Germany IFO enterprise local weather beat forecasts

Adidas rises 1.9% after upbeat earnings

DAX restoration runs into resistance

USD/JPY Falls as US-China De-escalation Hopes Fade

USD rally fades with commerce tariff headlines in focus

US composite PMI fell to a 16-month low

USD/JPY recovers from 140.00 low, however shouldn’t be but a reversal

is falling, giving again yesterday’s positive factors because the USD recovers losses steam. The temper is souring, benefiting the secure haven yen amid doubts over US-China de-escalation.

The is as soon as once more beneath stress after having fun with a pointy bounce within the earlier session. Donald Trump backed away from threats to fireside Federal Reserve chair Jerome Powell and moved in direction of a softer stance on China, supporting the USD.

While U.S. Treasury Secretary Scott Bessent mentioned on Tuesday that the continuing tariff slowdown towards China is unsustainable, the Trump administration additionally mentioned that the US will set tariffs on China over the approaching weeks and it is determined by China as to how quickly these come down. The feedback raised doubts over any de-escalation, placing the US greenback beneath stress.

In line with the Federal Reserve , considerations over falling enterprise confidence and rising prices within the US are growing. In the meantime, U.S. enterprise exercise slowed to a 16-month low in April because the US financial outlook deteriorated as a consequence of Trump’s tariff insurance policies.

In the meantime, Federal Reserve officers may assist restrict USD losses as a consequence of hawkish feedback. Jerome Powell mentioned final week that the US central financial institution was in no rush to maneuver on and cautioned that Trump’s commerce tariffs level to a stagflation outlook.

The USD stays depending on tariff headlines. US sturdy items and jobless claims information will even be launched later immediately.

On the within, forex has been boosted by international occasions slightly than home fundamentals. Alongside the primary it’s been the favoured secure haven within the foreign exchange house and can more likely to stay so.

The unfavourable influence on the Japanese economic system from tariff uncertainty and stress on inflation from the surging may preserve the OJ on the sidelines for now.

USD/JPY Technical Evaluation

USD/JPY continues to commerce in a falling channel, making a sequence of decrease lows and decrease highs. The worth bumped into assist at 139.90 and recovered increased, though it stays beneath the mid-point of the falling channel. The RSI stays beneath 50 and factors downward favouring sellers.

Sellers might want to take out the 140 assist zone to create a decrease low and prolong the downtrend.

Consumers would want to rise above 143.50, the weekly excessive, to increase positive factors in direction of the 145 spherical quantity and 146 resistance. An increase above right here negates the near-term selloff.

The and its European friends are falling on Thursday as buyers weigh up blended company outcomes and stay cautious amid the altering US tone surrounding the commerce struggle with China.

The scenario concerning commerce tariffs on China stays unclear. Whereas the White Home’s willingness to de-escalate the commerce struggle helped European shares and Wall Road get better on Wednesday, doubts are creeping again in after the Trump administration prompt it was as much as China to come back ahead, one thing Beijing has to date proven little willingness to do.

On the financial calendar, German improved barely to 86.9, forward of the 85.2 anticipated. That is definitely a greater determine than feared, given the commerce uncertainty. The German was additionally higher than anticipated yesterday, rising to 48 forward of the 47.6 forecast, and these two surveys are carefully linked.

On the earnings entrance, Adidas (OTC:) is rising 1.9%, the highest performer after the German sportswear maker reported Q1 gross sales and earnings above expectations.

Elsewhere, Brenntag and SAP have been the most important fallers, buying and selling over 3% decrease.

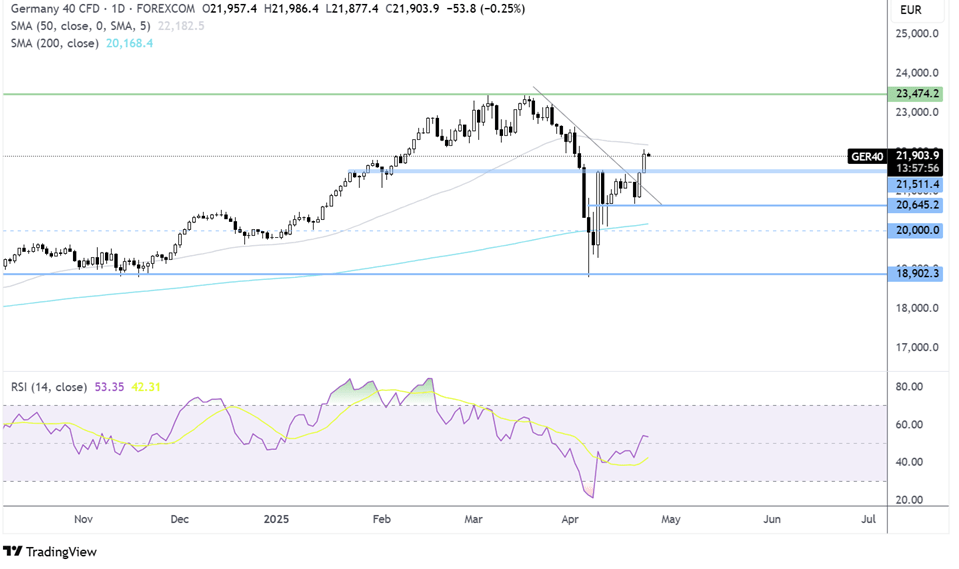

DAX Forecast – Technical Evaluation

The DAX has prolonged its restoration from the 18,800 2025 low, rising above the 200 SMA and 21,500 earlier than operating into resistance just under the 50 SMA at 21,900, having created the next excessive.

Consumers will look to increase the rise above 22,000 and the 50 SMA in direction of 22,500.

Instant assist is at 21,500, with a break beneath her negating the near-term uptrend. Beneath right here 21,670 the weekly low comes into play.

Authentic Submit