Retail management group and manufacturing facility output additionally undershot forecasts

Yields dropped sharply; markets priced in two Fed cuts by year-end

Crude slumped on Iran nuclear deal discuss

Gold bounced off pattern assist as dip-buyers stepped in aggressively

A string of softer-than-expected U.S. financial knowledge prints on Thursday revived expectations for extra charge cuts from the , leading to an enormous reversal in rate of interest markets following heavy losses earlier within the week. Reasonably than fret a few potential US recession, cyclical shares rallied, with capital shifting out of progress names that had outperformed in earlier days.

Whereas the charges and equities world have been enthusiastic, the FX universe was disinterested—seemingly taking its lead from technicals somewhat than something resembling fundamentals. Gold staged a dramatic bounce after hitting multi-week lows, whereas crude did the other on the prospect of much more provide hitting an already saturated market.

Downbeat Knowledge Revives Fee Lower Bets

Supply: TradingView

Treasury yields fell sharply in a single day as a batch of weaker-than-expected U.S. knowledge pointed to a cooling economic system and firmer prospects for Fed charge cuts. The standout miss got here from producer costs, with remaining demand unexpectedly falling 0.5% in April—nicely beneath the 0.2% rise anticipated. It was the biggest drop in over a 12 months. Core readings additionally undershot, hinting that upstream producers could also be absorbing the influence of upper import tariffs, at the least for now.

added to the gloom, slipping 0.4%—double the drop anticipated. The U.S. management group—which feeds into calculations—slumped 0.2%, suggesting the specter of larger tariffs noticed shoppers deliver ahead spending into Q1.

All up, the info painted an image of flagging demand and weakening momentum at the beginning of Q2, growing the chance the Fed could must ship a string of charge cuts ought to it start to tug on the labour market.

Supply: TradingView

Fee markets have been bid on the again of the info, with the tumbling over 9bps to dip beneath 4%, the down practically 8bps to 4.45%, and the curve steepening modestly as merchants priced in two Fed cuts this 12 months—most probably beginning in September.

Equities didn’t want a second invitation to rally on the again of the speed transfer, led by cyclical sectors. Unusually, the FX universe confirmed little curiosity within the knowledge, seemingly preferring to take its cues from technical somewhat than basic elements.

Exterior of charges, the opposite huge transfer on Thursday got here from crude oil. WTI slid greater than 2% as reviews surfaced of a possible nuclear deal between the U.S. and Iran. A breakthrough might unlock sanctioned Iranian provide, giving oil bears recent ammunition at a time when demand alerts are softening.

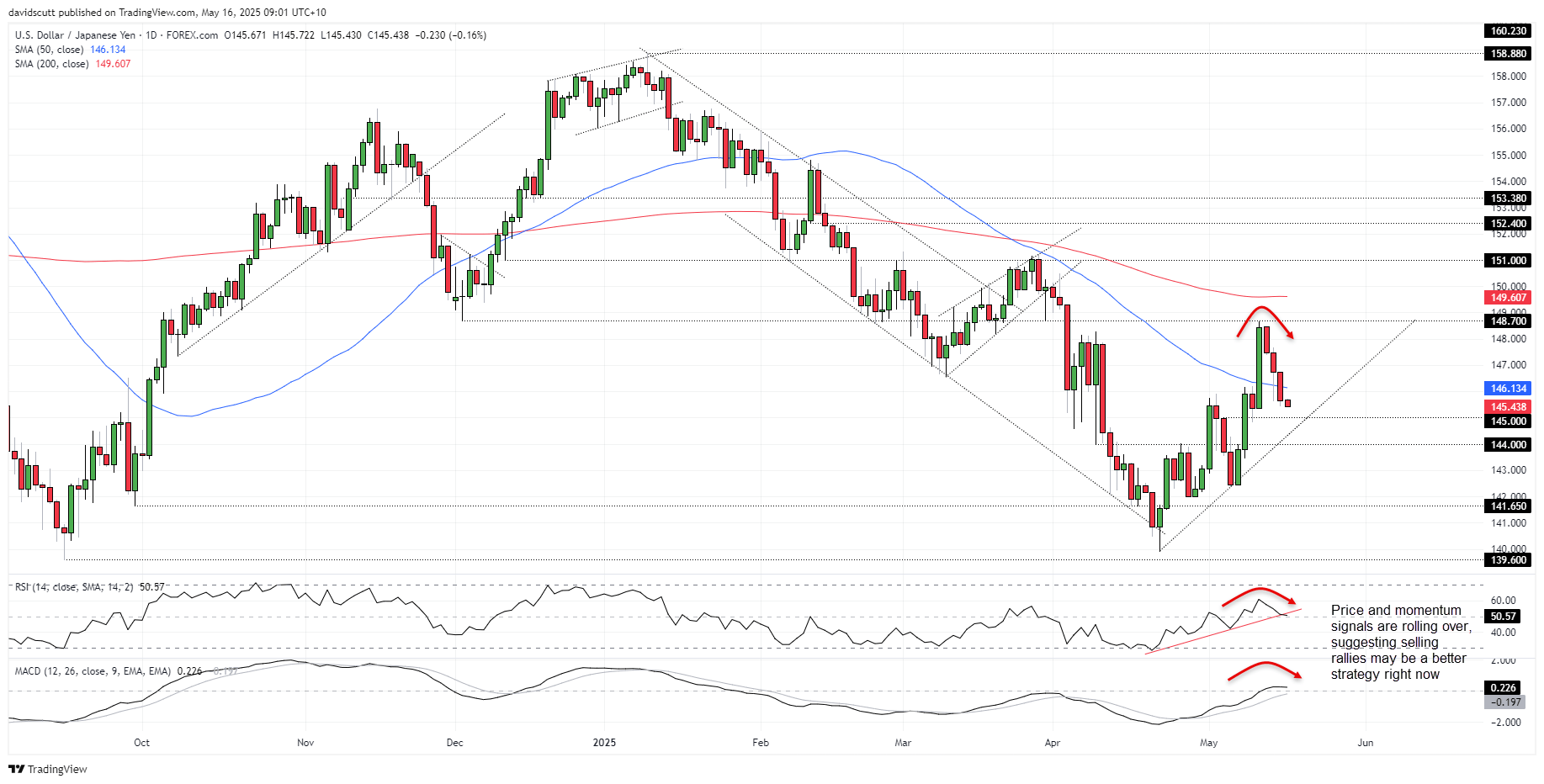

USD/JPY Unwind Gathers Steam

Supply: TradingView

stays one of many extra fascinating FX pairs on the market proper now, exhibiting little relationship with conventional drivers like rate of interest differentials and efficiency of riskier belongings. As a substitute, technicals look like taking part in a much bigger function within the yen’s actions, suggesting that needs to be the preliminary reference level for anybody considering setups involving the pair.

Having eked marginally into bullish territory, RSI (14) and MACD at the moment are threatening to roll over, hinting momentum could also be beginning to shift to the draw back. For now, each indicators sit in impartial territory, favouring a impartial bias that places extra emphasis on value motion.

On the draw back, ranges to look at embrace 145, the uptrend relationship again to the April lows, 144 and 141.65. Above, the 50DMA is discovered close to 146 right this moment—a stage that has seen loads of motion over the previous week. A break and shut above the 50DMA could shift near-term directional dangers larger, placing a possible retest of 148.70 on the desk.

Whereas Japanese Q1 knowledge can be launched right this moment, if current kind is any information, it’s unlikely to ship any significant market response. March quarter knowledge appears to be like like one thing from the distant previous given how quickly the macro surroundings is altering.

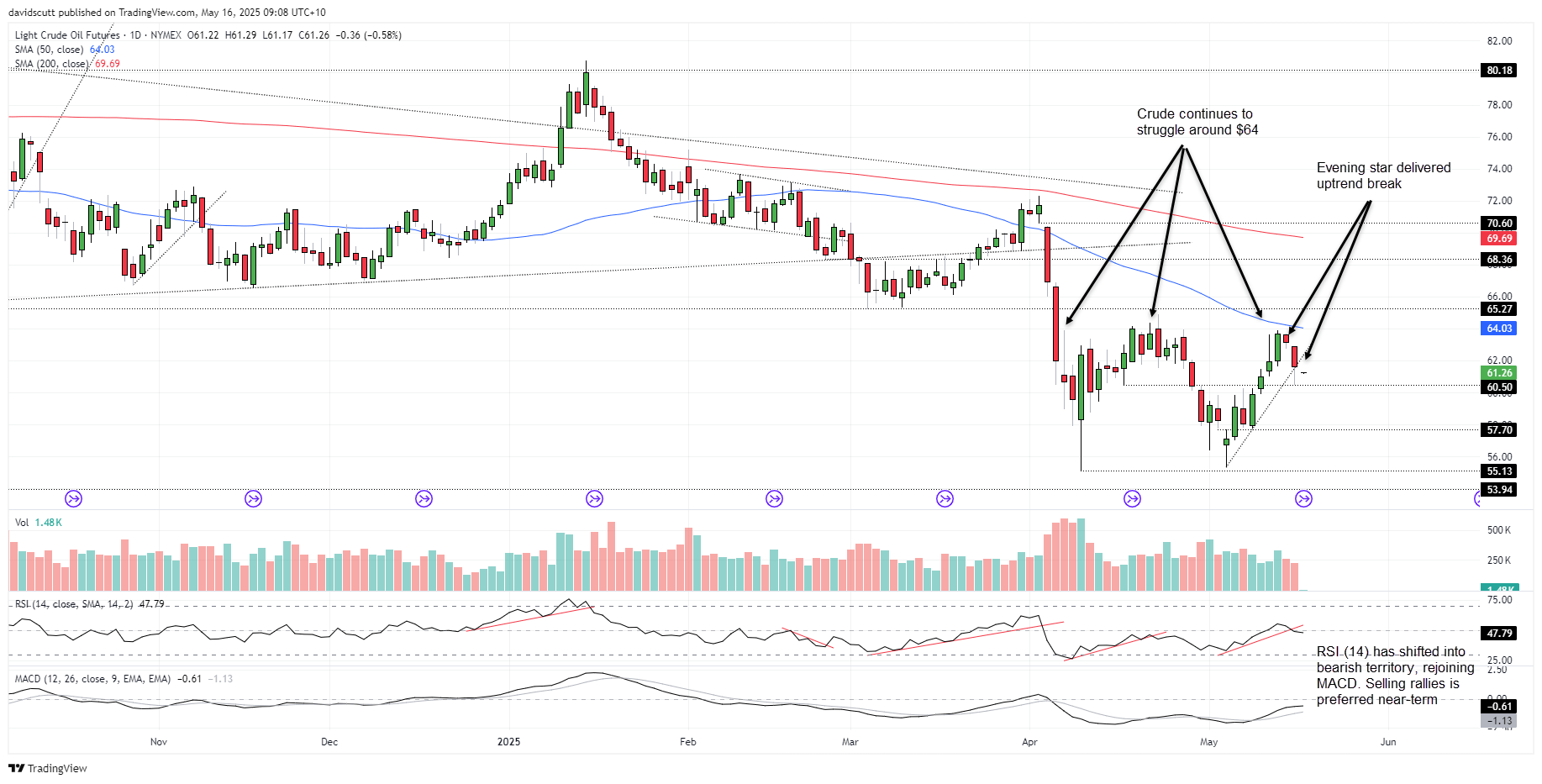

Crude Crunch on Potential Iran Deal

Supply: TradingView

delivered an apparent topping sample on Thursday, finishing a three-candle night star whereas concurrently breaking the uptrend relationship again to the lows set on Could 5. With momentum indicators wanting heavy and shifting marginally into bearish territory, the bounce over the previous fortnight could also be on its final legs.

On the draw back, $60.50, $57.70 and $55.13 are ranges to look at. Above, crude has persistently struggled over the previous month both facet of $64, making it a stage to look at ought to we see an unlikely squeeze larger.

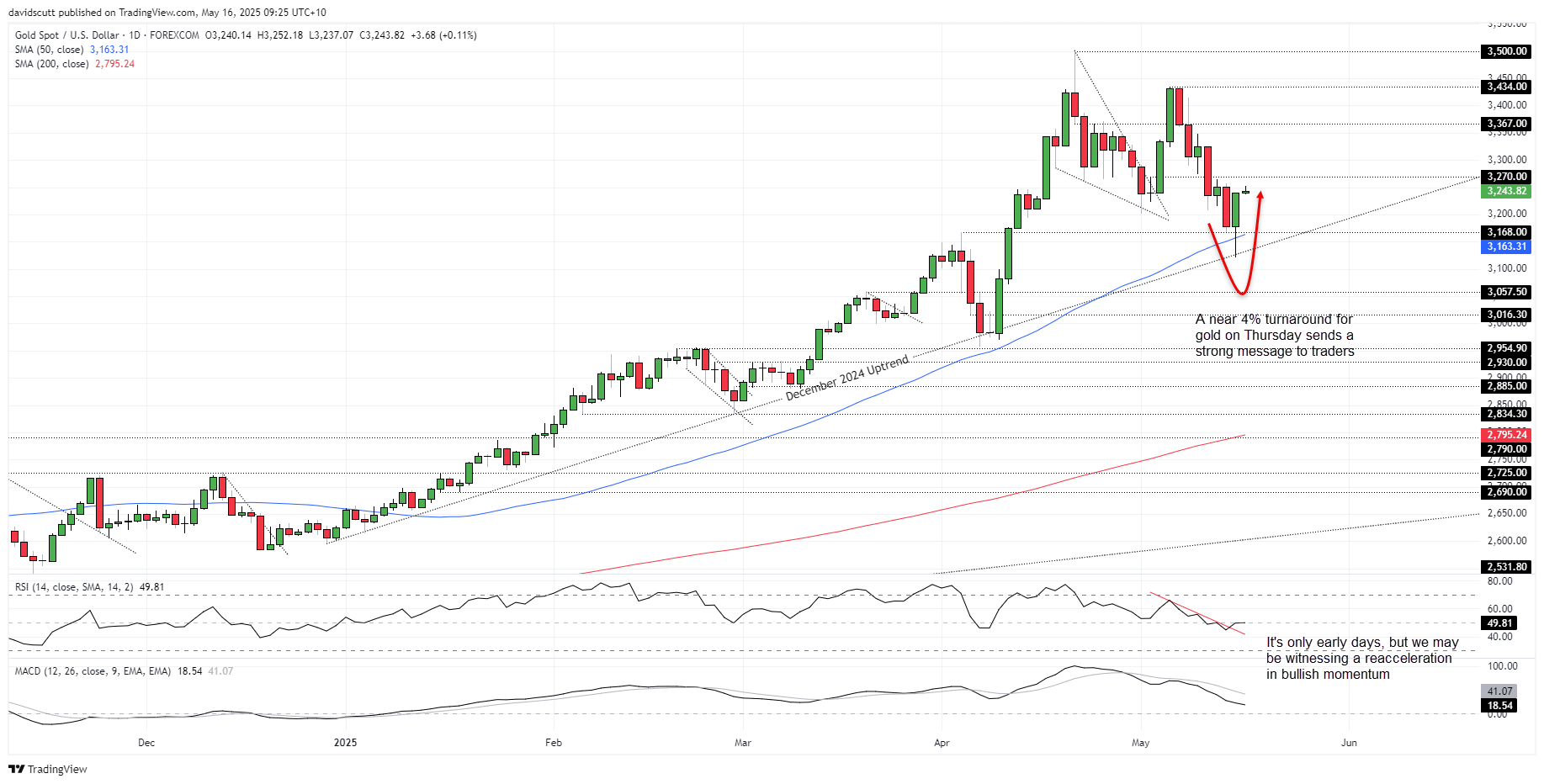

Gold Bulls Ship Highly effective Sign

Supply: TradingView

staged a robust bounce off the December 2024 uptrend on Thursday, erasing losses of practically 2% to shut up practically 2%. The dimensions of the transfer leaves little doubt that bullion stays a buy-on-dips play for now, placing larger emphasis on upside ranges than down as we transfer in the direction of the weekend.

$3270 looms as a barrier for these seeking to prolong the bullish transfer, with a break of that stage placing $3367 probably on the desk. On the draw back, $3168 stays a related stage with the uptrend and 50DMA situated simply beneath it.

Thursday’s thrust has seen RSI (14) break the downtrend it was sitting in, pushing it again to impartial territory. MACD continues to pattern decrease however stays nicely above zero, offering a mixed momentum sign that leans marginally bullish total. Value motion carries extra weight at this juncture.

Have a terrific weekend!

Authentic Publish