Key Takeaways

The Federal Reserve held the federal funds price regular at 4.25% to 4.5% to evaluate inflation dangers from tariffs.

Proposed tariffs by Trump may enhance inflationary pressures, affecting the Fed’s price choices.

Share this text

The Federal Reserve held rates of interest regular on Wednesday at a spread of 4.25% to 4.5% as officers continued to evaluate inflation dangers and rising uncertainty sparked by Trump’s commerce agenda.

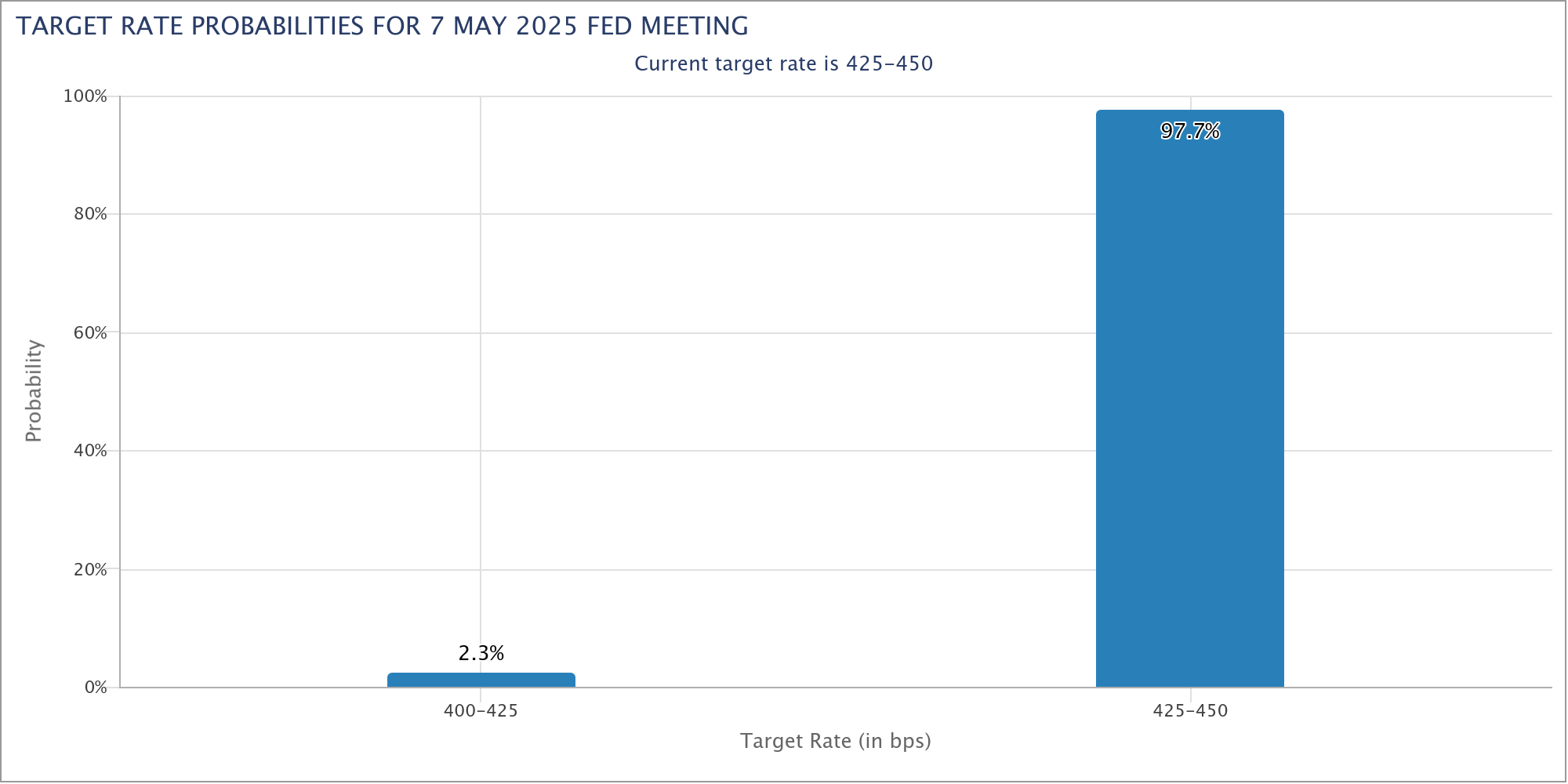

The central financial institution’s determination was consistent with market expectations. In line with knowledge from the CME FedWatch software, markets had priced in a virtually 98% likelihood that charges would stay unchanged on the Fed’s Could assembly.

This marks the third consecutive pause in price cuts since January. The central financial institution had beforehand lowered charges thrice in late 2024 in response to softening employment knowledge and easing inflation.

The newest coverage stance comes on the heels of cooling worth pressures and continued labor market energy. In March, the Client Value Index (CPI) fell 0.1% on a month-to-month foundation, whereas annual inflation eased to 2.4%, down from 2.8% in February.

In the meantime, April noticed strong job features, reinforcing the resilience of the financial system regardless of uncertainty about Trump’s tariffs.

The mixture of average inflation and strong employment supported the Fed’s selection to carry charges regular.

The Fed’s coverage assertion mentioned that current indicators recommend financial exercise has continued to develop at a strong tempo, with labor market situations remaining robust and the unemployment price stabilizing at low ranges. Nevertheless, it famous that inflation stays considerably elevated and uncertainty concerning the financial outlook has elevated additional.

The Committee mentioned the dangers of each increased unemployment and better inflation have risen and emphasised that future choices will rely on incoming knowledge and the evolving stability of dangers. It additionally reaffirmed its dedication to lowering its stability sheet and to attaining its twin mandate of most employment and a couple of% inflation.

President Trump has persistently pressured the Fed to decrease rates of interest, however current robust employment knowledge has decreased the possibilities of a price reduce in June.

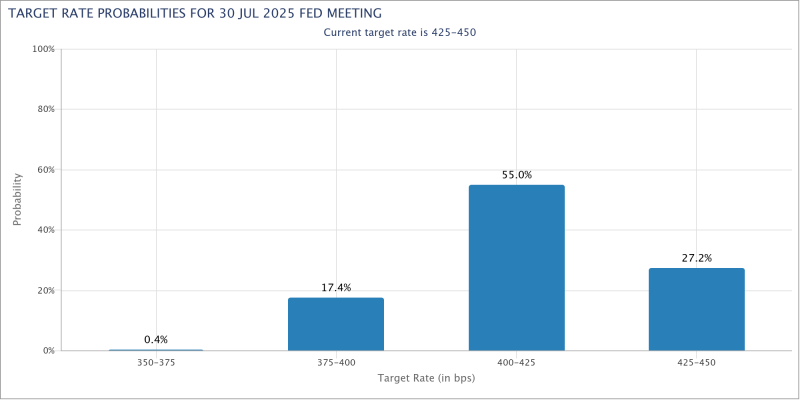

The market has shifted its expectation of price cuts, with individuals much less assured about reductions going into the third quarter. Traders now anticipate the Fed will start chopping charges in July, with two to a few further reductions projected by year-end.

Share this text