US shares ended Thursday’s session in unfavorable territory. Nevertheless, the surged 8.5% off its lows on Wednesday because the administration introduced a 90-day tariff pause for all international locations besides China. Sound acquainted? In Tuesday’s , we wrote:

For these of you with bearish nightmares, we share one essential takeaway from Monday’s market curler coaster. Whereas there’s a good probability the market could discover new lows over the approaching months, we should admire that there’s loads of gas for a sizeable bounce. The one piece of essential proof supporting this thesis was a Tweet claiming that Trump is contemplating a 90-day pause in all tariffs besides these on China.

After the official announcement of the 90-day pause, the “gas” propelled the market to its third-largest proportion achieve in historical past. The 2 situations forward of it each occurred in October 2008. The takeaway is that information about retalitory tariffs, pausing the tariffs, and any tariff agreements will proceed to drive markets with excessive volatility.

If Trump can flip the 90-day pause interval right into a sequence of constructive agreements with our largest commerce companions, there’s extra bullish gas within the tank. Negotiations with China shall be most essential. Retaliatory tariffs from China after which America have weighed on markets. The longer negotiations take, particularly with China, the extra unfavorable client and investor sentiment will negatively affect the financial system and markets.

Market Buying and selling Replace

, we mentioned the market response to the 90-day pause in tariffs, which despatched the shares surging within the third-largest single-day rally since WWII. As we acknowledged yesterday:

“With the weekly “promote sign” in place, we’ll very seemingly see the market both stall at these ranges (greatest case state of affairs) or retrace to check latest lows (most certainly case.). Let’s see if we are able to get some follow-through on at this time’s buying and selling.

Sadly, the market didn’t get a follow-through to yesterday’s shopping for, and it was a basic bear market rally. As mentioned yesterday morning, we took motion and used the rally to rebalance portfolio and cut back publicity to fairness danger.

“As we’ve mentioned over the past two weeks, the deep oversold situation of the market would result in a pointy reflexive rally that needs to be offered into to scale back danger and rebalance portfolios. That rally got here yesterday, and we’re lowering danger throughout all fashions this morning. Step one is to scale back publicity to positions, cut back goal weights, and enhance money ranges. The subsequent step, if wanted, shall be so as to add a brief place in portfolios. Right now is the 1st step.”

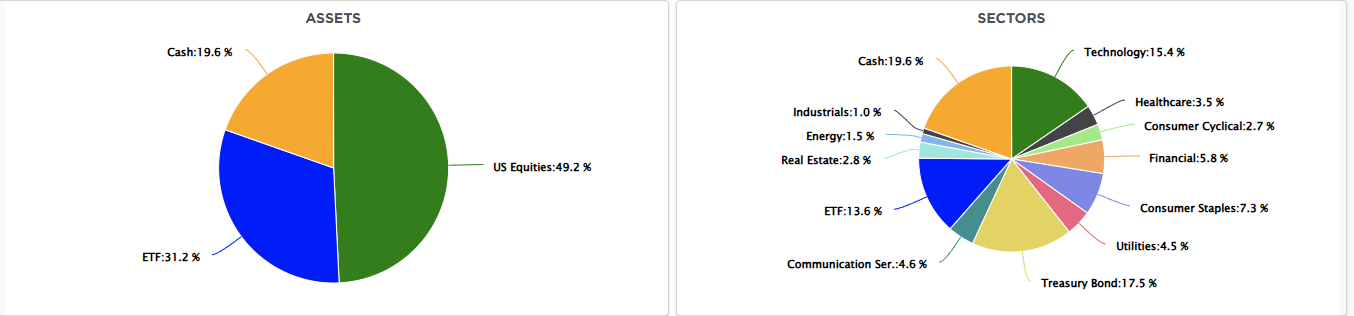

We elevated money ranges to just about 20% within the 60/40 portfolio and dropped fairness publicity to 49%. With the weekly promote sign in place, we’ll look to scale back fairness danger by one other 4-5% by including a brief place to the portfolio on the following rally.

Regardless of inflation dropping sharply and the and bond auctions going effectively, the danger within the bond market is spreading via the fairness markets. For extra info on the “foundation commerce” and why it’s such a danger, right here is an excerpt from the Present on Wednesday.

The market stays oversold within the close to time period, which ought to present some alternative for reflexive bounces to scale back danger and rebalance as wanted. I think that the bigger corrective course of stays effectively intact, and an eventual retest of lows, if not new lows, is probably going earlier than this course of is full.

Commerce accordingly.

CPI Surprises To The Draw back

The (-.1%) and (+.1%) got here in 0.2% beneath expectations. 12 months over 12 months (+2.8%), the Fed’s most popular inflation measure, is beneath 3% for the primary time since March 2021. Additionally essential, the so-called tremendous core CPI fell by 0.24%, the bottom studying since Could 2020. Supercore is the core calculation but in addition excludes housing.

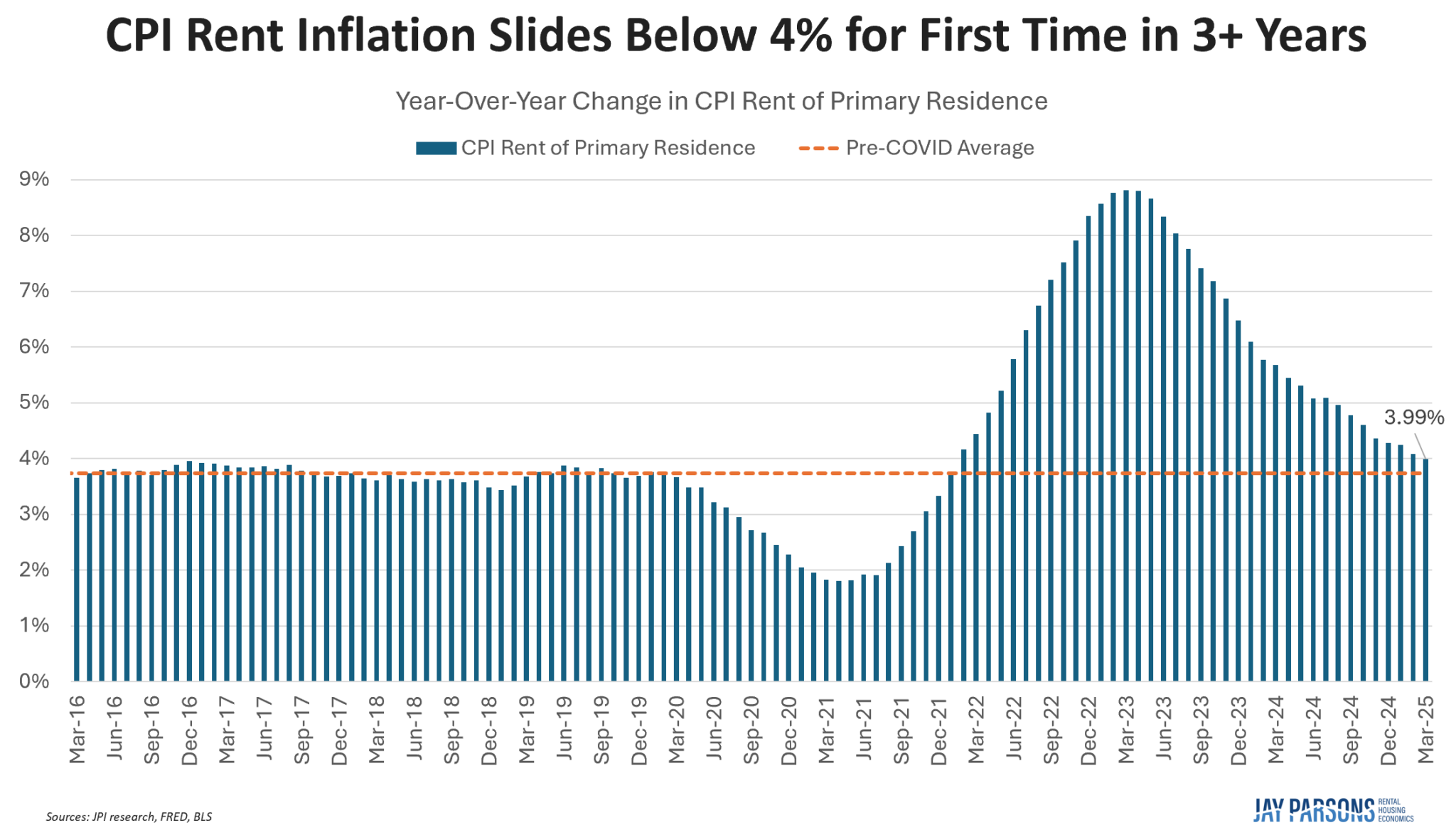

CPI lease inflation, as proven beneath, continues to say no steadily. It now sits a hair beneath 4%. Extra disinflation in rents and shelter costs will proceed, however the tempo could gradual from right here.

Whereas the info is superb, the preliminary affect of tariffs has but to be felt. Inflation knowledge might grow to be risky within the coming months because the tariffs’ inflationary and deflationary results ripple via the financial system.

Tweet of the Day