Export restrictions already priced in – may there be upside?

2H might be explosive

On this week’s Tech Edge, we analyse traders’ expectations forward of Nvidia’s (NASDAQ:) earnings and the potential upside within the second half of this yr.

At the moment marks the primary day that we be aware institutional traders stepping again into the market after panicking out in March.

It could be time to get again to fundamentals!

Our analysis digest is meant to maintain you on the reducing fringe of investments in information infrastructure, software program, and cybersecurity.

Expectations for Nvidia’s Earnings

Nvidia is anticipated to report earnings subsequent week. Though we count on a messy information, the expectations for Nvidia’s earnings are very low (a lot decrease than consensus signifies).

In the course of the quarter, there was a giant announcement concerning the US proscribing exports of H20’s to China. In consequence, Nvidia wrote off $5B of stock, leading to a margin hit of about ~15% (we count on GMs to drop from the low 70s to excessive 50% within the present quarter.

At face worth, $5B of stock could be ~$15B of income influence for the complete yr and ~$5B in 2Q-4Q per quarter, which is now in buy-side expectations. That is in-line with what Jensen highlighted at Computex. Nevertheless, we discovered it attention-grabbing that Nvidia didn’t point out the income influence within the press launch, implying that there might be important offsets.

To summarize, we count on a beat in F1Q26, a messy F2Q26 information, and a really robust F2H26. Consequently, all eyes can be on commentary associated to the Blackwell ramp, which we count on will greater than offset the adverse influence of China.

Right here is why a messy information gained’t matter:

Traders have deserted the AI commerce, and with a constructive 2H outlook (see beneath), they must come again and chase the high-quality AI shares.

Export Restrictions and Potential Regulatory Upside

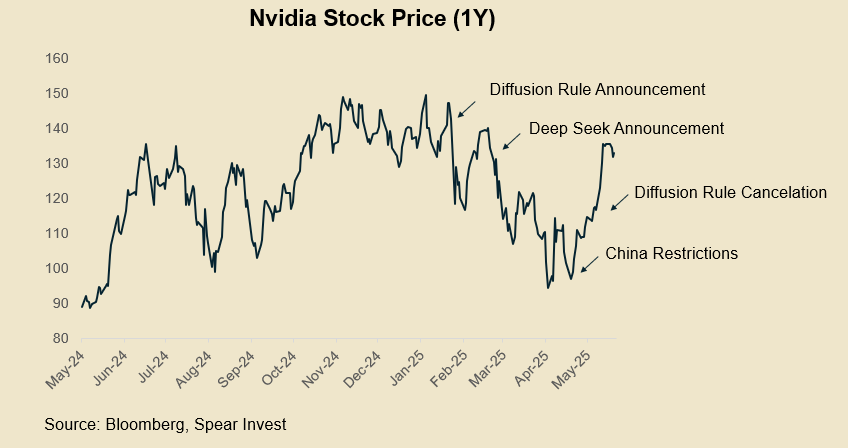

Whereas export restrictions to China weighed on Nvidia’s inventory and most analysts took their expectations down for each margins and revenues, a extra attention-grabbing growth that didn’t get as a lot consideration was the US BIS rescinding the AI Diffusion rule, which was launched in January of this yr and was anticipated to take impact on Might fifteenth, 25.

For background, the Diffusion rule aimed to restrict the worldwide unfold of superior synthetic intelligence capabilities. It’s objective was to limit the export of sure high-performance chips—not simply to China, however to different nations as nicely. The rule was designed to stop the proliferation of U.S.-origin know-how that might be utilized in army or surveillance purposes. However its broad scope may unintentionally weaken the worldwide competitiveness of U.S. chipmakers like NVIDIA by proscribing entry to key worldwide markets and undermining the benefits of proprietary platforms like Nvidia’s CUDA.

The truth is, with all of the export restrictions to China (launched underneath each administrations), Nvidia didn’t complain a single time however continued to switch its merchandise to suit up to date rules. Nevertheless, when it got here to the AI Diffusion rule, the corporate issued a public assertion.

This means to us that the constructive influence of canceling the diffusion rule will outweigh the adverse influence of the China restrictions, which is already in consensus numbers.

We highlighted the potential of cancellation again in April, when the US launched the incremental China rules.

Listed below are extra particulars

All Eyes Are on 2H25

Right here is why:

Grace Blackwell is in full manufacturing – Nvidia’s CEO, Jensen Huang, was rather more assured within the rollout at Computex and highlighted very robust demand.

The transition to the next-gen Blackwell Extremely GB300 methods can be considerably simpler, given the similarity in construction and infrastructure necessities.

Sovereign build-out: Final week’s Center-East offers may gain advantage 2H sufficient and offset the China drag. Advantages will lengthen for five years with extra pronounced influence in ’26 and past.

The underside line is that the incremental information for Nvidia has been constructive: Cloud Giants’ capex stunned to the upside, Deep Search was a non-event, the Dffusion rule received canceled, and Blackwell is ramping properly, however the inventory has gone nowhere, which may indicate important upside as soon as sentiment turns.

In abstract, institutional traders, each hedge funds and long-onlys, decreased publicity to the AI commerce and can now need to chase it no matter 2Q earnings, as fundamentals are anticipated to step up within the second half of this yr.