Up to date on Might twenty ninth, 2025 by Bob Ciura

On this planet of investing, volatility issues. Traders are reminded of this each time there’s a downturn within the broader market and particular person shares which are extra unstable than others expertise monumental swings in value.

Volatility is a proxy for danger; extra volatility typically means a riskier portfolio. The volatility of a safety or portfolio towards the imply is known as customary deviation.

Briefly, customary deviation is an investing metric that calculates the magnitude of a safety’s dispersion from its common value over a given time interval.

Consequently, we imagine customary deviation is a crucial monetary metric that traders ought to familiarize themselves with, when buying particular person shares.

To that finish, we created a listing of low volatility shares. The listing consists of the 100 lowest customary deviation shares within the S&P 500 Index.

You may obtain a spreadsheet of the 100 low volatility shares (together with different necessary monetary metrics like price-to-earnings ratios and dividend yields) by clicking on the hyperlink under:

This text will talk about customary deviation extra completely, and supply a dialogue of the 5 lowest-volatility dividend shares within the Certain Evaluation Analysis Database.

The desk of contents under permits for straightforward navigation.

Desk of Contents

Customary Deviation Overview

Customary deviation is a calculation that entails quite a few inputs, similar to a safety’s closing share costs over a given time frame, the imply worth over that point, and the variety of knowledge factors within the knowledge set.

Why this issues is as a result of traders can make the most of customary deviation to get a greater understanding of a safety’s volatility, and subsequently its danger.

Importantly, low or excessive customary deviation measures the scale of the actions a safety may make from its common efficiency.

In a standard distribution, a inventory’s value motion ought to fall inside one customary distribution of its imply value, roughly 68% of the time.

Moreover, the share value of the safety in query, must be inside two customary deviations of the imply, roughly 95% of the time.

To place this into perspective, assume a inventory has a imply value of $100, and a normal deviation of $10. In a standard distribution, the inventory in query ought to shut between $80-$120 per share, roughly 95% of the time.

After all, this nonetheless leaves a 5% likelihood that the inventory will shut outdoors the vary of $80-$120. On this manner, traders usually use customary deviation as a proxy for danger.

The traditional knowledge would recommend that low volatility shares ought to under-perform throughout market uptrends and outperform throughout downturns.

The next part discusses the 5 dividend-paying shares within the S&P 500 with the bottom customary deviation of each day returns over the previous 5 years.

Low Volatility Inventory #5: Verizon Communications (VZ)

5-12 months Customary Deviation: 1.34%

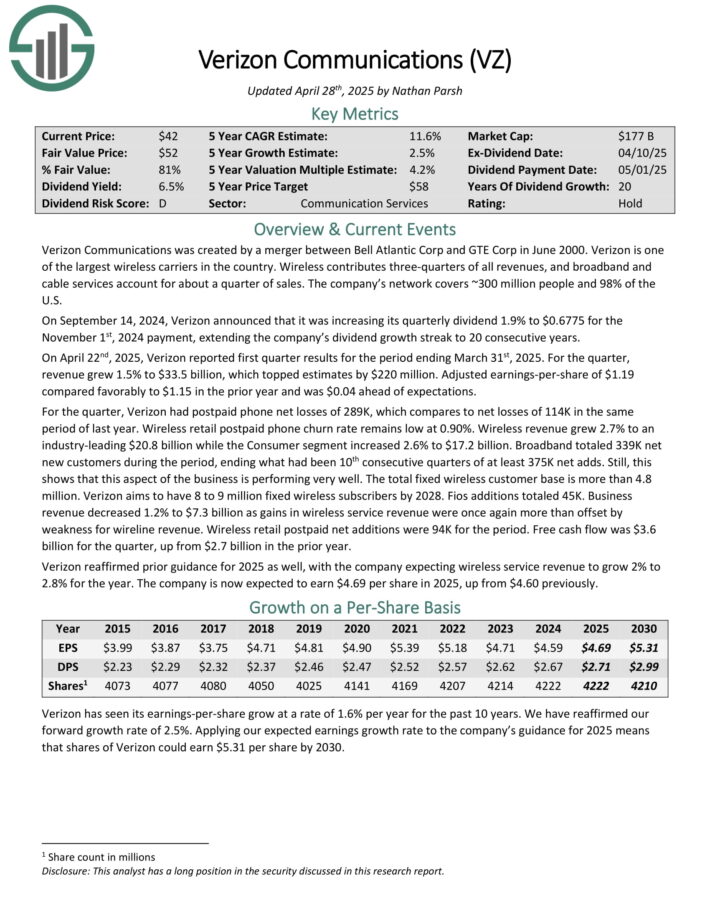

Verizon Communications was created by a merger between Bell Atlantic Corp and GTE Corp in June 2000. Verizon is likely one of the largest wi-fi carriers within the nation.

Wi-fi contributes three-quarters of all revenues, and broadband and cable companies account for a couple of quarter of gross sales. The corporate’s community covers ~300 million folks and 98% of the U.S.

On April twenty second, 2025, Verizon reported first quarter outcomes for the interval ending March thirty first, 2025. For the quarter, income grew 1.5% to $33.5 billion, which topped estimates by $220 million.

Supply: Investor Presentation

Adjusted earnings-per-share of $1.19 in contrast favorably to $1.15 within the prior 12 months and was $0.04 forward of expectations.

For the quarter, Verizon had postpaid cellphone web losses of 289K, which compares to web losses of 114K in the identical interval of final 12 months. Wi-fi retail postpaid cellphone churn fee stays low at 0.90%.

Wi-fi income grew 2.7% to an industry-leading $20.8 billion whereas the Client section elevated 2.6% to $17.2 billion.

Broadband totaled 339K web new prospects throughout the interval, ending what had been tenth consecutive quarters of no less than 375K web provides.

Click on right here to obtain our most up-to-date Certain Evaluation report on VZ (preview of web page 1 of three proven under):

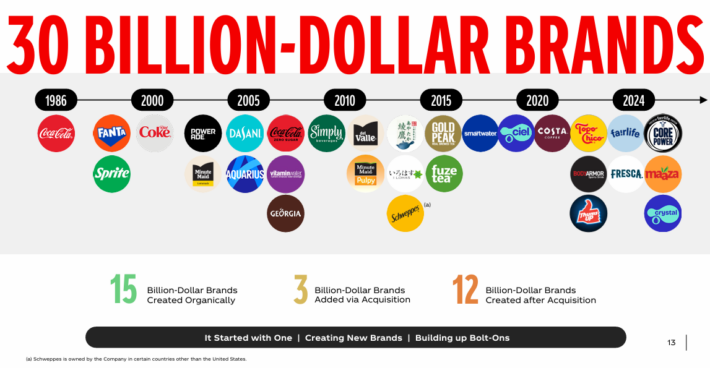

Low Volatility Inventory #4: Procter & Gamble (PG)

5-12 months Customary Deviation: 1.31%

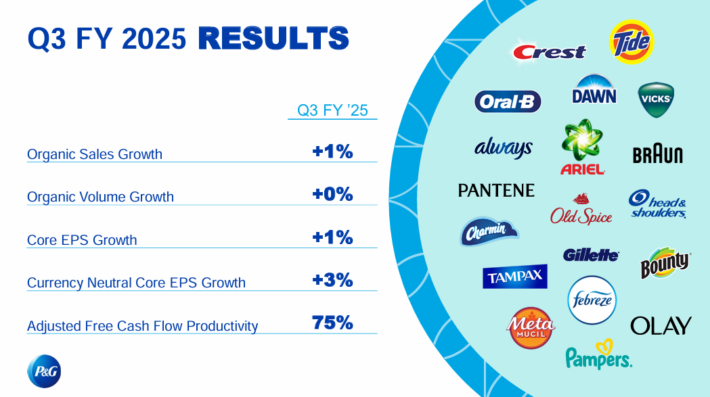

Procter & Gamble is a client merchandise big that sells its merchandise in over 180 nations.

Notable manufacturers embody Pampers, Luvs, Tide, Acquire, Bounty, Charmin, Puffs, Gillette, Head & Shoulders, Previous Spice, Daybreak, Febreze, Swiffer, Crest, Oral-B, Scope, Olay and plenty of extra.

On April eighth, 2025, Procter & Gamble raised its dividend by 5%, from $1.0065 per quarter to $1.0568.

In late April, Procter & Gamble reported (4/24/25) monetary outcomes for the third quarter of fiscal 2025 (its fiscal 12 months ends June thirtieth).

Supply: Investor Presentation

Gross sales dipped -2% however its natural gross sales edged up 1% over final 12 months’s quarter, due to increased costs.

Core earnings-per-share grew 1%, from $1.52 to $1.54, beating the analysts’ consensus by $0.01. The agency gross sales amid sustained value hikes are a testomony to the power of the manufacturers of Procter & Gamble.

Click on right here to obtain our most up-to-date Certain Evaluation report on PG (preview of web page 1 of three proven under):

Low Volatility Inventory #3: The Coca-Cola Firm (KO)

5-12 months Customary Deviation: 1.30%

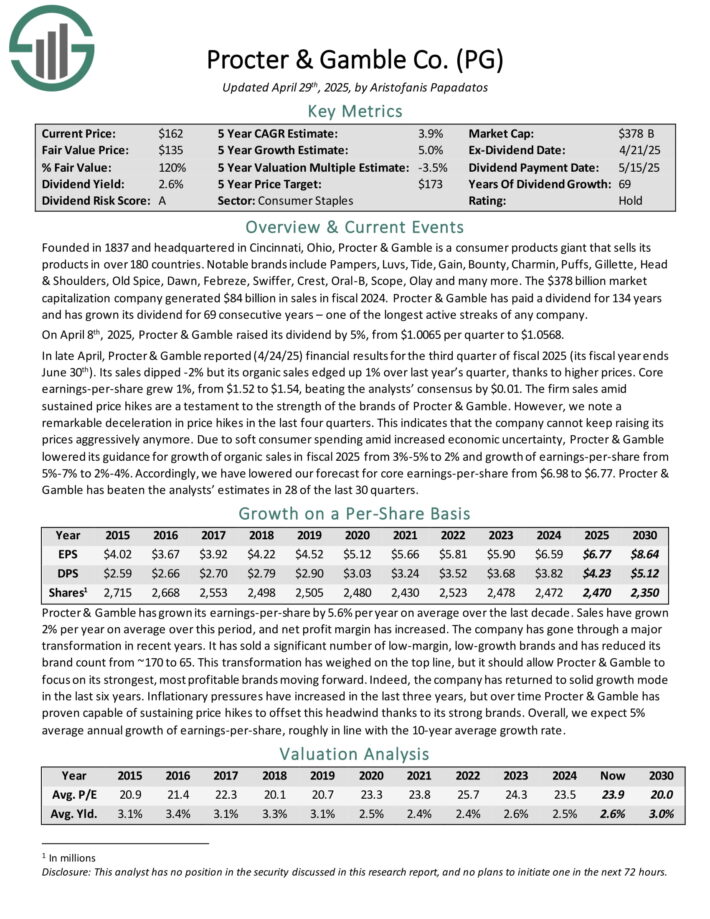

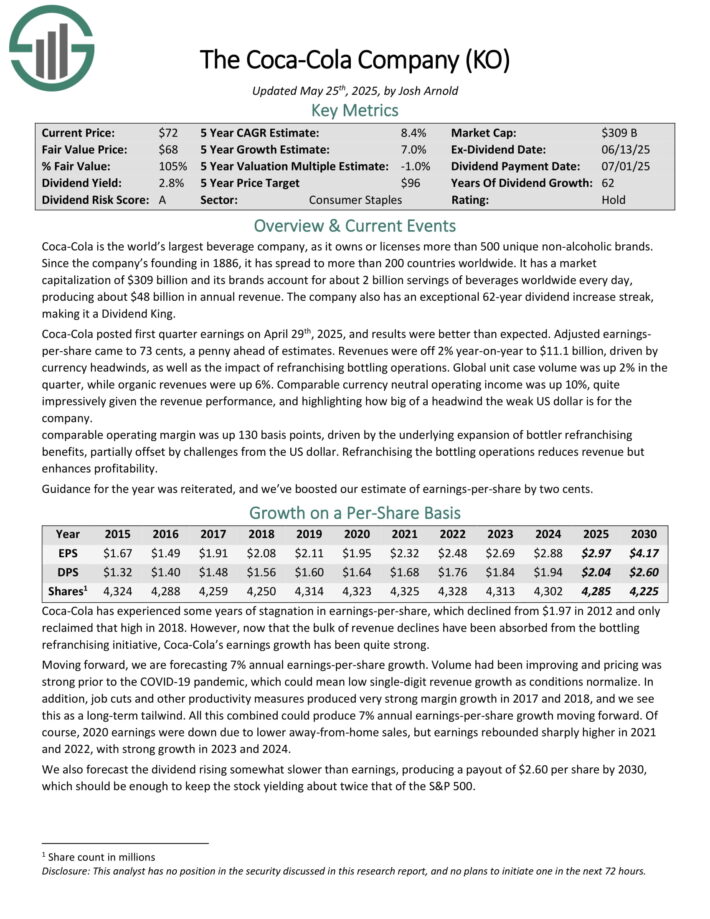

Coca-Cola is the world’s largest beverage firm, because it owns or licenses greater than 500 distinctive non–alcoholic manufacturers. Because the firm’s founding in 1886, it has unfold to greater than 200 nations worldwide.

Coca-Cola now has 30 billion-dollar manufacturers in its portfolio, which every generate no less than $1 billion in annual gross sales.

Supply: Investor Presentation

Coca-Cola posted first quarter earnings on April twenty ninth, 2025, and outcomes had been higher than anticipated. Adjusted earnings per-share got here to 73 cents, a penny forward of estimates.

Revenues had been off 2% year-on-year to $11.1 billion, pushed by forex headwinds, in addition to the impression of refranchising bottling operations. International unit case quantity was up 2% within the quarter, whereas natural revenues had been up 6%.

Click on right here to obtain our most up-to-date Certain Evaluation report on KO (preview of web page 1 of three proven under):

Low Volatility Inventory #2: Colgate-Palmolive (CL)

5-12 months Customary Deviation: 1.28%

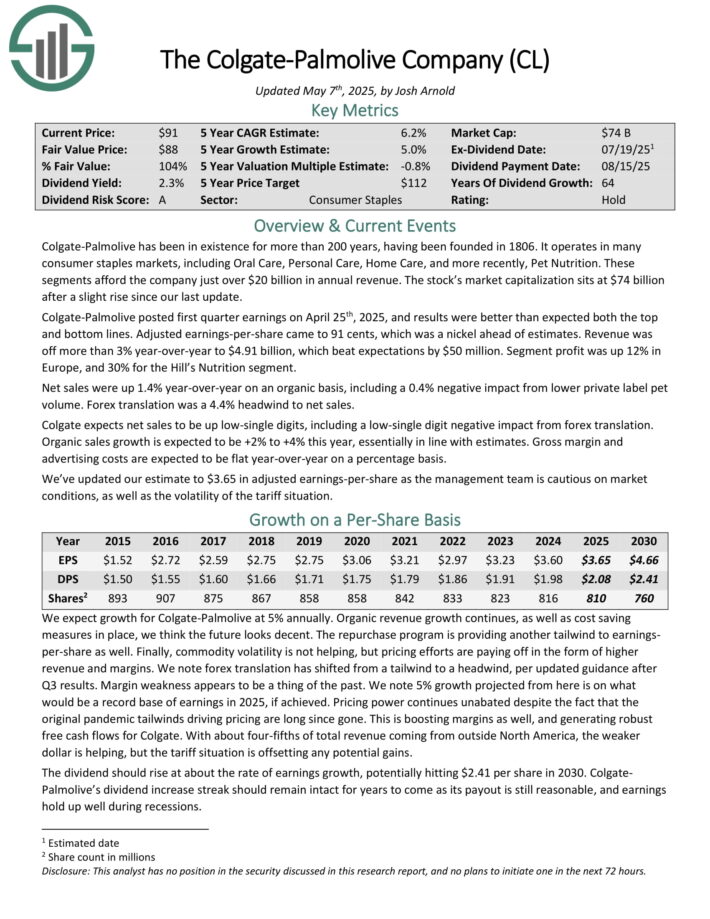

Colgate-Palmolive was based in 1806 and has constructed a powerful and in depth portfolio of client manufacturers. It operates globally, promoting in most nations all over the world.

About one-sixth of its income comes from Hill’s pet meals division, which has proven very robust progress in recent times.

The opposite five-sixths of income comes from a mixture of cleansing and private care merchandise, with the corporate’s most recognizable manufacturers being Colgate (tooth care) and Palmolive (cleaning soap).

The corporate has structured itself into 4 models: Oral Care, Private Care, Residence Care, and Pet Vitamin.

Supply: Investor presentation

Colgate-Palmolive posted first quarter earnings on April twenty fifth, 2025, and outcomes had been higher than anticipated each the highest and backside strains. Adjusted earnings-per-share got here to 91 cents, which was a nickel forward of estimates.

Income was off greater than 3% year-over-year to $4.91 billion, which beat expectations by $50 million. Section revenue was up 12% in Europe, and 30% for the Hill’s Vitamin section.

Web gross sales had been up 1.4% year-over-year on an natural foundation, together with a 0.4% damaging impression from decrease non-public label pet quantity. Foreign exchange translation was a 4.4% headwind to web gross sales. Colgate expects web gross sales to be up low-single digits, together with a low-single digit damaging impression from foreign exchange translation. Natural gross sales progress is anticipated to be +2% to +4% this 12 months.

Click on right here to obtain our most up-to-date Certain Evaluation report on CL (preview of web page 1 of three proven under):

Low Volatility Inventory #1: Johnson & Johnson (JNJ)

5-12 months Customary Deviation: 1.23%

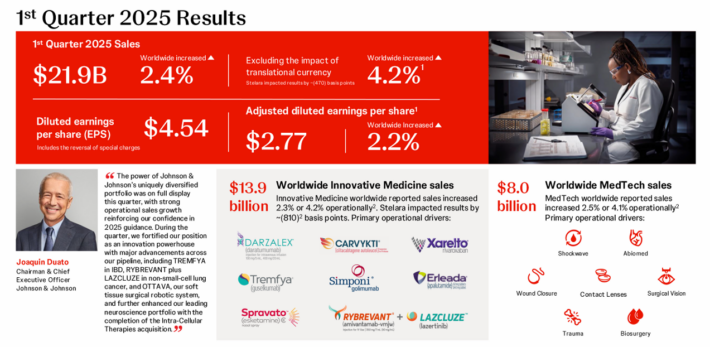

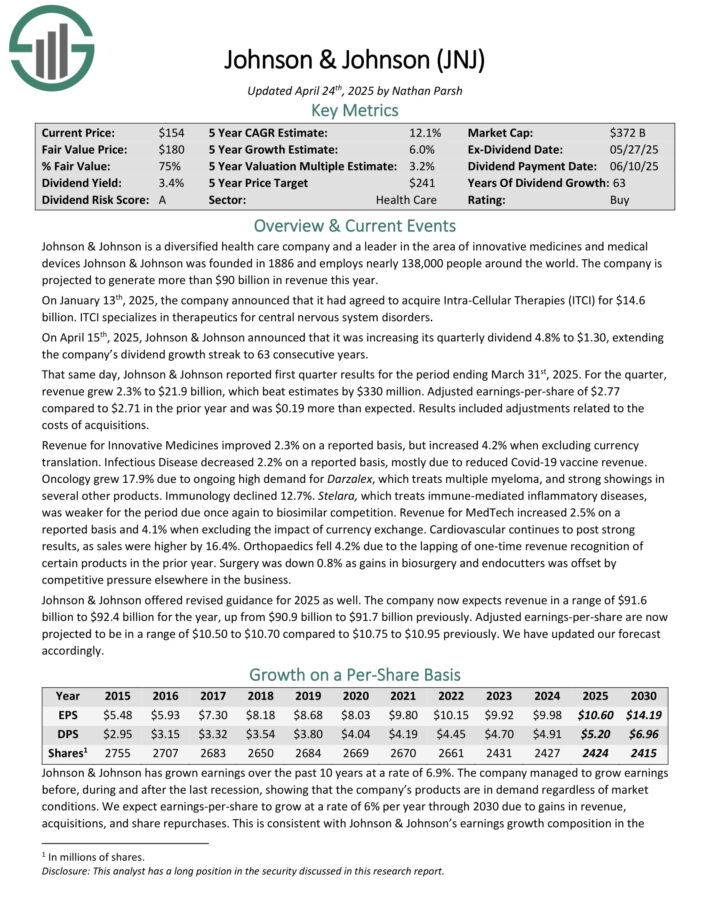

Johnson & Johnson is a diversified well being care firm and a pacesetter within the space of revolutionary medicines and medical gadgets Johnson & Johnson was based in 1886.

On April fifteenth, 2025, Johnson & Johnson introduced that it was rising its quarterly dividend 4.8% to $1.30, extending the corporate’s dividend progress streak to 63 consecutive years.

Supply: Investor Presentation

That very same day, Johnson & Johnson reported first quarter outcomes for the interval ending March thirty first, 2025. For the quarter, income grew 2.3% to $21.9 billion, which beat estimates by $330 million.

Adjusted earnings-per-share of $2.77 in comparison with $2.71 within the prior 12 months and was $0.19 greater than anticipated. Outcomes included changes associated to the prices of acquisitions.

Click on right here to obtain our most up-to-date Certain Evaluation report on JNJ (preview of web page 1 of three proven under):

Ultimate Ideas

Traders ought to take danger into consideration when buying particular person shares. In any case, if two securities are in any other case related by way of anticipated returns however one presents a decrease customary deviation, the investor would possible see stronger returns from the low volatility inventory.

Customary deviation may help traders decide which securities will produce larger deviation from the market common.

The 5 shares within the article not solely have low customary deviation, however additionally they provide enticing dividend yields and whole anticipated returns.

The next databases of dividend progress shares may be helpful for revenue traders:

The Dividend Aristocrats Record: dividend shares with 25+ years of consecutive dividend will increase

The Excessive Yield Dividend Aristocrats Record is comprised of the 20 Dividend Aristocrats with the best present yields.

The Dividend Achievers Record is comprised of ~400 shares with 10+ years of consecutive dividend will increase.

The Dividend Kings Record is much more unique than the Dividend Aristocrats. It’s comprised of 55 shares with 50+ years of consecutive dividend will increase.

The Excessive Yield Dividend Kings Record is comprised of the 20 Dividend Kings with the best present yields.

The Blue Chip Shares Record: shares that qualify as Dividend Achievers, Dividend Aristocrats, and/or Dividend Kings

The Excessive Dividend Shares Record: shares that attraction to traders within the highest yields of 5% or extra.

The Month-to-month Dividend Shares Record: shares that pay dividends each month, for 12 dividend funds per 12 months.

The Dividend Champions Record: shares which have elevated their dividends for 25+ consecutive years.Observe: Not all Dividend Champions are Dividend Aristocrats as a result of Dividend Aristocrats have further necessities like being in The S&P 500.

Thanks for studying this text. Please ship any suggestions, corrections, or inquiries to assist@suredividend.com.