In an interconnected financial system, tariffs don’t simply shift commerce – they’ve the potential to rewrite the foundations of enterprise operation throughout the US market and considerably change shopper conduct. And as all the time, during times of change, we’ve constructed cross-category groups of analysts and senior Mintel Consultants who’re working diligently to foretell what tariffs will imply for firms in relation to shopper demand, market dynamics, and innovation technique.

Predicting the impression of the tariffs is complicated. The insurance policies proceed to evolve, and the state of affairs remainsis fluid. At this level, most markets are going through a ten% baseline tariff, which is a shift from the unique proposals first put forth by the administration. Additional modifications are potential.

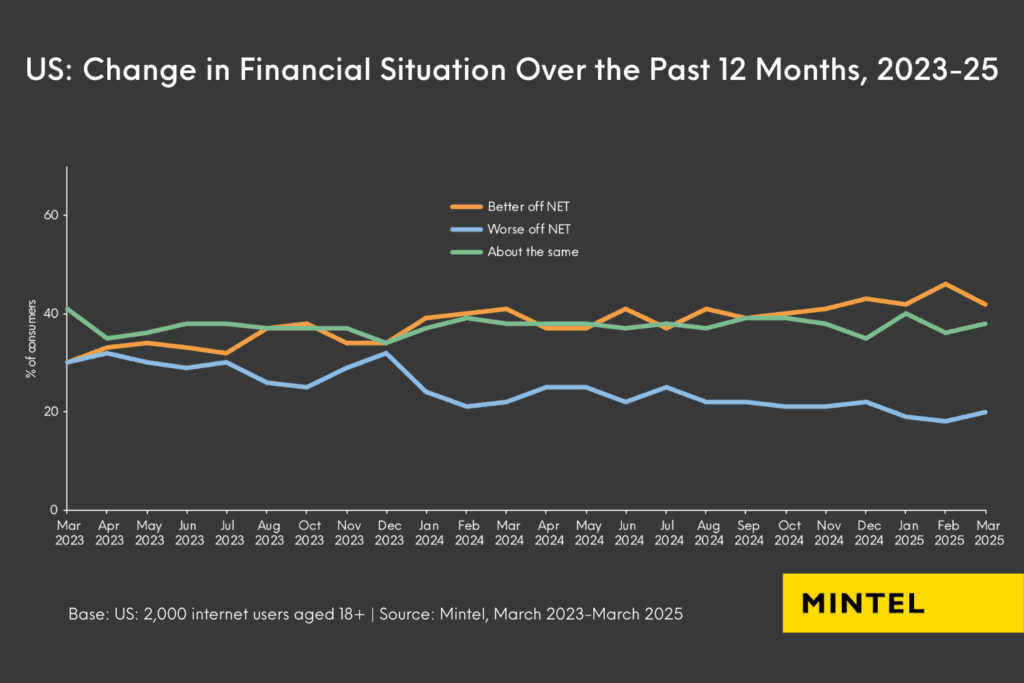

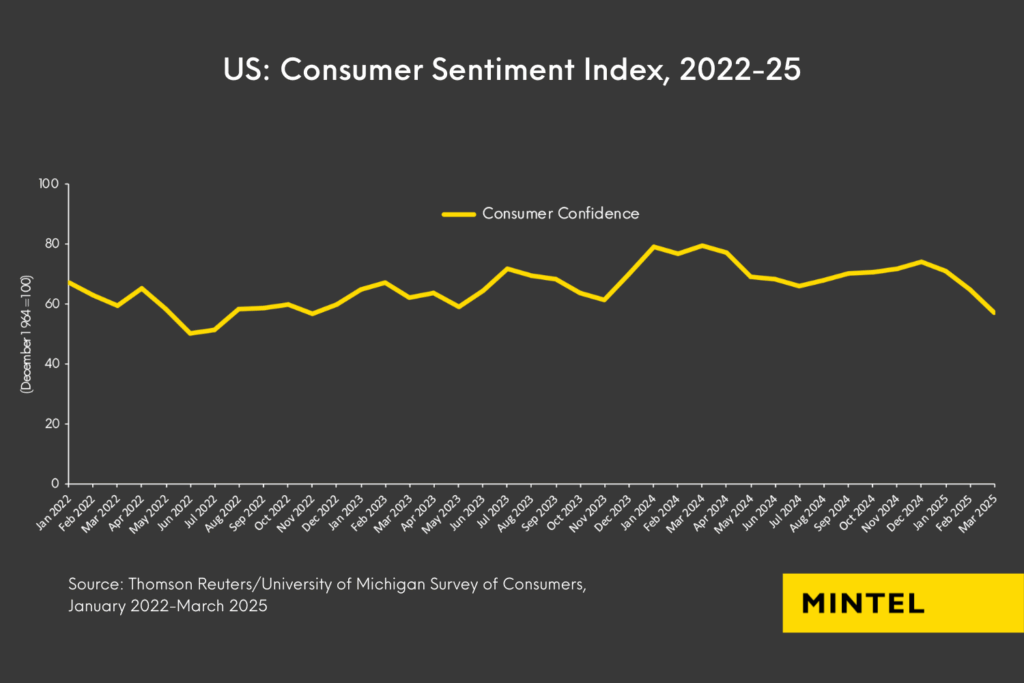

The impression of the tariffs goes past the direct prices to importers. The turbulence has affected monetary markets and launched a brand new interval of uncertainty for companies and customers. In intervals of uncertainty, shopper conduct, preferences, and attitudes have the potential to alter and evolve.

Nonetheless, intervals of uncertainty will also be intervals of development and alternative. They power us to rethink methods, reimagine potentialities, and join with customers in new and significant methods.

Drawing classes from the previous to tell technique at this time

Each time there have been intervals of uncertainty and main world occasions, Mintel’s analysis and knowledge over the previous a number of many years reveal widespread themes and patterns of conduct from each customers and companies.

The better the extent of uncertainty within the US market, the extra that companies and customers attempt to set up a way of management by carefully evaluating their spending.

This reevaluation nearly all the time results in lowering spending wherever potential. When uncertainty takes maintain, it is smart to try to create a margin of security and put together for the worse-case situation.

Three key behavioral shifts to make the most of

As we embark on this era of fluidity and uncertainty, listed here are three behaviors to anticipate from customers within the coming months (and presumably years):

Worth and efficacy are prime priorities… And customers will commerce up and down

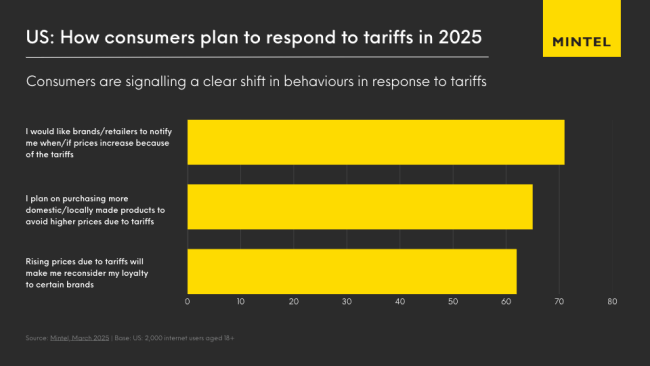

Shoppers can be extra aware of their spending and search methods to save cash whereas maximizing worth. Worth has been vital to US customers for a while, and that significance accelerated in 2021 with the post-COVID-19 inflationary interval. Worth now not means the least costly possibility in a class or trade. Real worth in the end comes from belief, efficacy, and relevance to a shopper’s life.

As customers purpose to stability worth and efficacy with lowering spending the place potential, they’ll make changes to their buy selections. Many decide to commerce right down to a non-public label model or validated decrease “dupe” model that may give them the identical high quality and efficiency, however for a decrease price. Quite a few retailers, reminiscent of Goal and Walmart, have invested closely in increasing and bettering the standard of their personal label manufacturers prior to now few years, and are effectively positioned for this era of uncertainty. A big 68% of US customers agree that retailer model objects supply higher worth than model title objects, and a few 61% agree that model title objects are usually not all the time higher-quality than retailer manufacturers. These Mintel findings underscore that the funding retailers have made of their personal label manufacturers has paid vital dividends.

Whereas buying and selling down tends to be a extra widespread apply in intervals of uncertainty, buying and selling up does occur, as customers discover methods to “deal with” themselves in sure classes. As well as, customers can even spend extra in sure classes in the event that they assume that’ll give them a greater return on their funding. That features spending now to save lots of later, as customers worry sudden worth will increase, particularly in key classes, reminiscent of expertise and vehicles.

Shoppers will gravitate in the direction of the familiarIn intervals of uncertainty, customers gravitate towards the acquainted as one other anchor and technique of management. In the course of the COVID-19 period, customers gravitated towards tried and examined, long-standing heritage manufacturers throughout classes, exhibiting much less curiosity in making an attempt new manufacturers.

Nonetheless, post-pandemic, customers shifted again to being open to new and rising manufacturers, and lots of mainstream heritage manufacturers have misplaced market share to new and disruptive manufacturers throughout classes within the post-COVID-19 period. There are numerous examples of this, together with Poppi and Olipop in carbonated mushy drinks, Native in deodorant and different private care classes, Scrub Daddy in cleansing instruments, and SmartSweets in sweet.

Nonetheless, within the present local weather, customers might swing again to favoring tried and examined heritage manufacturers which have proved their worth versus taking a danger on a brand new or unknown model that they or their household might not like, leading to a waste of cash. A big majority of 69% of US customers agree that they belief manufacturers which have been round for a very long time greater than new manufacturers.

The shifting financial panorama within the US may additionally make it harder for brand new manufacturers to emerge and discover success the way in which they’ve prior to now decade. Whereas the enlargement of social media and e-commerce has considerably diminished the barrier of entry for a brand new product or model in quite a few classes, components like tariffs might impose provide chain and operational obstacles which might be troublesome for brand new gamers to beat. Mainstream heritage manufacturers, most of that are primarily based within the US, are higher positioned to climate this era of uncertainty with their superior operations and infrastructure, which is able to make it simpler to make any vital changes.

Transparency can be extra vital than ever earlier than, and customers will count on itOver the previous 20 years, communication expertise and social media have reshaped the way in which customers join, share data, take up information and affect each other, rising as a number of the most transformative forces in trendy society. These forces, together with this era of uncertainty, signifies that enterprise actions are extra seen than ever. Shoppers will maintain manufacturers accountable in actual time. To navigate this, manufacturers want to guide with transparency and proactivity when speaking about worth will increase and product modifications (reminiscent of altering a formulation to make use of a domestically sourced ingredient) that impression customers.

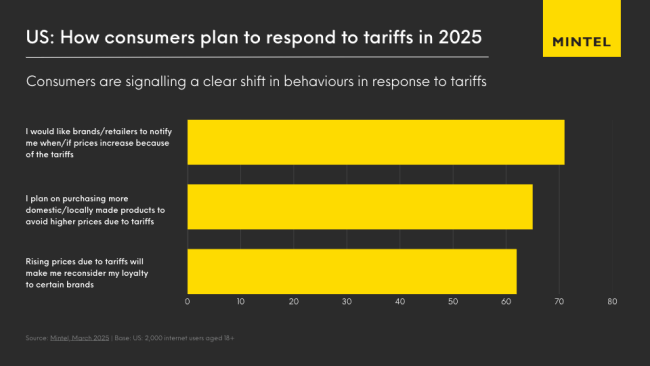

71% of US customers report that they want manufacturers/retailers to inform them if/when costs enhance due to the tariffs.

“Liberation Day”: What Tariffs Imply for US Shoppers (Consumer-access solely)

Many manufacturers raised costs following the pandemic to take care of materials prices and provide chain points, usually leaving customers to note the will increase at checkout. To adapt, manufacturers must be proactive and produce customers alongside on the journey as they make changes to their enterprise fashions to take care of this new financial shift, as customers are extra discerning and knowledgeable than ever. An absence of transparency will erode belief with customers…and finally impression gross sales and market share.

Manufacturers additionally want to arrange for the expectation of elevated transparency in different aspects of their enterprise. In at this time’s period of knowledge sharing and social media, operational practices have the potential to be uncovered at any time. Current posts from China, for instance, have revealed manufacturing practices of luxurious and wonder manufacturers, exhibiting how rapidly scrutiny can come up. Manufacturers have to be ready to future-proof their operations and stay agile, able to pivot rapidly if a apply or protocol comes beneath scrutiny, in the end defending each their enterprise and fame for the long run.

Inaction is riskier than funding and innovation

In periods of uncertainty and modifications in main world occasions, we’ve seen companies and types react in the identical means as customers, with a deal with lowering spending, particularly round innovation. Over the previous 30 years, our World New Merchandise Database has proven a notable slowdown in innovation exercise from manufacturers throughout these difficult intervals.

Harvard Enterprise Overview reported that manufacturers that continued to spend money on promoting throughout the Eighties downturn skilled longer-term development than people who pulled all advertising and marketing efforts.

Harvward Enterprise Overview

Now greater than ever, promoting artistic and worth propositions ought to contemplate and mirror anticipated conduct modifications of customers, and the emotional impression on exterior components and market shifts.

That’s the place our Mintel Consulting staff is available in. We’re right here that can assist you and work with you to keep away from the chance of inaction, present recent views, and create profitable methods tailor-made to your particular person aims.

Whether or not you want short-term options to spotlight must-have product options or wish to future-proof your innovation pipeline, our predictive modeling can information you. We’ll assist determine methods to face out at this time whereas uncovering future development alternatives in your class.

Let’s tackle this new period collectively. Attain out to the Mintel Consulting staff at this time, and we’ll show you how to create a tailor-made technique that units your model up for long-term success.

Contact a Marketing consultant