Bitcoin is holding agency across the $104,000 mark after a pointy rally pushed by days of sustained shopping for strain and renewed market optimism. Bulls regained management when BTC reclaimed the $90,000 stage in late April, reversing months of aggressive promoting that had weighed on value motion. The shift in sentiment has been clear, with bullish momentum constructing shortly and pushing the market again into key provide zones.

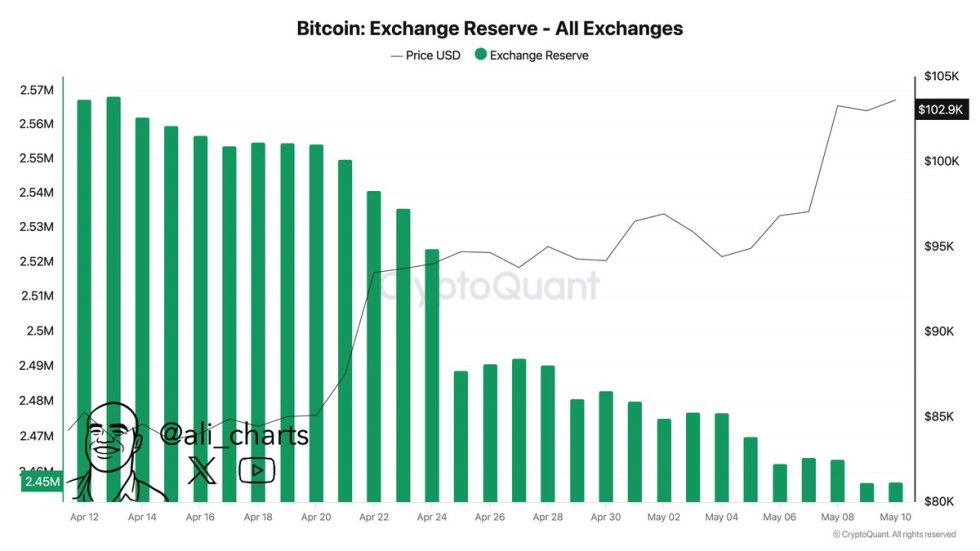

Supporting this pattern, on-chain information from CryptoQuant reveals that over 110,000 BTC have been withdrawn from exchanges up to now month. Traditionally, giant outflows from centralized platforms sign rising investor confidence and decreased sell-side liquidity—two key elements of sturdy upward traits. This conduct usually precedes main rallies, as long-term holders tighten provide whereas sidelining cash from near-term buying and selling.

Now, with Bitcoin buying and selling just under all-time highs, the market seems to be getting into a brand new part. Traders are watching intently as BTC consolidates above $100K, with analysts suggesting that the present construction units the stage for one more leg greater. If trade withdrawals proceed and sentiment stays bullish, a break towards the $109K all-time excessive might come ahead of anticipated.

Bitcoin Faces Last Resistance Earlier than Worth Discovery

Bitcoin is now making ready to check uncharted territory after enduring months of heavy promoting strain and protracted market skepticism. Following a powerful restoration since late April, BTC is at present discovering resistance across the $105,000 stage — a essential value level that might outline the subsequent part of the cycle. This space, simply shy of the all-time excessive, is prone to appeal to each profit-taking and speculative curiosity, which can end in elevated volatility earlier than a decisive breakout.

If bulls handle to push above the $105K mark, a surge towards new all-time highs could be imminent. Nonetheless, this stage additionally represents a psychological barrier that might set off a short-term rejection. Regardless of this, the underlying information helps a powerful bullish outlook.

Prime analyst Ali Martinez shared current on-chain information from CryptoQuant exhibiting that over 110,000 BTC have been withdrawn from centralized exchanges over the previous month. Such a big quantity of withdrawals traditionally correlates with accumulation by long-term holders, signaling confidence and decreased promoting strain.

This conduct means that the current rally is not only fueled by speculative hype but in addition supported by structural shifts in provide. As BTC provide tightens and demand will increase, significantly with institutional flows rising, the setup for a sustained breakout strengthens. Whereas some short-term resistance could persist, the broader pattern now favors the bulls. If trade outflows proceed at this tempo and macro sentiment stays secure, Bitcoin might quickly enter a value discovery part, forsaking the vary that outlined its motion for a lot of 2025.

BTC Worth Motion Particulars: Technical Ranges

Bitcoin is buying and selling across the $104,000 mark after a robust breakout rally that began in late April. As proven within the day by day chart, BTC surged via the $90K resistance and cleared $100K with sturdy momentum, however is now dealing with resistance close to $104K–$105K, a zone that beforehand acted as a significant provide area in the course of the February highs.

The chart reveals that BTC is consolidating just under this resistance with a small retrace and declining quantity, suggesting a cooling of momentum after a number of days of aggressive shopping for. This isn’t essentially bearish — brief pauses are widespread earlier than retesting key ranges, particularly when RSI and quantity stretch. The 200-day shifting common (SMA) and exponential shifting common (EMA) stay nicely beneath the present value, exhibiting that bulls keep structural management.

The important thing ranges to observe now are $103,600 (short-term help) and $104,900–$105,500 (resistance zone). A clear break above this vary would open the trail towards new all-time highs. Conversely, a failure to interrupt greater could result in a retest of the breakout zone close to $100K. Total, value motion stays bullish, however the subsequent few candles will probably be decisive for short-term pattern continuation.

Featured picture from Dall-E, chart from TradingView

Editorial Course of for bitcoinist is centered on delivering completely researched, correct, and unbiased content material. We uphold strict sourcing requirements, and every web page undergoes diligent overview by our crew of prime expertise consultants and seasoned editors. This course of ensures the integrity, relevance, and worth of our content material for our readers.