Este artículo también está disponible en español.

In a brand new analysis report shared on X, Joe Consorti, Head of Development at Theya, has dispelled ongoing rumors alleging that the Bitcoin value is being artificially held down. Consorti lays out a complete examination of on-chain knowledge, pointing to the traditional cyclical habits of long-term holders (LTHs) and their profit-taking patterns as key drivers of bitcoin’s present buying and selling dynamic.

Is The Bitcoin Value At the moment Manipulated?

One of many core arguments Consorti addresses is the suspicion that “the boring interval of consolidation” is perhaps engineered by hidden market forces. In his phrases: “Claims of synthetic value suppression is a gold-era argument that doesn’t work in bitcoin, whose ledger is auditable in actual time, that means we will see precisely who’s shopping for and promoting by their very own node on the community.”

Consorti underscores that any concerted effort to artificially cap Bitcoin can be seen to on-chain observers. As an alternative, the information factors to a well-trodden sample: after accumulating BTC within the cheaper price ranges—between $15,000 to $25,000—LTHs promote parts of their holdings into greater costs, redistributing cash to new market individuals who proceed bidding bitcoin upward. “That is regular. Those that held for years begin offloading as value strikes greater, transferring cash to new patrons stepping in to bid the value to even greater highs.”

Associated Studying

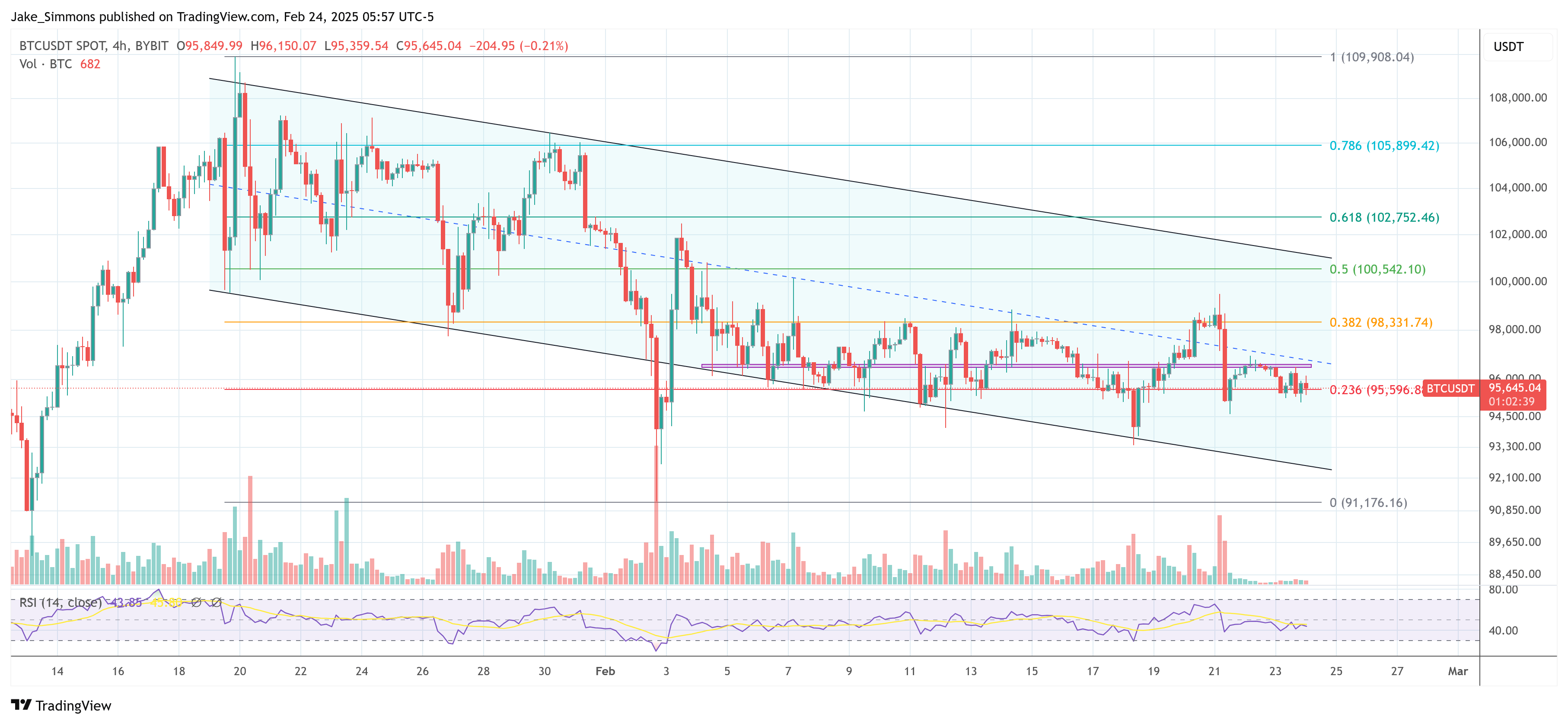

In accordance with Consorti, Bitcoin has now entered its 100+ day consolidation vary round $95,000—a stretch he compares to earlier multi-month consolidation phases that ultimately resolved in main value expansions.

The analysis offers a retrospective take a look at how LTHs behaved in earlier value climbs: “LTHs collected BTC from $15k to $25k, earlier than promoting to new market entrants (short-term holders) who bid the value as much as the subsequent ‘step’. They did the identical from $25k to $40k, from $40k to $65k, and from $65k to the ~$95,000 vary we discover ourselves in now.”

Consorti notes that LTHs have currently turned again into web accumulators. Though the shift is slight, he contends this habits normally marks the tail finish of consolidation earlier than one other breakout.

The researcher additionally factors to a latest $1.4 billion Ethereum hack on Bybit—allegedly the most important in crypto’s historical past—as an element momentarily knocking bitcoin off an try to interrupt out of its falling wedge sample. Regardless of the market disruption, bitcoin solely slipped 1.75% on the day, which Consorti says is a testomony to the main BTC’s “outright power” and diminishing correlation to broader crypto belongings.

Total, Consorti expects the falling wedge to “resolve itself by the primary week of March,” barring extra black swan occasions. He additionally observes that Bitcoin’s present consolidation zone could stretch past 101 days, cautioning that “most ache available in the market” may see it lengthen to 236 days, mirroring final summer season’s protracted consolidation interval.

Consorti additionally references the potential affect of President Trump’s working group on Bitcoin, which is about to resolve on the viability of a Strategic Bitcoin Reserve by the top of June. Ought to a last determination come sooner, he suggests it could present a serious spark for the market—both bullish or bearish, relying on the end result.

Spot ETF inflows, as soon as seen as a essential propeller of Bitcoin’s value, have diminished since early January. Though they nonetheless present 7–8 determine day by day inflows, these are down considerably from the 9–10 determine ranges that occurred all through final spring and fall, hinting that different market forces, similar to institutional and on-chain dynamics, is perhaps extra influential on this cycle’s value motion.

One other subject is Bitcoin’s dislocation from international M2 cash provide, which had tracked the value with uncanny accuracy for almost 18 months. That correlation broke when international M2 instructed a deeper downturn for bitcoin, but BTC continued to hover round $95,000. Now that M2 is edging upward once more on a weaker US greenback, the analysis suggests the potential for Bitcoin aligning for its subsequent leg greater.

Evaluating Bitcoin to gold with a 50-day lead likewise implies that gold’s latest trajectory could “level to an upside decision”, albeit much less exactly than M2 correlations. If this holds, a push in the direction of $120,000 seems believable.

Associated Studying

Consorti concludes by shifting consideration to the evolving panorama of US Treasury (UST) demand. Main international holders similar to China and Japan have progressively decreased or flatlined their positions—China’s holdings have reached a 2009 low of $759 billion, whereas Russia has absolutely exited, and Japan stays at $1.06 trillion for 13 years. “It’s not simply China. Russia has absolutely exited USTs. Japan, the most important international holder, has been sitting flat at $1.06 trillion for 13 years.”

In the meantime, the US Federal Reserve’s share of excellent marketable USTs has surged from 22% in 2008 to 47.3% in 2025, stepping in as international demand wanes. However a brand new participant is becoming a member of the market within the type of stablecoins, which collectively maintain about $200 billion in Treasuries to again their dollar-pegged tokens. In accordance with Consorti, this stablecoin demand: “Might decrease long-term rates of interest. The proliferation of stablecoins and their use of Treasuries as a reserve asset means they’re functioning like a completely new international central financial institution.”

He argues that stablecoins successfully guarantee contemporary demand for Treasuries, serving to the US authorities offset declining international involvement and maintain its borrowing wants. White Home AI & Crypto Czar David Sacks has publicly echoed this angle, saying stablecoins assist preserve liquidity for US debt.

At press time, BTC traded $95,645.

Featured picture created with DALL.E, chart from TradingView.com