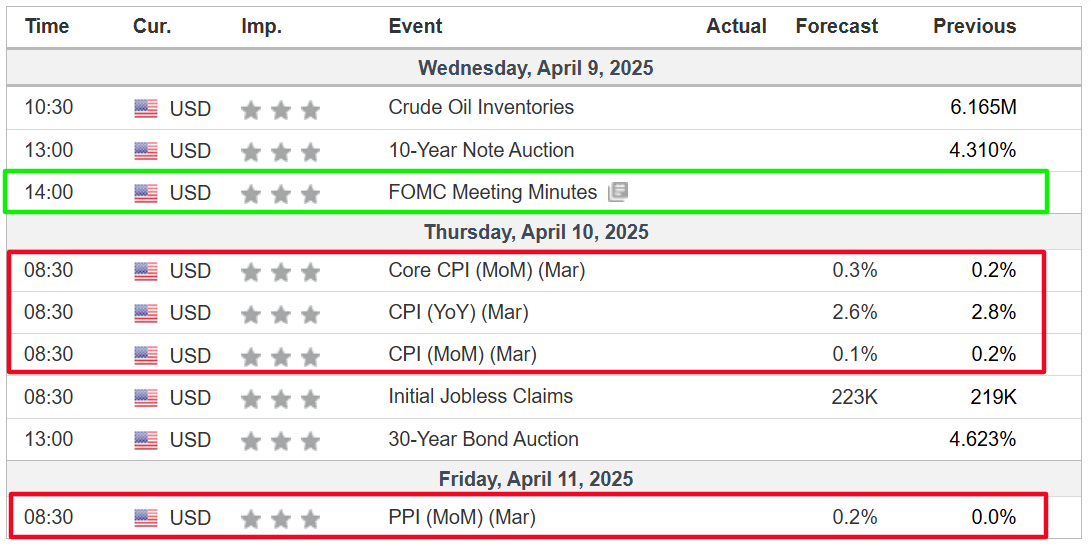

• Inflation information, Fed FOMC minutes, Trump tariff information and the beginning of Q1 earnings season can be in focus this week.

• Cal-Maine Meals’ sturdy progress trajectory makes it a promising purchase forward of its earnings report.

• Delta Air Strains faces industry-wide challenges and financial uncertainties, probably making it a inventory to promote.

• On the lookout for actionable commerce concepts to navigate the present market volatility? Subscribe right here to unlock entry to InvestingPro’s AI-selected inventory winners.

The inventory market bought off sharply for a second day on Friday, with the main indexes struggling their worst week for the reason that breakout of Covid in early 2020, as traders fled riskier property on fears that tariffs imposed by President Donald Trump may spark a commerce conflict and tip the worldwide financial system into recession.

Supply: Investing.com

For the week, the declined 7.9%, the tumbled 9.1%, whereas the tech-heavy slumped 10% to enter a bear market.

Highlighting rising panic amongst traders, the , or Wall Avenue’s worry gauge, closed at its highest stage since April 2020.

Extra volatility may very well be in retailer within the week forward as traders proceed to evaluate the outlook for the financial system, inflation, rates of interest and company earnings amid President Trump’s commerce conflict.

On the financial calendar, most essential can be Thursday’s U.S. client value inflation report for March, which may spark additional turmoil if it is available in increased than expectations.

The CPI information can be accompanied by the discharge of the most recent figures on producer costs. The College of Michigan client sentiment index can also be essential, particularly the report’s readings on inflation expectations.

Supply: Investing.com

Buyers can even give attention to the minutes of the Federal Reserve’s March FOMC assembly. This might give some perception into the long run path of rates of interest.

Elsewhere, a brand new earnings season is ready to get underway, with JPMorgan Chase (NYSE:), Wells Fargo (NYSE:), Morgan Stanley (NYSE:), BlackRock (NYSE:), and Delta Air Strains (NYSE:), a number of the large names on account of report. Commentary about client and enterprise demand can be key.

No matter which path the market goes, beneath I spotlight one inventory prone to be in demand and one other which may see contemporary draw back. Bear in mind although, my timeframe is only for the week forward, Monday, April 7 – Friday, April 11.

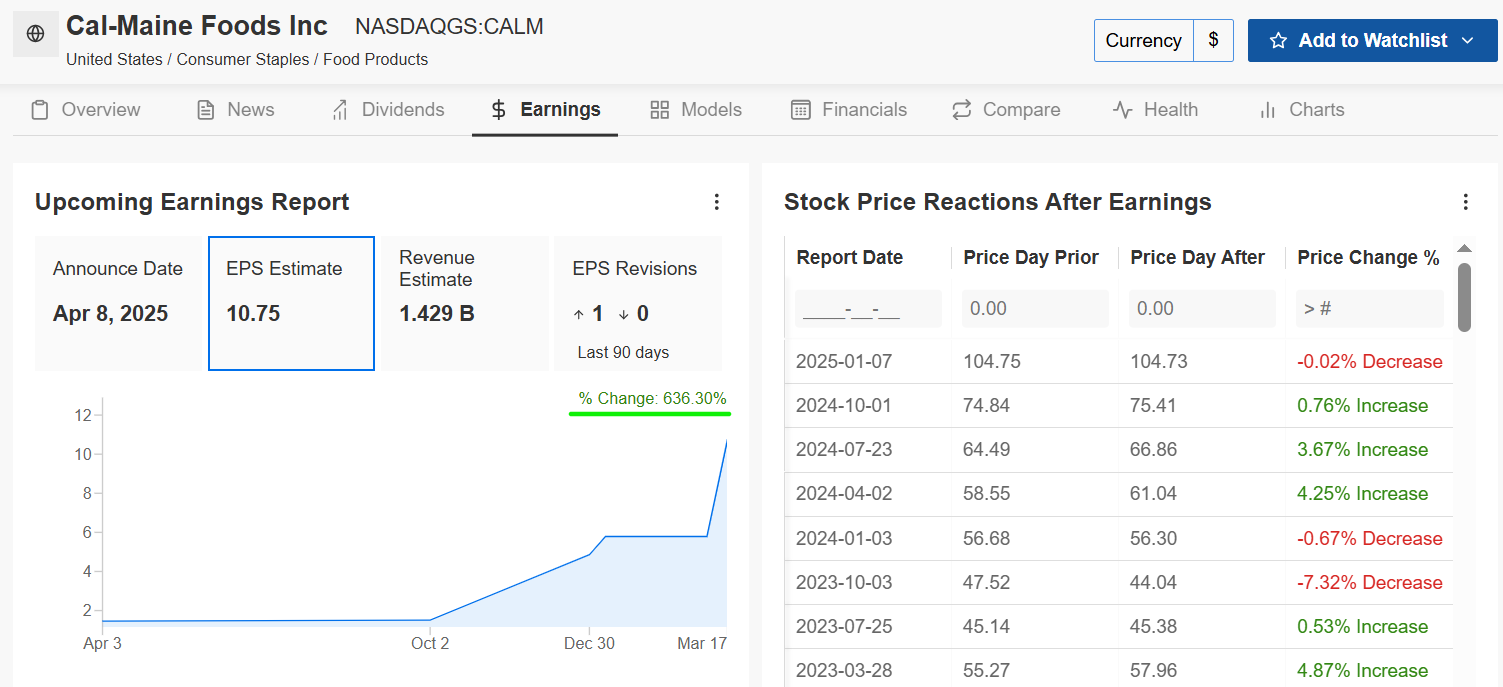

Inventory To Purchase: Cal-Maine Meals

Cal-Maine Meals (NASDAQ:), the nation’s largest egg producer, is gearing as much as report its fiscal third-quarter earnings on Tuesday after the market closes at 4:05PM ET. Based on the choices market, merchants are pricing in a swing of about 9% in both path for CALM inventory following the print.

Analysts are setting a excessive bar, anticipating triple-digit earnings progress—a staggering feat that may mark the third consecutive quarter of explosive positive aspects following a lackluster prior 12 months. This momentum stems from favorable market circumstances, together with elevated egg costs pushed by provide constraints and robust demand.

Supply: InvestingPro

Consensus estimates name for Cal-Maine to ship earnings per share of $10.75, hovering 257% from EPS of $3.01 within the year-ago interval. In the meantime, gross sales for the interval are anticipated to extend 102% yearly to $1.42 billion.

This anticipated progress is underpinned by quite a lot of components, resembling elevated demand for eggs, favorable pricing circumstances, and Cal-Maine’s strategic efforts to optimize manufacturing and distribution.

Regardless of the latest drop in egg costs amid softer client demand, I consider that Cal-Maine’s administration will present upbeat revenue and gross sales steerage for its full fiscal 12 months amid the continued influence of avian influenza on poultry inventories, that are at their tightest in over a decade.

Supply: Investing.com

CALM inventory ended Friday’s session at $92.29 and now testing key resistance ranges inside a two-month consolidation sample. A robust earnings beat may propel shares previous this hurdle, rewarding traders who get in forward of the report.

It’s value mentioning that Cal-Maine Meals exhibits spectacular monetary well being with a ‘VERY GOOD’ total rating of 8.6/10. The corporate’s steadiness sheet is especially sturdy at 9.4/10, indicating minimal debt considerations. Profitability metrics are stable at 8.7/10, although progress scores are extra modest at 7.6/10.

Remember to try InvestingPro to remain in sync with the market pattern and what it means on your buying and selling. Subscribe now and place your portfolio one step forward of everybody else!

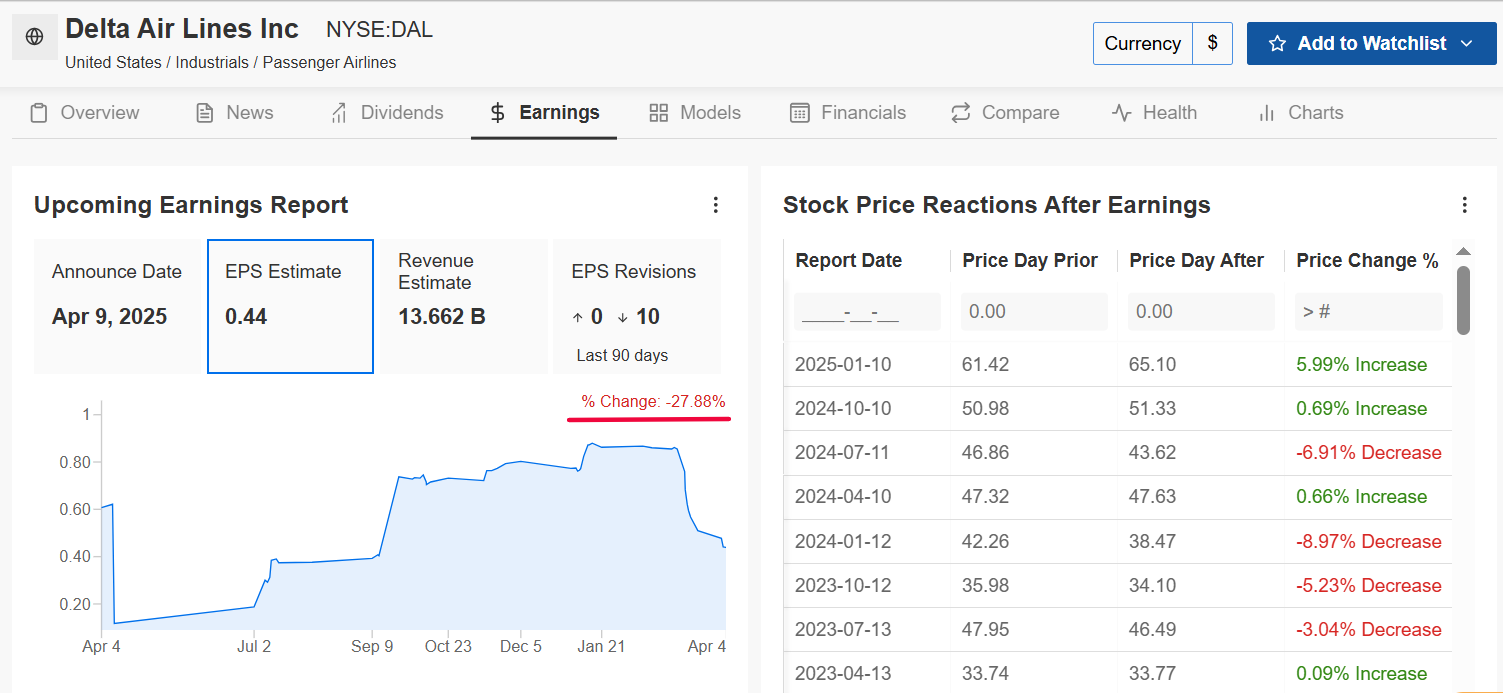

Inventory to Promote: Delta Air Strains

Contrastingly, Delta Air Strains is going through headwinds that make it a inventory to strategy with warning this week. The airline is scheduled to report its first-quarter earnings on Wednesday at 6:30AM ET, and the outlook is bleak.

As may very well be anticipated, an InvestingPro survey of analyst earnings revisions reveals rising pessimism forward of the print, with all ten analysts protecting Delta revising their EPS estimates downward prior to now 90 days. Tender client spending, pushed by a difficult financial surroundings, has put stress on Delta’s profitability and income.

Supply: InvestingPro

Wall Avenue sees the Atlanta, Georgia-based airliner incomes $0.44 per share, falling 2% from the year-ago interval. In the meantime, Delta is predicted to publish a modest 7% enhance in income, as much as $13.6 billion.

The airline {industry}, significantly Delta, has been navigating turbulent skies on account of a mixture of things, together with diminished bookings, decreased company journey, and heightened value sensitivity amongst shoppers. These challenges are additional compounded by the broader financial uncertainty and the potential influence of tariffs on worldwide journey demand.

Holding that in thoughts, Delta CEO Ed Bastian is prone to strike a cautious tone relating to the corporate’s fiscal 2025 outlook. Market contributors count on a large swing in DAL inventory after the print drops, based on the choices market, with a doable implied transfer of almost 10% in both path.

Supply: Investing.com

DAL inventory fell beneath $35 for the primary time since late 2023 on Friday earlier than closing the session at $37.25. At present valuations, Delta has a market cap of $23.9 billion, making it essentially the most helpful airline firm on the earth. Shares, that are buying and selling beneath their key shifting averages, are down 38.4% in 2025.

Not surprisingly, InvestingPro’s AI-powered quantitative mannequin charges Delta Air Strains with a ‘FAIR’ Monetary Well being Rating of 5.9/10, reflecting considerations over its spotty steadiness sheet, declining free money circulate, and weakening progress prospects.

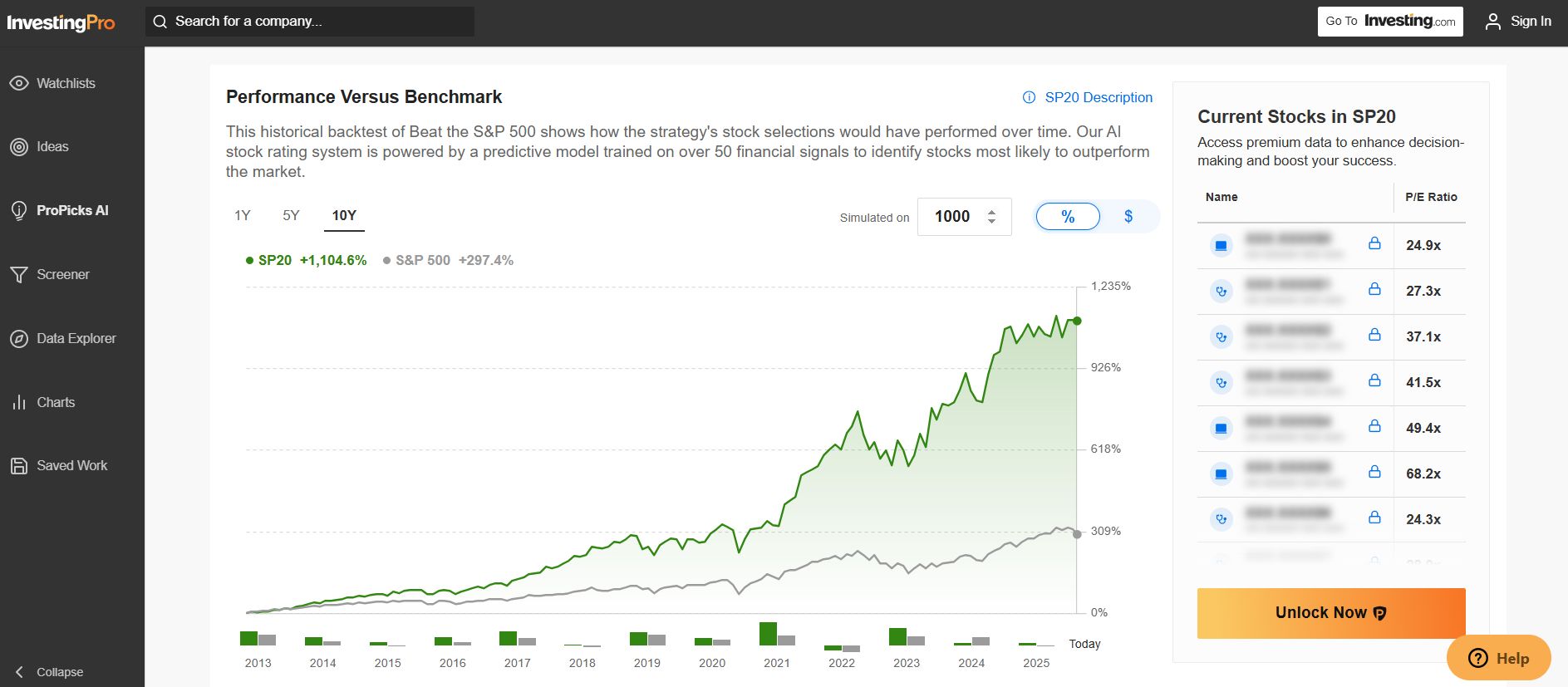

Whether or not you’re a novice investor or a seasoned dealer, leveraging InvestingPro can unlock a world of funding alternatives whereas minimizing dangers amid the difficult market backdrop.

Subscribe now and immediately unlock entry to a number of market-beating options, together with:

• ProPicks AI: AI-selected inventory winners with confirmed monitor report.

• InvestingPro Truthful Worth: Immediately discover out if a inventory is underpriced or overvalued.

• Superior Inventory Screener: Seek for the very best shares based mostly on tons of of chosen filters, and standards.

• Prime Concepts: See what shares billionaire traders resembling Warren Buffett, Michael Burry, and George Soros are shopping for.

Disclosure: On the time of writing, I’m quick on the S&P 500 and by way of the ProShares Brief S&P 500 ETF (SH) and ProShares Brief QQQ ETF (PSQ).

I often rebalance my portfolio of particular person shares and ETFs based mostly on ongoing danger evaluation of each the macroeconomic surroundings and corporations’ financials.

The views mentioned on this article are solely the opinion of the creator and shouldn’t be taken as funding recommendation.

Observe Jesse Cohen on X/Twitter @JesseCohenInv for extra inventory market evaluation and perception.