlook, high analyst Ali Martinez shared insights revealing that whales bought practically 200 million ADA throughout March alone. This type of large-scale promoting from high holders usually indicators fading confidence and provides additional draw back strain to already struggling value motion.

With market sentiment nonetheless fragile, Cardano’s subsequent transfer will doubtless rely upon whether or not bulls can reclaim momentum — or if continued whale promoting and macro fears drag the worth decrease. Holding present ranges is crucial to forestall ADA from sliding into much more vital territory within the days forward.

Associated Studying

Worth Motion Particulars: Bulls Defending Crucial Demand

Cardano (ADA) is at present buying and selling at $0.68 after failing to carry the $0.75 stage, signaling a continuation of bearish momentum. The current drop additionally pushed ADA under the 200-day transferring common (MA) and exponential transferring common (EMA), each sitting across the $0.72 mark — vital indicators which have now flipped into resistance. This loss has additional weakened the short-term construction, leaving bulls with restricted choices.

The following key stage to observe is $0.62. Bulls should defend this zone with conviction to forestall a deeper selloff and try and type a base for restoration. Reclaiming ranges above $0.72 could be step one in regaining management, however with out fast shopping for strain, the outlook stays fragile.

If Cardano fails to carry above $0.62, analysts warn {that a} sharp decline into the $0.57–$0.55 vary might observe. This may mark a big breakdown and will set off panic promoting, particularly as general market sentiment stays shaky.

Associated Studying

With ADA beneath strain and technical ranges breaking down, the approaching days will probably be essential. Bulls should act swiftly to reclaim misplaced floor, or threat watching Cardano slide additional into decrease demand zones.

Featured picture from Dall-E, chart from TradingView