High quality firms in sectors that profit within the present surroundings warrant elevated consideration.

Chevron and LyondellBasell stand out as resilient, value-driven investments poised to ship robust returns.

In search of extra actionable commerce concepts? Subscribe right here for 45% off InvestingPro!

As bond yields climb in 2025, with the word hovering round 4.50%, traders face a shifting market panorama. Rising yields, typically a sign of accelerating rates of interest and inflationary pressures, are likely to problem growth-oriented sectors like know-how whereas creating alternatives in value-driven, cyclical industries.

Supply: Investing.com

Two firms that stand out as compelling funding alternatives on this surroundings are Chevron (NYSE:) and LyondellBasell Industries NYSE:). These companies, rooted within the vitality and chemical substances sectors, are well-positioned to outperform when yields spike because of their resilience, enticing dividend yields, and publicity to macroeconomic tailwinds.

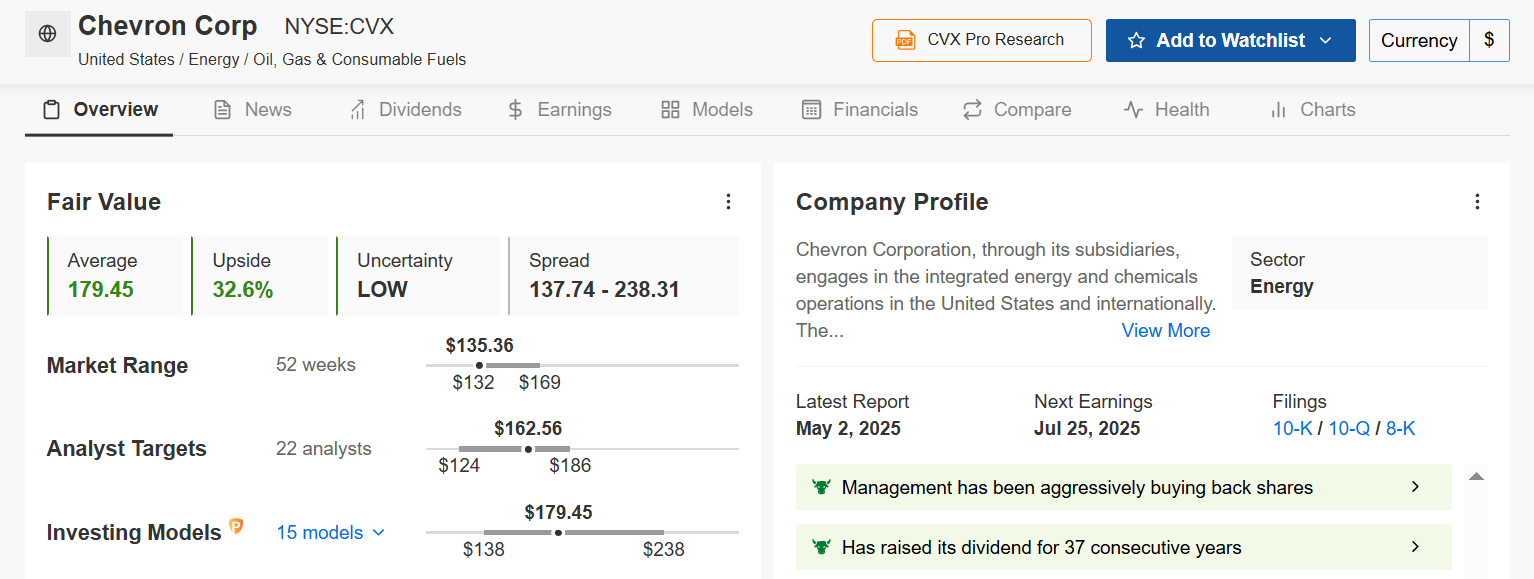

1. Chevron

Present Worth: $135.29

Honest Worth Estimate: $179.45 (+32.6% Upside)

Dividend Yield: 5.05%

Chevron, one of many world’s largest built-in oil and gasoline firms, is a standout alternative when bond yields rise. Greater yields typically correlate with inflationary pressures, which are likely to push commodity costs, together with oil, upward. Chevron’s diversified operations, spanning upstream exploration, midstream transportation, and downstream refining, enable it to capitalize on elevated vitality costs.

Supply: Investing.com

The oil large’s substantial dividend yield—at present at 5.05%—presents traders a premium over the 10-year Treasury yield, creating a sexy earnings proposition whilst charges rise. Importantly, Chevron has elevated its dividend for 37 consecutive years, demonstrating a dedication to returning capital to shareholders all through financial cycles.

The corporate’s 32.6% ‘Honest Worth’ upside suggests CVX inventory is at present undervalued by the InvestingPro fashions, offering notable potential for capital appreciation. With the inventory buying and selling close to its 52-week low, Chevron may supply a price alternative if fundamentals stay steady.

Supply: InvestingPro

A number of further tailwinds help Chevron’s outlook past the rising yield surroundings. The corporate’s disciplined capital allocation technique emphasizes high-return tasks whereas sustaining one of many strongest steadiness sheets within the trade. Analysts see profitability forward this 12 months, and with money flows ample sufficient to cowl curiosity funds, its reasonable debt degree seems manageable.

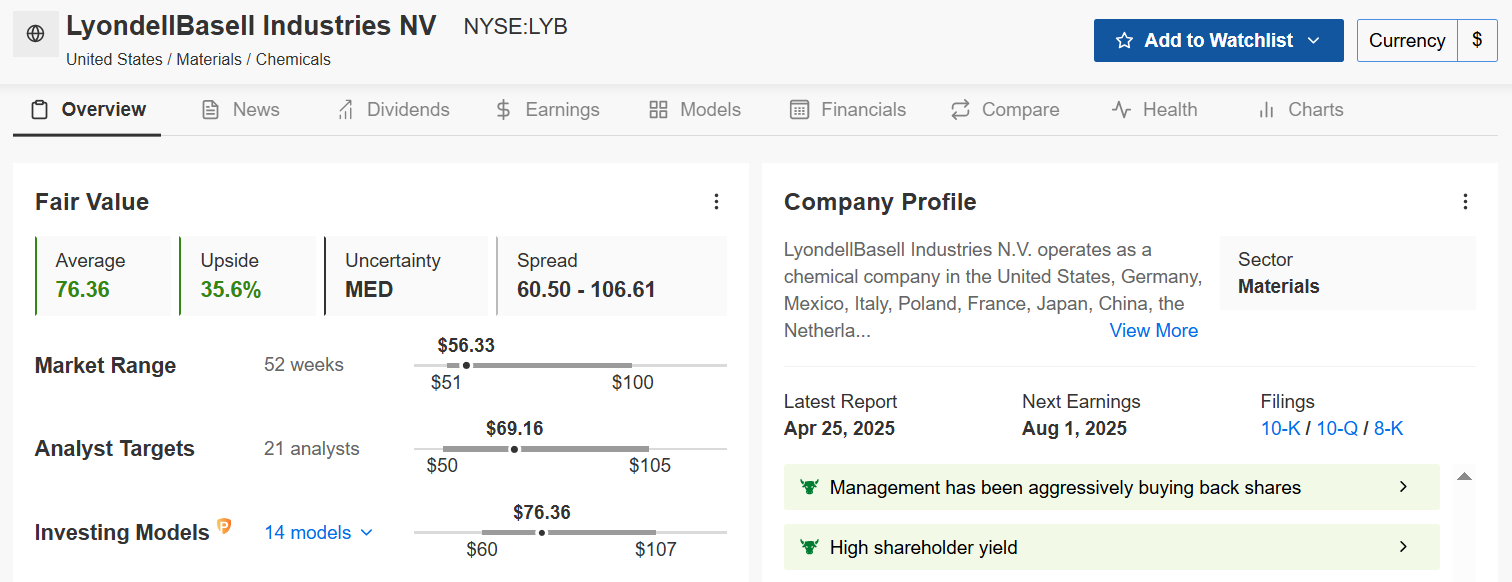

2. LyondellBasell Industries

Present Worth: $56.33

Honest Worth Estimate: $76.36 (+35.6% Upside)

Dividend Yield: 9.48%

LyondellBasell Industries, a world chief in chemical substances, plastics, and refining, is one other inventory well-suited for a rising yield surroundings. The corporate produces important supplies like polyethylene and polypropylene, that are crucial to industries akin to packaging, automotive, and building. Greater commodity costs, significantly for petrochemicals, increase the corporate’s margins, as uncooked materials prices are sometimes handed by means of to clients.

Supply: Investing.com

The corporate stands out for its excessive shareholder yield and a 15-year streak of uninterrupted dividends. LyondellBasell at present sports activities a strong 9.48% dividend yield, positioning it among the many higher-yield choices in chemical substances. The agency’s robust free money circulate yield and ongoing share buybacks add to its investor attraction.

LYB inventory’s 35.6% InvestingPro ‘Honest Worth’ upside is much more beneficiant than Chevron’s, reflecting deep undervaluation in accordance with consensus fashions, whereas its 2.35 Monetary Well being Rating factors to cheap, if barely decrease, steadiness sheet energy.

Supply: InvestingPro

LyondellBasell advantages from further tailwinds that might propel its inventory greater in 2025. The corporate’s international footprint, with important operations within the U.S. and Europe, positions it to capitalize on regional demand surges, significantly if U.S. infrastructure spending accelerates below new fiscal insurance policies.

Moreover, the corporate’s publicity to the round economic system, by means of initiatives like recycled plastics manufacturing, aligns with rising environmental, social, and governance (ESG) concerns, doubtlessly attracting a broader investor base.

Be sure you try InvestingPro to remain in sync with the market pattern and what it means in your buying and selling. Whether or not you’re a novice investor or a seasoned dealer, leveraging InvestingPro can unlock a world of funding alternatives whereas minimizing dangers amid the difficult market backdrop.

Subscribe now and immediately unlock entry to a number of market-beating options, together with:

ProPicks AI: AI-selected inventory winners with confirmed observe file.

InvestingPro Honest Worth: Immediately discover out if a inventory is underpriced or overvalued.

Superior Inventory Screener: Seek for one of the best shares primarily based on lots of of chosen filters, and standards.

Prime Concepts: See what shares billionaire traders akin to Warren Buffett, Michael Burry, and George Soros are shopping for.

Disclosure: On the time of writing, I’m lengthy on the S&P 500, and the Nasdaq 100 through the SPDR® S&P 500 ETF (SPY), and the Invesco QQQ Belief ETF (QQQ). I’m additionally lengthy on the Invesco Prime QQQ ETF (QBIG), and Invesco S&P 500 Equal Weight ETF (RSP).

I usually rebalance my portfolio of particular person shares and ETFs primarily based on ongoing threat evaluation of each the macroeconomic surroundings and firms’ financials.

The views mentioned on this article are solely the opinion of the writer and shouldn’t be taken as funding recommendation.

Comply with Jesse Cohen on X/Twitter @JesseCohenInv for extra inventory market evaluation and perception.