Up to date on June twenty seventh, 2025 by Bob Ciura

Whether or not an organization ought to pay a dividend relies on many components. Hundreds of publicly-traded corporations pay dividends to shareholders, and a few have maintained lengthy histories of elevating their dividends yearly.

Firms don’t resolve to start paying a dividend in a vacuum. There are a lot of points to be thought-about earlier than returning capital to shareholders with a dividend.

Nonetheless, many corporations pay dividends to shareholders; some have even managed to pay and enhance dividends for many years.

For instance, the Dividend Aristocrats are a choose group of 69 shares within the S&P 500 which have raised their dividends for 25+ years in a row.

You may obtain an Excel spreadsheet of all Dividend Aristocrats (with metrics that matter, akin to price-to-earnings ratios and dividend yields) by clicking the hyperlink beneath:

Disclaimer: Positive Dividend shouldn’t be affiliated with S&P World in any manner. S&P World owns and maintains The Dividend Aristocrats Index. The data on this article and downloadable spreadsheet is predicated on Positive Dividend’s personal evaluation, abstract, and evaluation of the S&P 500 Dividend Aristocrats ETF (NOBL) and different sources, and is supposed to assist particular person traders higher perceive this ETF and the index upon which it’s primarily based. Not one of the data on this article or spreadsheet is official information from S&P World. Seek the advice of S&P World for official data.

However, different corporations don’t pay a dividend proper now and won’t for a really very long time (or ever).

Firms which can be nonetheless within the early progress part of their growth usually select to reinvest extra capital again into their enterprise as a substitute of returning it to shareholders.

In any case, each greenback paid out in dividends is one much less greenback out there to develop the enterprise.

Netflix (NFLX) is a superb instance of this, as the corporate doesn’t at present pay a dividend and hasn’t because it went public in Might of 2002. This doesn’t imply that traders ought to all the time keep away from non-dividend-paying shares.

Associated: Dividend shares versus progress shares.

Many tech shares have initiated dividend funds over the previous decade as they’ve matured and now generate sturdy income. Buyers may very well be questioning if Netflix will ever pay a dividend.

Enterprise Overview

With greater than 300 million members unfold out over almost 200 international locations, Netflix is a media big. Whereas Netflix does provide all kinds of second-run tv programming and flicks, the corporate additionally produces its personal unique content material.

The corporate started with humble beginnings by mailing out DVDs to subscribers. However now its focus has shifted to streaming providers over the web. Subscribers have entry to Netflix’s library of TV collection, documentaries, and have movies throughout almost each style possible.

As well as, the corporate has spent closely on creating its personal content material, which was essential to Netflix’s success at rising its subscriber base by a excessive fee. The corporate additionally holds the main share of complete U.S. TV time.

This resulted in huge income progress through the years. Netflix’s annual income greater than tripled from 2016 to 2021, reaching $39 billion in 2024.

Within the 2025 first quarter, income elevated 12.5% year-over-year to $10.54 billion. Earnings-per-share rose 25% year-over-year to $6.61 per share.

Given its sturdy earnings progress, traders may assume that the corporate would contemplate paying a dividend to shareholders, however Netflix has not paid a dividend so far. A part of this rationalization is that the corporate continues to be not as extremely worthwhile because it may very well be.

Consensus estimates for 2025 are for earnings of $25.32 per share for Netflix, representing an earnings yield of simply ~2.1%.

In different phrases, if Netflix have been to distribute just about all of its annual earnings-per-share as a dividend, it might generate a 2.1% dividend yield.

After all, it might not do that as a result of it might deprive the corporate of money to spend money on progress and debt compensation. Content material prices are excessive, which is a giant motive why Netflix doesn’t pay dividends.

Causes For Paying A Dividend

Many corporations pay dividends as they’re an necessary a part of their capital allocation applications. Some corporations, akin to Dividend Aristocrats like Coca-Cola (KO) and Johnson & Johnson (JNJ), have elevated their dividends for a number of consecutive many years.

The truth is, each Coca-Cola and J&J are members of the unique Dividend Kings checklist.

Even corporations which have been traditionally reluctant to pay dividends have begun to take action lately. That is notably true amongst know-how corporations, which used to spend closely to develop their companies however now have began to make use of dividends as a strategy to return capital to shareholders.

Tech corporations like Alphabet (GOOGL) and Meta Platforms (META) have initiated dividends not too long ago as a result of their shareholder bases demanded a dividend, and their enterprise fashions generated constant free money move.

It is extremely comprehensible why these traders would need corporations to pay dividends. As inventory costs fall in a market downturn, dividends present a cushion towards paper losses.

Additionally they permit traders who reinvest dividends to buy extra shares at decrease costs, thus rising their general dividend earnings. When markets rise once more, dividends solely add to shareholder returns.

Dividends are additionally a worthwhile supply of earnings for retirees. Dividends can assist retired traders exchange the earnings they misplaced after they have stopped working.

Life’s bills proceed even when folks now not obtain a paycheck from their employer. For that reason, dividends could be a essential part of a retirement planning technique.

Nonetheless, progress corporations like Netflix differ from time-tested dividend shares like Coca-Cola and Johnson & Johnson as a result of they nonetheless must spend huge quantities of capital on content material to develop.

It is a essential expense if Netflix plans to not simply preserve however develop its subscriber base sooner or later.

The corporate has to compete with rivals within the leisure trade like Amazon (AMZN), YouTube, Hulu, and The Walt Disney Firm (DIS), and lots of others, making it doubtless that spending charges will solely rise from right here.

As well as, worldwide progress is a progress catalyst for Netflix that requires vital capital funding. An instance of that is the UK, the place Netflix is now producing exhibits and flicks.

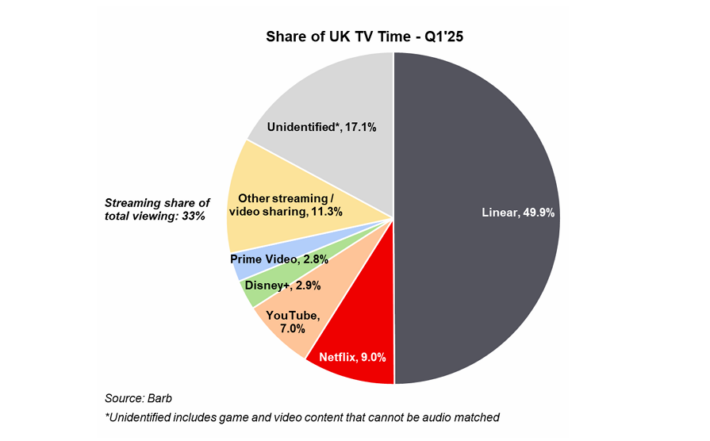

This funding is giving Netflix a rising share of TV time. Based on Netflix, it now instructions a TV share of 9%, up a full share level from the identical quarter final 12 months.

Supply: Investor Presentation

On account of its continued content material funding, Netflix could by no means pay a dividend to shareholders.

Will Netflix Ever Pay A Dividend?

Whereas there are actually good causes for paying a dividend, there stay legitimate causes for not doing so. Paying a dividend requires the money move wanted to cowl funds.

Firms that don’t provide constant free money move, like Netflix, would wrestle to search out the money to return to shareholders on a quarterly foundation.

Whereas the corporate technically may pay a dividend primarily based on its rising earnings-per-share, Netflix continues to make use of its money move on progress initiatives to extend its pool of subscribers.

Due to this, Netflix has did not generate constructive free money move progress on a constant foundation. The corporate expects to be free money move constructive this 12 months and past, which is an enchancment because it normally is typical for Netflix to publish damaging free money move.

Utilizing massive quantities of capital additionally signifies that Netflix has to entry debt markets with the intention to preserve spending. This has impacted the corporate’s steadiness sheet, providing one other impediment to a future dividend fee.

For instance, Netflix’s long-term debt elevated to $14.01 billion within the 2025 first quarter, from $13.79 billion on the finish of 2024. Whole liabilities stand at simply over $28 billion.

This debt makes it harder for Netflix to supply shareholders a dividend.

Primarily based on all of the above, a dividend might not be the best selection for Netflix, on condition that its funding spending and debt compensation stay a lot greater priorities for administration.

Remaining Ideas

How an organization allocates capital shouldn’t be set in stone. A capital allocation coverage may be modified over time. As a progress enterprise matures, it could resolve that paying a dividend is an effective use of capital.

As soon as an organization reaches constant profitability, administration could resolve {that a} dividend may appeal to new shareholders and reward present traders.

It’s doable that Netflix may finally make the identical resolution that many different tech shares have by way of a dividend, however it’s not doubtless.

For now, Netflix has many opponents, which suggests it nonetheless wants to make use of each greenback out there to proceed to create unique content material.

And with a major quantity of debt on the steadiness sheet, traders shouldn’t anticipate to obtain dividend funds from the corporate any time quickly.

For all these causes, it stays unlikely that Netflix pays a dividend within the subsequent a number of years.

See the articles beneath for an evaluation of whether or not different shares that at present don’t pay dividends will sooner or later pay a dividend:

Thanks for studying this text. Please ship any suggestions, corrections, or inquiries to help@suredividend.com.