Traders are more and more turning to corporations leveraging AI to drive income development and operational effectivity.

Amongst these, Salesforce, AppLovin, and Pinterest current compelling alternatives with huge upside potential.

In search of extra actionable commerce concepts? Subscribe right here for 45% off InvestingPro!

The tech-heavy has skilled a big resurgence in current weeks, fueled by contemporary optimism over de-escalating US-China commerce tensions and robust demand for synthetic intelligence (AI) options.

Supply: Investing.com

After a interval of consolidation, a number of AI-focused corporations are exhibiting renewed momentum because the market acknowledges their potential to revolutionize industries and ship substantial returns.

As such, listed here are three standout AI shares positioned for appreciable upside within the months forward.

1. Salesforce

12 months-To-Date Efficiency: -13%

Market Cap: $279 Billion

Salesforce (NYSE:), a frontrunner in cloud-based buyer relationship administration (CRM), is embedding AI throughout its platform to boost buyer engagement and data-driven insights. The corporate’s AI-driven analytics software, Einstein, supplies gross sales and advertising predictions that allow companies to make superior strategic choices.

Supply: Investing.com

The mixing of AI shouldn’t be solely boosting Salesforce’s high line by attracting new shoppers but in addition enhancing buyer retention and increasing its market attain. As companies more and more prioritize data-driven decision-making, the CRM supplier’s AI choices are anticipated to drive its inventory greater.

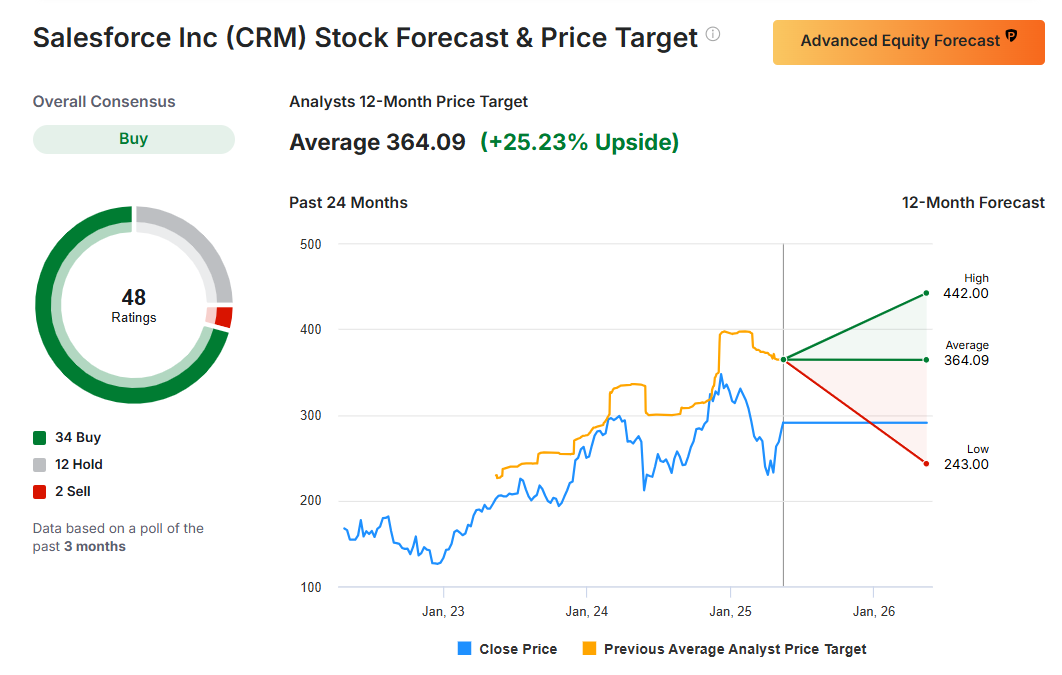

Salesforce stands out with a “GREAT” monetary well being score and a rating of three.04, reflecting sturdy fundamentals and robust operational effectivity. Analysts forecast a worth goal upside of 25.2%, suggesting notable room for appreciation from present ranges.

Supply: Investing.com

With 48 analysts overlaying the inventory and a consensus “Robust Purchase” advice, sentiment stays bullish regardless of current slowing in income development.

2. AppLovin

12 months-To-Date Efficiency: +16.3%

Market Cap: $127.4 Billion

Within the cell app area, Applovin (NASDAQ:) has emerged as a dominant pressure within the cell app ecosystem by its revolutionary AXON AI platform, which optimizes promoting efficiency throughout hundreds of cell purposes. This subtle machine studying system processes over 300 billion day by day advert requests, repeatedly enhancing focusing on precision and monetization effectivity.

Supply: Investing.com

A number of catalysts recommend substantial upside for AppLovin shares. The continued shift towards cell engagement globally supplies a rising addressable market, whereas ongoing enhancements to its AI algorithms proceed to widen its aggressive moat. Moreover, the corporate’s strategic pivot towards higher-margin software program providers over direct app possession has improved profitability metrics, attracting elevated institutional investor curiosity.

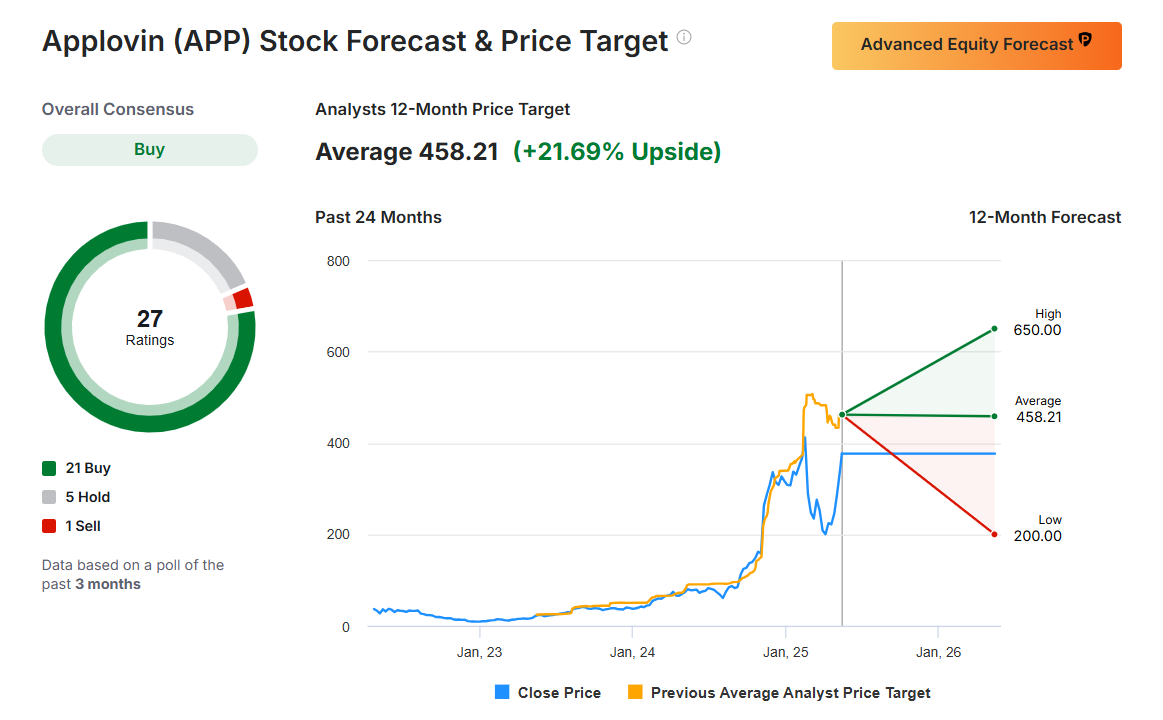

AppLovin boasts a “GREAT” monetary well being label, with a rating of three.42. Shares presently current a compelling funding case with analysts projecting a 21.7% upside potential and a imply worth goal of $458.21.

Supply: Investing.com

Of the 27 analysts overlaying APP, 21 have a ‘purchase’ score on the inventory, whereas just one charges it as a ‘promote’ together with 5 that price it as a ‘maintain’, signaling sturdy conviction.

3. Pinterest

12 months-To-Date Efficiency: +13.4%

Market Cap: $22.2 Billion

Pinterest (NYSE:) has leveraged synthetic intelligence to rework from a easy image-sharing platform into a classy visible discovery engine. The corporate’s AI algorithms energy all the things from content material suggestions to visible search capabilities that permit customers to search out merchandise by merely importing photographs, driving engagement and advert clicks.

Supply: Investing.com

This AI-centric method is delivering spectacular monetary outcomes. Consumer engagement metrics have dramatically improved, with time spent on the platform growing over 30% year-over-year in Q1. Extra importantly, Pinterest has efficiently monetized this engagement by AI-optimized promoting, with common income per person (ARPU) rising constantly throughout each home and worldwide markets.

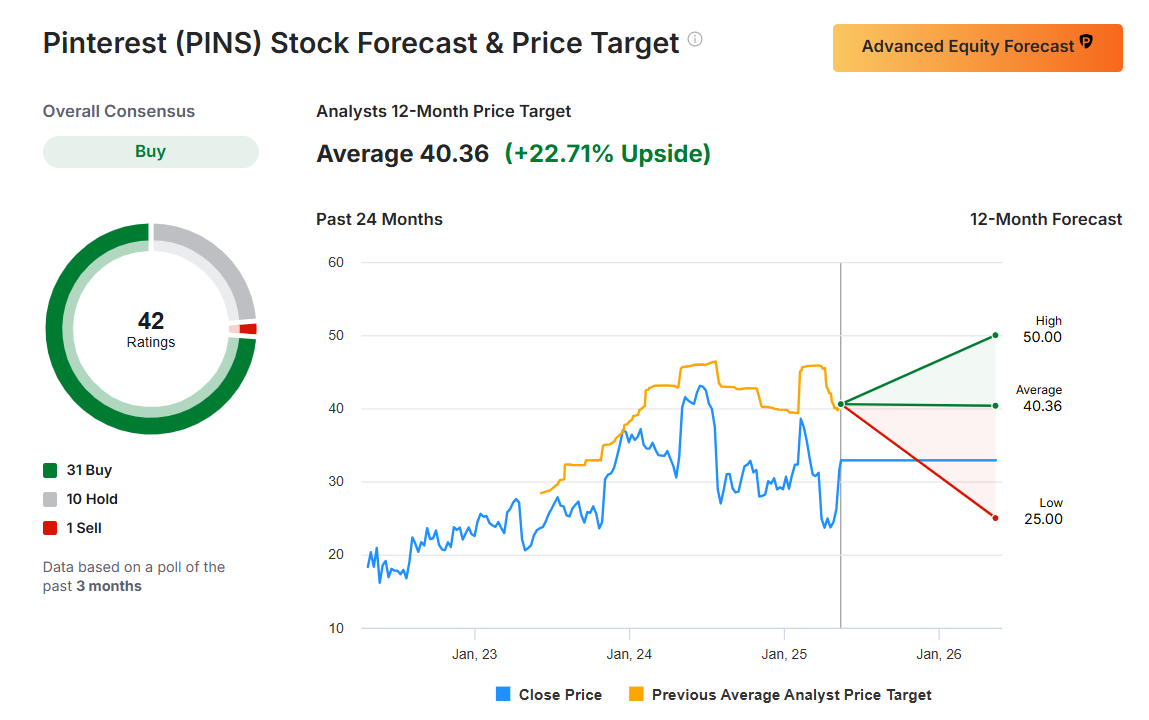

Pinterest posts a “GREAT” monetary well being rating of three.48—the best amongst this group—because of a fortress stability sheet and robust money circulate. With analysts predicting a 22.7% upside, Pinterest is seen as a possible rebound play after current underperformance, supported by new AI-driven advert codecs and worldwide enlargement alternatives.

Supply: Investing.com

The corporate’s dedication to AI innovation helps strengthen its promoting income mannequin, presenting potential upside for its inventory as digital advertising budgets rise.

Conclusion

The renewed tech rally presents a singular alternative for traders to capitalize on the AI revolution. By specializing in corporations like Salesforce, AppLovin, and Pinterest which can be successfully leveraging AI to spice up their high and backside strains, traders can place themselves for substantial features within the months forward.

As AI continues to reshape industries and drive innovation, these shares are well-positioned to guide the cost, making them compelling investments in right this moment’s market.

Be sure you try InvestingPro to remain in sync with the market pattern and what it means to your buying and selling. Whether or not you’re a novice investor or a seasoned dealer, leveraging InvestingPro can unlock a world of funding alternatives whereas minimizing dangers amid the difficult market backdrop.

Subscribe now and immediately unlock entry to a number of market-beating options, together with:

ProPicks AI: AI-selected inventory winners with confirmed observe report.

InvestingPro Truthful Worth: Immediately discover out if a inventory is underpriced or overvalued.

Superior Inventory Screener: Seek for the very best shares based mostly on a whole lot of chosen filters, and standards.

Prime Concepts: See what shares billionaire traders reminiscent of Warren Buffett, Michael Burry, and George Soros are shopping for.

Disclosure: On the time of writing, I’m lengthy on the S&P 500, and the Nasdaq 100 by way of the SPDR® S&P 500 ETF (SPY), and the Invesco QQQ Belief ETF (QQQ). I’m additionally lengthy on the Invesco Prime QQQ ETF (QBIG), Invesco S&P 500 Equal Weight ETF (RSP), and VanEck Vectors Semiconductor ETF (SMH).

I recurrently rebalance my portfolio of particular person shares and ETFs based mostly on ongoing threat evaluation of each the macroeconomic atmosphere and firms’ financials.

The views mentioned on this article are solely the opinion of the writer and shouldn’t be taken as funding recommendation.

Comply with Jesse Cohen on X/Twitter @JesseCohenInv for extra inventory market evaluation and perception.