German CPI information may be an even bigger driver for the euro.

US inflation can also be within the highlight because the PCE report is awaited.

Will German elections change the outlook a lot?

When Germany’s chancellor, Olaf Scholz, known as a snap basic election again in December, there was hope {that a} new authorities would inject a lot life into the flagging financial system. With the February 23 election day virtually right here, it’s unclear how consequential Sunday’s vote shall be, if in any respect.

Wanting on the newest polls, the conservative CDU/CSU bloc is more likely to be the most important celebration within the Bundestag. However they’ll want the assist of at the least one different celebration to have the ability to kind a majority authorities. That is the place incumbent Chancellor Scholz’s SPD celebration is available in. Though the 2 usually are not pure companions, a grand coalition could also be essential to preserve the far-right AfD out of energy.

Nevertheless, this can be troublesome to do if the AfD or far-left events like The Left get extra votes than anticipated, shrinking the primary events’ shares much more than what the polls at the moment point out. The Greens and the FDP have already misplaced important votes so any coalition that doesn’t embrace each the CDU/CSU and SPD might not be very secure.

And with all the primary events having dominated out an alliance with the AfD, Scholz and CDU/CSU chief Friedrich Merz could have no alternative however to search out sufficient widespread floor to steer the nation for the subsequent 4 years. One space the place the 2 events may wrestle, however which is essentially the most essential for the markets, is the talk about whether or not to chill out Germany’s strict debt brake rule. The German authorities is obliged constitutionally to maintain the structural deficit of the funds at not more than 0.35% of .

Loosening this rule might go a good distance in boosting spending to elevate the financial system out of the doldrums. However the CDU/CSU isn’t too eager on tweaking it and is more likely to connect situations to any settlement to lift the borrowing restrict.

However, if on Monday morning the election outcomes level to a CDU/CSU and SPD coalition, the euro might take pleasure in a modest rally, and if within the coming days, the celebration leaders determine to prioritize reforming the debt brake, there might be additional beneficial properties for the one foreign money.

Nevertheless, if the AfD comes a detailed second, the euro might face some promoting stress as the federal government might require the celebration’s votes to go some laws even when it’s not included within the new coalition, permitting it to push by means of a few of its far-right agenda.

Information additionally Issues for the Euro

Within the occasion that the German elections don’t result in a lot of a political shift in Europe’s largest financial system, merchants might flip their consideration to the incoming information. The Ifo survey is out on Monday and can shed some gentle on German enterprise sentiment in February, whereas on Friday, the preliminary numbers are because of be printed.

Eurozone has been creeping larger since October so an extra uptick in Germany’s prints might solid doubt on expectations of three extra 25-bps fee cuts by the ECB this 12 months.

As for the euro space, the ultimate CPI estimates for January are out on Monday. Buyers can even be maintaining a tally of the minutes of the ECB’s January assembly due on Thursday. Any worries amongst policymakers about inflation not coming again all the way down to 2% rapidly sufficient might present some upside to the euro, though on the entire, it’s unlikely that both the German CPI or ECB minutes will considerably transfer the needle for fee lower bets.

PCE Inflation Could Maintain Fee Lower Optimism Alive

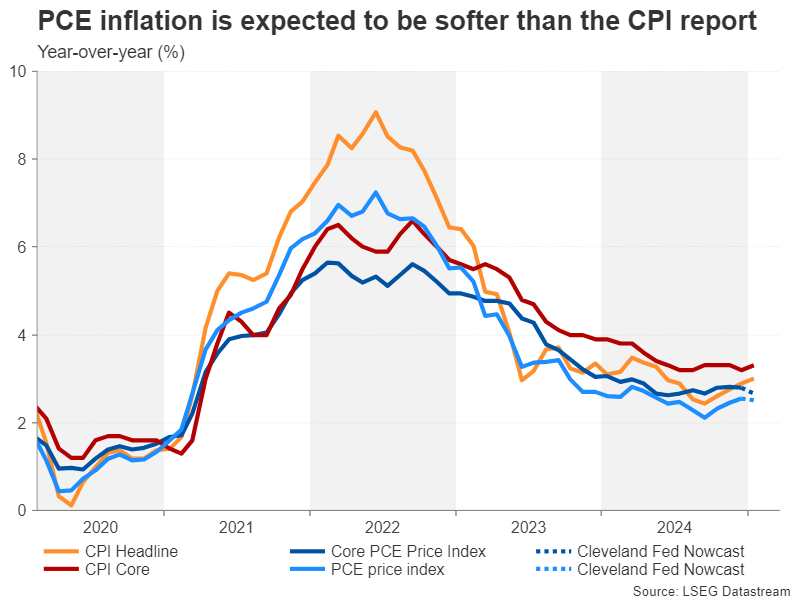

Over in america, sticky has been a fair larger downside for the . The inched as much as 3.0% in January, dashing hopes for 2 fee cuts in 2025. However the market response wasn’t as damaging as one would have anticipated, partly as a result of buyers predicted that the measure of inflation, which the Fed attaches extra significance to, wouldn’t be as scorching because the CPI readings.

In accordance with the Cleveland Fed’s Nowcast mannequin, the core PCE value index eased to 2.7% in January from 2.8%, and headline PCE edged all the way down to 2.5%. If these estimates become right when the precise numbers are launched on Friday and there are not any upside surprises within the month-on-month figures, expectations for 2 25-bps fee reductions might proceed to recuperate, weighing on the .

The PCE report can even embrace the most recent stats on private earnings and consumption, whereas earlier within the week, there’s a slew of different releases. The Convention Board’s carefully watched client confidence gauge is out on Tuesday, to be adopted by new dwelling gross sales on Wednesday. There’s a barrage of indicators on Thursday, together with sturdy items orders and pending dwelling gross sales for January, in addition to the second estimate of This autumn GDP development.

Geopolitical Dangers Might Help the US Greenback

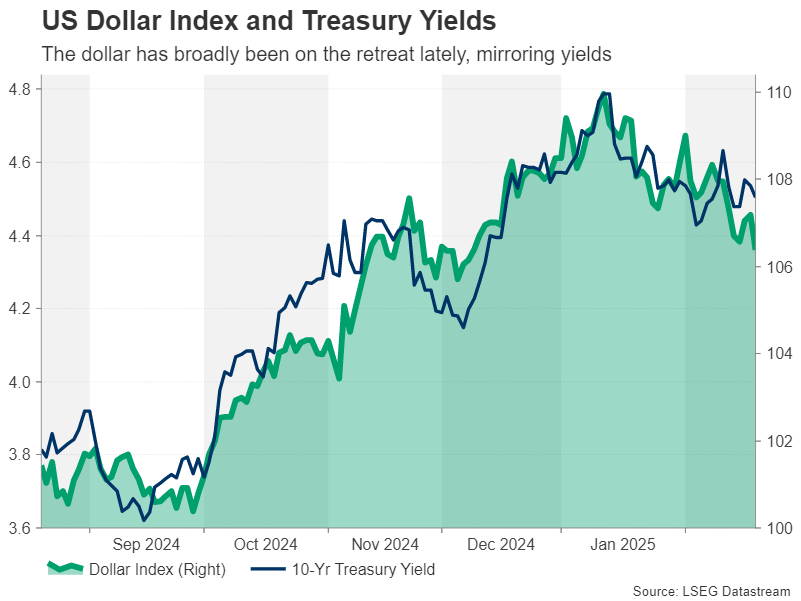

With danger urge for food remaining resilient within the face of elevated geopolitical uncertainty following President Trump’s change of insults with Ukraine’s President Zelensky, any indicators of weak spot within the US financial system might once more encourage buyers to ratchet up their rate-cut bets even when the inflation numbers don’t again it.

However the US greenback, which is buying and selling close to two-month lows in opposition to a basket of currencies, nonetheless stands an opportunity of rebounding if the geopolitical headlines worsen. Particularly, an extra deterioration within the relations between Trump and Zelensky and vis-à-vis with the EU, or new tariff bulletins, might redirect some flows again to the US greenback.