Think about you’re planning to get a brand new bank card and also you’re weighing two comparable choices. Each supply comparable advantages and cost the identical annual payment. However one card presents a welcome bonus of 80,000 factors, whereas the opposite presents a welcome bonus of 100,000 factors. Primarily based on these bonuses, which card would you select?

The cardboard that comes with extra factors might appear to be the plain reply, however the actuality is that you simply’re lacking a vital piece of knowledge: You may’t inform which bonus is healthier with out figuring out how a lot the respective factors are value. Relying on the worth of the factors every card earns, the smaller welcome bonus might truly be value extra.

Realizing the worth of factors and miles is a crucial step towards utilizing them correctly, which is why NerdWallet publishes valuations of widespread airline, resort and bank card rewards. Right here’s how you should use these valuations to your profit.

Learn how to use valuations for award journey

Realizing the worth of your foreign money is crucial in any transaction. Right here’s how factors and miles valuations can help you in reserving journey.

Determine whether or not to e-book with factors or money

Award journey creates alternatives to save cash, however simply because you may e-book a visit with factors or miles doesn’t imply it’s best to. Some award redemptions are phenomenal and a few are dismal, with loads of territory in between. Valuations are the important thing to determining the place a given award lies on that spectrum.

You should use our flight calculator to determine whether or not to e-book flights in factors or money. Or you are able to do the calculation your self: (Money worth – charges when reserving with factors)/variety of factors.

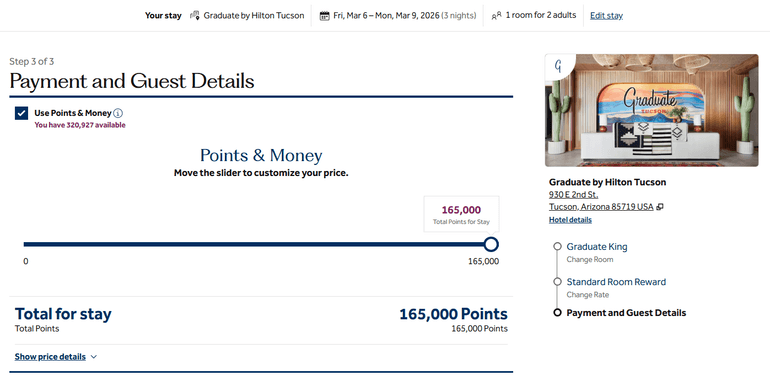

Suppose you’re reserving an extended weekend go to to the College of Arizona in March of 2026. You wish to be near campus, so that you resolve on the Graduate by Hilton Tucson resort. After taxes, the whole price for 3 nights in a 1 King Mattress room is $1,319.27.

Nevertheless, you’ve gotten a stash of Hilton Honors factors, so that you test the award price and see that you may as an alternative e-book the identical keep (with a comparable cancellation coverage) for 165,000 factors.

Dividing the money worth by the award worth yields a redemption worth of slightly below 0.8 cents per level. NerdWallet’s valuation for Hilton Honors is 0.6 cent per level; by that metric, reserving an award gives higher than anticipated worth on this case.

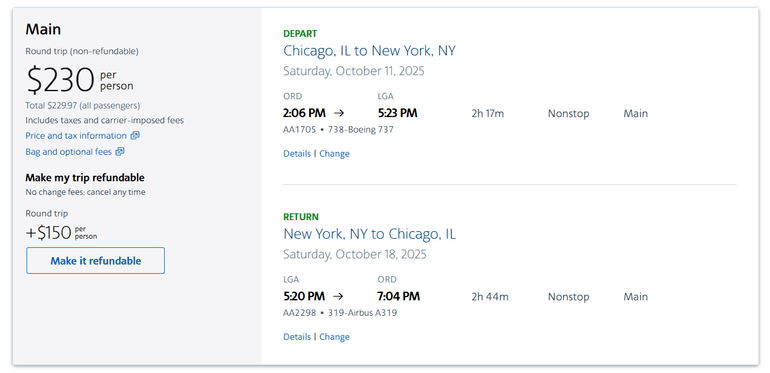

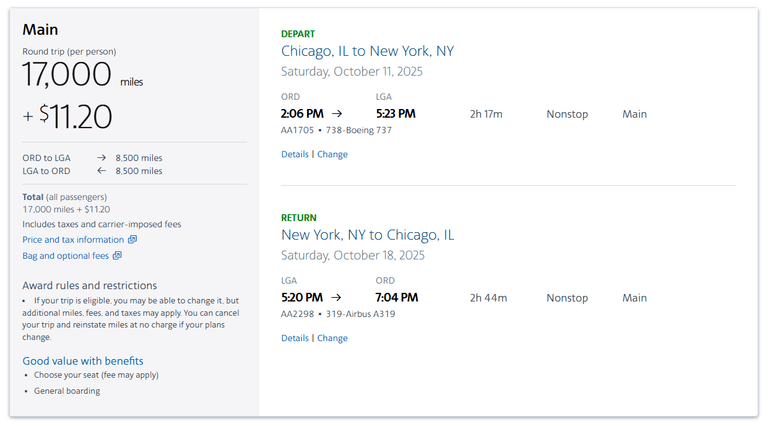

For one more instance, think about an American Airways financial system flight from Chicago to New York LaGuardia in October 2025. This nonstop itinerary is offered for $229.97 round-trip.

Alternatively, you may e-book the identical flights for 17,000 AAdvantage miles plus $11.20 in charges.

This award presents a return of roughly 1.3 cents per mile, whereas NerdWallet’s valuation for AAdvantage miles is 1.6 cents apiece. Which means the award gives decrease than anticipated worth, so in case your resolution rests solely on that valuation, then paying money is the higher possibility.

However valuations don’t exist in a vacuum, and there are different elements to contemplate when assessing the worth of an award. Within the case of reserving the American flight, redeeming miles gives a extra versatile cancellation coverage. You may cancel and get a full refund as long as you accomplish that earlier than the primary flight departs. You can too cancel the money fare, however you’ll be refunded in American Airways credit score that expires after a 12 months. That distinction makes the award flight extra attractive, particularly in case your plans are tentative.

Other than a extra favorable cancellation coverage, you may additionally favor to e-book an award when you’re frightened about factors expiring otherwise you’re seeking to maintain money prices down.

Then again, you would possibly lean towards paying money if:

You’re conserving factors for a extra invaluable future award.

You gained’t get a superb return as a result of the factors worth comes with paying hefty award surcharges.

Select between award reserving choices

Valuations will help you establish not solely whether or not to e-book an award, but additionally which sort of award to e-book and which loyalty program it’s best to use to e-book it.

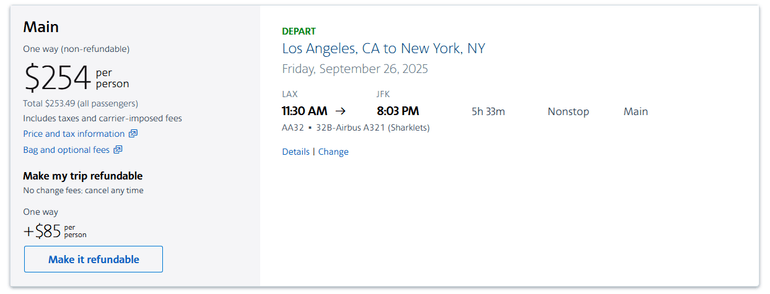

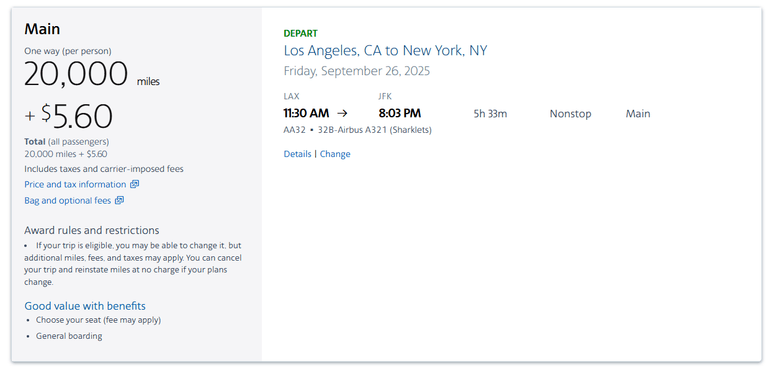

For instance, think about you’re reserving a one-way flight from Los Angeles to New York in late September, and you’ve got reserves of each American Airways AAdvantage miles and Alaska Airways Mileage Plan miles. You don’t thoughts paying money, however you’re completely happy to make use of miles when you’re getting a superb deal.

Checking award charges, you see the identical flight accessible for 20,000 AAdvantage miles plus $5.60 in charges. That yields a redemption worth of 1.2 cents per mile, which is nicely beneath NerdWallet’s valuation of 1.6 cents per mile, indicating a subpar return in your miles.

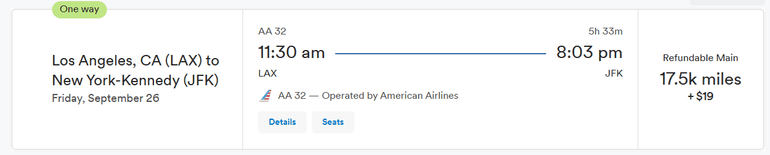

Nevertheless, since American Airways and Alaska Airways are each Oneworld alliance members, you may redeem Alaska Mileage Plan miles to e-book American Airways flights. On this case, you may e-book the very same flight via Alaska Airways for 17,500 Mileage Plan miles plus $19 in charges, yielding a redemption worth of 1.4 cents per mile. NerdWallet’s valuation for Mileage Plan miles is 1.3 cents per mile, making this award a good return of worth.

This instance illustrates how redeeming factors just isn’t solely in regards to the variety of factors or miles you utilize, but additionally what you suppose these factors or miles are value.

Reserving this flight with AAdvantage miles isn’t a superb deal. However assuming you agree with NerdWallet’s valuation, reserving the very same flight via Mileage Plan is an efficient deal as a result of these miles aren’t value as a lot.

There’s normally multiple approach to e-book award journey. Realizing your choices and their relative values will assist you establish good redemption alternatives and reject unhealthy ones.

Maximize spending

Along with serving to you redeem rewards, factors and miles valuations will help you establish your finest choices for incomes them.

The Chase Sapphire Most well-liked® Card earns 3 Chase Final Rewards® factors per greenback on eating worldwide. You can switch these factors at a 1:1 ratio to World of Hyatt factors, which NerdWallet values at 2.2 cents every. Multiplying these two numbers yields a return of 6.6 cents per greenback spent on eating, so utilizing your Chase Sapphire Most well-liked® Card might earn you $6.60 value of rewards in your $100 eating buy.

In distinction, the Hilton Honors American Specific Surpass® Card earns 6 factors per greenback on eligible U.S. eating places (see charges and costs). Nevertheless, NerdWallet’s valuations checklist Hilton Honors factors at simply 0.6 cent apiece, yielding a return of three.6 cents per greenback on eating or $3.60 on a $100 buy. Despite the fact that the cardboard earns twice as many factors, the return on spending at eating places is decrease as a result of Hilton factors are much less invaluable than Chase Final Rewards® factors.

Consider different presents

You should use valuations to evaluate the return you’ll get from different incomes alternatives, similar to bank card welcome bonuses and spending bonuses, retention presents, loyalty program promotions, compensation for overbooked flights and extra.

For instance, think about a resort loyalty program is working a promotion providing 2,000 bonus factors per evening (on prime of what you’d already earn). If this system in query is IHG Rewards, then the promotion would earn you an additional $10 of worth per evening, since NerdWallet values these factors at 0.5 cent apiece.

That’s much less more likely to transfer the needle than if the identical promotion got here from World of Hyatt; NerdWallet values Hyatt factors at 2.2 cents apiece, so in that case you’d be getting $44 of additional worth every evening.

How to not use factors and miles valuations

Listed here are a couple of pitfalls to keep away from when making use of valuations to your individual award redemptions.

Don’t deal with valuations like gospel

NerdWallet’s valuations are the product of real-world knowledge, however they’re not common. Despite the fact that NerdWallet might put Hyatt factors at a better worth, it’s potential that you may discover an award stick with one other resort model at an excellent increased valuation. With most applications utilizing dynamic pricing, there are normally loads of award redemptions that fall above or beneath NerdWallet’s numbers.

Think about how a lot you’ll use a reward foreign money

It doesn’t matter what the valuation of a journey rewards foreign money is, rewards are solely invaluable when you truly use them. Once you’re deciding which sort of factors or miles to gather, think about your private preferences. Does a sure airline supply extra flights from your own home airport? Do you like to redeem factors for a sure sort of award journey, similar to enterprise class flights or all-inclusive resorts?

For instance, you’re extra more likely to discover makes use of for Alaska Mileage Plan miles in Seattle than in Miami. You won’t wish to gather Hyatt factors if there aren’t any Hyatt properties at your normal trip locations.

Don’t confuse valuations for return on spending

To maximise your return on spending, you must think about each the worth of the factors you’re incomes and the speed at which you’re incomes them.

For instance, NerdWallet values Marriott Bonvoy factors at 0.9 cent every and JetBlue TrueBlue factors at 1.5 cents every. If you happen to face a alternative between incomes 2 Marriott factors per greenback or 1 JetBlue level per greenback, the upper incomes price means your whole return from the Marriott factors can be increased although these factors have a decrease valuation individually.

Don’t over-maximize

Valuations will help you resolve whether or not reserving an award is sensible, however you shouldn’t let valuations do the deciding for you. One of the best awards are those that take you the place you wish to go at a worth you may afford; if meaning redeeming factors for lower than the valuations say they’re value, that’s okay!

Equally, there’s no advantage in getting a excessive redemption worth purely for its personal sake. You would possibly get an incredible return from utilizing factors to e-book top quality flights or stays in overwater bungalows, however the redemption worth is just significant when you truly wish to e-book these awards. In brief, don’t let metrics dictate the way you journey.