Up to date on Could twenty second, 2025 by Bob Ciura

The snowball impact exhibits the ability of compounding.

While you push a small snowball down a hill, it constantly picks up snow. When it reaches the underside of the hill it’s a large snow boulder.

The snowball compounds throughout its journey down the hill. The larger it will get, the extra snow it packs on with every revolution. The snowball impact explains how small actions carried out over time can result in massive outcomes.

In the identical manner, investing in high-quality dividend progress shares can generate massive quantities of dividend earnings over lengthy intervals of time. That’s as a result of dividend progress shares are likely to pay rising dividends yearly.

After which you may reinvest these rising dividends to buy extra shares every year. This ends in a rise within the complete variety of shares you personal, in addition to a rise within the dividend per share, for a strong wealth compounding impact.

Buyers on the lookout for the very best dividend progress shares ought to think about the Dividend Aristocrats, a bunch of 69 shares within the S&P 500 with 25+ consecutive years of dividend progress.

You’ll be able to obtain an Excel spreadsheet of all 69 Dividend Aristocrats (with metrics that matter similar to dividend yields and price-to-earnings ratios) by clicking the hyperlink under:

This text exhibits the best way to harness the ability of the snowball impact to multiply your wealth and earnings many occasions over.

It additionally consists of 5 actual world examples of the ‘snowball impact’ shares which have compounded investor wealth.

Desk of Contents

You’ll be able to immediately leap to any particular part by clicking on the hyperlinks under:

The Energy of The Snowball Impact

Earlier than we focus on the best way to harness the ability of the snowball impact we should perceive the ability of compounding.

The snowball metaphor visually exhibits the ability of compounding.

“Essentially the most highly effective pressure on this planet is compound curiosity”– Attributed to Albert Einstein

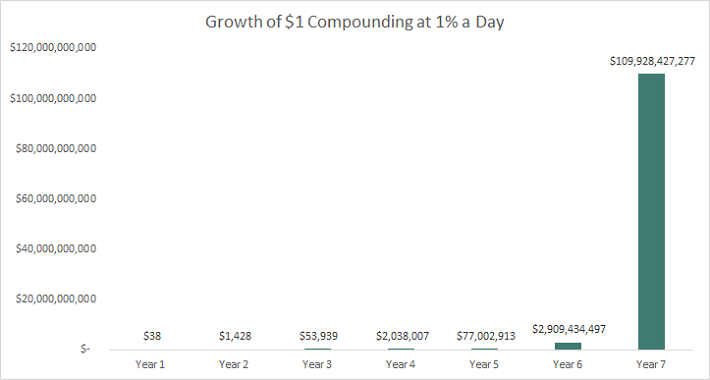

Right here’s the ability of compound curiosity:

Think about you invested $1 that compounded at 1% a day. In 5 years your $1 would develop to over $77 million. You’d be among the many richest folks on this planet by yr 7.

Remember that compounding will not be a get wealthy fast scheme. It takes time – and many it. There are not any investments that compound at 1% a day in the actual world.

The inventory market has compounded wealth (adjusting for inflation) at ~7% a yr over the long term. At this charge an funding within the inventory market has traditionally doubled each 10.4 years.

It takes extra time to compound wealth in the actual world – however that doesn’t make the precept of compounding any much less highly effective.

Take Warren Buffett for example. Warren Buffett is price over $150 billion. Warren Buffett’s wealth comes from the great advantages of the snowball impact by means of time.

Warren Buffett compounded his wealth by means of a particular sort of funding.

Buffett invests in:

Shareholder-friendly companies

With sturdy aggressive benefits

Buying and selling at honest or higher costs

“All there’s to investing is choosing good shares at good occasions and staying with them so long as they continue to be good firms.”– Warren Buffett

The subsequent part of this text discusses the best way to harness the ability of the snowball impact by investing in the identical sort of companies Warren Buffett does.

How You Can Harness The Snowball Impact

You’ll be able to harness the ability of the snowball impact by investing in the identical sort of companies which have made Warren Buffett so rich over time.

Particularly, firms with sturdy and sturdy aggressive benefits and shareholder pleasant managements, buying and selling at honest or higher costs.

The excellent news is you don’t even should seek for these companies. There’s a listing of 55 companies with 50+ years of consecutive dividend will increase known as the Dividend Kings listing.

Nothing says ‘sturdy and sturdy aggressive benefits and shareholder pleasant administration’ like 50 or extra years of paying rising dividends in a row.

Coca-Cola (certainly one of Buffett’s largest investments) is a Dividend King. There are lots of different well-known shares within the Dividend Kings listing, together with:

Chances are you’ll learn this and assume: “these companies might have a historical past of success, however isn’t their run over”?

Buyers have wasted great sums of cash chasing ‘the brand new scorching inventory’. It’s regular reliable outcomes that result in long-term wealth multiplication.

What would occur should you had invested in a number of the most well-known Dividend Kings in 1990?

The 7 instance companies under all had 25+ years of consecutive dividend will increase by the top of 1990. They have been well-known, blue-chip shares in 1990.

It didn’t take a genius to purchase and maintain them…

However the outcomes converse for themselves. 5 examples of the snowball impact in motion are under. All examples assume dividends have been reinvested.

Instance #1: The Coca-Cola Firm (KO)

Coca-Cola compounded investor wealth at 10.4% a yr (together with dividends) from 1991 by means of 2022. $1 invested in Coca-Cola initially of 1991 could be price $23.62 by the top of 2022.

Coca-Cola was the biggest soda model in the US in 1990… And had a 98 yr working historical past on the time. It was not a start-up.

Instance #2: Lowe’s Firms (LOW)

Lowe’s is the second-largest residence enchancment retailer in the US, behind solely The Residence Depot (HD). In 1991 Lowe’s was one of many largest residence enchancment shops in the US. It had a dividend historical past of over 25 consecutive years of will increase even then.

Investing in Lowe’s initially of 1991 (32 years in the past) has labored out very properly…

The corporate’s inventory has compounded (together with dividends) at an unbelievable 20.4% yearly over this time interval. $1 invested in Lowe’s initially of 1991 would e price $379.74 on the finish of 2022.

Instance #3: Procter & Gamble (PG)

Procter & Gamble was simply as well-known in 1990 as it’s right this moment. The corporate has an iconic model portfolio with names like Tide, Bounty, Gillette, and Charmin (amongst many others).

The corporate was based in 1837. In 1990, Procter & Gamble had been round for 153 years… Not precisely a younger firm.

Nonetheless, long-term traders in Procter & Gamble have performed properly. The inventory has produced 32-year annualized complete returns of 11.3% a yr. $1 invested in Procter & Gamble initially of 1991 could be price $31.08 by the top of 2022.

Instance #4: Colgate-Palmolive (CL)

Colgate-Palmolive traces its historical past again to 1806. Each the Colgate and Palmolive manufacturers are simply acknowledged.

Along with these manufacturers, Colgate-Palmolive owns the Pace Stick, Delicate Cleaning soap, and Hill’s manufacturers (amongst many others).

Colgate-Palmolive has paid dividends since 1893. The corporate has paid rising dividends for over 50 consecutive years. In 1991 the corporate had a streak of 28 consecutive dividend will increase.

How did 1991 traders do? Colgate-Palmolive generated a compound annual returns of 11.7% throughout this 32-year interval. $1 invested in Colgate-Palmolive initially of 1991 could be price $32.64 by the top of 2022.

Instance #5: Johnson & Johnson (JNJ)

Johnson & Johnson is among the most secure companies on this planet. This stability is mirrored in Johnson & Johnson’s lengthy historical past of dividend funds to shareholders. This ‘sluggish and regular’ enterprise has been a boon for shareholders over the long-run.

The corporate generated compound complete returns of 12.4% a yr for shareholders in the course of the 1991 by means of 2022 time interval. $1 invested in Johnson & Johnson could be price $42.41.

The corporate’s low inventory value beta and volatility solely provides to its enchantment. Buyers have traditionally generated glorious returns with Johnson & Johnson inventory with out as many gut-wrenching ups and downs as in comparison with different shares.

Snowball-Impact Shares For The Subsequent 25 Years

All 5 examples above trounced the market regardless of being properly established companies with lengthy dividend histories.

However…

What shares would be the subsequent snowball impact compounders?

There’s no must reinvent the wheel. Anybody holding the serial compounders above ought to proceed to take action.

For these seeking to enter into new positions in snowball impact shares ought to search for the next:

Above common dividend yield

Under common price-to-earnings ratio

Lengthy dividend historical past

The most important constraint of the three is the lengthy dividend historical past. We’ll begin by choosing solely from shares with 25+ years of rising dividends.

Out of those lengthy dividend historical past shares, we’ll display screen for:

A dividend yield above the S&P 500’s 1.3% yield

A price-to-earnings under the S&P 500’s ratio long-term common of 16.1

We’ll then type these by anticipated complete return. Whole return is the anticipated earnings-per-share progress charge, plus the present dividend yield, in addition to the online impression of any optimistic or unfavourable adjustments within the price-to-earnings a number of.

The ten highest anticipated complete return shares with 25+ years of rising dividends, a dividend yield above 1.30%, and a price-to-earnings ratio under 16 (utilizing information from Certain Evaluation), are listed under:

Stepan Co. (SCL) | Anticipated complete return of 21.8%

Becton Dickinson & Co. (BDX) | Anticipated complete return of 19.4%

The Andersons Inc. (ANDE) | Anticipated complete return of 18.6%

Sonoco Merchandise (SON) | Anticipated complete return of 18.4%

PepsiCo Inc. (PEP) | Anticipated complete return of 17.8%

Jap Bankshares (EBC) | Anticipated complete return of 17.8%

Goal Corp. (TGT) | Anticipated complete return of 16.8%

PPG Industries (PPG) | Anticipated complete return of 15.3%

Farmers & Retailers Bancorp (FMCB) | Anticipated complete return of 15.0%

Tennant Co. (TNC) | Anticipated complete return of 15.0%

The ten shares listed above greatest match the factors to greatest make the most of the snowball impact.

‘Snowball shares’ have sturdy aggressive edges. Proof of their aggressive benefits is seen by their lengthy working historical past and constant dividend will increase.

Lengthy-term investing in nice companies with shareholder-friendly managements at honest or higher costs will very probably produce compound wealth features over time.

Associated: The video under discusses long-term investing and wealth creation.

Bear in mind the snowball impact when selecting your investments.

Different Dividend Lists

The Dividend Aristocrats listing will not be the one solution to rapidly display screen for shares that commonly pay rising dividends.

Thanks for studying this text. Please ship any suggestions, corrections, or inquiries to help@suredividend.com.