Be part of Our Telegram channel to remain updated on breaking information protection

The Bitcoin worth has slipped 2% during the last 24 hours to commerce at $101,647 as of 4.05 a.m. EST with the each day buying and selling quantity rising 37% to $110.41 billion.

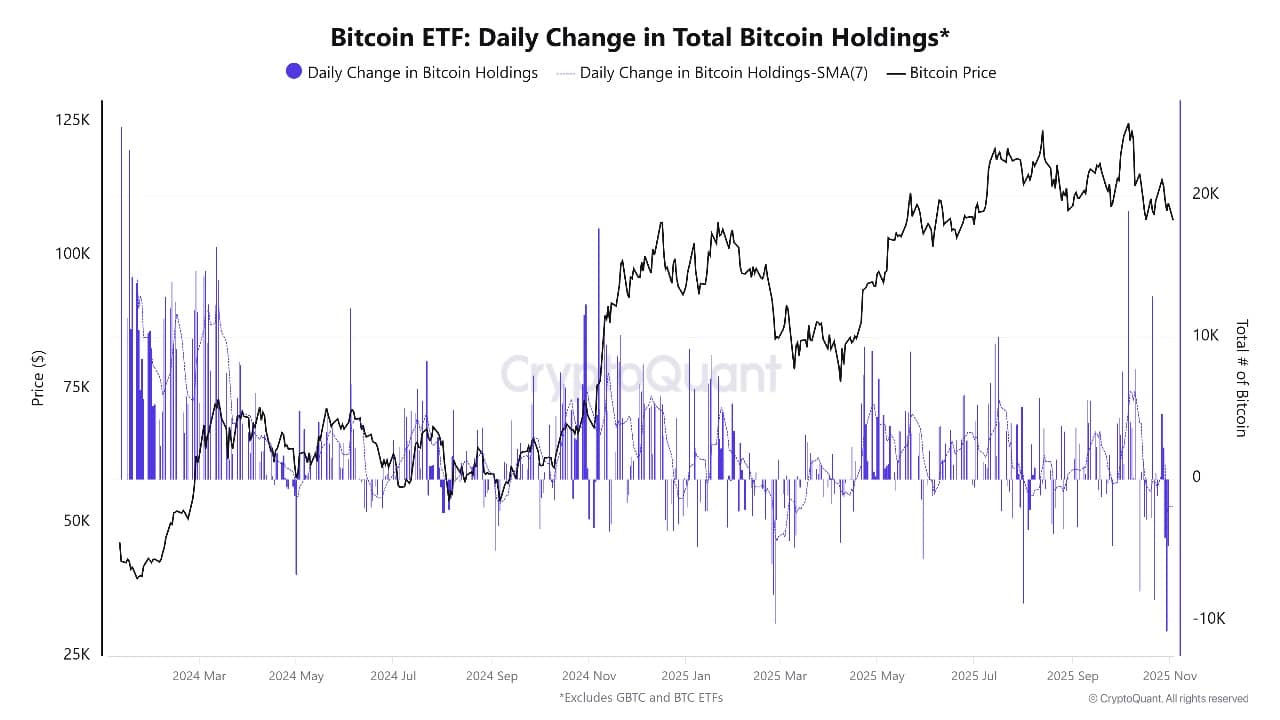

The correction follows heavy promoting strain as US spot Bitcoin and Ethereum ETFs posted almost $800 million in outflows yesterday. Worries are rising throughout the crypto market about weaker demand, bearish institutional indicators, and what comes subsequent for the BTC worth.

Main losses began earlier this week when Bitcoin crashed by means of the important thing $100,000 assist. The sharp decline triggered a wave of concern, sparking excessive worry amongst merchants and analysts.

Based on CryptoQuant, if the $100,000 degree doesn’t maintain, Bitcoin might slide a lot decrease, probably dropping to $72,000 within the subsequent couple of months.

For a number of days in a row, funds like BlackRock’s IBIT noticed enormous withdrawals, pulling liquidity from the Bitcoin market simply as different indicators turned adverse.

Bitcoin treasury demand is falling off a cliff.

One of many important causes we’re seeing this dump. pic.twitter.com/B4TPipd9sB

— Crypto Rover (@cryptorover) November 5, 2025

When ETF inflows are constructive, they normally assist Bitcoin by decreasing obtainable provide, however once they flip adverse, they’ve the other impact.

On-Chain Tendencies For Bitcoin Sign Waning Demand

CryptoQuant’s analysis factors to a gradual drop in spot demand since an enormous liquidation occasion hit the market on Oct. 11. That day noticed over $19 billion in leveraged positions worn out, marking the most important single liquidation in crypto historical past. Since then, indicators akin to spot alternate flows, ETF flows, and the Coinbase premium have been largely adverse.

Each day Change in Complete Bitcoin Holdings Supply: CryptoQuant

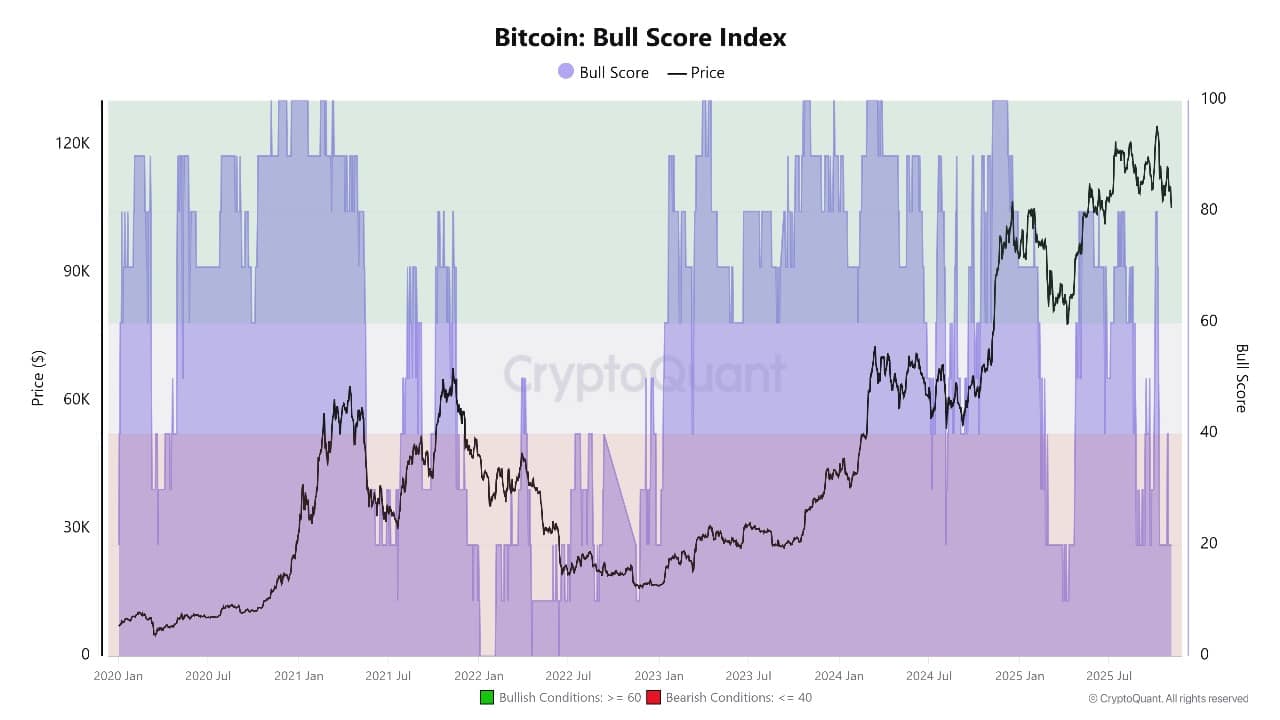

The Bull Rating Index, which tracks sentiment and momentum, has slumped to twenty. This low rating indicators a clearly bearish market. Decrease demand from US traders and a adverse Coinbase premium present that American consumers are actually extra reluctant or promote greater than they’re shopping for.

Bitcoin Bull Rating Index Supply: CryptoQuant

Furthermore, historic parallels are being drawn to earlier bear market durations, when Bitcoin’s spot demand weakened and worth corrections prolonged. With ETF outflows rising and buying and selling exercise dropping on exchanges, confidence in a quick rebound stays very low amongst analysts watching the blockchain knowledge.

Bitcoin Worth Prediction: Might BTC Drop To $72,000?

The technical image for Bitcoin is rising extra bearish. Based on CryptoQuant and analysts like Julio Moreno, an important degree to observe is $100,000. If Bitcoin trades under this era for a sustained time frame, the danger of a fall to $72,000 will increase sharply within the subsequent one or two months.

On the weekly chart, Bitcoin continues to be in a large rising channel, however current candles look heavy, and sellers are pushing the value in direction of the center of the vary. The $102,940 degree matches Bitcoin’s 50-week easy shifting common (SMA), which acted as assist earlier than however could now change into resistance.

BTCUSD Evaluation Supply: Tradingview

If BTC fails to reclaim and maintain above that line quickly, extra draw back may very well be forward.

In the meantime, momentum indicators level to rising weak spot: The RSI (Relative Energy Index) is round 44, a bearish studying that implies bears are in cost and there’s room for a continued drop.

The MACD (Transferring Common Convergence Divergence) has crossed adverse, supporting the concept a deeper downtrend is forming. Whereas the CMF (Chaikin Cash Movement) is barely above zero, reflecting minimal capital influx.

If promoting strain persists and Bitcoin can not construct new assist above $100,000, the channel’s decrease boundary, presently close to $75,000, will possible be examined subsequent. This strains up with CryptoQuant’s warning of a possible drop to $72,000. Historic assist round $80,000 to $85,000 could provide solely transient reduction if panic promoting takes maintain.

On the upside, if Bitcoin rapidly recovers and reclaims $103,000–$105,000, it might start to stabilize. Key resistance lies at $110,000 and once more at $125,000, the place many merchants will likely be watching to see if bulls can return in power. Nonetheless, with ETF outflows and on-chain weak spot dominating the headlines, sentiment stays cautious for now.

Associated Articles:

Greatest Pockets – Diversify Your Crypto Portfolio

Simple to Use, Function-Pushed Crypto Pockets

Get Early Entry to Upcoming Token ICOs

Multi-Chain, Multi-Pockets, Non-Custodial

Now On App Retailer, Google Play

Stake To Earn Native Token $BEST

250,000+ Month-to-month Energetic Customers

Be part of Our Telegram channel to remain updated on breaking information protection