The Trump tariffs, introduced on April 2, are so wantonly silly and harmful that I can barely stand to debate them. However as a result of their affect shall be up to now ranging, I can’t not.

Amusingly, Russia, which is already tremendous sanctioned, is a giant relative winner by already having tailored by reoriented its commerce to the World South and turning into much more of an autarky. However it’ll nonetheless expertise second-hand penalties as its commerce companions begin limping.

Nevertheless, even thought the US is about to reap the harvest Trump is sowing, the US in all probability is not going to be the sooner massive sufferer. Odds favor rising economic system crises first. Do not forget that Jomo has been warning for a minimum of a 12 months and a half of the rising odds of economic upheaval in creating international locations, due amongst different factor to a continued excessive greenback and gradual progress globally. Regardless that the enterprise pointed to the greenback falling in a world forex index, that’s weighted in direction of massive economies. As we’ll talk about additional, Southeast Asian currencies declined in opposition to the buck. Some international locations on this area have been already see as prone to a disaster, not resulting from overseas debt exposures however extreme home debt. Trump’s kick within the head might push them into the hazard zone.

One other space in danger, with which I’m much less acquainted, is Central America. Their economies rely in a giant manner upon remittances from the US, which Trump is working very exhausting to cut back. The US runs a commerce surplus with Central America however its member states will nonetheless face the “base tariff” of 10%. Not that Trump cares a lot about niceties like treaties (see as an illustration the JCPOA), however per Reuters, Guatemala has already complained that the brand new tariffs violate the DR-CAFTA commerce pact. Mexico, which does run a big surplus with the US, is considerably monetary disaster (versus simply plain tremendous unhealthy recession) protected by advantage of getting giant FX reserves.

The purpose about rising markets is contagion. When (not if) a not-trivial rising economic system goes right into a meltdown, buyers reflexively run for canopy. Any nation that’s colorably just like the one having a seizure shall be shunned. Which means amongst different issues the worth of their forex will fall.

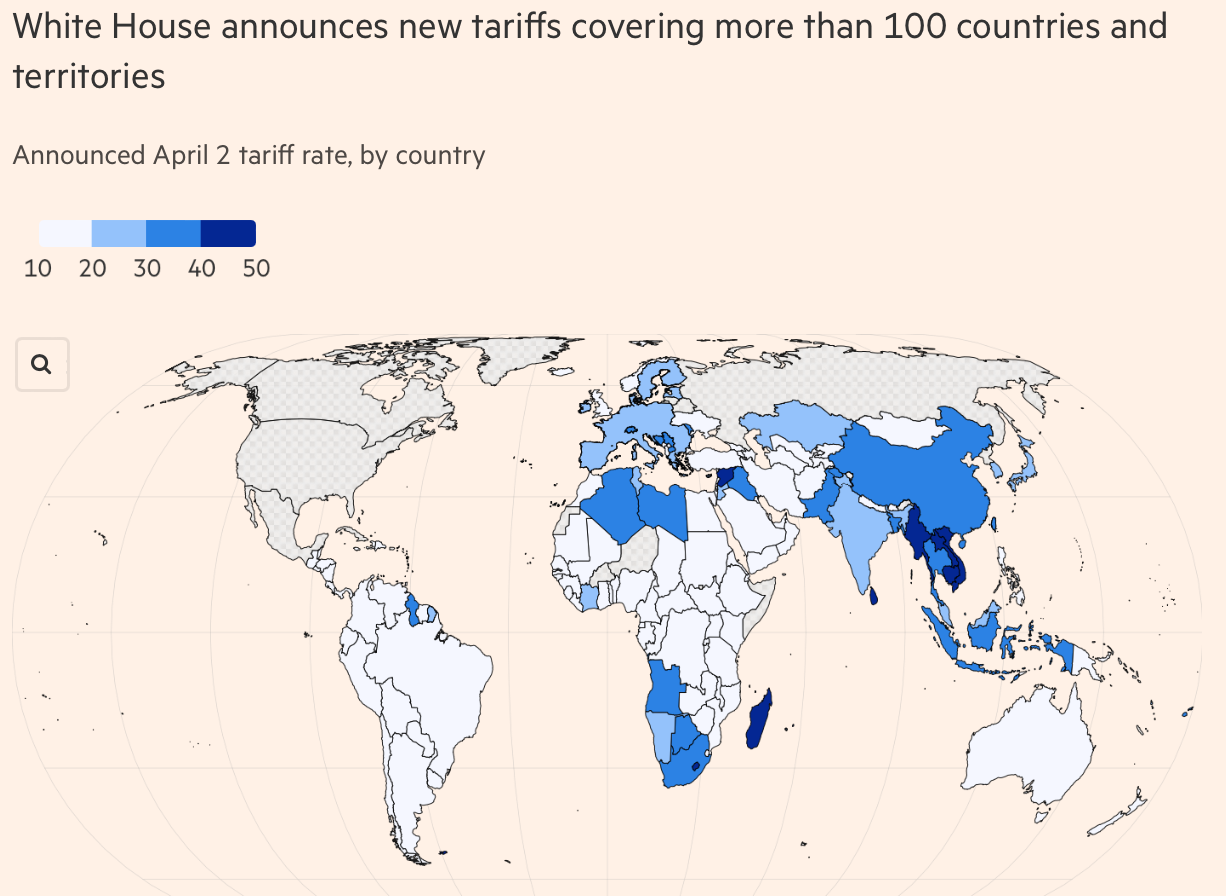

Now that we now have some precise numbers, we are able to count on to see some stabs at evaluation over the approaching weeks. Some consultants tried claiming that China wouldn’t be a lot affected as a result of its export to the US have been solely 3% of GDP. First, that’s not a de minimus quantity. Second, for causes of price and/or discount of controversy, China has moved some manufacturing to Southeast Asia, significantly Vietnam, and Mexico. Third, Trump has additionally focused each nation besides Russia and North Korea. At a minimal, they are going to see a discount of their financial exercise, which can blow again to commerce with China.

If readers have any early sightings from manufactures, exporters, or middlemen, please pipe up.

Some overviews. Right here is the White Home Truth Sheet. Word Trump ritually invokes a nationwide emergency when he’s the one inflicting one. In a separate Truth Sheet, he eradicated the de minimus exemptions beginning Could 5. It isn’t properly drafted however it appears to cowl solely items from China and Hong Kong.

From the Wall Road Journal:

U.S. inventory markets have been poised to open sharply decrease. The U.S. greenback sank greater than 2% in opposition to the euro, Japanese yen and Swiss franc. Oil and gold each fell and buyers dashed for the protection of Treasurys, a response to fears that the tariffs will tip the economic system towards recession.

All U.S. imports shall be topic to a ten% tariff, efficient April 5.

Trump will impose even larger charges on some nations that the White Home considers unhealthy actors on commerce. For instance, Japan faces a 24% obligation and the European Union faces a 20% levy, efficient April 9.

China shall be hit with a brand new 34% tariff, including to earlier duties, just like the 20% tariff Trump imposed over fentanyl. Which means the bottom tariff fee on Chinese language imports shall be 54%, earlier than including pre-existing levies.

The tariffs are pegged to quantities Trump says different international locations impose on the U.S. Right here’s the maths behind the levies.

Some world leaders are vowing to retaliate, whereas others are hopeful there may be nonetheless time to strike a cope with the U.S.

Canada and Mexico are excluded from the reciprocal tariff regime.They’re nonetheless topic to plans to impose 25% tariffs on most imports to the U.S., although the administration has given an exemption for autos and plenty of different items. Right here’s a listing of the merchandise and international locations exempted from the tariffs.

Trump’s 25% tariffs on foreign-made autos and elements took impact at 12:01 a.m. ET.

Extra element from the BBC:

Customized tariffs for ‘worst offenders’

White Home officers additionally stated that they’d impose what they describe as particular reciprocal tariffs on roughly 60 of the “worst offenders”.

These will go into impact on 9 April.

Trump’s officers say these international locations cost larger tariffs on US items, impose “non-tariff” obstacles to US commerce or have in any other case acted in methods they really feel undermine American financial objectives.

The important thing buying and selling companions topic to those customised tariff charges embody:

European Union: 20%

China: 54% (which incorporates earlier tariffs)

Vietnam: 46%

Thailand: 36%

Japan: 24%

Cambodia: 49%

South Africa: 30%

Taiwan: 32%

The Monetary Occasions weighed in with Donald Trump baffles economists with tariff components:

The components used to calculate the tariffs, launched by the US commerce consultant, took the US’s commerce deficit in items with every nation as a proxy for alleged unfair practices, then divided it by the quantity of products imported into the US from that nation.

The ensuing tariff equals half the ratio between the 2, leading to international locations reminiscent of Vietnam and Cambodia — which ship giant quantities of manufactured items to the US however import solely small portions from the US — attracting punitive tariffs of 46 and 49 per cent respectively.

In contrast the UK, with which the US had an annual surplus in items commerce final 12 months, shall be hit solely by the baseline 10 per cent tariff that applies to all international locations barring Canada and Mexico.

Economists argued the USTR methodology was deeply flawed economically and wouldn’t achieve its acknowledged goal of “driving bilateral commerce deficits to zero”. They added that, regardless of the White Home’s claims that “tariffs work”, commerce balances are pushed by a bunch of financial components, not merely tariff ranges….

Economists additionally attacked Trump’s obsession with lowering bilateral commerce deficits to zero as economically illiterate, since there’ll at all times be objects that it’s unattainable or economically unviable for international locations to develop or make themselves — for instance, the US can’t develop its personal bananas on any significant scale.

Some hope that is only a Trump opening bid and aid could be attainable. However the Administration is making confused noises. From NBC:

Trump surrgoates have been sending combined messages within the wake of his shock tariffs announcement yesterday.

On X, Eric Trump, the president’s second-oldest son and the principal of The Trump Group, predicted talks would begin.

“I wouldn’t need to be the final nation that tries to barter a commerce cope with @realDonaldTrump,” he wrote. “The primary to barter will win — the final will completely lose. I’ve seen this film my total life … ”

However on CNN, White Home Press Secretary Karoline Leavitt stated there could be no negotiations. She urged Wall Road to “belief in President Trump” and rejected the concept that Trump would pull again on tariffs earlier than they go into impact.

From CNBC:

Pharmaceutical firms breathed a sigh of aid Wednesday after U.S. President Donald Trump revealed that they’d not be topic to reciprocal tariffs — however that reprieve might show fleeting because the White Home strikes forward with plans for the sector.

The Trump administration is contemplating launching a so-called 232 investigation into prescribed drugs, amongst different industries, which might result in import duties below the Commerce Growth Act, Bloomberg cited a senior administration official as saying on Wednesday.

But in addition from CNBC, evocative of Annie Lennox, “A few of them need to be abused”:

The most recent U.S. tariffs might price the Polish economic system 0.4% of gross home product or roughly 10 billion zlotys ($2.64 billion), in line with a preliminary estimate shared by Polish Prime Minister Donald Tusk.

“A extreme and ugly blow, as a result of it comes from the closest ally, however we are going to survive it. Our friendship should additionally survive this take a look at,” he stated

Bloomberg clears its throat and factors out that up to now, US buyers are the largest losers (not clear that is true outdoors massive and superior economies; Southeast Asian currencies fell versus the greenback):

Donald Trump’s shake-up of the worldwide buying and selling system is hurting US property greater than these in lots of the massive economies he has simply slapped with extra tariffs.

US fairness index futures tumbled greater than 4% after the US President introduced a sweeping collection of tariffs following the market shut on Wednesday, and a gauge of the greenback slumped. However the affect elsewhere was much less excessive. The Stoxx Europe 600 was down 1.3% in morning buying and selling whereas the euro was up 1.3% in opposition to the greenback, hitting its highest degree since October. A broad gauge of Asian shares fell as a lot as 1.7%

For what could appear a parochial take, from the Bangkok Submit:

Southeast Asian shares and currencies fell after Asian rising nations got a number of the largest tariff will increase by US President Donald Trump. Vietnamese shares tumbled.

Vietnam’s fundamental inventory index slid as a lot as 6.2%, heading for its largest one-day drop in additional than 4 years, whereas equities in Thailand, the Philippines, Malaysia and Singapore additionally declined. The Thai baht weakened as a lot as 0.8% in opposition to the greenback, and the Vietnamese dong and Malaysian ringgit additionally dropped.

Southeast Asian property slipped after the area was hit significantly exhausting by the reciprocal tariffs introduced by Trump on Wednesday. He stated the US would place a 46% tariff on Vietnam’s exports, 36% on Thailand’s, and 32% on Indonesia’s. The area’s largest buying and selling companion — China — was closely focused, with Beijing now going through a cumulative 54% tariff….

‘It’s not stunning to see panic promoting as native buyers solely anticipated 10%-to-15% tariffs,” stated Nguyen Anh Duc, head of institutional brokerage and funding advisory at SBB Securities Corp. “Margin lending balances of brokers is sort of excessive and might make issues worse. If inventory costs plunge one other 10%, we might even see margin name pressures.”…

The associated fee to insure Southeast Asian international locations’ sovereign debt additionally climbed. Credit score-default swaps monitoring rising Asia bonds widened by essentially the most in 19 months, in line with merchants…

An additional uptick in commerce tensions could heap extra stress on Asian currencies. The Indonesian rupiah has slumped 2.8% this 12 months and final month fell to the weakest degree because the Asian monetary disaster in 1998.

We’ll want to attend for different footwear to drop, significantly reciprocal tariffs. Nevertheless it’s exhausting to adequately categorical how that is an ignorant and savage act of destruction.