Holding $75,000 help is essential for stability.

A break above $82,300 may sign bullish momentum.

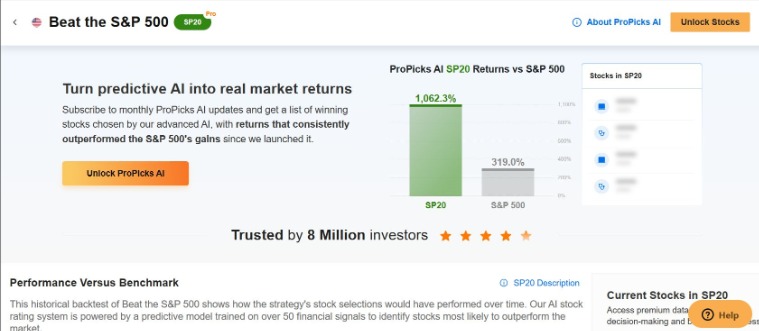

In search of extra actionable commerce concepts to navigate the present market volatility? Subscribe right here to unlock entry to ProPicks AI winners.

The 90-day tariff delay introduced by US President Donald Trump gave a lift. The cryptocurrency bounced again from an vital help stage. On April 9, its value went up by almost 10% to $83,500. This fast soar, backed by on-chain information, confirmed that buyers react quick to good world information.

Tariff Delay Sparks Bitcoin Rally

When the Trump administration lowered tariffs to 10% for many nations—however not China—it eased market uncertainty for 90 days. This transfer sparked a robust response from each the inventory and crypto markets. The , , and all rose by 5% to eight%, displaying renewed curiosity in dangerous property.

On the crypto aspect, the halt in capital outflows from Bitcoin ETFs means that investor confidence is returning. In line with CoinGlass information, spot Bitcoin ETFs noticed a complete outflow of $326 million earlier within the week. However after Trump’s announcement, these outflows got here to a cease.

On-Chain Knowledge Confirms Institutional Curiosity

CryptoQuant information reveals that 48,575 BTC—value about $3.6 billion—was moved to financial savings addresses on April 9. That is the largest one-day BTC influx in three years and alerts that long-term or institutional buyers could also be coming again.

IntoTheBlock evaluation additionally factors to a pointy rise in inflows to giant BTC wallets over the previous 90 days. Notably, there is a rise in addresses holding between 1,000 and 10,000 BTC. This implies that huge buyers are adjusting their positions. Regardless of short-term value dips, long-term holders appear assured and are persevering with to purchase.

China Uncertainty Nonetheless a Vital Threat

Though the tariff cuts utilized to most nations, China was unnoticed. The US raised tariffs on Chinese language items to 145%, and China responded with a 125% tariff on US merchandise. This transfer is prone to worsen the US-China commerce struggle.

Within the brief time period, this stress is including to volatility within the crypto market. Nonetheless, there’s a rising perception {that a} potential US-China commerce deal may spark a brand new rally in BTC costs. Together with the tariff struggle, ongoing foreign money tensions are additionally hurting each economies. A commerce settlement may ease stress and result in a optimistic shift within the markets.

Bitcoin Technical Outlook

Bitcoin is presently trying to find technical route. Whereas macro information and on-chain exercise level to upside potential, the BTC value continues to be transferring in a falling channel, indicating that bearish danger stays. A possible commerce deal might be an efficient catalyst for a pattern reversal in costs.

Bitcoin continues to maneuver in a falling channel sample on the every day chart, with the value hovering round $81,600. The worth, particularly beneath the brief and medium-term transferring averages, reveals that technical stress continues. In line with technical indicators and significant ranges, BTC has vital resistance to beat. The short-term EMA ranges are nonetheless above the value, indicating that the adverse momentum continues. To ensure that Bitcoin to recuperate, it wants to interrupt above these averages first.

The primary technical hurdle on the every day chart is the $82,300 stage, which works as an vital resistance as it’s the intersection of the higher band of the falling channel and the Fib 0.236 stage. BTC’s failure to cross this stage may improve promoting stress.

The second resistance stage is at roughly $87,000, which coincides with the Fib 0.382 retracement stage and the 3-month EMA standing out as a affirmation level of a pattern reversal.

Outstanding Help Ranges on Potential Pullbacks

The important thing help stage to look at beneath is $75,000. This zone is a robust technical help, lining up with the midpoint of the falling channel and the 0.618 Fibonacci stage. If this space breaks, promoting may improve, pushing the value down towards the $65,600 vary. Earlier this week, consumers stepped in strongly at $75,000, displaying it additionally acts as a psychological help.

On the every day chart, the Stochastic RSI has turned upward from oversold ranges. This implies a doable short-term rebound. Nonetheless, for any restoration to final, Bitcoin wants to interrupt above the $82,300 resistance with sturdy quantity.

Proper now, Bitcoin stays in a sideways-to-downward pattern within the brief time period. A transparent transfer previous $82,300 is required for bullish momentum to construct. Till then, the vary between $75,000 and $87,000 shall be key. Day by day closes close to these ranges will assist sign the following main transfer.

***

You’ll want to take a look at InvestingPro to remain in sync with the market pattern and what it means to your buying and selling. Whether or not you’re a novice investor or a seasoned dealer, leveraging InvestingPro can unlock a world of funding alternatives whereas minimizing dangers amid the difficult market backdrop.

Subscribe now and immediately unlock entry to a number of market-beating options, together with:

ProPicks AI: AI-selected inventory winners with confirmed observe file.

Superior Inventory Screener: Seek for the most effective shares based mostly on tons of of chosen filters, and standards.

High Concepts: See what shares billionaire buyers equivalent to Warren Buffett, Michael Burry, and George Soros are shopping for.

Disclaimer: This text is written for informational functions solely. It isn’t supposed to encourage the acquisition of property in any manner, nor does it represent a solicitation, provide, suggestion or suggestion to speculate. I wish to remind you that every one property are evaluated from a number of views and are extremely dangerous, so any funding choice and the related danger belongs to the investor. We additionally don’t present any funding advisory providers.