Article up to date on June third, 2025 by Bob CiuraSpreadsheet information up to date every day

The Dividend Aristocrats are a choose group of 69 S&P 500 shares with 25+ years of consecutive dividend will increase.

They’re the ‘better of the very best’ dividend progress shares. The Dividend Aristocrats have an extended historical past of outperforming the market.

The necessities to be a Dividend Aristocrat are:

Be within the S&P 500

Have 25+ consecutive years of dividend will increase

Meet sure minimal dimension & liquidity necessities

There are presently 69 Dividend Aristocrats. You may obtain an Excel spreadsheet of all 69 (with metrics that matter corresponding to dividend yields and price-to-earnings ratios) by clicking the hyperlink under:

Disclaimer: Certain Dividend is just not affiliated with S&P World in any means. S&P World owns and maintains The Dividend Aristocrats Index. The data on this article and downloadable spreadsheet is predicated on Certain Dividend’s personal overview, abstract, and evaluation of the S&P 500 Dividend Aristocrats ETF (NOBL) and different sources, and is supposed to assist particular person buyers higher perceive this ETF and the index upon which it’s primarily based. Not one of the data on this article or spreadsheet is official information from S&P World. Seek the advice of S&P World for official data.

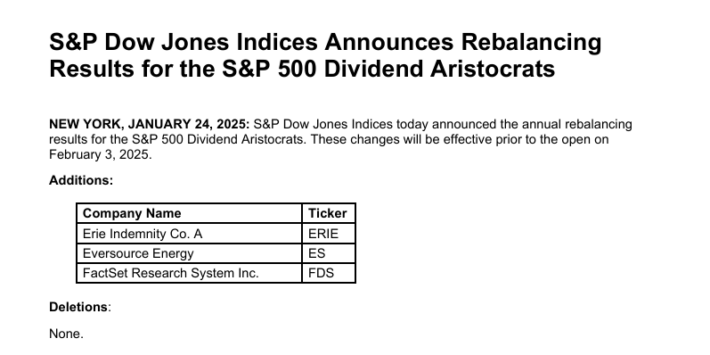

Notice 1: On January twenty fourth, 2025, Erie Indemnity (ERIE), Eversource Power (ES), and FactSet Analysis System (FDS) had been added to the listing with no deletions, leaving 69 Dividend Aristocrats.

Supply: S&P Information Releases.

You may see detailed evaluation on all 69 additional under on this article, in our Dividend Aristocrats In Focus Sequence. Evaluation contains valuation, progress, and aggressive benefit(s).

Desk of Contents

Easy methods to Use The Dividend Aristocrats Listing To Discover Dividend Funding Concepts

The downloadable Dividend Aristocrats Excel Spreadsheet Listing above accommodates the next for every inventory within the index:

Worth-to-earnings ratio

Dividend yield

Market capitalization

All Dividend Aristocrats are high-quality companies primarily based on their lengthy dividend histories. An organization can’t pay rising dividends for 25+ years with out having a powerful and sturdy aggressive benefit.

However not all Dividend Aristocrats make equally good investments at present. That’s the place the spreadsheet on this article comes into play. You should utilize the Dividend Aristocrats spreadsheet to rapidly discover high quality dividend funding concepts.

The listing of all Dividend Aristocrats is efficacious as a result of it provides you a concise listing of all S&P 500 shares with 25+ consecutive years of dividend will increase (that additionally meet sure minimal dimension and liquidity necessities).

These are companies which have each the need and talent to pay shareholders rising dividends year-after-year. This can be a uncommon mixture.

Collectively, these two standards are highly effective – however they don’t seem to be sufficient. Worth have to be thought of as effectively.

The spreadsheet above means that you can type by trailing price-to-earnings ratio so you may rapidly discover undervalued, high-quality dividend shares.

Right here’s tips on how to use the Dividend Aristocrats listing to rapidly discover high-quality dividend progress shares probably buying and selling at a reduction:

Obtain the listing

Kind by ‘Trailing PE Ratio,’ smallest to largest

Analysis the highest shares additional

Right here’s how to do that rapidly within the spreadsheet:

Step 1: Obtain the listing, and open it.

Step 2: Apply a filter operate to every column within the spreadsheet.

Step 3: Click on on the small grey down arrow subsequent to ‘Trailing P/E Ratio’, after which type smallest to largest.

Step 4: Evaluation the best ranked Dividend Aristocrats earlier than investing. You may see detailed evaluation on each Dividend Aristocrat discovered under on this article.

That’s it; you may comply with the identical process to type by some other metric within the spreadsheet.

Efficiency Of The Dividend Aristocrats

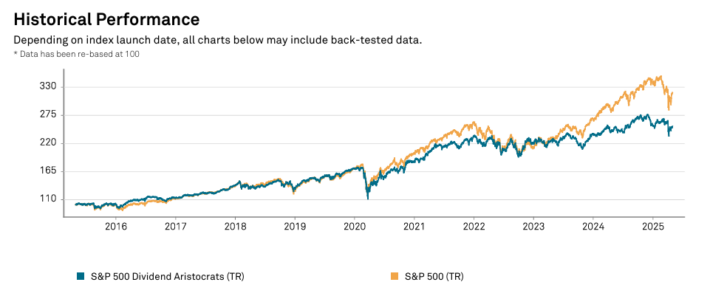

In Might 2025, the Dividend Aristocrats, as measured by the Dividend Aristocrats ETF (NOBL), registered a complete return of two.2%. It under-performed the SPDR S&P 500 ETF (SPY) for the month.

NOBL generated returns of two.2% in Might 2025

SPY generated returns of 6.3% in Might 2025

Brief-term efficiency is usually noise. Efficiency must be measured over a minimal of three years, and ideally longer intervals of time.

The Dividend Aristocrats Index has barely under-performed the broader market index during the last decade, with a 9.39% complete annual return for the Dividend Aristocrats and a 12.80% complete annual return for the S&P 500 Index.

However the Dividend Aristocrats have exhibited decrease threat than the benchmark, as measured by commonplace deviation.

Supply: S&P Reality Sheet

Increased complete returns with decrease volatility is the ‘holy grail’ of investing. It’s value exploring the traits of the Dividend Aristocrats intimately to find out why they’ve carried out so effectively.

Notice {that a} good portion of the outperformance relative to the S&P 500 comes throughout recessions (2000 – 2002, 2008). Dividend Aristocrats have traditionally seen smaller drawdowns throughout recessions versus the S&P 500. This makes holding by means of recessions that a lot simpler.

Case-in-point: In 2008 the Dividend Aristocrats Index declined 22%. That very same yr, the S&P 500 declined 38%.

Nice companies with sturdy aggressive benefits have a tendency to have the ability to generate stronger money flows throughout recessions. This enables them to achieve market share whereas weaker companies battle to remain alive.

The Dividend Aristocrats Index has crushed the market during the last 28 years…

We consider dividend paying shares outperform non-dividend paying shares for 3 causes:

An organization that pays dividends is prone to be producing earnings or money flows in order that it could possibly pay dividends to shareholders. This excludes ‘pre-earnings’ start-ups and failing companies. Briefly, it excludes the riskiest shares.

A enterprise that pays constant dividends have to be extra selective with the expansion initiatives it takes on as a result of a portion of its money flows are being paid out as dividends. Scrutinizing over capital allocation choices probably provides to shareholder worth.

Shares that pay dividends are keen to reward shareholders with money funds. This can be a signal that administration is shareholder pleasant.

In our view, Dividend Aristocrats have traditionally outperformed the market and different dividend paying shares as a result of they’re, on common, higher-quality companies.

A high-quality enterprise ought to outperform a mediocre enterprise over an extended time frame, all different issues being equal.

For a enterprise to extend its dividends for 25+ consecutive years, it will need to have or not less than had within the very latest previous a powerful aggressive benefit.

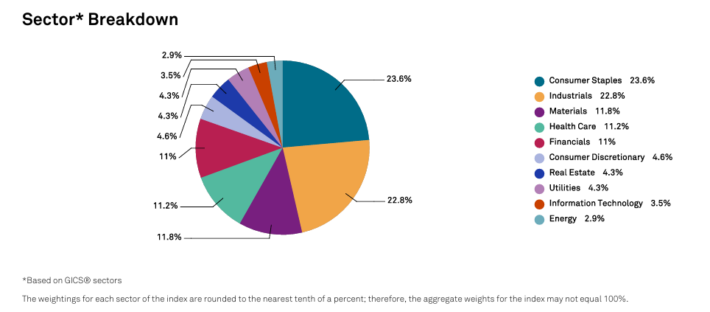

Sector Overview

A sector breakdown of the Dividend Aristocrats Index is proven under:

The Dividend Aristocrats Index is tilted towards Shopper Staples and Industrials relative to the S&P 500. These 2 sectors make up over 40% of the Dividend Aristocrats Index, however lower than 20% of the S&P 500.

The Dividend Aristocrats Index can be considerably underweight the Data Know-how sector, with a ~3% allocation in contrast with over 20% allocation inside the S&P 500.

The Dividend Aristocrat Index is crammed with secure ‘outdated economic system’ blue chip client merchandise companies and producers; the Coca-Cola’s (KO), and Johnson & Johnson’s (JNJ) of the investing world.

These ‘boring’ companies aren’t prone to generate 20%+ earnings-per-share progress, however in addition they are not possible to see giant earnings drawdowns as effectively.

The ten Finest Dividend Aristocrats Now

This analysis report examines the ten finest Dividend Aristocrats from our Certain Evaluation Analysis Database with the best 5-year ahead anticipated complete returns.

Dividend Aristocrat #10: Albemarle Corp. (ALB)

5-year Anticipated Annual Returns: 12.8%

Albemarle is the most important producer of lithium and second largest producer of bromine on the planet. The 2 merchandise account for practically two-thirds of annual gross sales.

Albemarle produces lithium from its salt brine deposits within the U.S. and Chile. The corporate has two joint ventures in Australia that additionally produce lithium. Albemarle’s Chile property supply a really low-cost supply of lithium. The corporate operates in practically 100 nations.

On April thirtieth, 2025, Albemarle reported first quarter outcomes for the interval ending March thirty first, 2025. For the quarter, income fell 20.6% to $1.08 billion, however this missed estimates by $80 million.

Adjusted earnings-per-share of -$0.18 in contrast unfavorably to $0.26 within the prior yr, however this was $0.48 higher than anticipated.

Outcomes had been impacted weaker common costs for lithium. For the quarter, income for Power Storage was down 34.5% to $524.6 million. This section was impression by decrease costs (-34%) whereas quantity was unchanged.

Revenues for Specialties had been up 1.6% to $321 million as quantity (+11%) was offset by a lower in pricing (-8%). Ketjen gross sales of $231.5 million decreased 5.1% from the prior yr as increased costs (+4%) solely partially offset a lower in quantity (-8%).

Albemarle offered an outlook for 2025 as effectively, with the corporate anticipating income in a spread of $4.9 billion to $5.2 billion not less than.

Wit a Beta worth of 1.63, ALB is a excessive beta inventory.

Click on right here to obtain our most up-to-date Certain Evaluation report on ALB (preview of web page 1 of three proven under):

Dividend Aristocrat #9: Sysco Company (SYY)

5-year Anticipated Annual Returns: 12.9%

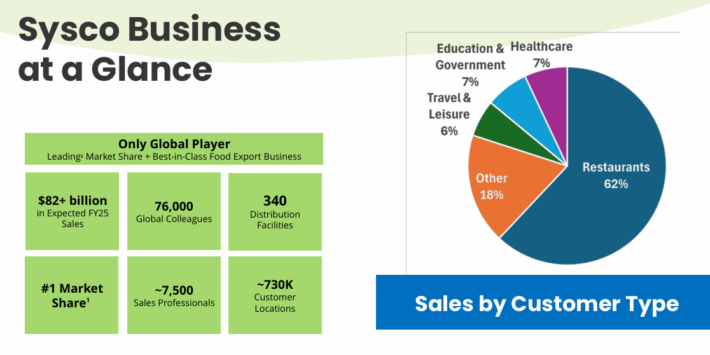

Sysco Company is the most important wholesale meals distributor in the USA. The corporate serves 600,000 places with meals supply, together with eating places, hospitals, colleges, resorts, and different amenities.

Supply: Investor Presentation

On April twenty ninth, 2025, Sysco reported third-quarter outcomes for Fiscal Yr (FY)2025. The corporate reported gross sales of $19.6 billion, up 1.1% from Q3 2024, regardless of a 2.0% decline in U.S. Foodservice quantity. Gross revenue fell 0.8% to $3.6 billion, with gross margin dropping 35 foundation factors to 18.3% on account of decrease volumes and product combine.

Working revenue decreased 5.7% to $681 million, and adjusted working revenue fell 3.3% to $773 million, pushed by increased working bills from enterprise investments and provide chain prices. Internet earnings dropped 5.6% to $401 million, with adjusted internet earnings down 2.9% to $469 million.

Diluted EPS was $0.82, down 3.5%, whereas adjusted EPS remained flat at $0.96. Sysco revised its FY25 steering, projecting 3% gross sales progress and not less than 1% adjusted EPS progress.

Click on right here to obtain our most up-to-date Certain Evaluation report on SYY (preview of web page 1 of three proven under):

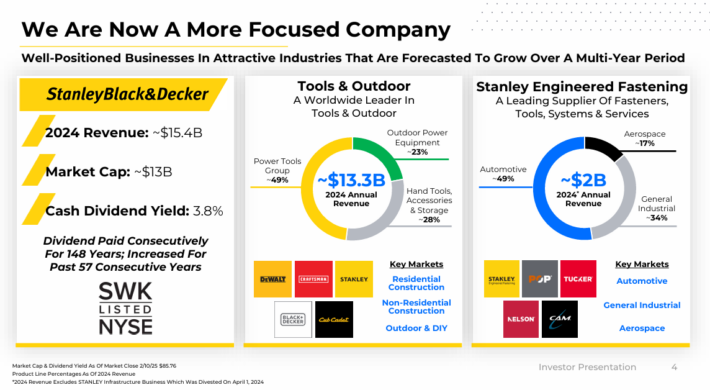

Dividend Aristocrat #8: Stanley Black & Decker (SWK)

5-year Anticipated Annual Returns: 12.9%

Stanley Black & Decker is a world chief in energy instruments, hand instruments, and associated gadgets. The corporate holds the highest international place in instruments and storage gross sales.

Stanley Black & Decker is second on the planet within the areas of economic digital safety and engineered fastening. The corporate consists of three segments: instruments & out of doors, and industrial.

Supply: Investor Presentation

On April thirtieth, 2025, Stanley Black & Decker reported first quarter outcomes. For the quarter, income fell 3.4% to $3.74 billion, however this was $20 million forward of estimates. Adjusted earnings-per-share of $0.75 in contrast favorably to $0.56 within the prior yr and was $0.08 greater than anticipated.

Companywide natural progress improved 1% for the quarter, however this was offset by foreign money alternate and divestitures. Natural gross sales for Instruments & Out of doors, the most important section inside the firm, had natural progress of 1%.

North America improved 2%, Europe was unchanged, and the remainder of the world declined 3%. Good points for DEWALT, Out of doors and Aerospace had been offset by weaker ends in Shopper and Auto Manufacturing.

Click on right here to obtain our most up-to-date Certain Evaluation report on SWK (preview of web page 1 of three proven under):

Dividend Aristocrat #7: Nucor Company (NUE)

5-year Anticipated Annual Returns: 13.0%

Nucor is the most important publicly traded US-based metal company primarily based on its market capitalization. The metal trade is notoriously cyclical, which makes Nucor’s streak of 52 consecutive years of dividend will increase much more exceptional.

Nucor is a member of the Dividend Kings on account of its dividend historical past.

On April 28, 2025, Nucor Company reported its monetary outcomes for the primary quarter of 2025. The corporate posted internet earnings attributable to stockholders of $156 million, or $0.67 per diluted share, a big lower from $845 million, or $3.46 per share, in the identical quarter of the earlier yr.

Adjusted internet earnings, excluding one-time prices associated to facility closures and repurposing, had been $179 million, or $0.77 per share, surpassing analyst expectations of $0.64 per share.

Internet gross sales for the quarter had been $7.83 billion, down 4% year-over-year however up 11% sequentially, pushed by a ten% improve in complete shipments to six.83 million tons, regardless of a 12% decline in common gross sales value per ton in comparison with the primary quarter of 2024.

Click on right here to obtain our most up-to-date Certain Evaluation report on NUE (preview of web page 1 of three proven under):

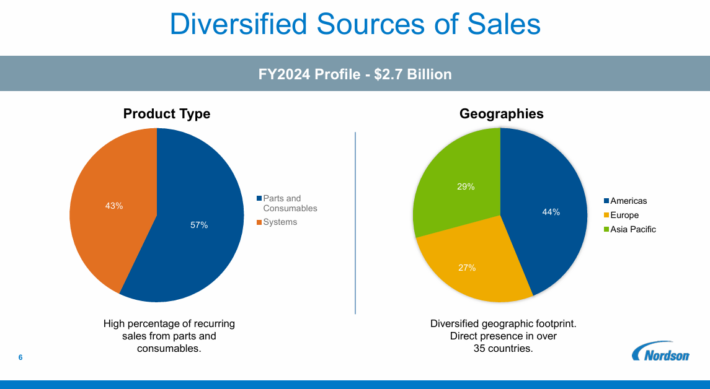

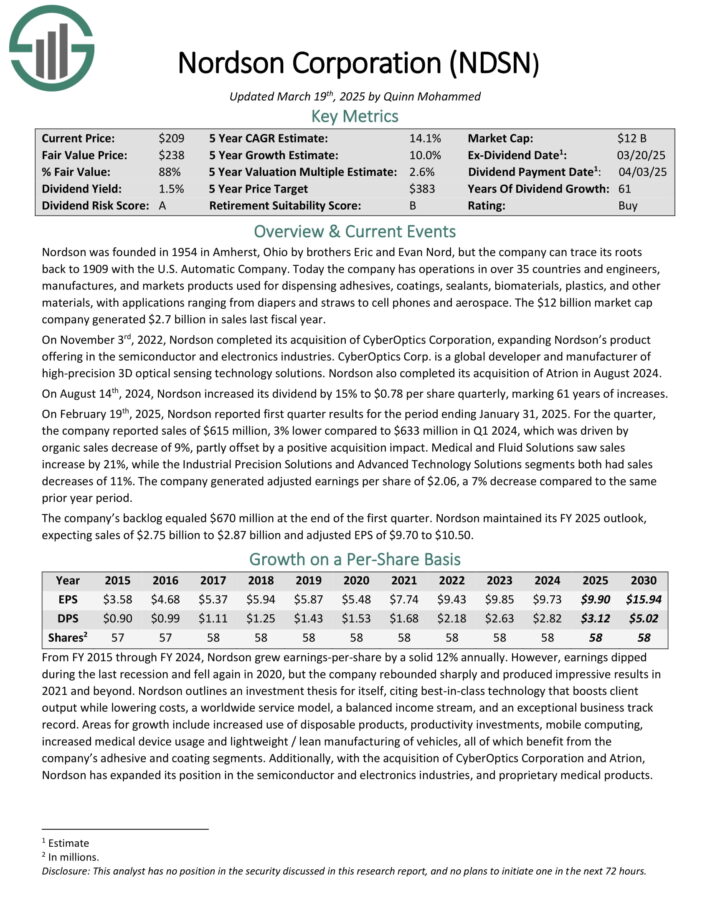

Dividend Aristocrat #6: Nordson Company (NDSN)

5-year Anticipated Annual Returns: 16.4%

Nordson was based in 1954 in Amherst, Ohio by brothers Eric and Evan Nord, however the firm can hint its roots again to 1909 with the U.S. Computerized Firm.

Right this moment the corporate has operations in over 35 nations and engineers, manufactures, and markets merchandise used for allotting adhesives, coatings, sealants, biomaterials, plastics, and different supplies, with functions starting from diapers and straws to cell telephones and aerospace.

Supply: Investor Presentation

On February nineteenth, 2025, Nordson reported first quarter outcomes for the interval ending January 31, 2025. For the quarter, the corporate reported gross sales of $615 million, 3% decrease in comparison with $633 million in Q1 2024, which was pushed by natural gross sales lower of 9%, partly offset by a optimistic acquisition impression.

Medical and Fluid Options noticed gross sales improve by 21%, whereas the Industrial Precision Options and Superior Know-how Options segments each had gross sales decreases of 11%. The corporate generated adjusted earnings per share of $2.06, a 7% lower in comparison with the identical prior yr interval.

Click on right here to obtain our most up-to-date Certain Evaluation report on NDSN (preview of web page 1 of three proven under):

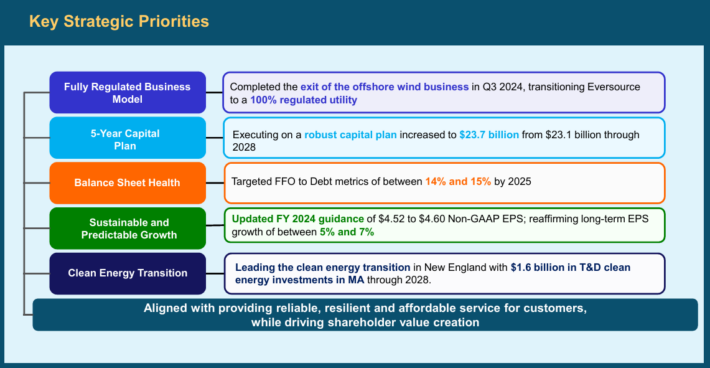

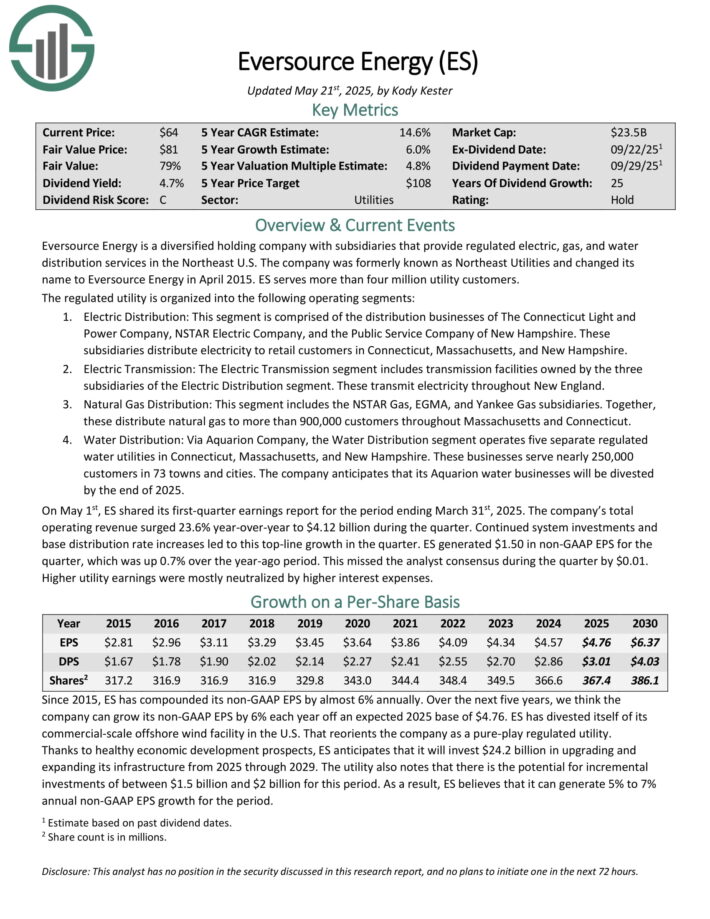

Dividend Aristocrat #5: Eversource Power (ES)

5-year Anticipated Annual Returns: 14.3%

Eversource Power is a diversified holding firm with subsidiaries that present regulated electrical, fuel, and water distribution service within the Northeast U.S.

FactSet, Erie Indemnity, and Eversource Power are the three new Dividend Aristocrats for 2025.

The corporate’s utilities serve greater than 4 million clients. Eversource has delivered regular progress to shareholders for a few years.

Supply: Investor Presentation

On Might 1st, ES shared its first-quarter earnings report for the interval ending March thirty first, 2025. The corporate’s complete working income surged 23.6% year-over-year to $4.12 billion throughout the quarter.

Continued system investments and base distribution charge will increase led to this top-line progress within the quarter. ES generated $1.50 in non-GAAP EPS for the quarter, which was up 0.7% over the year-ago interval.

Click on right here to obtain our most up-to-date Certain Evaluation report on ES (preview of web page 1 of three proven under):

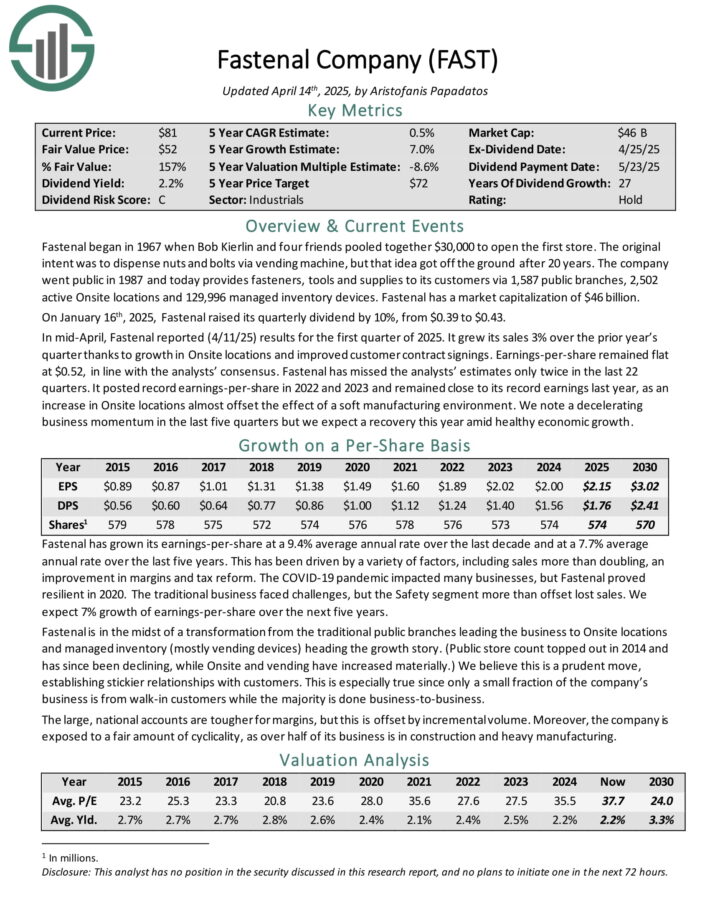

Dividend Aristocrat #4: Fastenal Co. (FAST)

5-year Anticipated Annual Returns: 15.4%

Fastenal offers fasteners, instruments and provides to its clients by way of 1,587 public branches, 2,502 lively Onsite places and 129,996 managed stock gadgets.

On January sixteenth, 2025, Fastenal raised its quarterly dividend by 10%, from $0.39 to $0.43.

In mid-April, Fastenal reported (4/11/25) outcomes for the primary quarter of 2025. It grew its gross sales 3% over the prior yr’s quarter due to progress in Onsite places and improved buyer contract signings. Earnings-per-share remained flat at $0.52, consistent with the analysts’ consensus.

Fastenal has missed the analysts’ estimates solely twice within the final 22 quarters. It posted report earnings-per-share in 2022 and 2023 and remained near its report earnings final yr, as a rise in Onsite places virtually offset the impact of a tender manufacturing setting.

Fastenal has a primary mover aggressive benefit in its industrial merchandising and Onsite places, creating a really sticky and well-attuned buyer relationship with excessive switching prices. Furthermore, its scale permits the corporate to proceed its progress path, regulate to enterprise preferences and reliably ship wanted items.

Click on right here to obtain our most up-to-date Certain Evaluation report on FAST (preview of web page 1 of three proven under):

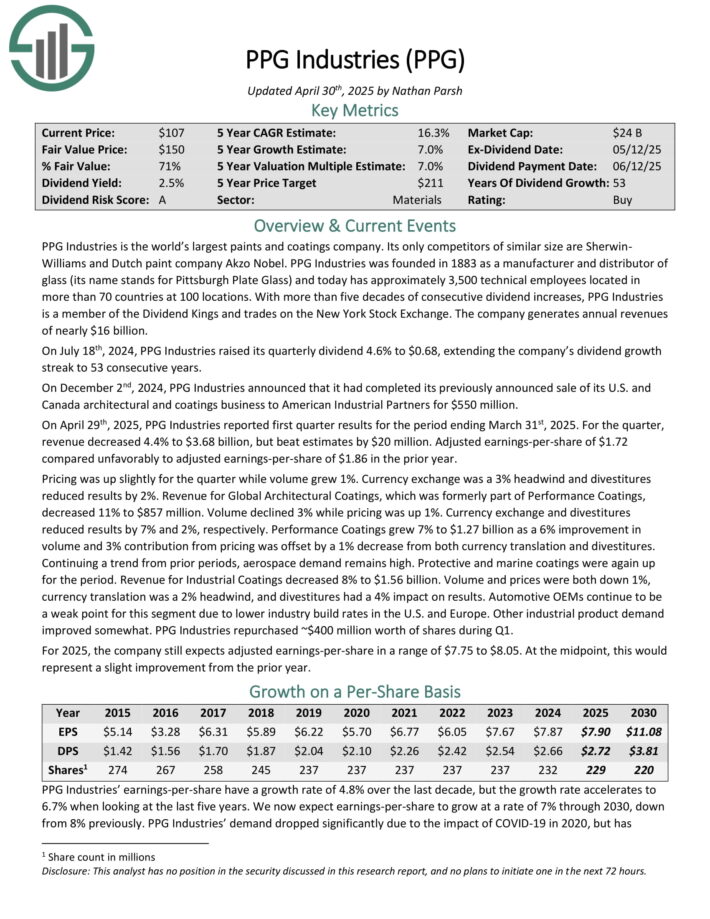

Dividend Aristocrat #3: PPG Industries (PPG)

5-year Anticipated Annual Returns: 15.5%

PPG Industries is the world’s largest paints and coatings firm. Its solely rivals of comparable dimension are Sherwin-Williams and Dutch paint firm Akzo Nobel.

PPG Industries was based in 1883 as a producer and distributor of glass (its identify stands for Pittsburgh Plate Glass) and at present has roughly 3,500 technical workers situated in additional than 70 nations at 100 places.

On April twenty ninth, 2025, PPG Industries reported first quarter outcomes for the interval ending March thirty first, 2025. For the quarter, income decreased 4.4% to $3.68 billion, however beat estimates by $20 million. Adjusted earnings-per-share of $1.72 in contrast unfavorably to adjusted earnings-per-share of $1.86 within the prior yr.

Pricing was up barely for the quarter whereas quantity grew 1%. Foreign money alternate was a 3% headwind and divestitures lowered outcomes by 2%. Income for World Architectural Coatings, which was previously a part of Efficiency Coatings, decreased 11% to $857 million.

Quantity declined 3% whereas pricing was up 1%. Foreign money alternate and divestitures lowered outcomes by 7% and a couple of%, respectively. Efficiency Coatings grew 7% to $1.27 billion as a 6% enchancment in quantity and three% contribution from pricing was offset by a 1% lower from each foreign money translation and divestitures.

For 2025, the corporate expects adjusted earnings-per-share in a spread of $7.75 to $8.05.

Click on right here to obtain our most up-to-date Certain Evaluation report on PPG (preview of web page 1 of three proven under):

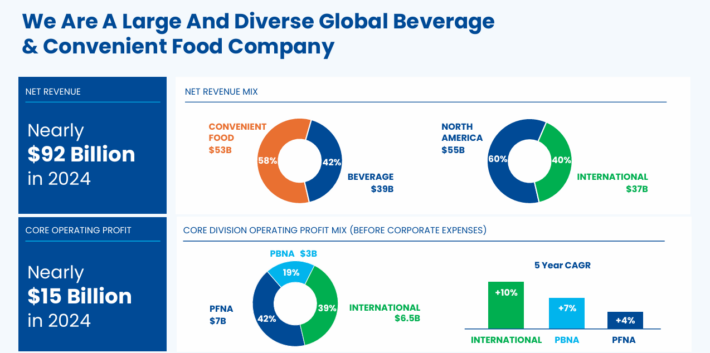

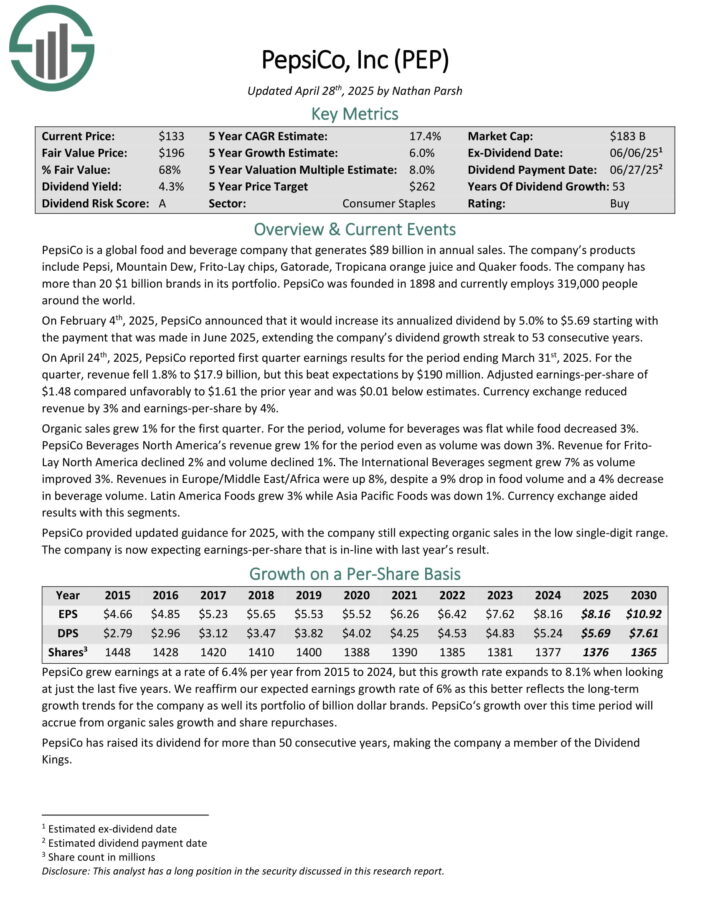

Dividend Aristocrat #2: PepsiCo Inc. (PEP)

5-year Anticipated Annual Returns: 17.8%

PepsiCo is a worldwide meals and beverage firm. Its merchandise embrace Pepsi, Mountain Dew, Frito-Lay chips, Gatorade, Tropicana orange juice and Quaker meals.

Its enterprise is break up roughly 60-40 by way of meals and beverage income. It is usually balanced geographically between the U.S. and the remainder of the world.

Supply: Investor Presentation

On April twenty fourth, 2025, PepsiCo reported first quarter earnings outcomes for the interval ending March thirty first, 2025. For the quarter, income fell 1.8% to $17.9 billion, however this beat expectations by $190 million.

Adjusted earnings-per-share of $1.48 in contrast unfavorably to $1.61 the prior yr and was $0.01 under estimates. Foreign money alternate lowered income by 3% and earnings-per-share by 4%.

Natural gross sales grew 1% for the primary quarter. For the interval, quantity for drinks was flat whereas meals decreased 3%. PepsiCo Drinks North America’s income grew 1% for the interval whilst quantity was down 3%.

Income for Frito Lay North America declined 2% and quantity declined 1%.

Click on right here to obtain our most up-to-date Certain Evaluation report on PEP (preview of web page 1 of three proven under):

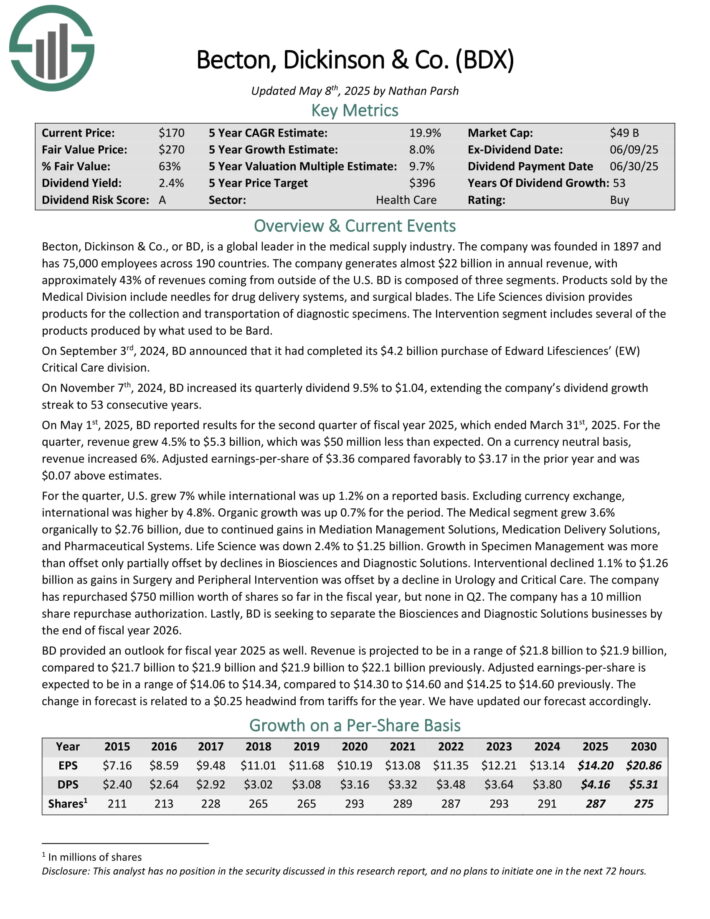

Dividend Aristocrat #1: Becton Dickinson & Co. (BDX)

5-year Anticipated Annual Returns: 20.0%

Becton, Dickinson & Co. is a worldwide chief within the medical provide trade. The corporate was based in 1897 and has 75,000 workers throughout 190 nations.

The corporate generates about $20 billion in annual income, with roughly 43% of revenues coming from exterior of the U.S.

Becton, Dickinson & Co., or BD, is a worldwide chief within the medical provide trade. The corporate generates virtually $22 billion in annual income, with roughly 43% of revenues coming from exterior of the U.S.

BD consists of three segments. Merchandise bought by the Medical Division embrace needles for drug supply methods, and surgical blades. The Life Sciences division offers merchandise for the gathering and transportation of diagnostic specimens. The Intervention section contains a number of of the merchandise produced by what was Bard.

On Might 1st, 2025, BD reported outcomes for the second quarter of fiscal yr 2025, which ended March thirty first, 2025. For the quarter, income grew 4.5% to $5.3 billion, which was $50 million lower than anticipated.

On a foreign money impartial foundation, income elevated 6%. Adjusted earnings-per-share of $3.36 in contrast favorably to $3.17 within the prior yr and was $0.07 above estimates.

For the quarter, U.S. grew 7% whereas worldwide was up 1.2% on a reported foundation. Excluding foreign money alternate, worldwide was increased by 4.8%. Natural progress was up 0.7% for the interval.

Click on right here to obtain our most up-to-date Certain Evaluation report on BDX (preview of web page 1 of three proven under):

The Dividend Aristocrats In Focus Evaluation Sequence

You may see evaluation on each single Dividend Aristocrat under. Every is sorted by GICS sectors and listed in alphabetical order by identify. The most recent Certain Evaluation Analysis Database report for every safety is included as effectively.

Shopper Staples

Industrials

Well being Care

Shopper Discretionary

Financials

Supplies

Power

Data Know-how

Actual Property

Utilities

Historic Dividend Aristocrats Listing(1989 – 2025)

The picture under exhibits the historical past of the Dividend Aristocrats Index from 1989 by means of 2025:

Notice: CL, GPC, and NUE had been all eliminated and re-added to the Dividend Aristocrats Index by means of the historic interval analyzed above. We’re uncertain as to why. Corporations created by way of a spin-off (like AbbVie) might be Dividend Aristocrats with lower than 25 years of rising dividends if the mother or father firm was a Dividend Aristocrat.

Disclaimer: Certain Dividend is just not affiliated with S&P World in any means. S&P World owns and maintains The Dividend Aristocrats Index. The data on this article and downloadable spreadsheet and picture under is predicated on Certain Dividend’s personal overview, abstract, and evaluation of the S&P 500 Dividend Aristocrats ETF (NOBL) and different sources, and is supposed to assist particular person buyers higher perceive this ETF and the index upon which it’s primarily based. Not one of the data on this article or spreadsheet is official information from S&P World. Seek the advice of S&P World for official data.

This data was compiled from the next sources:

Continuously Requested Questions

This part will deal with a few of most typical questions buyers have concerning the Dividend Aristocrats.

1. What’s the highest-paying Dividend Aristocrat?

Reply: Franklin Sources (BEN) presently yields 6.0%.

2. What’s the distinction between the Dividend Aristocrats and the Dividend Kings?

Reply: The Dividend Aristocrats have to be constituents of the S&P 500 Index, have raised their dividends for not less than 25 consecutive years, and fulfill quite a lot of liquidity necessities.

The Dividend Kings solely have to have raised their dividends for not less than 50 consecutive years.

3. Is there an ETF that tracks the Dividend Aristocrats?

Reply: Sure, the Dividend Aristocrats ETF (NOBL) is an exchange-traded fund that particularly holds the Dividend Aristocrats.

4. What’s the distinction between the Dividend Aristocrats and the Dividend Champions?

Reply: The Dividend Aristocrats and Dividend Champions share one requirement, which is that an organization will need to have raised its dividend for not less than 25 consecutive years.

However just like the Dividend Kings, the Dividend Champions don’t should be within the S&P 500 Index, nor fulfill the varied liquidity necessities.

5. Which Dividend Aristocrat has the longest lively streak of annual dividend will increase?

At present, there are 3 Dividend Aristocrats tied at 69 years: Procter & Gamble, Real Components, and Dover Company.

6. What’s the common dividend yield of the Dividend Aristocrats?

Proper now, the common dividend yield of the Dividend Aristocrats is 2.0%.

7. Are the Dividend Aristocrats protected investments?

Whereas there are by no means any ensures relating to the inventory market, we consider the Dividend Aristocrats are among the many most secure dividend shares relating to the sustainability of their dividend payouts.

The Dividend Aristocrats have sturdy aggressive benefits that permit them to boost their dividends every year, even throughout a recession.

Different Dividend Lists & Closing Ideas

The Dividend Aristocrats listing is just not the one strategy to rapidly display screen for shares that often pay rising dividends.

The Dividend Kings Listing is much more unique than the Dividend Aristocrats. It’s comprised of 55 shares with 50+ years of consecutive dividend will increase.

The Blue Chip Shares Listing: shares that qualify as Dividend Achievers, Dividend Aristocrats, and/or Dividend Kings

The Excessive Dividend Shares Listing: shares that enchantment to buyers within the highest yields of 5% or extra.

The Month-to-month Dividend Shares Listing: shares that pay dividends each month, for 12 dividend funds per yr.

There may be nothing magical concerning the Dividend Aristocrats. They’re ‘simply’ a set of high-quality shareholder pleasant shares which have sturdy aggressive benefits.

Buying these kinds of shares at truthful or higher costs and holding for the long-run will probably lead to favorable long-term efficiency.

Thanks for studying this text. Please ship any suggestions, corrections, or inquiries to assist@suredividend.com.