President Donald Trump’s tariffs add new issues for US grocery buyers, who’re already bored with excessive foods and drinks costs. If President Trump’s proposals for tariffs turn out to be a actuality, foods and drinks firms in addition to retailers might want to justify any worth will increase, whereas sustaining an agile method to their provide chains as they navigate the most recent coverage adjustments.

These tariffs will straight influence foods and drinks costs and provide, particularly with the commonality of imports from Canada and Mexico. As of Monday (Feb third), Canada and Mexico have reached a cope with the US to delay the tariffs for 30 days. Canada’s prime minister, Justin Trudeau, mentioned tariffs on his nation’s items can be postponed as negotiations on a border deal happen. Mexico negotiated an identical delay by agreeing to ship hundreds of troops to the US-Mexico border.

Manufacturers might want to put together clear and compassionate communication concerning the explanations for any consumer-facing changes. Clear communication is vital to keep away from drawing the ire of US shoppers who’re weary of getting to regulate to new disruptions.

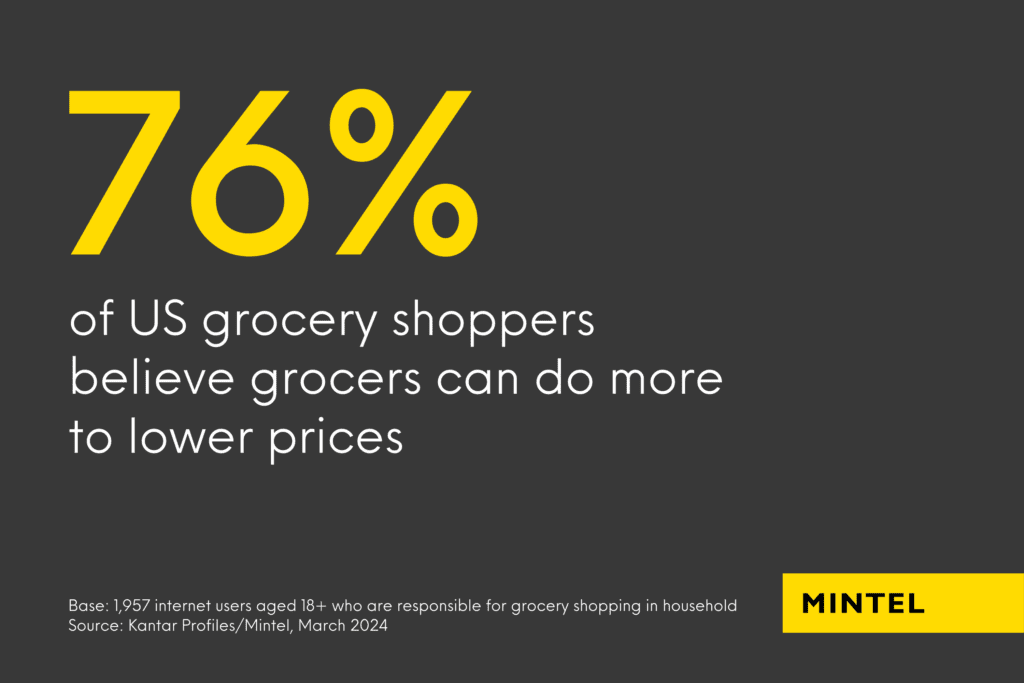

US shoppers already really feel like they’ve been unable to flee excessive costs. Any extra worth hikes – regardless of the trigger – can be unwelcome by US shoppers who’re already worn out from years of upper value of dwelling, particularly foods and drinks.

Shoppers will really feel the influence of tariffs

In his first time period, President Trump used tariffs as a tactic to start out negotiations with different nations. Thus it’s potential that the long-lasting tariffs could possibly be much less excessive or extra particularly directed at industries the place the US seeks a aggressive benefit, resembling expertise or inexperienced vitality.

But, as seen through the first Trump administration, tariffs elevate costs on different requirements and pressure shoppers who’re already feeling pinched. US shoppers have discovered money-saving swaps up to now few years, however extra worth hikes from tariffs would restrict their choices for low-cost foods and drinks options. Greater dwelling prices can be particularly laborious on the 27% of US shoppers who describe their monetary state of affairs as tight, struggling, or in hassle. Greater costs additionally would restrict the leftover cash the 36% of US shoppers who classify themselves as OK have every month.

Provide chain transparency

Tariffs additionally may trigger manufacturers to hunt new sources for elements, packaging supplies and imported merchandise. Mintel’s 2025 International Meals & Drink Pattern Chain Response predicted provide chain shifts and recommends manufacturers encourage shoppers to be open to new origins, elements, and different alterations that come up due to readjusted provide chains.

The present inflationary surroundings has made many US buyers keenly conscious of foods and drinks costs. Many consumers can be fast to name out and query the explanations for greater costs whether or not they’re from geopolitical causes like tariffs or not.

Price-conscious buyers can be extra keen to just accept a change in origin, formulation, or packaging whether it is made to take care of pricing. Manufacturers can also share different advantages of home manufacturing, resembling Latin American beer model Presidente’s word that it’s “brewed within the USA for a more energizing style.” As seen throughout COVID-19, manufacturers and retailers that aren’t impacted by tariffs can clarify how their US enterprise practices profit folks and the home financial system.

What we expect

Be open with shoppers: Foods and drinks manufacturers ought to put together to be clear and empathetic with shoppers if tariffs trigger any will increase in worth or changes within the common provide chains for elements, packaging supplies, or imported merchandise.

Tread rigorously with worth will increase: With greater than half of US buyers feeling impacted by excessive foods and drinks costs, retailers and types should be strategic about any worth will increase associated to tariffs. Keep low prices on family necessities which might be impacted by tariffs; whereas extra worth flexibility could also be out there for premium, non-essential imported objects.

Clarify any adjustments as a result of provide chain points: If tariffs trigger manufacturers to seek out new origins, elements, or packaging, comply with the suggestions from Mintel’s 2025 International Meals & Drink Pattern Chain Response and be trustworthy with shoppers concerning the adjustments and the explanations they have been enacted.

If you’re interested by studying extra about how the Trump Administration’s tariffs will influence the foods and drinks business, take a look at this Mintel Highlight article or contact us right this moment.