What’s the most effective inventory buying and selling platform to make use of?

Whether or not you’re a newbie or an skilled dealer, it’s good to check your choices and brokerage companies to be sure you’re gaining access to the belongings you wish to commerce and options that can assist you with all the pieces from selecting investments to rebalancing your portfolio.

Public com has been round since 2019 and in some ways, it revolutionized the world of on-line buying and selling.

You might be questioning about Public.com’s security and asking: Is Public.com legit?

On this Public com evaluate, we’ll inform you concerning the firm’s historical past and mission, its security options and the safety measures that hold customers protected, and the way it compares to different on-line brokerages.

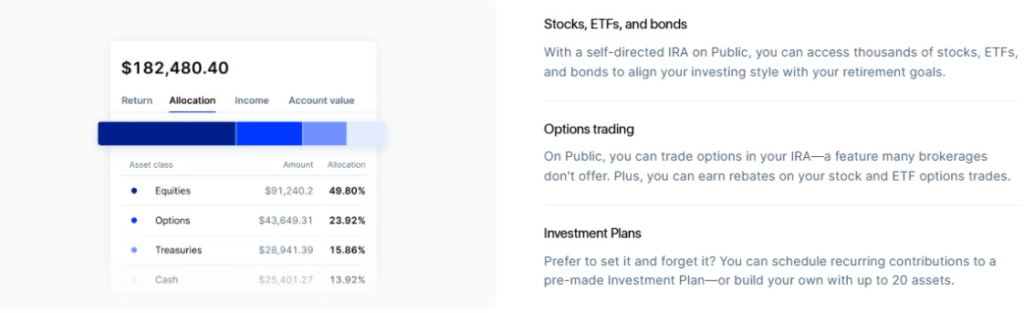

We’ll additionally discuss how Public.com permits customers to commerce shares, bonds, mutual funds, ETFs, futures, choices, crypto and presents a excessive yield money account.

Preserve studying to get all the data you should determine whether or not Public.com is best for you!

Is Public.com Legit? Right here’s What You Ought to Know

Public.com hasn’t been round so long as a few of the better-known on-line brokerages, however that doesn’t imply it isn’t legit.

Firm Background and Founding

Public.com was first based in 2019 and have become the primary on-line buying and selling platform to supply commission-free, fractional buying and selling. Robinhood and different platforms rapidly adopted swimsuit.

Their mission is to “give folks each alternative to develop their wealth.”

Stated one other method, Public.com needs to make investing straightforward and does so by offering a user-friendly interface and reasonably priced charges, in order that anyone who needs to can bounce in and begin constructing a portfolio.

For the reason that firm’s inception, it has added options and belongings that enable for portfolio diversification and administration. You should purchase and promote shares, bonds, treasury bonds, mutual funds, ETFs, crypto, and different asset courses, along with a excessive yield money account.

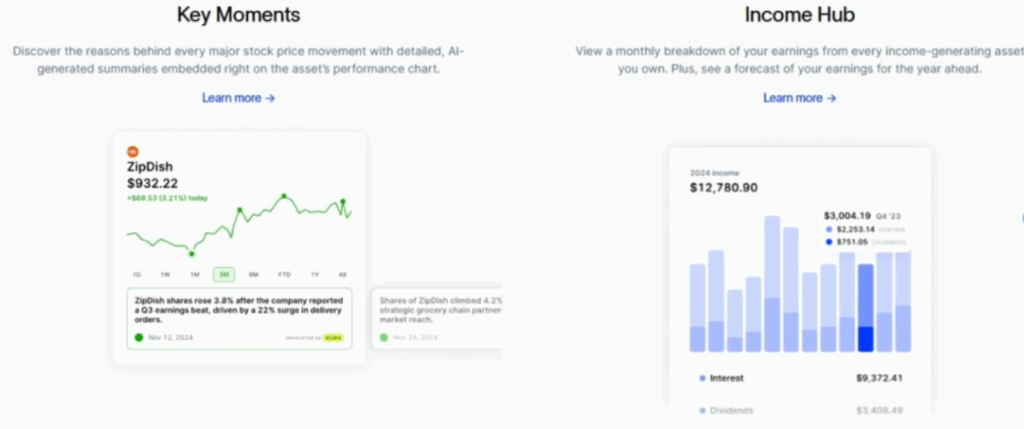

Public.com and public premium customers get entry to helpful instruments, knowledge, and even AI-powered funding insights to assist them handle their investments, make knowledgeable choices, and improve their wealth.

Professional Tip:

Earn a 4.1% yield in your money as we speak with Public.com!

Possession Construction and Funding

Through the years since its founding, Public.com has obtained funding from quite a lot of non-public buyers. A few of the names which have offered capital embody Lakestar, Tiger World, actress Zoe Saldana, and skateboarding celebrity Tony Hawk.

One of many issues we like about Public.com is the corporate’s dedication to transparency. Listed here are a couple of highlights.

Public.com brokerage accounts are held with Open to the Public Investing, Inc, a registered broker-dealer with FINRA.

Customers’ shares are held in avenue identify at Apex Clearing Company, Public Investing’s clearing and custody agency.

Each Public Investing and Apex are members of SIPC and FINRA.

SIPC insurance coverage protection protects person belongings as much as $500,000.

This clear strategy is one thing that ought to set buyers’ minds comfortable. For those who use Public.com, you received’t want to fret about an organization failure placing your belongings or your excessive yield money account in danger.

Security Options That Defend Your Investments

Security needs to be a serious concern everytime you’re contemplating an funding platform. No one needs to take pointless dangers with their cash, in spite of everything.

THe excellent news is that Public.com takes person security extraordinarily severely. Listed here are a few of the security options that reply the query: Is Public.com protected?

256-bit encryption

Like many different digital brokerages, Public.com makes use of 256-bit bank-level encryption to guard customers’ accounts and investments.

Encryption protects your saved belongings and likewise presents end-to-end safety throughout transactions.

Two-factor authentication

Two-factor authentication, or 2FA, is a safety measure that you may allow that requires you to make use of a secondary log-in methodology to entry your account.

It’s one thing we all the time suggest on any web site or app the place you’re sharing monetary info or have a funded account.

Why? As a result of it ought to by no means be straightforward for somebody unauthorized to entry your accounts, investments, or money deposits.

Public.com doesn’t require 2FA, which suggests you’ll want to enter the menu, select Account Settings, after which allow it.

Biometric login choices

Public.com refers to 2FA as Biometric Authentication, and there are 3 ways you should use it.

Fingerprint scan

Facial recognition

PIN

A PIN isn’t biometric, so we’d say it’s the least safe of those three choices. If somebody has your cellphone, they might doubtlessly see the authentication code, particularly when you’ve got it set as much as preview texts when your cellphone is locked.

Professional Tip:

Earn as much as a $10,000 money bonus while you switch your current account to Public.com as we speak!

How Public.com Makes Cash Whereas Retaining You Secure

No Public app investing evaluate can be full with out an evidence of how Public.com makes cash whereas nonetheless preserving you protected.

We’ve already informed you that they don’t cost fee on commonplace trades, however they earn a living in different methods.

The no-PFOF (elective tipping) mannequin for shares and ETFs

Public.com (and numerous different buying and selling platforms) used to cost a cost for order circulate (PFOF) which normally amounted to only some pennies per commerce.

The quantity charged assorted primarily based on the kind of commerce, with higher-risk trades garnering the best charges.

In 2021, Public.com removed the PFOF mannequin and changed it with a no-PFOF mannequin that permits for elective tipping.

One crucial word about tipping: the Public.com interface DEFAULTS to tipping, so that you’ll must uncheck the field in case you don’t wish to depart a tip (this may make an enormous distinction when you’ve got excessive month-to-month buying and selling quantity).

Premium subscription evaluate

Signing up for a fundamental Public.com self directed brokerage account is free, which makes it an reasonably priced choice for newbie buyers who wish to begin constructing a portfolio.

There’s additionally a premium choice, and Public.com earns a few of its cash by means of subscriptions, which price $8 monthly for public premium members.

One cool factor about Public Premium is that even the $8 monthly cost goes away when you’ve got a complete portfolio steadiness of $50,000 or extra.

Premium subscribers get entry to enhanced knowledge, together with earnings name transcripts, customized worth alerts, and VIP buyer help.

Choices rebate program transparency

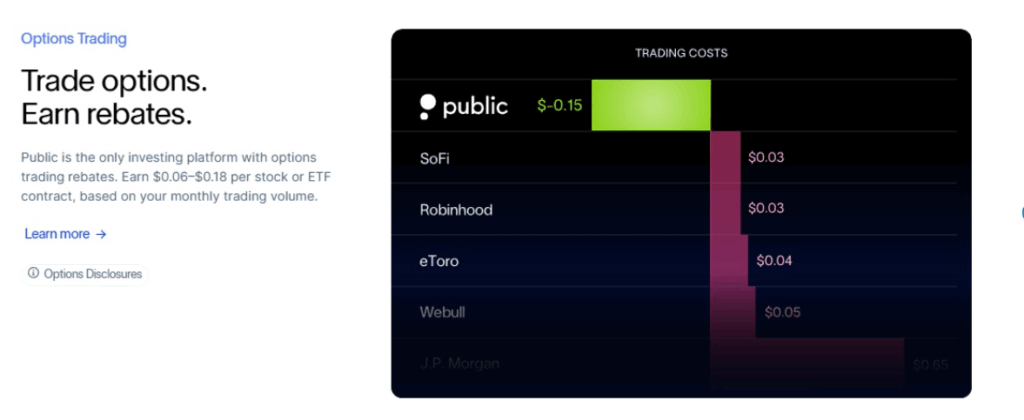

Choices buying and selling all the time comes with a payment. On Public.com the charges vary from $0.35 to $0.50 per contract, costs that align with trade requirements.

Public.com encourages choices buying and selling by together with a clear rebate program. It provides merchants a rebate between $0.06 and $0.18 per choices commerce primarily based on commerce quantity.

In fact, extra choices trades imply more cash for Public.com, however the rebate interprets to lower-than-average costs, thus encouraging merchants to take part.

How Does Public.com Stack Up In opposition to Conventional Brokers?

It’s not unusual for digital brokerages to be in comparison with conventional brokerages. Right here’s our tackle how Public.com stacks up.

Public.com vs. established brokerages

Public.com established itself as a digital brokerage, which suggests it was all the time designed to be a cell app and/or on-line platform.

That differentiates it from conventional brokerages, a lot of which began as analog companies the place brokerage purchasers met in individual or talked to their brokers on the cellphone.

These conventional brokerages needed to adapt to create on-line platforms. Some have created platforms that prioritize the person expertise, whereas others have struggled to take action.

Public.com had a user-friendly interface and excessive ranges of digital safety from the outset. As a mobile-first platform, security precautions resembling 2FA, biometrics, and encryption had been inbuilt and have all the time been there to guard customers.

Professional Tip:

Lock in a 7.3% bond yield with Public.com as we speak!

Cell-first safety concerns

As a result of Public.com began out as a cell buying and selling app, mobile-first safety on their app is thorough and spectacular. A couple of examples embody:

Machine lock for telephones and tablets

Biometric authentication

OS-level encryption

THese issues have additionally turn out to be commonplace on apps created by conventional brokerages.

Regulatory compliance comparability

Public.com is regulated by the SEC, a member of FINRA, and customers’ deposits are insured in a checking account by the SIPC.

Any licensed broker-dealer should register with the SEC and be part of FINRA, so that is an space the place Public.com comes out even with conventional brokers, who provide the identical protections.

Frequent Safety Issues—and How Public.com Handles Them

Public.com is totally ready to deal with any safety issues as they come up.

Platform reliability throughout market volatility

One of many instances when buyers are at their most weak is throughout market volatility.

When the market is experiencing turbulence, buying and selling platforms resembling Public.com expertise higher-than-normal visitors and that will imply that there are safety dangers, together with the chance of the platform crashing.

There aren’t any information studies of Public.com experiencing any outages when there’s excessive visitors, in order that’s an excellent signal for customers.

WIthdrawal course of safety

Withdrawals out of your Public.com account are straightforward to make inside the app or internet interface.

As we talked about earlier than, all transactions, together with withdrawals, are protected by end-to-end, 256-bit encryption, which is identical stage of encryption that banks use for account safety.

Customer support response to safety points

Public.com makes it straightforward to contact customer support and report safety points.

Routine customer support requests must be submitted by means of stay chat within the app or through e-mail.

There’s a devoted e-mail (safety@public.com) for reporting safety points. It’s best to restrict such points to those who:

Might lead to a monetary loss for Public.com or its members

Might impression the confidentiality or integrity of members info or Public.com programs

Have the potential to impression a lot of folks

Account restoration procedures

If you should get better your account, you’ll be able to contact Public.com at help@public.com for help or use the stay chat function.

You possibly can scale back the chance of shedding entry to your account by enabling 2FA, utilizing machine lock, and never sharing your account info or financial institution particulars with anybody.

Is Public.com Proper for You?

Is Public.com protected? Is it best for you? Right here’s how we see it.

Learners, mobile-first customers, and people fascinated by ESG (environmental, social, and governance) investing are more likely to love Public.com. (Public.com presents ESG scores for all shares.)

It’s much less more likely to attraction to energetic buyers who need instruments to handle their very own portfolios, superior analysts, and individuals who need a big number of cryptocurrencies or multi asset investing..

Right here’s our tackle the professionals and cons.

Conclusion

Now that you just’ve learn our Public.com evaluate, you could be searching for an summary. Right here’s our tackle Public free, their excessive yield money account, and their premium membership.

Is Public.com among the best funding apps?

Public.com presents customers full transparency about charges, state-of-the-art financial institution grade safety, and a easy, user-friendly interface that’s supreme for learners, trying to construct a diversified portfolio with excessive curiosity on money balances (uninvested money) and excessive yield bonds.

The corporate is official and controlled, and there’s insurance coverage in place to guard customers’ accounts and holdings.

All in all, Public.com compares favorably to different digital platforms and conventional brokerages for newbie buyers (particularly with public premium account options and a excessive yield money account), though it lacks intensive asset courses, different investments, and funding evaluation.

In case you are curious to how a Public investing brokerage account compares to Robinhood particularly, take a look at our Public.com vs Robinhood full evaluate!

FAQ

Sure, Public.com has a user-friendly, mobile-first interface that makes it straightforward for learners to start out their investing journey with state-of-the-art safety.

Sure, Public makes use of the identical 256-bit encryption utilized by banks and credit score unions.

For those who go for the premium choice, which supplies you entry to customized alerts and extra knowledge than the free model, you’ll pay simply $8 monthly. In case your general steadiness is greater than $50,000, the premium service is free.