Hartford Funds researchers, in collaboration with Ned Davis Analysis, discovered that dividend shares averaged an annualized return of 9.2% between 1973 and 2024, and did so whereas being much less unstable than the benchmark index.

By comparability, non-dividend shares earned a extra modest annualized return of 4.31% over 51 years and have been extra unstable than the .

With that in thoughts, we got down to discover three attention-grabbing shares that pay a big dividend, commerce at low valuations, and are often supported by the broader market.

Right here they’re:

1. Enterprise Merchandise Companions

Enterprise Merchandise Companions LP (NYSE:) is an organization primarily engaged within the transportation, storage, and processing of power merchandise akin to , , and petrochemicals. It was based in 1968 and is headquartered in Houston, Texas.

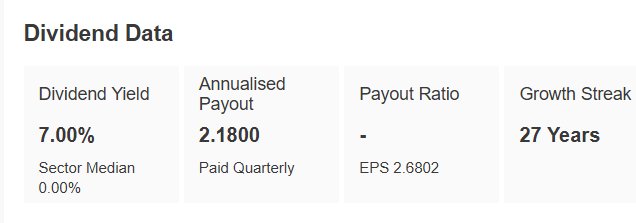

It has elevated its dividend in every of the final 27 years, and the yield presently stands at 7%.

Supply: InvestingPro

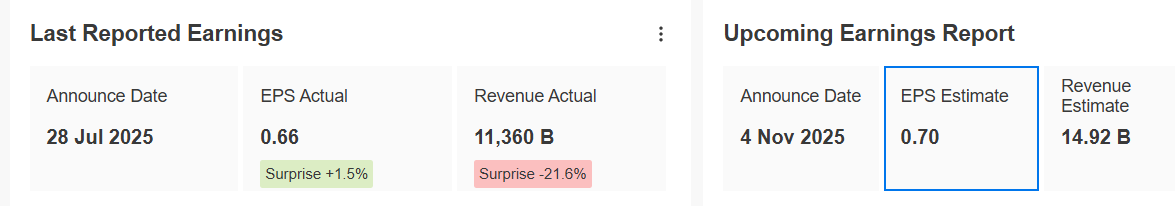

Within the , it beat earnings per share (EPS) expectations with $0.66 per share versus a forecast of $0.65 — a constructive shock of 1.54%. Nevertheless, income got here in considerably beneath projections at $11.36 billion in comparison with the anticipated $14.49 billion, down 21.6%. It can current its accounts for the quarter on November 4.

Supply: InvestingPro

Being an power middleman has one benefit: money move predictability. A lot of the contracts Enterprise has signed with drilling corporations are fastened in nature. This eliminates all elements of inflation and worth volatility, permitting Enterprise to precisely forecast its money move from operations a number of years upfront.

It has greater than half a dozen main initiatives underneath building, totaling $5.6 billion. These initiatives — primarily centered on increasing its publicity to liquefied pure gasoline — must be operational by the top of 2026 and are anticipated to spice up the corporate’s money move.

The ahead price-to-earnings (P/E) ratio is 10.5, roughly according to its common ahead P/E over the previous 5 years.

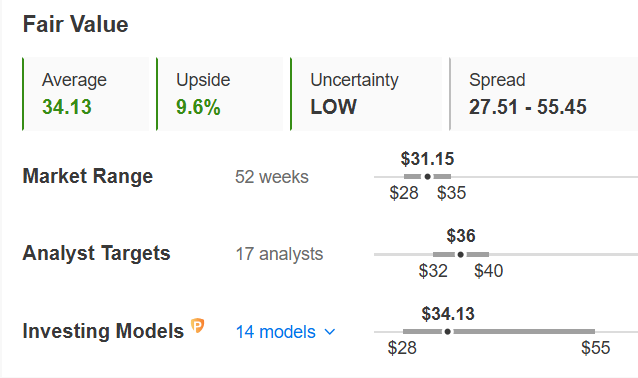

Its shares are buying and selling 9.6% beneath their honest worth, or worth in accordance with fundamentals, which might be $34.13. The market consensus offers it a worth goal of $36.

Supply: InvestingPro

2. Stanley Black & Decker

Stanley Black & Decker (NYSE:) is a producer and distributor of merchandise for do-it-yourself and gardening, in addition to for industrial functions. In 1843, Stanley Works was born, and in 1910, Black & Decker was based. In 2010, Stanley Works merged with Black & Decker. It’s headquartered in New Britain, Connecticut.

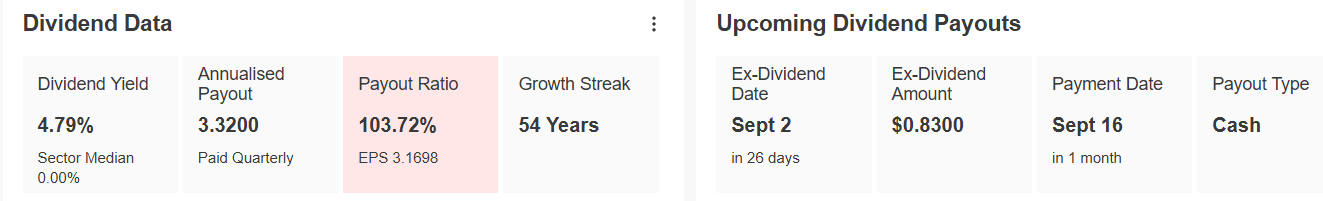

It can pay a dividend of $0.83 on September 16, and shares should be held previous to September 2 to obtain it. The corporate’s dividend yield is 4.79%.

Supply: InvestingPro

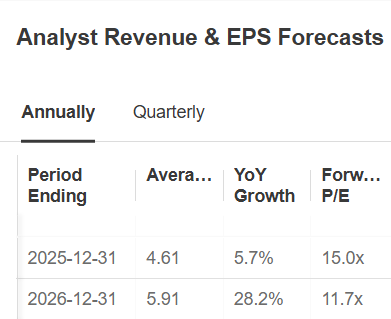

In second-quarter , gross sales declined 2% year-on-year to $3.95 billion. Its internet revenue rose sharply to $101.9 million. We are going to be taught the subsequent quarter’s outcomes on October 23. For the total computation of 2025, EPS (earnings per share) is predicted to extend by 5.7%, and by 2026, by 28.2%.

Supply: InvestingPro

The corporate stays centered on its provide chain transformation and cost-saving initiatives. In truth, the worldwide price discount program initiated in 2022 has already generated round $1.8 billion in financial savings. As well as, it’s relocating manufacturing out of China to mitigate the tariff influence, shifting to Asia.

There may be operational enchancment with increasing margins and correct execution of the effectivity plan, in addition to potential if the development and manufacturing sector within the U.S. reactivates.

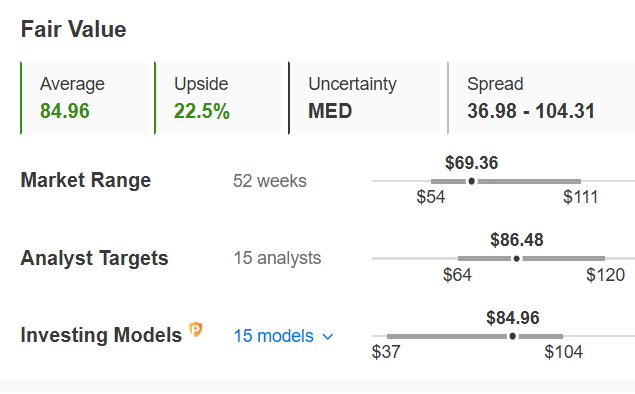

Its shares are buying and selling 22.5% beneath their worth primarily based on fundamentals, which might be $84.96. The market consensus offers it a mean worth goal of $86.48.

Supply: InvestingPro

3. MetLife

MetLife (NYSE:) affords an attention-grabbing case examine amongst giant insurance coverage corporations, combining traits of each worth and development. Its ahead price-to-earnings ratio of 8.6x is considerably beneath its historic common and the broader sector, suggesting the inventory could also be undervalued.

Supply: InvestingPro

Nevertheless, this low a number of will not be on account of deteriorating fundamentals. Analysts anticipate sturdy earnings development of almost 50% in 2025, together with a projected 5.9% improve in income—uncommon for a mature insurer. The inventory additionally holds a “Robust Purchase” consensus from analysts, primarily based on earnings outlook and operational enhancements.

Supply: InvestingPro

When it comes to revenue, MetLife has a protracted historical past of shareholder returns. The corporate has raised its dividend for 12 consecutive years and maintained uninterrupted payouts for 26 years. Whereas the present dividend yield is 2.7%, that is supported by a conservative payout ratio, which permits for potential will increase sooner or later. Moreover, MetLife repurchased $510 million price of shares within the second quarter of 2025, contributing to a excessive complete shareholder yield.

****

Make sure you try all of the market-beating options InvestingPro affords.

InvestingPro members can unlock a robust suite of instruments designed to assist smarter, sooner investing choices, like the next:

ProPicks AI

Constructed on 25+ years of monetary information, ProPicks AI makes use of a machine-learning mannequin to identify high-potential shares utilizing each industry-recognized metric recognized to the large funds {and professional} buyers. Up to date month-to-month, every choose features a clear rationale.

Honest Worth Rating

The InvestingPro Honest Worth mannequin offers you a transparent, data-backed reply. By combining insights from as much as 15 industry-recognized valuation fashions, it delivers a professional-grade estimate of what any inventory is actually price.

WarrenAI

WarrenAI is our generative AI skilled particularly for the monetary markets. As a Professional person, you get 500 prompts every month. Free customers get 10 prompts.

Monetary Well being Rating

The Monetary Well being Rating is a single, data-driven quantity that displays an organization’s general monetary power.

Market’s Prime Inventory Screener

The superior inventory screener options 167 custom-made metrics to search out exactly what you’re searching for, plus pre-defined screens like Dividend Champions and Blue-Chip Bargains.

Every of those instruments is designed to save lots of you time and enhance your investing edge.

Not a Professional member but? Try our plans right here or by clicking on the banner beneath. InvestingPro is presently accessible at as much as 50% off amid the limited-time summer season sale.

Disclaimer: This text is written for informational functions solely. It’s not supposed to encourage the acquisition of property in any method, nor does it represent a solicitation, provide, suggestion or suggestion to speculate. I wish to remind you that each one property are evaluated from a number of views and are extremely dangerous, so any funding determination and the related threat belongs to the investor. We additionally don’t present any funding advisory providers.