Printed on April eleventh, 2025 by Nathan Parsh

Corporations that pay month-to-month dividends may also help traders safe constant money flows, offering revenue extra recurrently than those who pay quarterly or annual funds.

That stated, simply 76 firms at present provide month-to-month dividend funds, which might severely restrict an investor’s choices. You possibly can see all 76 month-to-month dividend-paying names right here.

You possibly can obtain our full Excel spreadsheet of all month-to-month dividend shares (together with metrics that matter, like dividend yield and payout ratio) by clicking on the hyperlink under:

One title that we have now not but reviewed is Savaria Company (SISXF), a Canadian-based firm that operates within the accessibility business. Shares at present yield greater than 3.6%, which is greater than twice the typical yield of the S&P 500 Index.

This text will consider the corporate, its enterprise mannequin, and its dividend to find out whether or not Savaria Company is an effective candidate for buy.

Enterprise Overview

Savaria Company is a specialty industrial equipment firm that gives accessibility options for the aged and disabled. Although the corporate has a market capitalization of simply $789 million, Savaria Company has a stable world footprint.

The corporate operates in Canada, the U.S., the U.Ok., Germany, China, and Italy. Savaria Company has greater than 1 million sq. ft of manufacturing house, 30 direct gross sales workplaces, and 17 product and distribution facilities.

Savaria Company contains a number of enterprise segments, together with Accessibility, Affected person Care, and Tailored Autos.

Accessibility manufactures merchandise akin to stairlifts for straight and curved staircases and wheelchair platform lifts. This section contributes ~70% of income. Affected person Care, which accounts for 21% of income, manufactures and markets therapeutic help surfaces for medical beds and different medical tools. Tailored Autos produces autos to be used by sufferers with mobility difficulties. This section is the smallest inside the firm, making up lower than 10% of whole income. The corporate was based in 1979 and is predicated in Laval, Quebec, Canada.

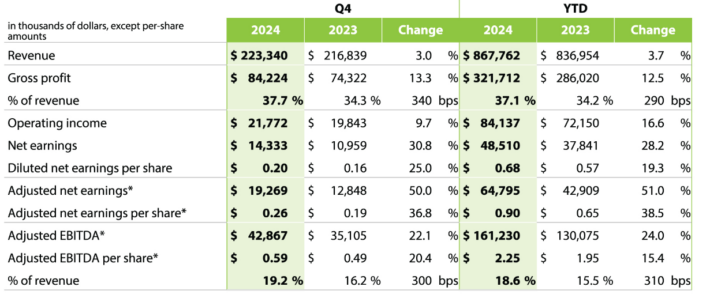

The corporate reported stable monetary outcomes for the fourth quarter of 2024.

Supply: Fourth Quarter Earnings Outcomes

Income reached $223.3 million, a rise of three.0% in comparison with This autumn 2023. This progress was pushed by 0.9% natural progress and a 2.1% optimistic overseas alternate impression. The corporate’s Accessibility section had 3.4% natural progress throughout the quarter, whereas the Affected person Care section improved 4.5%. Gross revenue rose by 12.5%, and working revenue improved by 16.6%, reflecting larger margins and elevated effectivity.

Savaria’s adjusted EBITDA for the quarter was $42.87 million, up 22.1% from the earlier 12 months, with an adjusted EBITDA margin of 19.2%. The Accessibility section had a very robust efficiency, with an adjusted EBITDA margin of 19.8%. Affected person Care maintained a wholesome 19.1% margin. Moreover, Savaria diminished its internet debt ratio to 1.63, signaling improved monetary well being and liquidity, with out there funds of $242.8 million for future investments and progress.

Development Prospects

Savaria Company has quite a few tailwinds that ought to assist the corporate proceed to develop. First, the corporate’s major markets are seeing aged folks make up a better proportion of the entire inhabitants. Within the U.S. alone, these over 65 are projected to make up greater than 20% of the inhabitants by 2030. Folks on this age group are inclined to require extra help with mobility.

Subsequent, the overwhelming majority of older folks want to stay of their houses. In keeping with AARP, practically 80% of individuals over 50 wish to keep of their houses as they age. Greater than two-thirds say that their properties have accessibility points inside and outdoors the house. Savaria ought to have the ability to capitalize on this development because it buys up smaller gamers within the business.

Supply: Investor Presentation

Savaria Company estimates that the worldwide long-term market will develop at 6% yearly by 2030, a stable, if not spectacular, progress price. By the top of this decade, the U.S. is forecasted to have greater than 20 million folks requiring long-term care.

Given that folks reside longer, wish to stay of their houses, and have accessibility challenges, an organization like Savaria Company is poised to profit from product demand.

The corporate gives quite a lot of merchandise, from chair lifts to autos to beds, that may enormously enhance the standard of life for patrons. This will additionally assist folks stay of their houses as a substitute of coming into an grownup care middle, which may be far more costly than the merchandise that Savaria Company markets. Folks wishing to stay of their residence may very properly be prepared to buy a product if it implies that they will proceed to reside as they’ve.

Dividend Evaluation

Savaria Company started paying an annual dividend earlier than switching to a quarterly dividend in 2013. By late 2017, the corporate transformed to its present month-to-month cost schedule.

Funds have fluctuated for U.S. traders because of foreign money alternate, however the dimension of the dividend has steadily elevated over time. U.S. traders obtained $0.37 in annual dividends in 2024 and are anticipated to obtain $0.39 in 2025. For essentially the most half, dividend progress has been very low during the last 5 years. We don’t anticipate that it will change.

The dividend hasn’t elevated materially prior to now and isn’t forecasted to take action within the close to future as a result of excessive payout ratio. Final 12 months, Savaria Company’s payout ratio was 79%. It must be famous that the corporate has raised its dividend for 12 consecutive years in native foreign money.

With outcomes exhibiting indicators of progress, the dividend is probably going protected. A downturn within the enterprise may name that into query, particularly contemplating the debt on the corporate’s stability sheet.

The annualized price of $0.39 for U.S. traders ends in a 3.6% yield.

Closing Ideas

Savaria Company is a small, month-to-month dividend-paying firm that’s well-positioned to benefit from people who find themselves dwelling longer. With most individuals wanting to stay of their houses, tackling accessibility and mobility challenges will seemingly be a major business within the coming decade.

This positions the corporate in an advantageous spot. A rising enterprise ought to assist defend its dividends and supply the capital wanted to pay down debt to a way more manageable degree. Decrease debt would additionally assist to guard the dividend. Buyers on the lookout for month-to-month revenue and entry to a rising inhabitants would possibly discover Savaria Company a lovely funding possibility.

Don’t miss the sources under for extra month-to-month dividend inventory investing analysis.

And see the sources under for extra compelling funding concepts for dividend progress shares and/or high-yield funding securities.

Thanks for studying this text. Please ship any suggestions, corrections, or inquiries to help@suredividend.com.