appears unbelievable! The fabulous short-term purchase and promote zones chart for gold.

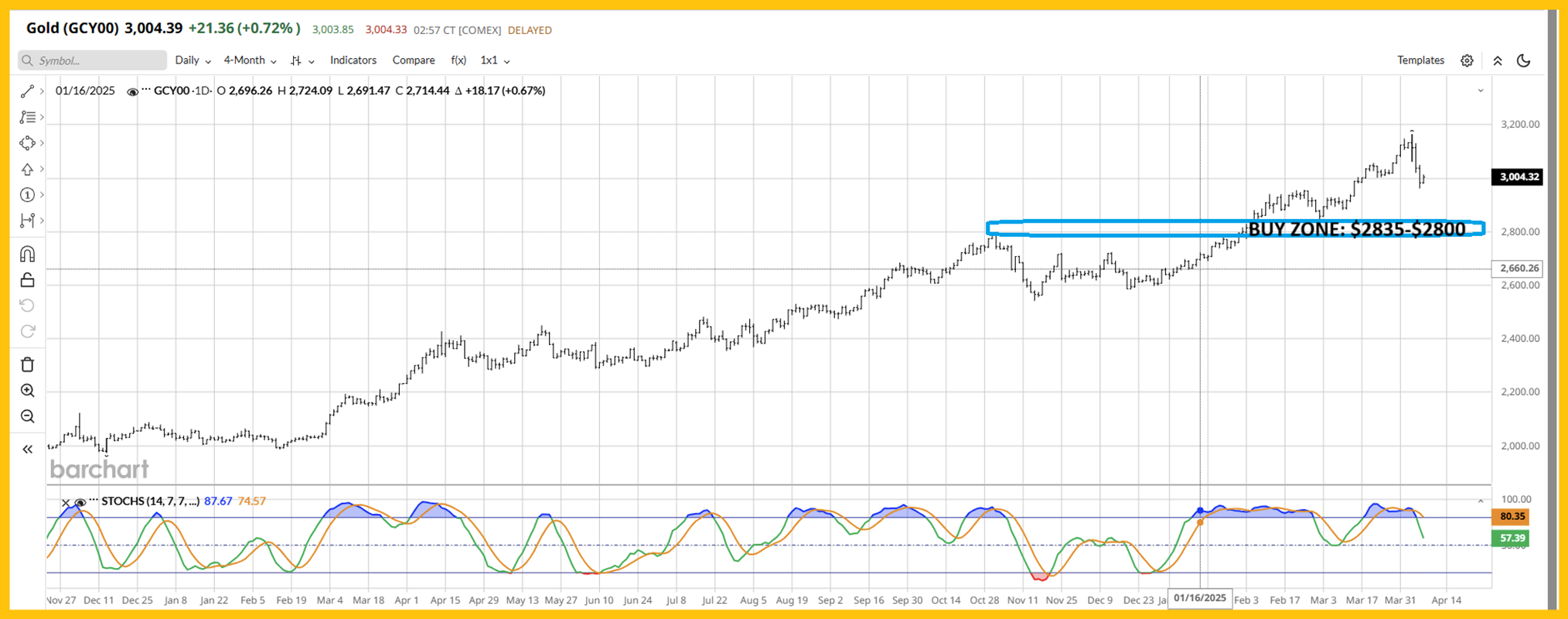

We purchased the strategy to the $2956 horizontal help and resistance (HSR) zone yesterday, and the market is surging increased in the present day.

The important thing to purchasing these zones is to play the chances with out “calling a low”. The excellent news is that odds are very excessive that gold bounces properly increased from right here.

Word the washed-out place of the 14,7,7 collection Stochastics oscillator. It’s deeply oversold, and rallies have normally occurred from key oscillator positioning like this prior to now.

Traders want to have the ability to purchase a couple of zone, like the massive business merchants do.

In a nutshell, no soldier goes into a significant struggle anticipating to win it with only one battle. Gold market traders must suppose much less like inventory market value chasers do, and extra like gridline warriors.

On that notice, the following massive purchase zone for gold is the $2835-$2800 zone. If this rally fails and there’s one other dip, gold in all probability trades on this second horizontal help zone, and execs (present and potential) should be patrons if that happens.

Governments are modern-day pirates. President Donnie’s obsession with taking pictures tariff tax cannon balls is turning into extra of a priority to his billionaire backers every day however…

If a billionaire price $20billion loses $10billion in a wipeout of the US inventory market and financial system, they nonetheless have vastly extra buying energy than they’ll ever want.

In distinction, the common US citizen has lots of debt and lives nearly paycheck to paycheck. Their tiny financial savings are principally within the type of mortgaged houses and 401k inventory market plans. They’ll’t deal with far more inflation… nevertheless it’s coming:

If a product is made in Vietnam by employees which are paid a $100/week pittance by a US company, there will likely be an enormous spike in the price of that product if its “onshored” to America, the place employees would balk at working for a wage like their Vietnamese counterparts receives a commission. Costs will rise for waylaid shoppers, and company earnings will fall… for the businesses fortunate sufficient to not be utterly destroyed by the tariffs.

Within the massive image, American authorities pirates live an empire transition fantasy, one the place a tiny inhabitants of 150million fiat-oriented US employees lord over the remainder of the world… and their authorities retains the world consistent with tariff tax cannons.

The issue for the pirates is that the majority residents within the East (and some savvy ones within the West!) are centered on supreme cash gold relatively than failed cash fiat.

This chart is principally an image of a fiat-obsessed man with a water pistol standing on the backside of Niagara Falls… and the person imagines he can shoot extra water up the falls than the golden falls pour onto him. Does that sound sane?

The US authorities is preventing one other unwinnable struggle, like fiat cash itself is preventing an unwinnable struggle towards gold.

Quick-term merchants ought to take into consideration switching their purpose… from getting extra fiat to getting extra gold. That’s as a result of the massive development for fiat is down, down, and down. Even with the most effective short-term techniques, the mission to get extra fiat by consistently shopping for and promoting gold is vastly extra onerous than the other mission, which is to purchase and promote fiat… to get extra gold!

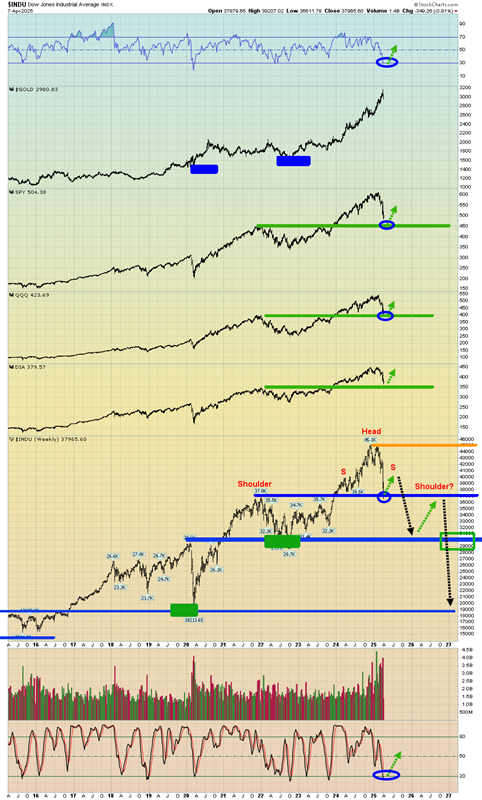

A take a look at the inventory market. The US inventory market is clearly due for a bounce, and that’s excellent news for silver and the miners, which regularly surge because the Dow does too.

Because the US authorities pirates press on with their stagflationary tariff taxing insanity, an enormous divergence/decoupling occasion possible lies forward… for gold and the inventory market.

This US inventory market rally in all probability solely types the precise shoulder of a H&S prime, and whereas US charges can drop within the short-term because of the market mayhem… they may start to rise because the inflation from the tariffs seems.

An excellent-sized mixture of the market meltdowns of 1929 and 1966 seems to be on the history-rhymes horizon. The one query is: Are gold bugs ready?

The weekly GDX (NYSE:) chart. There was a textbook pullback after the breakout and an enormous rally straight to $60 is one reasonable state of affairs from right here.

Right here’s one other state of affairs for the weekly chart, the place a rally additionally begins now, lasts maybe till June or July, and from there a extra typical deal with on the cup sample types… with that deal with formation lasting till about October… after which there’s a rally not simply to $60, however to $100 and extra!

Gamblers may be aggressive gold inventory patrons right here, however extra conservative traders might want to wait till September/October, which can also be usually when a seasonal low for the metals happens. I’m anticipating an enormous stagflation-oriented US inventory market crash at the moment as effectively, with gold shares faring a lot better than the inventory market… after which the miners ought to start a significant surge that ought to final effectively into the 12 months 2026!