Up to date on Could 1st, 2025 by Bob Ciura

Traders trying to generate greater revenue ranges from their funding portfolios ought to have a look at Actual Property Funding Trusts or REITs.

These are corporations that personal actual property properties and lease them to tenants, or put money into actual property backed loans, each of which generate a gradual stream of revenue.

The majority of their revenue is then handed on to shareholders via dividends.

You’ll be able to see all 200+ REITs right here.

You’ll be able to obtain our full listing of REITs, together with necessary metrics resembling dividend yields and market capitalizations, by clicking on the hyperlink under:

The great thing about REITs for revenue buyers is that they’re required to distribute 90% of their taxable revenue to shareholders yearly within the type of dividends. In return, REITs sometimes don’t pay company taxes.

In consequence, lots of the 200+ REITs we monitor provide excessive dividend yields of 5%+.

However not all high-yielding shares are automated buys. Traders ought to fastidiously assess the basics to make sure that excessive yields are sustainable.

Word that whereas the securities on this article have very excessive yields, a excessive yield alone doesn’t make for a strong funding. Dividend security, valuation, administration, steadiness sheet well being, and development are additionally essential components.

We urge buyers to make use of the evaluation under as informative however to do important due diligence earlier than shopping for into any safety – particularly high-yield securities.

Many (however not all) high-yield securities have a big threat of a dividend discount and/or deteriorating enterprise outcomes.

Desk of Contents

You’ll be able to immediately leap to any particular part of the article through the use of the hyperlinks under:

Excessive-Yield REIT No. 10: Neighborhood Healthcare Belief (CHCT)

Neighborhood Healthcare Belief is an REIT which owns income-producing actual property properties linked to the healthcare sector, resembling doctor places of work, specialty facilities, behavioral services, inpatient rehabilitation services, and medical workplace buildings.

The belief has investments in 197 properties in 35 states, totaling 4.4 million sq. toes.

On February 18th, 2025, Neighborhood Healthcare Belief reported fourth quarter outcomes for the interval ending December thirty first, 2024.

Funds from operations (FFO) per share dipped 16% to $0.48 from $0.57 within the prior yr quarter. Adjusted FFO per share, nevertheless, declined by 10% to $0.55.

Through the quarter, Neighborhood Healthcare acquired three properties for $8.2 million. These properties have been 100% leased with lease expirations via 2029.

The belief additionally has seven properties underneath definitive buy agreements, with a mixed buy value of roughly $170 million, anticipated to shut from 2025 via 2027.

Click on right here to obtain our most up-to-date Positive Evaluation report on CHCT (preview of web page 1 of three proven under):

Excessive-Yield REIT No. 9: Chimera Funding Corp. (CIM)

Chimera Funding Company is an actual property funding belief (REIT) that may be a specialty finance firm. The corporate’s main enterprise is in investing via subsidiaries in a diversified portfolio of mortgage property, together with residential mortgage loans, Non-Company RMBS, Company CMBS, and different actual property associated securities.

Chimera’s revenue is predominantly obtained by the distinction between the revenue the corporate earns on its property and financing and hedging prices.

The corporate funds the acquisition of property via a number of funding sources: asset securitization, repurchase agreements (repo), warehouse strains, and fairness capital.

On Could twenty first, 2024, Chimera executed a 1-for-3 reverse inventory break up as a consequence of its depressed inventory value, which resulted from the impression of excessive rates of interest. This was a damaging improvement.

In mid-February, Chimera launched (2/12/25) outcomes for the fourth quarter of fiscal 2024. Its core earnings-per-share edged up sequentially, from $0.36 to $0.37, due to decrease provisions for credit score losses. Chimera missed the analysts’ consensus by $0.01.

Click on right here to obtain our most up-to-date Positive Evaluation report on CIM (preview of web page 1 of three proven under):

Excessive-Yield REIT No. 8: Pennymac Mortgage Funding Belief (PMT)

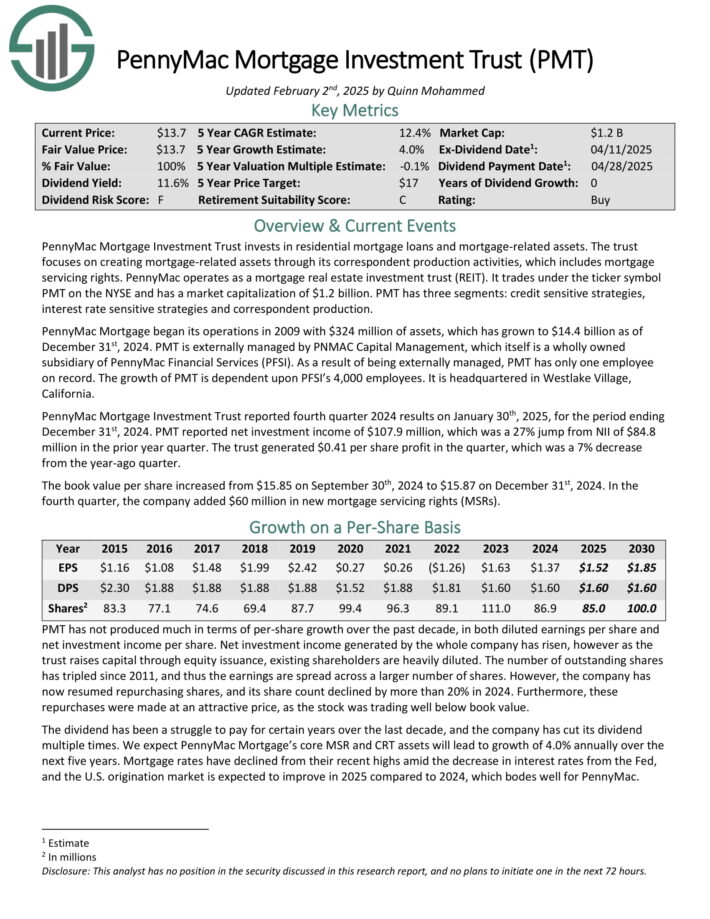

PennyMac Mortgage Funding Belief invests in residential mortgage loans and mortgage-related property. PMT has three segments: credit score delicate methods, rate of interest delicate methods and correspondent manufacturing.

PennyMac Mortgage started its operations in 2009 with $324 million of property, which has grown to $13.1 billion as of September thirtieth, 2024. PMT is externally managed by PNMAC Capital Administration, which itself is an entirely owned subsidiary of PennyMac Monetary Providers (PFSI).

PennyMac Mortgage Funding Belief reported fourth quarter 2024 outcomes on January thirtieth, 2025, for the interval ending December thirty first, 2024. PMT reported internet funding revenue of $107.9 million, which was a 27% leap from NII of $84.8 million within the prior yr quarter.

The belief generated $0.41 per share revenue within the quarter, which was a 7% lower from the year-ago quarter.

The e-book worth per share elevated from $15.85 on September thirtieth, 2024 to $15.87 on December thirty first, 2024. Within the fourth quarter, the corporate added $60 million in new mortgage servicing rights (MSRs).

Click on right here to obtain our most up-to-date Positive Evaluation report on PMT (preview of web page 1 of three proven under):

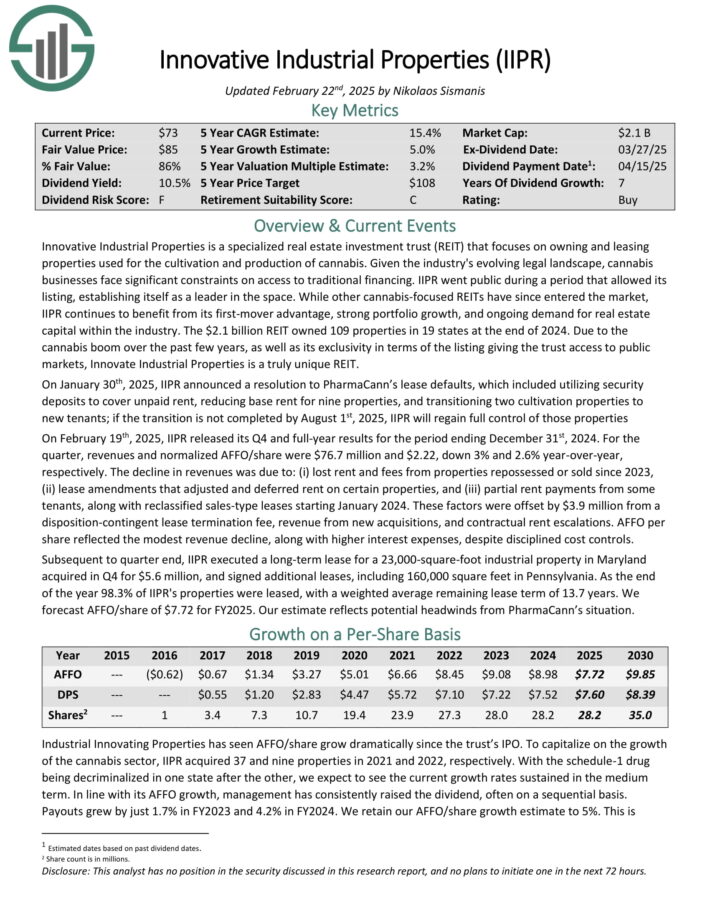

Excessive-Yield REIT No. 7: Progressive Industrial Properties (IIPR)

Progressive Industrial Properties, Inc. is a single-use “specialty REIT” that solely focuses on proudly owning properties used for the cultivation and manufacturing of hashish.

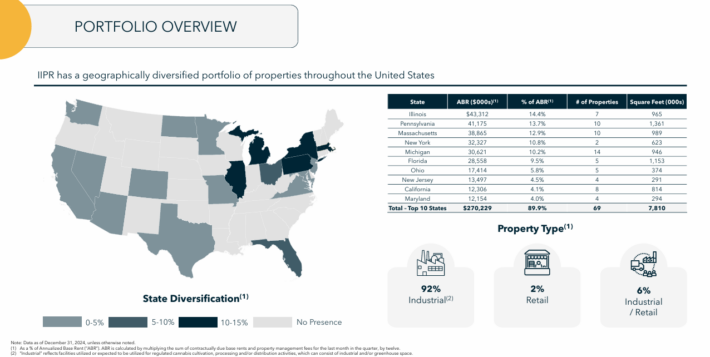

As of the top of 2024, IIPR had 109 properties, with a weighted common lease size of 13.7 years. Roughly 92% of IIPR’s properties are industrial, with retail comprising 2% and blended properties the remaining 6%.

Supply: Investor Presentation

On February nineteenth, 2025, IIPR launched its This autumn and full-year outcomes for the interval ending December thirty first, 2024. For the quarter, revenues and normalized AFFO/share have been $76.7 million and $2.22, down 3% and a pair of.6% year-over-year, respectively.

The decline in revenues was as a consequence of misplaced hire and costs from properties repossessed or offered since 2023, lease amendments that adjusted and deferred hire on sure properties, and (iii) partial hire funds from some tenants, together with reclassified sales-type leases beginning January 2024.

These components have been offset by $3.9 million from a disposition-contingent lease termination charge, income from new acquisitions, and contractual hire escalations.

Click on right here to obtain our most up-to-date Positive Evaluation report on IIPR (preview of web page 1 of three proven under):

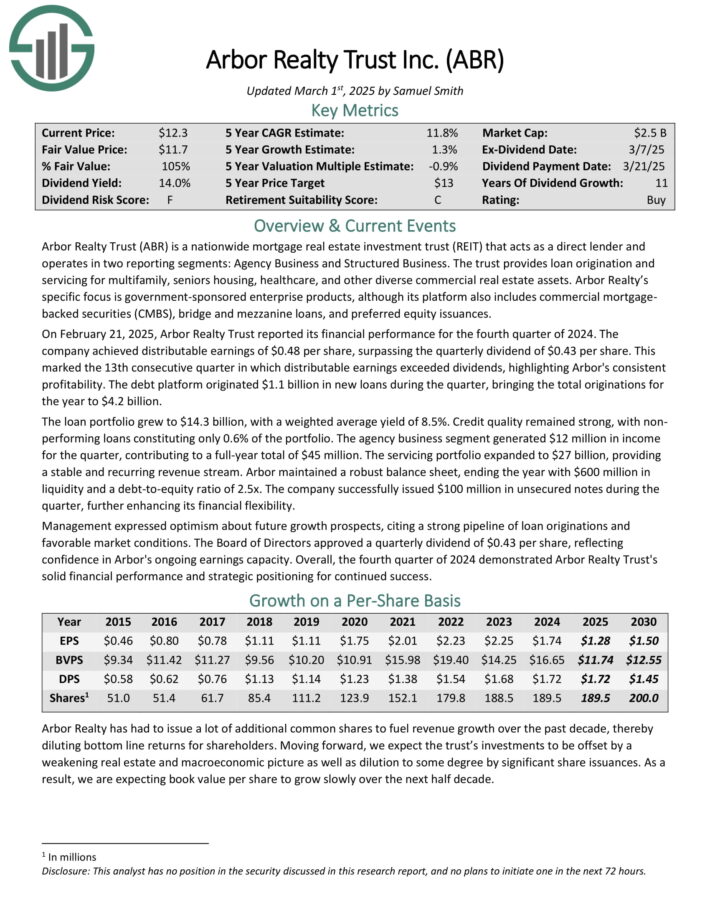

Excessive-Yield REIT No. 6: Arbor Realty Belief (ABR)

Arbor Realty Belief is a nationwide mortgage actual property funding belief (REIT) that acts as a direct lender and operates in two reporting segments: Company Enterprise and Structured Enterprise. The belief supplies mortgage origination and servicing for multifamily, seniors housing, healthcare, and different various industrial actual property property.

Arbor Realty’s particular focus is government-sponsored enterprise merchandise, though its platform additionally contains industrial mortgage backed securities (CMBS), bridge and mezzanine loans, and most well-liked fairness issuances.

On February 21, 2025, Arbor Realty Belief reported its monetary efficiency for the fourth quarter of 2024. The corporate achieved distributable earnings of $0.48 per share, surpassing the quarterly dividend of $0.43 per share.

This marked the thirteenth consecutive quarter wherein distributable earnings exceeded dividends, highlighting Arbor’s constant profitability. The debt platform originated $1.1 billion in new loans throughout the quarter, bringing the full originations for the yr to $4.2 billion.

Click on right here to obtain our most up-to-date Positive Evaluation report on ABR (preview of web page 1 of three proven under):

Excessive-Yield REIT No. 5: AGNC Funding Corp. (AGNC)

American Capital Company Corp is a mortgage actual property funding belief that invests primarily in company mortgage–backed securities (or MBS) on a leveraged foundation.

The agency’s asset portfolio is comprised of residential mortgage go–via securities, collateralized mortgage obligations (or CMO), and non–company MBS. Many of those are assured by authorities–sponsored enterprises.

Within the fourth quarter of 2024, AGNC Funding Corp. reported a complete loss per frequent share of $0.99, a reversal from the great revenue of $0.93 per share recorded within the earlier quarter.

Regardless of this, the corporate achieved a constructive financial return of 13.2% for the complete yr, pushed by its constant month-to-month dividend totaling $1.44 per frequent share.

The corporate’s internet unfold and greenback roll revenue, excluding catch-up premium amortization, was $0.65 per frequent share for the quarter, down from $0.67 per share within the prior quarter.

AGNC’s tangible internet e-book worth per frequent share stood at $9.08 as of December 31, 2024, reflecting a lower from $9.84 on the finish of the third quarter.

Click on right here to obtain our most up-to-date Positive Evaluation report on AGNC Funding Corp (AGNC) (preview of web page 1 of three proven under):

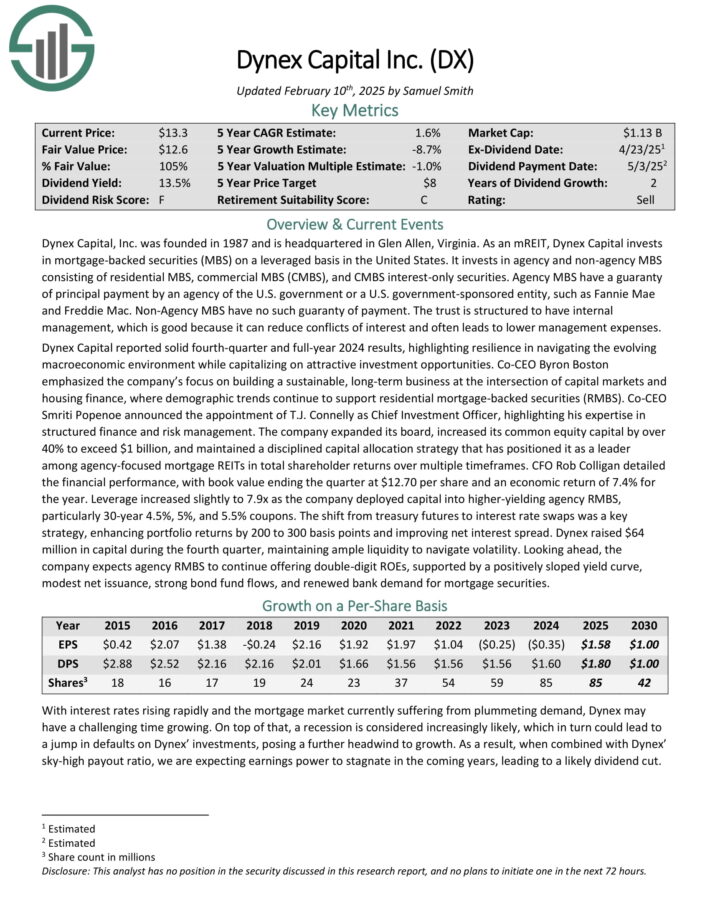

Excessive-Yield REIT No. 4: Dynex Capital (DX)

Dynex Capital invests in mortgage–backed securities (MBS) on a leveraged foundation in the USA. It invests in company and non–company MBS consisting of residential MBS, industrial MBS (CMBS), and CMBS curiosity–solely securities.

Supply: Investor Presentation

Dynex Capital launched its fourth-quarter 2024 monetary outcomes, with e-book worth ending the quarter at $12.70 per share and an financial return of seven.4% for the yr.

Leverage elevated barely to 7.9x as the corporate deployed capital into higher-yielding company RMBS, significantly 30-year 4.5%, 5%, and 5.5% coupons.

The shift from treasury futures to rate of interest swaps was a key technique, enhancing portfolio returns by 200 to 300 foundation factors and bettering internet curiosity unfold.

Click on right here to obtain our most up-to-date Positive Evaluation report on DX (preview of web page 1 of three proven under):

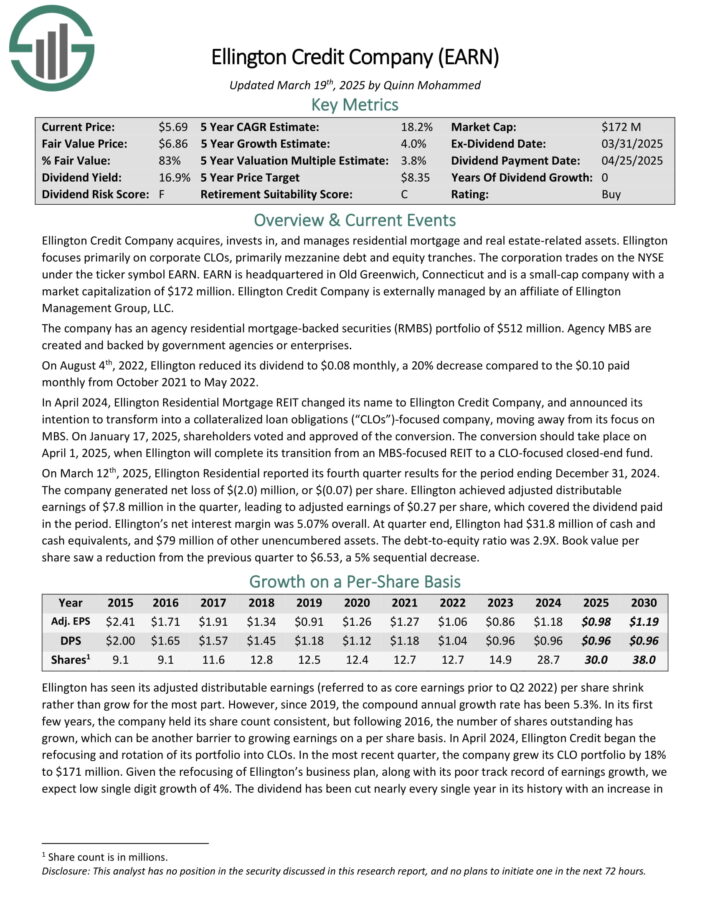

Excessive-Yield REIT No. 3: Ellington Credit score Co. (EARN)

Ellington Credit score Co. acquires, invests in, and manages residential mortgage and actual property associated property. Ellington focuses totally on residential mortgage-backed securities, particularly these backed by a U.S. Authorities company or U.S. authorities–sponsored enterprise.

Company MBS are created and backed by authorities businesses or enterprises, whereas non-agency MBS are not assured by the federal government.

On March twelfth, 2025, Ellington Residential reported its fourth quarter outcomes for the interval ending December 31, 2024. The corporate generated a internet lack of $(2.0) million, or $(0.07) per share.

Ellington achieved adjusted distributable earnings of $7.8 million within the quarter, resulting in adjusted earnings of $0.27 per share, which lined the dividend paid within the interval.

Ellington’s internet curiosity margin was 5.07% general. At quarter finish, Ellington had $31.8 million of money and money equivalents, and $79 million of different unencumbered property.

Click on right here to obtain our most up-to-date Positive Evaluation report on EARN (preview of web page 1 of three proven under):

Excessive-Yield REIT No. 2: ARMOUR Residential REIT (ARR)

ARMOUR Residential invests in residential mortgage-backed securities that embody U.S. Authorities-sponsored entities (GSE) resembling Fannie Mae and Freddie Mac.

It additionally contains Ginnie Mae, the Authorities Nationwide Mortgage Administration’s issued or assured securities backed by fixed-rate, hybrid adjustable-rate, and adjustable-rate residence loans.

Unsecured notes and bonds issued by the GSE and the US Treasury, cash market devices, and non-GSE or authorities agency-backed securities are examples of different forms of investments.

Within the fourth quarter of 2024, ARMOUR Residential REIT, Inc. reported a GAAP internet lack of $49.4 million, or $0.83 per frequent share. Regardless of this, the corporate achieved distributable earnings of $46.5 million, equating to $0.78 per frequent share, which fell wanting the anticipated $0.97. Web curiosity revenue for the quarter was $12.7 million.

Throughout this era, ARMOUR raised roughly $136.2 million via the issuance of about 7.2 million shares by way of an on the market providing program. The corporate maintained its month-to-month frequent inventory dividend at $0.24 per share, totaling $0.72 for the quarter.

Click on right here to obtain our most up-to-date Positive Evaluation report on ARMOUR Residential REIT Inc (ARR) (preview of web page 1 of three proven under):

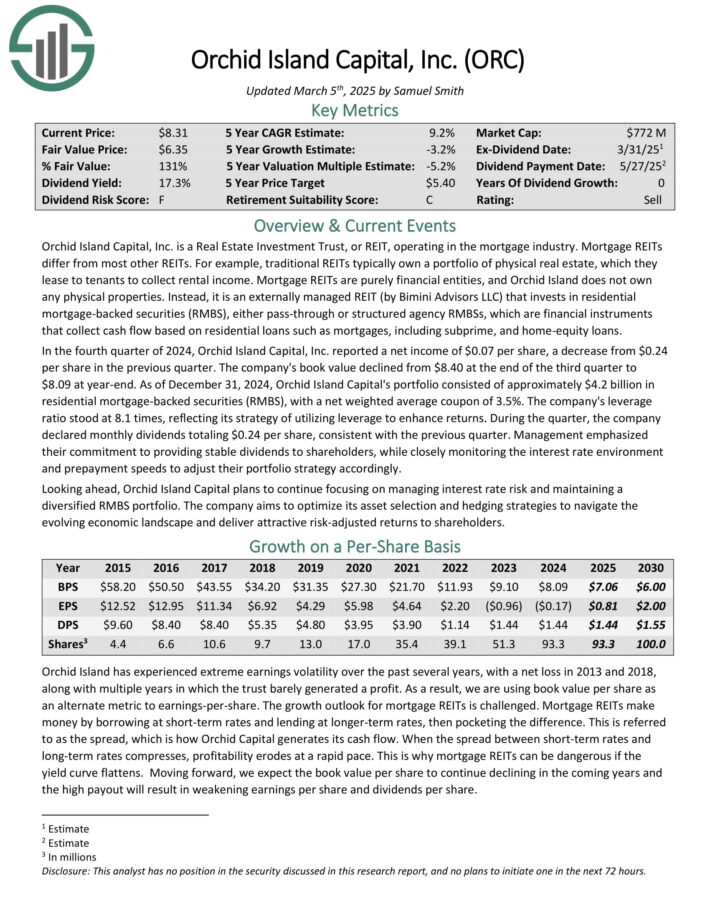

Excessive-Yield REIT No. 1: Orchid Island Capital Inc (ORC)

Orchid Island Capital is a mortgage REIT that’s externally managed by Bimini Advisors LLC and focuses on investing in residential mortgage-backed securities (RMBS), together with pass-through and structured company RMBSs.

These monetary devices generate money movement based mostly on residential loans resembling mortgages, subprime, and home-equity loans.

Within the fourth quarter of 2024, Orchid Island Capital, Inc. reported a internet revenue of $0.07 per share, a lower from $0.24 per share within the earlier quarter. The corporate’s e-book worth declined from $8.40 on the finish of the third quarter to $8.09 at year-end.

As of December 31, 2024, Orchid Island Capital’s portfolio consisted of roughly $4.2 billion in residential mortgage-backed securities (RMBS), with a internet weighted common coupon of three.5%. The corporate’s leverage ratio stood at 8.1 occasions, reflecting its technique of using leverage to boost returns.

Click on right here to obtain our most up-to-date Positive Evaluation report on Orchid Island Capital, Inc. (ORC) (preview of web page 1 of three proven under):

Closing Ideas

REITs have important attraction for revenue buyers as a consequence of their excessive yields. These 10 extraordinarily high-yielding REITs are particularly engaging on the floor, though buyers must be conscious that abnormally excessive yields are sometimes accompanied by elevated dangers.

If you’re inquisitive about discovering high-quality dividend development shares and/or different high-yield securities and revenue securities, the next Positive Dividend assets will probably be helpful:

Excessive-Yield Particular person Safety Analysis

Different Positive Dividend Assets

Thanks for studying this text. Please ship any suggestions, corrections, or inquiries to help@suredividend.com.