Do you wrestle to know the foreign exchange market? You’re not alone. Many merchants get misplaced in value modifications, lacking out on good alternatives. This may result in large losses and missed possibilities to earn money.

However there’s a device that may change the whole lot: pattern strains. These easy instruments could make your foreign currency trading higher, supplying you with clear instructions in complicated markets.

Pattern strains are key in foreign currency trading. They present value modifications, serving to you discover when to purchase or promote. Studying about pattern strains can assist you see market tendencies early. This may make your buying and selling selections higher and enhance your earnings.

Key Takeaways

Pattern strains require a minimum of three contact factors for validation.

Steeper angles point out larger momentum in value motion.

Trendline flips can present vital entry factors.

Mix pattern strains with different indicators for higher outcomes.

Look ahead to breakouts with elevated buying and selling quantity.

Use pattern strains throughout numerous asset courses.

Understanding the Fundamentals of Pattern Traces

Pattern strains are key in foreign exchange chart evaluation. They information merchants by way of the complicated world of forex markets. Let’s discover the fundamentals of pattern strains and their function in foreign currency trading.

What Are Pattern Traces in Foreign exchange Buying and selling

Pattern strains are straight strains that join value factors on a chart. They present a forex pair’s course over time. pattern line wants a minimum of two value factors in the identical course.

Merchants use these strains to identify market actions. They search for upward (bullish), downward (bearish), or sideways (ranging) tendencies.

The Function of Pattern Traces in Technical Evaluation

In technical evaluation, pattern strains information merchants. They present assist and resistance ranges. This helps merchants discover the most effective instances to enter or exit the market.

Pattern strains could be drawn on any time-frame. This lets merchants see each short-term and long-term tendencies.

Fundamental Elements of Pattern Line Evaluation

Pattern line evaluation has a number of key elements:

Slope: Reveals the pattern’s energy and course

Touchpoints: The extra the rice touches the road, the stronger it’s

Time-frame: Longer frames give extra dependable strains

Quantity: Low quantity makes strains extra more likely to break

Pattern Sort

Route

Slope

Buying and selling Sign

Uptrend

Rising

Constructive

Bullish

Downtrend

Falling

Unfavourable

Bearish

Sideways

Horizontal

Impartial

Consolidation

Understanding pattern line fundamentals helps merchants make sensible decisions within the foreign exchange market. By studying pattern line evaluation, you’ll spot buying and selling possibilities and handle dangers higher.

Varieties of Foreign exchange Market Developments

Foreign exchange merchants should know the three major market tendencies. These tendencies information the market and have an effect on buying and selling plans.

An uptrend means costs preserve going up, forming larger lows. This exhibits a bullish market the place patrons lead. Merchants look to purchase throughout pullbacks in an uptrend.

A downtrend exhibits costs falling, with decrease highs. This implies a bearish market the place sellers management. On this case, merchants may promote on rallies.

A sideways pattern, or ranging market, occurs when costs keep in a horizontal channel. This exhibits market indecision. It may be powerful for trend-following methods.

Pattern Sort

Attribute

Buying and selling Strategy

Uptrend

Greater lows

Purchase on pullbacks

Downtrend

Decrease highs

Promote on rallies

Sideways

Horizontal vary

Commerce breakouts or vary

Understanding these tendencies is vital for foreign currency trading success. Merchants use instruments like shifting averages and pattern strains to test the market course. For instance, if the value is above a rising 50-period shifting common, it typically means an uptrend.

Bear in mind, tendencies can change. An uptrend may flip right into a downtrend or a sideways market. Control these modifications to regulate your buying and selling plan. By studying to establish tendencies, you’ll discover higher buying and selling possibilities within the foreign exchange market.

Find out how to Use Pattern Traces for Foreign exchange Buying and selling

Pattern line drawing is vital in foreign currency trading. It lets merchants see market tendencies and make sensible decisions. This half will train you the best way to use pattern strains nicely in foreign exchange charts.

Figuring out Main Tops and Bottoms

Step one is to search out main tops and bottoms. For uptrends, join a minimum of two excessive factors. For downtrends, hyperlink two or extra low factors. Extra factors make the pattern line stronger.

Connecting Value Factors Appropriately

When linking value factors, take a look at the value motion. Upward strains imply the market is bullish. Downward strains present it’s bearish. Steeper strains may imply costs received’t preserve going.

Validating Pattern Line Power

How robust a pattern line is issues. Extra touches with out breaks imply it’s stronger. Longer timeframes give extra dependable strains. However, excessive volatility could make a line weaker.

Pattern Line Sort

Market Indication

Drawing Methodology

Upward

Bullish

Join larger lows

Downward

Bearish

Join decrease highs

Begin with a pattern line drawing on demo accounts. Then, use them with different instruments like RSI or shifting averages. This manner, you get a greater view of the market and might handle dangers higher.

Drawing Strategies for Efficient Pattern Traces

Studying how to attract pattern strains is vital for good foreign exchange charting. This half talks about superior methods to make dependable pattern strains. It helps you make higher buying and selling decisions.

Utilizing Candlestick Wicks vs Our bodies

Merchants argue over utilizing wicks or our bodies for pattern strains in candlestick evaluation. Wicks give exact value ranges, whereas our bodies present market emotions. Your alternative is dependent upon your buying and selling type and the market.

Correct Angle and Slope Choice

The angle of your pattern line issues quite a bit. Steeper strains may break, however gentler ones last more. pattern line connects a minimum of two key value factors with out crossing by way of candle our bodies.

A number of Contact Level Affirmation

Extra contact factors make a pattern line stronger. Three or extra touches imply a robust pattern. This method confirms commerce setups.

Variety of Contact Factors

Pattern Line Power

Buying and selling Confidence

2

Weak

Low

3

Average

Medium

4+

Sturdy

Excessive

Utilizing these strategies, you’ll make extra correct pattern strains. This results in smarter buying and selling decisions within the foreign exchange market.

Superior Pattern Line Patterns

Studying superior pattern line patterns is vital for foreign currency trading success. These patterns give insights into market tendencies and value actions. Try some necessary pattern line patterns to spice up your chart evaluation and buying and selling.

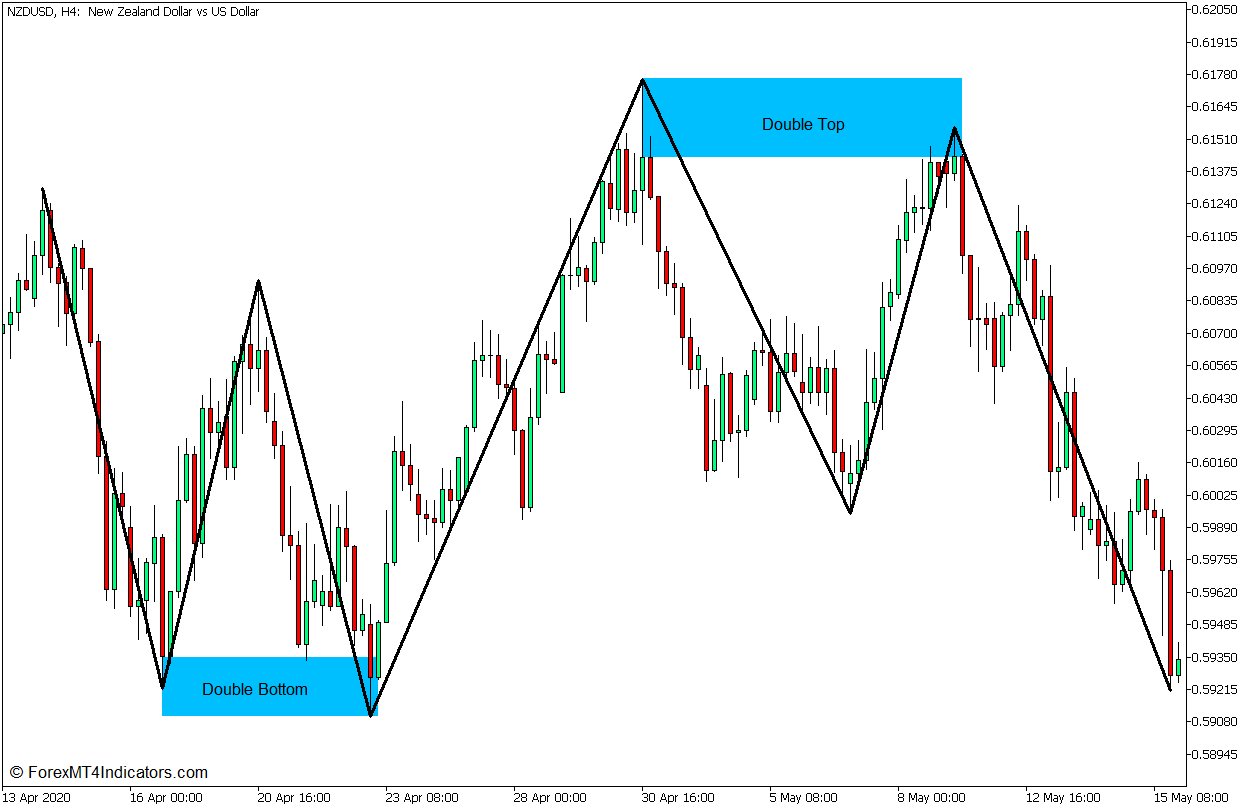

Wedges, channels, and triangles are prime superior patterns. Wedges kind when pattern strains meet, hinting at a reversal. Channels present costs shifting in a variety, nice for buying and selling inside that vary. Triangles kind when strains get nearer, typically earlier than large value strikes.

Pattern line breaks are key indicators. An increase above resistance means a bullish pattern. A fall under assist exhibits bearish sentiment. Ready for affirmation after a break can result in an 80% success charge in recognizing actual market modifications.

Sample

Formation

Buying and selling Implication

Wedge

Converging pattern strains

Potential reversal

Channel

Parallel pattern strains

Vary buying and selling alternatives

Triangle

Narrowing pattern strains

Attainable breakout

Utilizing these superior patterns in your buying and selling could make an enormous distinction. Over 90% of profitable merchants depend on pattern strains. By studying these patterns, you’ll be prepared to identify complicated market tendencies and discover nice buying and selling possibilities.

Buying and selling Methods Utilizing Pattern Traces

Pattern line methods are key for foreign currency trading. They assist merchants discover the most effective instances to purchase or promote. Let’s take a look at the best way to use pattern strains to make sensible buying and selling decisions.

Entry and Exit Factors

Pattern strains present when to purchase or promote. When costs hit a assist line in an uptrend, it’s a great time to purchase. Close to a resistance line in a downtrend, it’s time to promote.

Exit factors are when pattern strains are damaged or while you attain your revenue purpose.

Help and Resistance Flips

Help and resistance buying and selling is about when pattern strains change roles. A damaged resistance line turns into assist. A damaged assist line turns into resistance.

This helps merchants know when to enter or exit trades and handle dangers.

Breakout Buying and selling Alternatives

Breakouts occur when costs go previous pattern strains. They present large modifications or continuations in tendencies. Merchants enter within the breakout course, with stop-losses simply past the road.

This technique goals to catch large value swings as new tendencies begin.

Technique

Key Factors

Finest Timeframe

Pattern Following

Enter trades within the pattern course

Day by day

Trendline Bounce

Commerce at assist/resistance

Hourly (H1)

Breakout Buying and selling

Enter on-trend line breaks

4-hour

Profitable pattern line buying and selling wants observe and evaluation. By utilizing these methods and managing dangers, merchants can enhance their foreign exchange efficiency.

Widespread Pattern Line Buying and selling Errors to Keep away from

Pattern line evaluation is a robust device in foreign currency trading. However, it’s simple to fall into frequent pitfalls. Understanding these errors can assist you keep away from expensive errors and enhance your buying and selling psychology.

One large mistake is forcing strains to suit the market. This may result in improper conclusions in 70% of instances. Good pattern strains join a minimum of two clear swing factors, making the evaluation extra correct.

Ignoring the bigger market pattern is one other large error. About 65% of swing merchants make poor selections by specializing in short-term modifications. Day by day pattern strains are normally extra necessary than these on shorter time frames.

Overcomplicating evaluation with too many pattern strains confuses 60% of merchants

Failing to regulate pattern strains as market situations change will increase loss charges by 80%

75% of merchants don’t comply with established tendencies, considerably rising doable losses

Overtrading is a typical concern, with 50% of merchants reacting to small value modifications. This may result in larger transaction prices, slicing earnings by 5-15%. threat administration technique can reduce losses by 40%.

By recognizing these trendline pitfalls and dealing in your buying and selling psychology, you’ll be able to enhance. Observe drawing pattern strains throughout totally different market situations. This may enable you get higher and enhance your probabilities of success.

Combining Pattern Traces with Different Technical Instruments

Pattern strains are highly effective when used with different instruments. They make buying and selling methods stronger and assist merchants really feel extra assured. Let’s see the best way to mix pattern strains with key indicators for higher outcomes.

Utilizing Momentum Indicators

Momentum instruments like RSI and MACD are nice with pattern strains. They assist affirm when a pattern is robust or when it would change. For instance, if a forex pair breaks a pattern line and the RSI is excessive, it is likely to be a robust purchase sign.

Quantity Evaluation Integration

Quantity provides depth to pattern line indicators. Massive quantity when a pattern line is damaged exhibits an actual transfer. A small quantity may imply it’s only a fake-out. Merchants use this to know if a pattern change is robust.

Value Motion Affirmation

Value motion patterns again up pattern line indicators. Candlestick patterns close to pattern strains can present if a pattern will preserve going or change. A bullish engulfing sample at an uptrend line is likely to be a great time to purchase.

Software

Use with Pattern Traces

Profit

RSI

Verify overbought/oversold ranges

Spot doable reversals

MACD

Sign line crossovers close to pattern strains

Validate pattern energy

Quantity

Examine the quantity on pattern line breaks

Verify breakout validity

Candlesticks

Search for patterns at trendline touches

Predict value course

By combining pattern strains with these indicators, merchants get a clearer view of the market. This helps in creating robust buying and selling methods and making higher decisions.

Conclusion

Studying to make use of pattern strains is vital for good foreign currency trading abilities. This information coated the fundamentals of pattern strains and the best way to use them. Pattern strains assist spot market tendencies, assist, and resistance ranges.

They make it simpler to make sensible buying and selling decisions. Pattern strains are necessary in foreign currency trading. They assist discover assist and resistance ranges.

Utilizing pattern strains with different instruments like shifting averages can assist affirm tendencies. This makes timing trades higher. Pattern strains are only one a part of an even bigger evaluation plan.

They need to be used with threat administration methods. This contains setting stop-loss and take-profit ranges. Pattern strains give invaluable insights however are a part of an even bigger plan.

Merchants ought to preserve working towards with pattern strains. They should spot breakouts and adapt to market modifications. With effort and time, pattern strains generally is a key a part of profitable buying and selling.