NYC Q2 2025 Funding Report

Armed with complete knowledge from our mates at CrunchBase, we’ve analyzed the biggest NYC Startup funding rounds from Q2 2025. From AI-powered platforms and fintech options to meals supply improvements and healthcare expertise, this quarter demonstrated the continued range and energy of New York’s startup ecosystem. Past the uncooked funding numbers, this evaluation contains detailed details about every firm’s business focus, founding crew, enterprise mannequin, and whole funding historical past to offer deeper context about these high-growth ventures driving enterprise capital in NYC ahead.

🚀 REACH NYC TECH LEADERS

AlleyWatch is NYC’s main supply of tech and startup information, reaching town’s most lively founders, buyers, and tech leaders. Study Extra →

Spherical: Sequence BDescription: Blackbird Labs is a web3 hospitality expertise platform that ought to immediately join eating places and prospects. Based by Ben Leventhal in 2022, Blackbird has now raised a complete of $85.0M in whole fairness funding and is backed by Andreessen Horowitz, QED Traders, Union Sq. Ventures, Circle, and Spark Capital.Traders within the spherical: a16z crypto, American Categorical Ventures, Coinbase Ventures, Spark Capital, Union Sq. VenturesIndustry: Hospitality, Data Expertise, Loyalty Applications, Web3Founders: Ben LeventhalFounding yr: 2022Total fairness funding raised: $85.0M

17. Crux $50.0M

Spherical: Sequence BDescription: Crux is a capital market firm that gives debit market,transferable tax credit, and market intelligence for tax credit score transfers. Based by Alfred Johnson and Allen Kramer in 2023, Crux has now raised a complete of $77.1M in whole fairness funding and is backed by Andreessen Horowitz, QED Traders, Lowercarbon Capital, Large Ventures, and Acrew Capital.Traders within the spherical: Acrew Capital, Andreessen Horowitz, Ardent Enterprise Companions, CIV, Large Ventures, Liberty Mutual Strategic Ventures, Lowercarbon Capital, MassMutual Ventures, New System Ventures, OMERS Ventures, Three Cairns GroupIndustry: Clear Vitality, Finance, Lending, Manufacturing, Renewable EnergyFounders: Alfred Johnson, Allen KramerFounding yr: 2023Total fairness funding raised: $77.1M

17. Rogo $50.0M

Spherical: Sequence BDescription: Rogo is a safe Generative AI platform purpose-built for elite monetary establishments. Based by Gabriel Stengel, John Willett, and Tumas Rackaitis in 2022, Rogo has now raised a complete of $79.0M in whole fairness funding and is backed by BoxGroup, Khosla Ventures, Thrive Capital, Tiger World Administration, and Firm Ventures.Traders within the spherical: AlleyCorp, BoxGroup, J.P. Morgan Development Fairness Companions, Khosla Ventures, Constructive Sum, Thrive Capital, Tiger World ManagementIndustry: Analytics, Synthetic Intelligence (AI), Enterprise Intelligence, Monetary Providers, FinTech, Generative AIFounders: Gabriel Stengel, John Willett, Tumas RackaitisFounding yr: 2022Total fairness funding raised: $79.0M

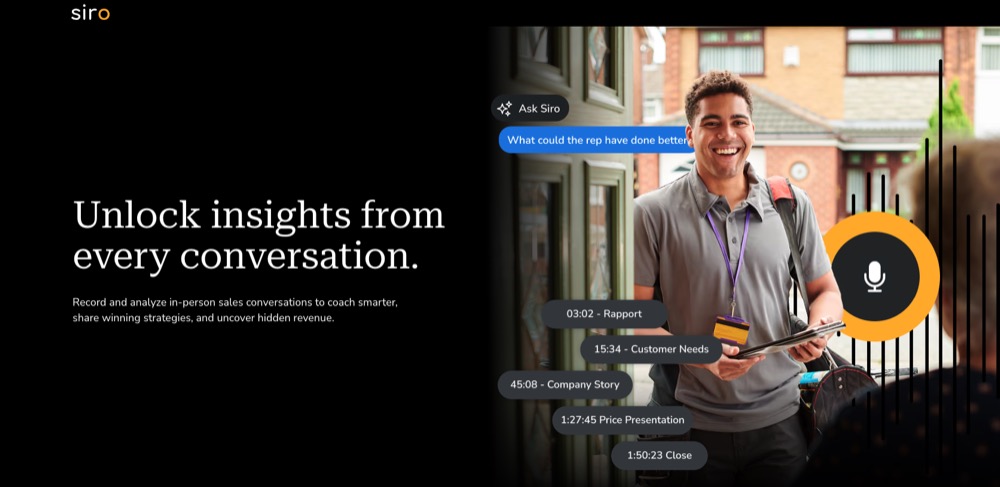

17. Siro $50.0M

Spherical: Sequence BDescription: Siro builds an AI Coach that identifies alternatives to raise any gross sales crew. Based by Jake Cronin and Joseph Jordan in 2020, Siro has now raised a complete of $68.0M in whole fairness funding and is backed by StepStone Group, Index Ventures, SignalFire, 01 Advisors, and Alchemist Accelerator.Traders within the spherical: 01 Advisors, CRV, Dave Salvant, Ding Zhou, Fika Ventures, Index Ventures, Michael Stoppelman, Saumil Mehta, SignalFire, Songe LaRon, StepStone GroupIndustry: Data Expertise, Gross sales, SoftwareFounders: Jake Cronin, Joseph JordanFounding yr: 2020Total fairness funding raised: $68.0M

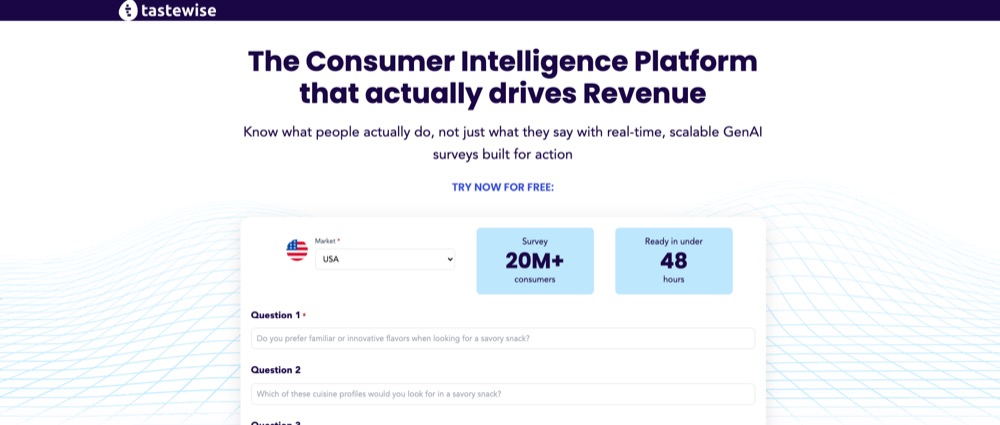

Spherical: Sequence BDescription: Tastewise is a shopper intelligence platform that gives insights for meals manufacturers. Based by Alon Chen and Eyal Gaon in 2018, Tastewise has now raised a complete of $71.6M in whole fairness funding and is backed by PeakBridge, PICO Enterprise Companions, TELUS World Ventures, Disruptive, and Disruptive AI Enterprise Capital.Traders within the spherical: Disruptive AI Enterprise Capital, Duo Companions, PeakBridge, PICO Enterprise Companions, TELUS World VenturesIndustry: Analytics, Synthetic Intelligence (AI), Large Knowledge, Shopper Items, Meals and Beverage, Advertising and marketing, Predictive Analytics, Eating places, RetailFounders: Alon Chen, Eyal GaonFounding yr: 2018Total fairness funding raised: $71.6M

Spherical: Sequence CDescription: Vivrelle is a luxurious equipment membership membership that gives entry to a shared closet of designer purses, jewellery, and diamonds. Based by Blake Cohen Geffen and Wayne Geffen in 2018, Vivrelle has now raised a complete of $131.0M in whole fairness funding and is backed by Origin Ventures, Protagonist, 3L Capital, Plus Capital, and Chapford Capital Group.Traders within the spherical: ProtagonistIndustry: E-Commerce, Style, Jewellery, Subscription ServiceFounders: Blake Cohen Geffen, Wayne GeffenFounding yr: 2018Total fairness funding raised: $131.0M

15. Ethic $64.0M

Spherical: Sequence DDescription: Ethic develops expertise that helps wealth advisors. Based by Doug Scott, Jay Lipman, and Johny Mair in 2015, Ethic has now raised a complete of $162.8M in whole fairness funding and is backed by Oak HC/FT, 500 World, Nyca Companions, UBS, and Fifty Years.Traders within the spherical: State Avenue World AdvisorsIndustry: Finance, Monetary Providers, FinTech, Affect Investing, SustainabilityFounders: Doug Scott, Jay Lipman, Johny MairFounding yr: 2015Total fairness funding raised: $162.8M

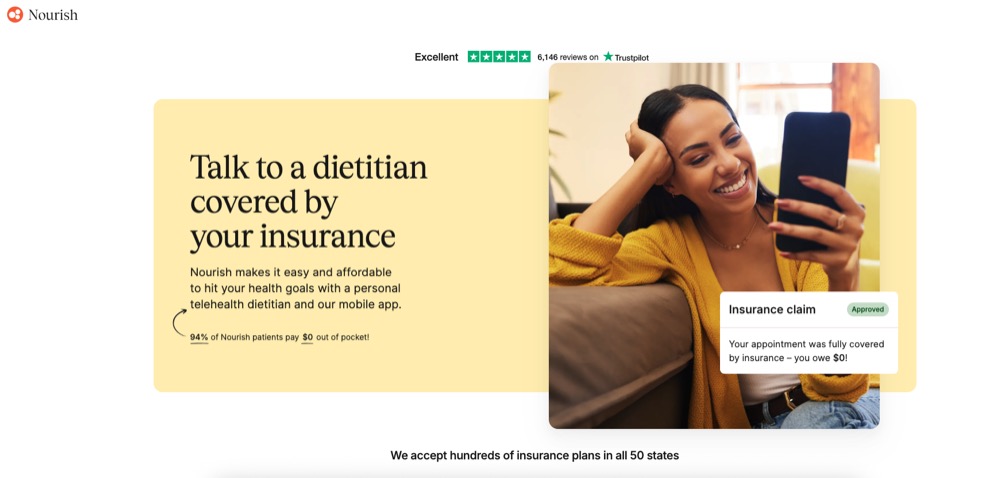

Spherical: Sequence BDescription: Nourish is a telehealth platform that connects people with registered dietitian nutritionists for customized vitamin counseling. Based by Aidan Dewar, Sam Perkins, and Stephanie Liu in 2021, Nourish has now raised a complete of $113.1M in whole fairness funding and is backed by Y Combinator, BoxGroup, Maverick Ventures, Thrive Capital, and Index Ventures.Traders within the spherical: Atomico, BoxGroup, G Squared, Index Ventures, J.P. Morgan Development Fairness Companions, Maverick Ventures, Pinegrove Capital Companions, Thrive Capital, Y CombinatorIndustry: Apps, Well being Care, Diet, TelehealthFounders: Aidan Dewar, Sam Perkins, Stephanie LiuFounding yr: 2021Total fairness funding raised: $113.1M

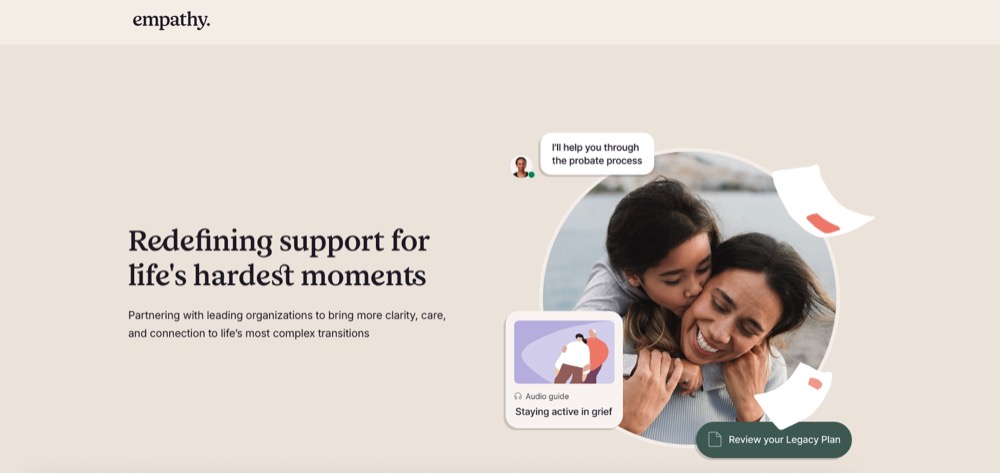

Spherical: Sequence CDescription: Empathy is a help system cellular software that guides and helps households alongside the journey of loss. Based by Ron Gura and Yonatan Bergman in 2020, Empathy has now raised a complete of $162.0M in whole fairness funding and is backed by Basic Catalyst, Index Ventures, LocalGlobe, Adams Avenue Companions, and Munich Re Ventures.Traders within the spherical: Adams Avenue Companions, Aflac World Ventures, Allianz Life Ventures, Brewer Lane Ventures, Citi Affect Fund, Entree Capital, Basic Catalyst, Index Ventures, Latitude, LionTree, MassMutual Ventures, MetLife, Munich Re Ventures, New York Life Ventures, Securian Ventures, SemperVirens Enterprise Capital, Sumitomo Ventures, TIAAIndustry: Apps, Well being Care, Data Expertise, SoftwareFounders: Ron Gura, Yonatan BergmanFounding yr: 2020Total fairness funding raised: $162.0M

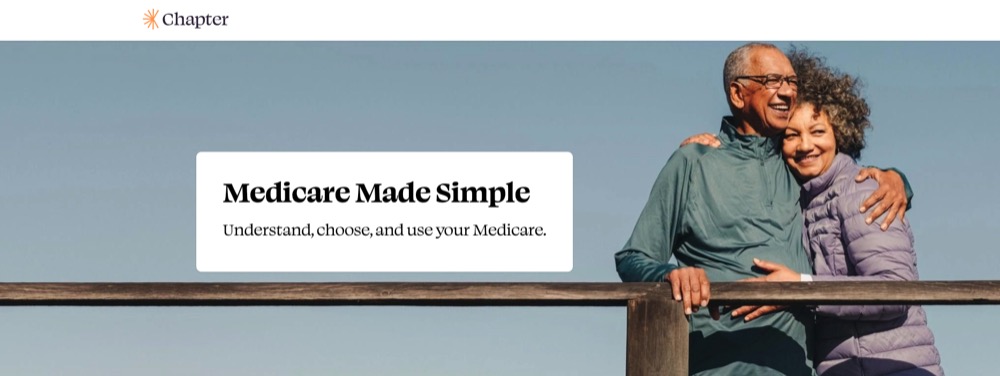

Spherical: Sequence DDescription: Chapter affords a Medicare navigation platform that gives advisory companies for seniors searching for well being protection. Based by Cobi Blumenfeld-Gantz, Corey Metzman, and Vivek Ramaswamy in 2020, Chapter has now raised a complete of $184.0M in whole fairness funding and is backed by Maverick Ventures, Susa Ventures, XYZ Enterprise Capital, Narya Capital, and Addition.Traders within the spherical: Addition, Maverick Ventures, Narya Capital, Stripes, Susa Ventures, XYZ Enterprise CapitalIndustry: Aged, Well being Care, Well being Insurance coverage, MedicalFounders: Cobi Blumenfeld-Gantz, Corey Metzman, Vivek RamaswamyFounding yr: 2013Total fairness funding raised: $184.0M

💡 CONNECT WITH NYC INNOVATORS

Be a part of NYC’s high tech corporations in reaching AlleyWatch’s engaged viewers of founders, buyers, and decision-makers. Study Extra →

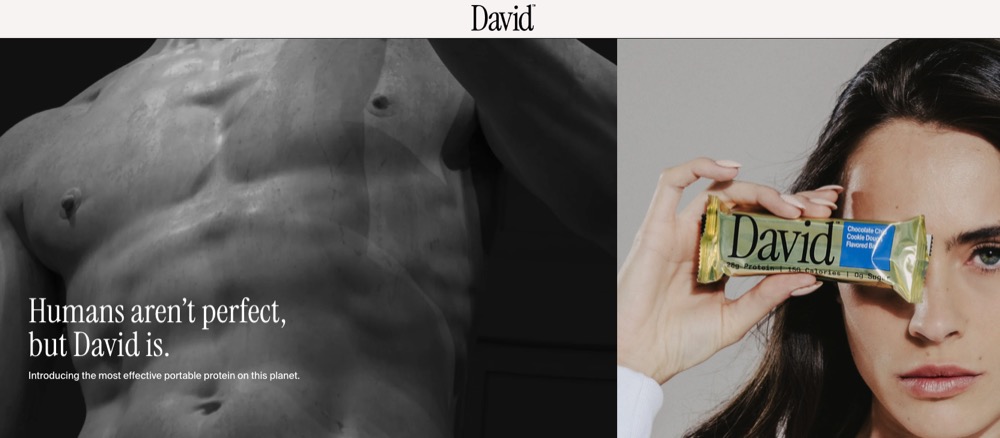

12. David $75.0M

Spherical: Sequence ADescription: David is a food-tech agency targeted on creating high-protein, low-calorie, blood-sugar-friendly meals. Based by Zach Ranen in 2023, David has now raised a complete of $85.0M in whole fairness funding and is backed by Valor Fairness Companions, Valor Siren Ventures, Greenoaks, Peter Rahal, and Peter Attia.Traders within the spherical: Greenoaks, Valor Fairness PartnersIndustry: Health, Meals and Beverage, NutritionFounders: Zach RanenFounding yr: 2023Total fairness funding raised: $85.0M

Spherical: Sequence CDescription: Ready affords an AI-powered platform designed to reinforce emergency response operations. Based by Dylan Gleicher, Michael Chime, and Neal Soni in 2019, Ready has now raised a complete of $151.4M in whole fairness funding and is backed by Basic Catalyst, Andreessen Horowitz, Radical Ventures, First Spherical Capital, and 8VC.Traders within the spherical: Andreessen Horowitz, First Spherical Capital, Basic Catalyst, Radical VenturesIndustry: Synthetic Intelligence (AI), Enterprise Software program, Public SafetyFounders: Dylan Gleicher, Michael Chime, Neal SoniFounding yr: 2019Total fairness funding raised: $151.4M

Spherical: Sequence DDescription: Astronomer is a knowledge orchestration platform constructed on Apache Airflow, enabling groups to construct, run, and monitor knowledge pipelines at scale. Based by Greg Neiheisel, Ry Walker, and Tim Brunk in 2018, Astronomer has now raised a complete of $375.9M in whole fairness funding and is backed by Perception Companions, Bosch Ventures, Venrock, 500 World, and Salesforce Ventures.Traders within the spherical: Bain Capital Ventures, Bosch Ventures, Perception Companions, Meritech Capital Companions, Salesforce Ventures, VenrockIndustry: Analytics, Large Knowledge, Knowledge Integration, Machine Studying, SoftwareFounders: Greg Neiheisel, Ry Walker, Tim BrunkFounding yr: 2018Total fairness funding raised: $375.9M

Spherical: VentureDescription: Dataminr is a real-time AI platform that detects early indicators of high-impact occasions and rising dangers. Based by Jeffrey Kinsey, Sam Hendel, and Theodore Bailey in 2009, Dataminr has now raised a complete of $1.1B in whole fairness funding and is backed by BoxGroup, HSBC, Alumni Ventures, Wellington Administration, and Fortress Funding Group.Traders within the spherical: Fortress Funding Group, NightDragonIndustry: Analytics, Synthetic Intelligence (AI), Data Expertise, Danger Administration, SoftwareFounders: Jeffrey Kinsey, Sam Hendel, Theodore BaileyFounding yr: 2009Total fairness funding raised: $1.1B

8. Tennr $101.0M

Spherical: Sequence CDescription: Tennr is a healthcare AI startup that gives an automation platform for medical paperwork. Based by Diego Baugh, Trey Holterman, and Tyler Johnson in 2021, Tennr has now raised a complete of $161.0M in whole fairness funding and is backed by Andreessen Horowitz, Y Combinator, IVP, Lightspeed Enterprise Companions, and Basis Capital.Traders within the spherical: Andreessen Horowitz, Basis Capital, Frank Slootman, Google Ventures, ICONIQ Capital, IVP, Lightspeed Enterprise PartnersIndustry: Synthetic Intelligence (AI), Well being Care, Medical, SoftwareFounders: Diego Baugh, Trey Holterman, Tyler JohnsonFounding yr: 2021Total fairness funding raised: $161.0M

Spherical: Sequence EDescription: Digital Asset develops distributed ledger and good contract infrastructure aimed toward enabling synchronized finance throughout establishments. Based by Don Wilson, Eric Saraniecki, Shaul Kfir, Sunil Hirani, and Yuval Rooz in 2014, Digital Asset has now raised a complete of $442.2M in whole fairness funding and is backed by Citi, Republic, Goldman Sachs, YZi Labs, and BNP Paribas.Traders within the spherical: 7RIDGE, BNP Paribas, Circle Ventures, Citadel Securities, DRW Enterprise Capital, DTCC, Goldman Sachs, IMC, Liberty Metropolis Ventures, Optiver, Paxos, Polychain, QCP, Republic, Tradeweb, Virtu Monetary, YZi LabsIndustry: Blockchain, Cryptocurrency, Developer Platform, Developer Instruments, FinTechFounders: Don Wilson, Eric Saraniecki, Shaul Kfir, Sunil Hirani, Yuval RoozFounding yr: 2014Total fairness funding raised: $442.2M

6. Stash $146.0M

Spherical: Sequence HDescription: Stash develops a private finance software to mix banking, investing, and recommendation into one platform. Based by Brandon Krieg, David Ronick, and Ed Robinson in 2015, Stash has now raised a complete of $572.3M in whole fairness funding and is backed by StepStone Group, Union Sq. Ventures, Goodwater Capital, Coatue, and Founders Fund.Traders within the spherical: Goodwater Capital, Serengeti Asset Administration, StepStone Group, T. Rowe Value, Union Sq. Ventures, College of Illinois FoundationIndustry: Apps, Banking, FinTech, Cellular Apps, Private FinanceFounders: Brandon Krieg, David Ronick, Ed RobinsonFounding yr: 2015Total fairness funding raised: $572.3MAlleyWatch’s unique protection of this spherical: Stash Raises $146M to Improve Monetary Steering with its AI-Powered Platform

📈 ENGAGE NYC DECISION MAKERS

Join with NYC’s tech ecosystem by means of AlleyWatch, essentially the most trusted voice in native tech and startups. Study Extra →

Spherical: Sequence CDescription: Kalshi is an change app that enables folks to commerce on occasion outcomes. Based by Luana Lopes Lara and Tarek Mansour in 2018, Kalshi has now raised a complete of $215.2M in whole fairness funding and is backed by Y Combinator, Bond, Sequoia Capital, Paradigm, and SV Angel.Traders within the spherical: Bond, Multicoin Capital, Neo, Paradigm, Peng Zhao, Sequoia CapitalIndustry: Finance, Monetary Providers, FinTech, Web, Predictive AnalyticsFounders: Luana Lopes Lara, Tarek MansourFounding yr: 2018Total fairness funding raised: $215.2M

4. Ramp $200.0M

Spherical: Sequence EDescription: Ramp is a monetary operations platform designed to save lots of corporations money and time. Based by Eric Glyman, Gene Lee, and Karim Atiyeh in 2019, Ramp has now raised a complete of $1.3B in whole fairness funding and is backed by Basic Catalyst, Stripe, Citi, Sequoia Capital, and Founders Fund.Traders within the spherical: 137 Ventures, 8VC, Avenir, D1 Capital Companions, Definition, Founders Fund, Basic Catalyst, GIC, ICONIQ Development, Khosla Ventures, Lux Capital, Pathlight Ventures, Sands Capital Ventures, Stripes, Thrive CapitalIndustry: Finance, Monetary Providers, FinTechFounders: Eric Glyman, Gene Lee, Karim AtiyehFounding yr: 2019Total fairness funding raised: $1.3B

Spherical: Sequence DDescription: Runway is an utilized AI analysis firm that creates AI-powered content material creation instruments for the media and leisure sectors. Based by Alejandro Matamala Ortiz, Anastasis Germanidis, and Cristobal Valenzuela Barrera in 2018, Runway has now raised a complete of $544.5M in whole fairness funding and is backed by Basic Atlantic, NVIDIA, Madrona, Google, and Felicis.Traders within the spherical: Baillie Gifford, Constancy, Basic Atlantic, NVIDIA, SoftBankIndustry: Apps, Synthetic Intelligence (AI), Generative AI, Machine Studying, Software program, Video EditingFounders: Alejandro Matamala Ortiz, Anastasis Germanidis, Cristobal Valenzuela BarreraFounding yr: 2018Total fairness funding raised: $544.5M

2. Cyera $540.0M

Spherical: Sequence EDescription: Cyera is an AI-powered knowledge safety platform that provides enterprises deep context on their knowledge to guarantee cyber-resilience and compliance. Based by Tamar Bar-Ilan and Yotam Segev in 2021, Cyera has now raised a complete of $1.3B in whole fairness funding and is backed by Accel, Sequoia Capital, Lightspeed Enterprise Companions, Sapphire Ventures, and Coatue.Traders within the spherical: Accel, Alta Park Capital, Coatue, Cyberstarts, Georgian, Greenoaks, Lightspeed Enterprise Companions, Redpoint, Sapphire Ventures, Sequoia Capital, Spark CapitalIndustry: Synthetic Intelligence (AI), Cloud Knowledge Providers, Cyber Safety, Community SecurityFounders: Tamar Bar-Ilan, Yotam SegevFounding yr: 2021Total fairness funding raised: $1.3B

Spherical: Sequence DDescription: Marvel is a meals supply startup that operates truck-based eating places from which customers can order meals by means of a cellular app. Based by Juan Cappello and Marc Lore in 2018, Marvel has now raised a complete of $2.4B in whole fairness funding and is backed by Basic Catalyst, Accel, New Enterprise Associates, Forerunner, and Bain Capital Ventures.Traders within the spherical: Accel, American Categorical Ventures, Forerunner, Google Ventures, New Enterprise AssociatesIndustry: E-Commerce, Meals and Beverage, Meals Supply, RestaurantsFounders: Juan Cappello, Marc LoreFounding yr: 2018Total fairness funding raised: $2.4B

🚀 REACH NYC TECH LEADERS

AlleyWatch is NYC’s main supply of tech and startup information, reaching town’s most lively founders, buyers, and tech leaders. Study Extra →