Up to date on April seventeenth, 2025 by Nathan Parsh

Buyers searching for excessive yields might think about buying shares of Enterprise Growth Firms, also called BDCs. These shares continuously have a better dividend yield than the broader inventory market common.

Some BDCs even pay month-to-month dividends.

You may obtain our full Excel spreadsheet of all month-to-month dividend shares (together with metrics that matter, like dividend yield and payout ratio) by clicking on the hyperlink beneath:

Oxford Sq. Capital Company (OXSQ) is a Enterprise Growth Firm (BDC) that pays a month-to-month dividend. Oxford Sq. can also be a extremely yielding inventory, with a yield of practically 17% primarily based on anticipated dividends for fiscal 2025. That is 12 instances the common yield of the S&P 500.

Nonetheless, buyers ought to all the time needless to say the sustainability of a dividend is simply as vital, if no more so, than the yield itself.

BDCs typically present excessive ranges of revenue, however many (together with Oxford Sq.) have hassle sustaining their dividends, significantly throughout recessions. This text will study the corporate’s enterprise, progress prospects, and consider the protection of the dividend.

Enterprise Overview

Oxford Sq. Capital Corp. is a Enterprise Growth Firm (BDC) specializing in financing early- and middle-stage companies by way of loans and Collateralized Mortgage Obligations (CLOs). You may see our full BDC listing right here.

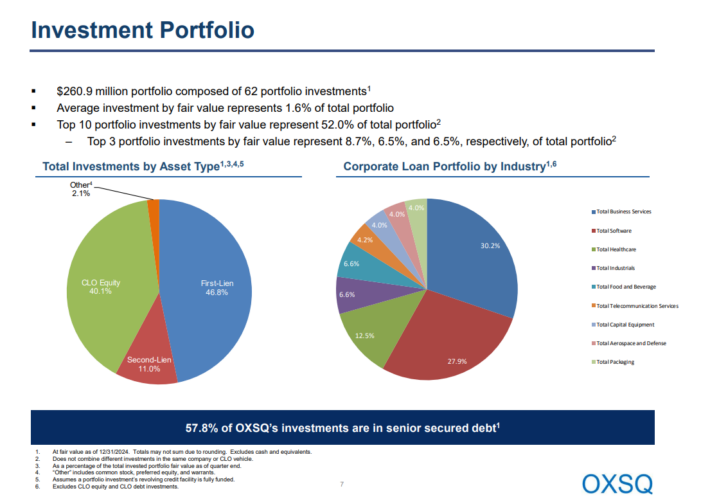

The corporate holds a well-diversified portfolio of First–Lien, Second–Lien, and CLO fairness property unfold throughout seven industries, with the very best publicity in enterprise providers and software program, at 30.2% and 27.9%, respectively.

Supply: Investor presentation

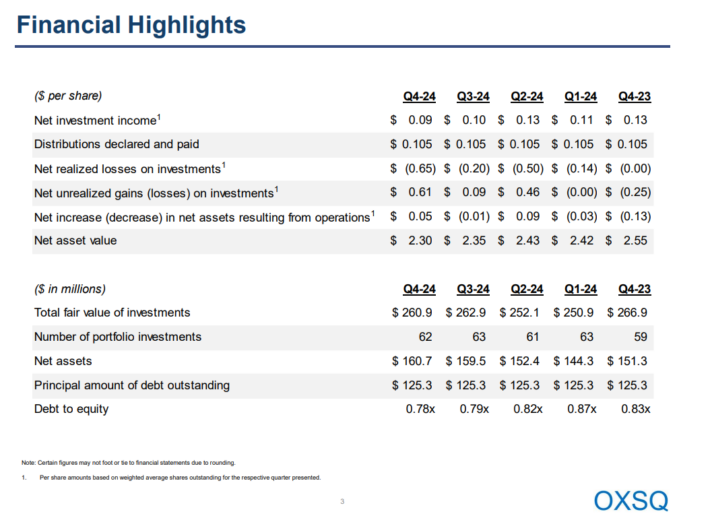

On February 28, 2025, Oxford Sq. introduced its This fall and 2024 outcomes for the interval ended December 31, 2024.

Supply: Investor presentation

The corporate reported whole funding revenue of $42.7 million for the yr, a lower of $9.1 million from the earlier yr. This decline was primarily as a result of a discount in curiosity revenue from debt investments.

The weighted common yield on debt investments improved to fifteen.8% from 13.3% within the earlier yr. The money distribution yield on money income-producing CLO fairness investments rose barely to 16.2% from 15.3% on a sequential foundation. The efficient yield on CLO fairness investments was 8.8%, down marginally from 9.6% in Q3 2024.

Complete bills had been $16.2 million for the yr, down considerably from $24.5 million within the prior yr because of the absence of incentive charges.

Consequently, web funding revenue (NII) totaled $26.4 million, or $0.42 per share, in comparison with $27.4 million, or $0.48 per share, within the earlier yr. The corporate’s web asset worth (NAV) per share of $2.30 was down from $2.55 a yr in the past. Based mostly on its present portfolio, Oxford Sq. tasks to have a full-year 2025 funding revenue per share (IIS) of $0.42.

Progress Prospects

The corporate’s funding revenue per share had been declining at an alarming price, as financing turned cheaper, stopping Oxford Sq. from refinancing at its earlierly larger charges. Moreover, the corporate has traditionally over-distributed dividends to shareholders, thereby eroding its NAV and future revenue era as a result of lowered asset holdings.

Contemplating that the Fed has not lower rates of interest because of the present financial uncertainty, we anticipate Oxford Sq. to generate secure funding revenue per share within the close to time period.

The 2020 dividend lower ought to allow Oxford Sq. to retain some money, hopefully permitting it to start out regrowing its NAV. With charges unlikely to proceed moving any decrease for the second, revenue era ought to stabilize.

With funding throughout a large breadth of various industries, Oxford Sq. has a fairly balanced portfolio. The corporate’s prime three industries do make up a lot of the portfolio, however they’re in numerous areas of the economic system. This gives some safety within the occasion of a downturn in a single business.

Nonetheless, if charges decline over time, the corporate’s receivables could possibly be additional pressured, worsening its monetary efficiency yearly. Total, we consider that the corporate’s future investment revenue era carries substantial dangers, whereas a possible recession and an antagonistic financial surroundings might severely injury its curiosity revenue.

Dividend Evaluation

Oxford Sq. solely lately started paying a month-to-month dividend, with the primary being distributed in April 2019. Complete dividends paid over the previous few years are listed beneath:

2015 dividends: $1.14

2016 dividends: $1.16 (1.8% enhance)

2017 dividends: $0.80 (31% decline)

2018 dividends: $0.80 (no enhance)

2019 dividends: $0.80 (no enhance)

2020 dividends: $0.6120 (23.5% decline)

2021 dividends: $0.42 (31.4% decline)

2022 dividends: $0.42 (Flat)

2023 dividends: $0.54(28.5% enhance)

2024 dividends: $0.42 (22% decline)

Shareholders obtained a small enhance in 2016, adopted by three massive dividend reductions since 2017. This inconsistency in dividend payout is because of the firm’s risky monetary efficiency. Final yr’s dividend whole was negatively impacted by the absence of a $0.12 per share particular dividend that occurred in 2023. The month-to-month cost has remained the identical for the reason that 2020 lower.

Oxford Sq. at the moment pays a month-to-month dividend of $0.035 per share, equaling an annualized payout of $0.42 per share.

Based mostly on a full-year payout of $0.42 per share, Oxford Sq. inventory yields 16.9%. Though the dividend cuts in recent times have been substantial, the dividend yield stays remarkably excessive. That mentioned, buyers mustn’t focus solely on yield; dividend security is a vital consideration for revenue buyers, and on this regard, Oxford Sq. leaves lots to be desired.

Based mostly on our expectation of a full-year funding revenue per share of $0.42 for 2025, the corporate is projected to take care of a 100% dividend payout ratio for 2025. Nonetheless, if funding revenue declines from present ranges, one other dividend lower might consequence.

Ultimate Ideas

Oxford Sq. boasts a strong enterprise mannequin, characterised by diversification throughout numerous funding property and industries. The corporate has additionally taken steps to construct up its much less dangerous asset place whereas lowering its reliance on riskier CLOs.

That mentioned, Positive Dividend recommends that risk-averse buyers keep away from Oxford Sq.. We consider that the dividend doesn’t supply sufficient security. The corporate distributes primarily all of its funding revenue, leaving little room for maneuver. Any decline in funding revenue might result in additional dividend cuts, making Oxford Sq. a much less engaging funding choice for buyers searching for secure and safe sources of revenue.

Don’t miss the sources beneath for extra month-to-month dividend inventory investing analysis.

And see the sources beneath for extra compelling funding concepts for dividend progress shares and/or high-yield funding securities.

Thanks for studying this text. Please ship any suggestions, corrections, or inquiries to help@suredividend.com.